By Suzanne Kapner

With just two weeks until Black Friday -- the day after

Thanksgiving that kicks off the holiday season -- executives at the

nation's biggest department stores said Thursday they are seeing

signs that consumers are turning their attention from voting to

shopping.

Macy's Inc. and Kohl's Corp. cited improving sales trends and

gave upbeat outlooks for the key holiday season, despite posting

another quarter of declining sales, as the chains struggle with

changing shopping habits and competition from discounters.

Nordstrom Inc., meanwhile, reported a sales increase and lifted its

financial targets for the year.

"We have momentum coming out of October," Kohl's Chief Executive

Kevin Mansell said. "We feel we're very well positioned for the

upcoming holiday season."

Shares of the companies rallied in Thursday's trading, giving a

lift to other retail stocks.

Mr. Mansell worried about an election hangover, due to

uncertainty about President-elect Donald Trump's agenda. But Macy's

CEO Terry Lundgren said: "To have a group of the population feeling

like their voices have been heard is a positive thing." With wages

rising and unemployment low, he added, "there is a potential for

consumers to spend in the fourth quarter."

Mr. Mansell said better inventory management could help shield

the company from seasonal or political volatility. "We are doing

things with an eye to the long-term," he said. This should

"continue to benefit us regardless of whether or not you think the

consumer is in a buying mood for holiday or is still not so

much."

A more complete picture of the consumer mind-set will emerge

next week when other large chains such as Wal-Mart Stores Inc.,

Target Corp. and Home Depot Inc. report their latest results.

Perhaps even more important than the impact of the election on

retail sales is the unseasonably warm weather in much of the

country. Although inventory levels are in good shape compared with

a year ago, that could change if cold weather doesn't materialize,

leading to "another over-inventoried, heavily-promotional holiday

season," Citi analyst Kate McShane wrote in a note to clients.

Macy's booked a 2.7% decline in same-store sales in its latest

period, the seventh straight quarter in which sales and profits

have declined. The retailer also struck a deal Thursday with

Brookfield Properties that could further shrink its retail

footprint.

Kohl's same-store sales fell 1.7% in the period, its third

straight drop, despite what it said was a strong back-to-school

shopping period. Unlike Macy's, most of the chain's locations

aren't in traditional shopping malls, and the company doesn't plan

to shrink its store base.

Nordstrom said sales at existing stores rose 2.4%, its first

increase in two quarters. Lower inventory levels at its stores, and

throughout the industry as a whole, are resulting in fewer

discounts and more stable margins, the chain said.

Sales at existing Hudson Bay Co. stores also fell in the period,

including a 4.6% decline at its Saks Fifth Avenue chain.

Shoppers increasingly are opting to make purchases online,

especially at Amazon.com Inc. or at fast-fashion chains such as

H&M Hennes & Mauritz AB, leaving department stores

struggling with lower foot traffic.

Both Macy's and Kohl's have tried to adapt. Macy's has been

closing weaker stores and adding kiosks that sell Apple Inc.

watches or other electronics. Kohl's has brought in more national

brands, such as Nike Inc. and American Girl dolls. But both still

rely on heavy discounts to drive foot traffic.

Neil Saunders, the chief executive of Conlumino, a retail

research firm, noted that Macy's made just 2 cents for every $1 in

revenue in the latest quarter. The results, Mr. Saunders said,

"show a company grappling with what looks like a terminal

decline."

Some brands, such as Michael Kors Holdings Ltd. and Ralph Lauren

Corp., that historically have relied heavily on department stores

are pulling back from those chains in an effort to sell more goods

at full price. On Thursday, Ralph Lauren reported that sales to

department stores fell 10% in its latest quarter, while Michael

Kors said sales in the channel tumbled 18.4%.

Macy's said the average purchase price of an item increased

during the quarter, which helped offset fewer transactions, and

that online sales continued to grow by double digits.

Comparable inventory declined 3% putting the company on stronger

footing heading into the holidays than last year, when it resorted

to discounting to clear unsold goods. Macy's reaffirmed its profit

forecast for the year, and said it expects sales to decline less

than expected.

Overall, Macy's reported a third-quarter profit of $17 million,

down from $118 million a year earlier, hurt by restructuring costs.

Sales fell 4.2% to $5.63 billion.

On the real estate deal, Macy's said Thursday that Brookfield

would be able to redevelop up to 50 properties, either by adding on

to a particular store or revamping the entire site. Financial terms

weren't disclosed. "They will reimagine not just some of our store

locations, but our parking lots, and property we own," Mr. Lundgren

said.

The Brookfield deal is part of Macy's strategy to generate value

from real estate as many of its stores underperform in a rocky

retail environment. Over the summer, Macy's said it would shut 100

more stores, about 15% of its base, in addition to 40 closures

announced earlier this year. Activist investors have called for

Macy's to generate more value from its real estate.

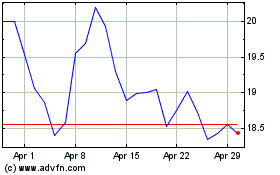

Macy's shares, which have climbed 13% in the past three months,

popped up 5.6% on Thursday, while shares of Kohl's rose 11.5%.

Nordstrom shares climbed 7.2%, and shares of J.C. Penney Co., which

reports earnings Friday morning, jumped 5.4%.

Kohl's profit rose 22% to $146 million. Revenue fell 2.3% to

$4.33 billion. For the period ended Oct. 1, Ralph Lauren reported a

profit of $45 million, down from $160 million a year earlier.

Revenue declined 7.6% to $1.82 billion. Sales at the company's

retail stores, excluding newly opened and closed locations,

declined 8%.

Earlier this year the luxury apparel and accessories company

embarked on a turnaround plan that included refocusing on its core

Ralph Lauren, Polo and Lauren brands, as well as store closings and

job cuts.

--Joshua Jamerson, Ezequiel Minaya and Imani Moise contributed

to this article.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

November 10, 2016 20:00 ET (01:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

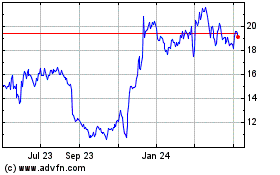

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024