Tiffany Authorizes More Share Buybacks

January 21 2016 - 6:50PM

Dow Jones News

Tiffany & Co. said Thursday that it has approved a new

stock-buyback program of up to $500 million through Jan. 31,

2019.

The repurchase authorization replaces an existing program that

had about $61 million available for repurchases as of

Wednesday.

The company's market capitalization is about $7.8 billion.

On Tuesday, the luxury retailer said "challenging and uncertain

global economic conditions" have resulted in restrained consumer

spending, and a stronger U.S. dollar continues to dent foreign

tourist spending. For the crucial holiday shopping season, Tiffany

reported a 3% currency-adjusted drop in world-wide sales and a 5%

decline in sales at stores open at least a year.

Tiffany is one of many retailers that posted disappointing

holiday sales. Earlier this month, Macy's Inc. said it would cut

thousands of jobs and reported that sales at existing stores in

November and December fell 4.7%.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

January 21, 2016 18:35 ET (23:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

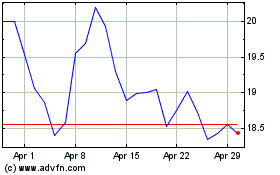

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

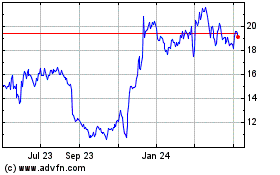

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024