By Suzanne Kapner

A few years ago, Restoration Hardware had three Denver-area

stores scattered in malls. Today, the furniture chain has just one

new one: a palatial, four-story gallery with a rooftop garden.

A few years ago, Restoration Hardware had three stores in malls

scattered around Denver. Today, the furniture chain has just one

new one: a palatial, four-story gallery with a rooftop garden.

Retailers from Gap Inc. to Abercrombie & Fitch Inc. are

abandoning a decades-old strategy of growing sales by blanketing

cities with stores as consumers do more of their shopping online

and less at the mall.

The shifting shopping habits have prompted chains such as

Williams-Sonoma Inc. and Macy's Inc. to close stores in secondary

malls to focus on web sales and more upscale shopping centers.

Restoration Hardware Holdings Inc. closed its three older

Denver-area stores and last fall opened the 70,000-square-foot

flagship at the Cherry Creek Shopping Center, an upscale mall that

also is home to Burberry and Brooks Brothers.

Restoration Hardware declined to discuss its new approach, but

its change in direction is part of a redesign of the nation's

commercial centers -- a reversal of the "malling" of America.

"With technology, retailers don't need that extra store in a

marginal market," said William Taubman, the chief operating officer

of Taubman Centers Inc., which owns Cherry Creek and mainly

operates high-end, or so-called "A" malls. That is widening the gap

between the country's most productive malls and weaker properties,

executives and analysts said.

Once-solid regional "B" malls that thrived for years are losing

shoppers and tenants to the "A" malls -- those with sales per

square foot in excess of $500, according to Green Street

Advisors.

The research firm estimates that about 44% of total U.S. mall

value, which is based on sales, size and quality among other

measures, resides with the top 100 properties, out of about 1,000

malls.

Almost all of the 40 stores that Macy's closed last year were in

"B" or "C" malls, according to Green Street. For already weak

malls, the loss of an anchor can accelerate a downward spiral that

leads to other vacancies.

Not all "B" malls are struggling, however.

"If they are the only game in town, they are less at risk," said

DJ Busch, a senior analyst at Green Street. What undermines them is

when a better mall opens nearby. That was the case when The Mall at

University Town Center opened in Sarasota, Fla., in 2014, and

pulled a number of tenants out of nearby Westfield Southgate mall,

including Williams-Sonoma, Dillard's and Saks Fifth Avenue.

Mall owners disagree about whether the Internet is their main

problem. They point to demographic changes that redirected

population and income growth away from malls built years ago, along

with a real estate glut that has left the U.S. with 24 square feet

of retail space per person, compared with 15 for Canada, 10 for

Australia and 5 for the U.K., according to the International

Council of Shopping Centers.

They also note that e-commerce amounted to just 7.5% of total

fourth-quarter retail sales, according to the U.S. Census Bureau.

But if you strip out grocery, home improvement and other items you

typically can't buy at a mall, says Mr. Busch, e-commerce is closer

to 20% of mall sales.

Many of the top malls are attracting higher end tenants and

leasing space to upscale restaurants and gyms, or hosting events.

As a result, shoppers are more apt to bypass smaller, local malls

that tend to stock basic items more easily purchased online.

Kelly Woyan-Rudnicki, a writer and movie producer who lives in

San Clemente, Calif., said she prefers to drive 30 miles to South

Coast Plaza in Costa Mesa, rather than shop at her local mall. In

addition to a wide range of stores, from Chanel to Uniqlo, the mall

boasts 40 restaurants and coffee shops, and hosts events such as

fashion shows and book signings.

"It's the whole immersive experience," she said.

That is paying off for retailers like Restoration Hardware. CEO

Gary Friedman told analysts in March, that sales were two-to-four

times higher in markets where it had switched to giant stores. "We

are very early into the transformation of our real estate," he

said. "All of our next-generation design galleries are exceeding

plan."

Taubman's tenants averaged sales-per-square-foot of $800 last

year, up 57% since 2005. That compares with CBL & Associates

Properties Inc., which operates "B" and "C" malls. Its

sales-per-square-foot rose just 13% to $374 during that period.

CBL Chief Executive Stephen Lebovitz said his company's

middle-market malls haven't benefited as much from the recent boom

in luxury sales, but weren't hurt as much during the recession. As

a result, their sales growth has been slower, but more even.

Large mall operators have been divesting lower-performing

properties to double down on their most profitable locations. Both

Simon Property Group Inc. and General Growth Properties Inc. have

spun off lower-quality malls into separate companies so they can

focus their capital on higher end properties.

During the past decade, Westfield Corp. has sold 36 lower

performing U.S. centers for about $5.9 billion, including five

malls sold in December. "As a landlord, we're investing in the real

estate that retailers want to be in," said Peter Lowy, Westfield's

co-chief executive.

Companies that are acquiring "B" malls see opportunities to

improve their productivity. Starwood Retail Partners is trying to

add restaurants and new anchors to The Shops at Willow Bend in

Plano, Texas, which was 30% vacant in 2014 when it was acquired

from Taubman.

Starwood demolished space that had been vacated by Saks Fifth

Avenue and plans to rebuild it as a restaurant village. It is also

in talks with a potential new anchor tenant, but won't disclose the

name until a deal is signed. "When we're done, I'm sure it will be

an 'A' mall," said Scott Wolstein, Starwood Retail's chief

executive.

(END) Dow Jones Newswires

April 20, 2016 19:18 ET (23:18 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

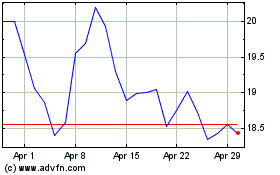

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

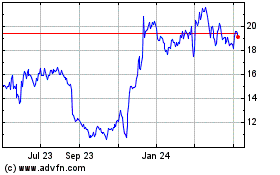

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024