Ahead of the Tape: Bed Bath Shouldn't Go Beyond -- WSJ

September 21 2016 - 3:02AM

Dow Jones News

By Steven Russolillo

Maybe Bed Bath & Beyond Inc. should take a page out of

Macy's Inc.'s playbook.

The home-goods retailer has suffered along with a host of

traditional brick-and-mortar retailers as consumers shop more

online. Margins have shriveled, same-store sales have dropped and

the stock has suffered. Recent wage pressures have only added to

the company's troubles.

Wednesday's fiscal second-quarter results are expected to

continue reflecting those woes.

But if they sound familiar, it is because Bed Bath & Beyond

isn't alone. It might learn something from department-store giant

Macy's, which made the dramatic announcement in August that it

would close an additional 100 stores, about 14% of its footprint.

While the closings are expected to hurt sales in the short run,

cost savings should help increase profitability over the longer

term.

Bed Bath & Beyond has taken a different approach. Steadily

adding to its store count, it currently has 1,533 locations across

its brands, up from 1,500 two years ago. It deserves kudos for not

overbuilding like some of its competitors, but fewer locations

might help. While its stores are still profitable, they are

becoming increasingly less so.

Bed Bath & Beyond's return on invested capital has fallen in

each of the past three years, recently dropping to 20% from 23%.

That marked the second-biggest year-over-year drop on record, with

only the decline in the financial crisis being bigger.

True, Bed Bath & Beyond's ROIC is higher than that of many

of its competitors. But it is also well below its five-year average

of 24%. And continued investment in e-commerce will likely take an

additional toll on profitability due to lower margins than

brick-and-mortar sales.

E-commerce is no slam dunk, either. The bulk of Bed Bath &

Beyond's products are commoditized. A survey by KeyBanc Capital

Market's Bradley Thomas found roughly four of every five Bed Bath

& Beyond products on its website were also available on

Amazon.com Inc., up from about half three years ago. And those

products are about 9% more expensive at Bed Bath & Beyond.

That puts even more onus on store count. For Bed Bath &

Beyond, less might be more.

(END) Dow Jones Newswires

September 21, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

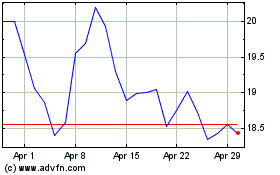

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

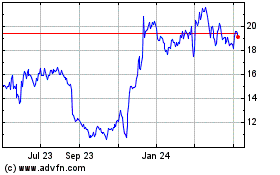

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024