Wal-Mart Lifts Profit Outlook as Sales Grow -- 3rd Update

August 18 2016 - 12:18PM

Dow Jones News

By Joshua Jamerson and Sarah Nassauer

Wal-Mart Stores Inc. is reaping the benefits of spending big to

boost sales, getting more shoppers through its doors at a time when

many retailers are struggling to attract foot traffic.

On Thursday the retailer said sales in existing U.S. stores rose

for the eighth consecutive quarter, up 1.6% as more customers

visited, providing a stark contrast to other retailers reporting

weak earnings in recent days including Target Corp. and Macy's

Inc.

The world's biggest retailer has poured billions recently into

making its U.S. stores more efficient and pleasant, boosting

employee wages and improve e-commerce operations as it tries to

fend off Amazon.com Inc.

"With transitions like this you tend to gain first with existing

customers," said Wal-Mart U.S. CEO Greg Foran on a conference call.

Those customers are visiting more often and "I think they are

putting an extra item in the basket because it's in stock or looks

fresh," said Mr. Foran.

Executives attributed sales gains in the U.S. to improvements

they have made to stores, as well lower gas prices which left

shoppers with more money to spend. Sales were hurt by deflationary

food prices, they said.

Wal-Mart lifted its per-share profit outlook for the year to

$4.15 to $4.35 and said third-quarter sales in existing U.S.

Wal-Mart stores would rise 1.0% to 1.5%. Shares, which were trading

near 52-week highs, rose 1.7% to $74.24 in midmorning trading.

Sales look strong, said John Zolidis, retail analyst at the

Buckingham Research Group in a note. "Unfortunately, the price of

this stability has been a multiyear erosion in margins and

profitability." Wal-Mart's profit [operating income] fell 7.2% in

the second quarter ended July 31.

Many traditional retailers have struggled recently to grow sales

and adjust to customer's changing online shopping habits. Target

said Wednesday that same-store sales fell for the first time in

more than two years and warned sales would fall in the next two

quarters. Macy's last week said it would shut 100 more stores, or

14% of its physical base, as shoppers increasingly opt to make

purchases online and spend more on services including travel and

health care than on goods.

In the second quarter, Wal-Mart reported global e-commerce sales

rose 11.8%, the first time in nine quarters the retailer's online

sales growth has increased quarter-over-quarter, but still slower

than the e-commerce market's growth overall.

Earlier this month, Wal-Mart agreed to purchase discount

e-commerce retailer Jet.com Inc. for $3.3 billion, the largest

acquisition of a U.S. e-commerce startup. Wal-Mart also said

current head of e-commerce Neil Ashe would be replaced by Jet's

founder Marc Lore to lead its e-commerce efforts once the deal is

complete. It expects to close the deal later this year.

Wal-Mart ramped up package delivery to lead its e-commerce

efforts speeds in the second quarter and started selling millions

more products on its website. In July Wal-Mart offered a free

monthlong trial of a $49 two-day shipping membership similar to

Amazon's popular Prime program, a sign that its delivery logistics

network is becoming more robust.

Walmart.com now sells 15 million items, said executives, as it

added more third-party sellers. Until May, the technology behind

Wal-Mart's website capped the number of products it could display

to shoppers at around 8 million, a major competitive weakness

compared with Amazon's hundreds of millions of available

products.

Wal-Mart is also trying to make its produce, meat and grocery

business more top-of-mind for shoppers, an effort at the heart of

its plan to fend off online retailers as consumers still tend to

shop offline for fresh food. During the quarter, the company

reported strong traffic in food and consumables, such as beauty and

cosmetics, in its grocery segment. The company also reported

stronger pharmacy sales, helped by drug price inflation and more

prescriptions filled.

Entertainment sales were soft. Target also reported weakness in

electronics sales. Consumers are still "a little more cautious than

the numbers might indicate," said Wal-Mart Finance Chief Brett

Biggs, on a conference call. "But overall we are seeing a consumer

that is acting quite steadily.

Overall, Wal-Mart reported earnings of $3.77 billion, or $1.21 a

share, compared with a year-earlier profit of $3.48 billion, or

$1.08 a share. Excluding the gain from the sale of its Yihaodian

website in China, the company earned $1.07 a share.

In U.S. stores, the bulk of Wal-Mart's revenue, 1.2% more people

shopped and spent 0.4% more. Sales in Wal-Mart's smaller format

Neighborhood markets rose 6.5% in the quarter.

Revenue edged up 0.5% to $120.85 billion. In constant currency,

revenue rose 2.8%.

Write to Joshua Jamerson at joshua.jamerson@wsj.com and Sarah

Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

August 18, 2016 12:03 ET (16:03 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

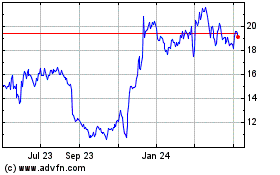

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

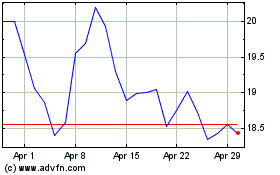

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024