By Liam Pleven

Macy's Inc. is the latest major retailer to consider spinning

off its real-estate assets into a separate company, following

recent moves by Sears Holdings Corp. and Darden Restaurants

Inc.

But first it will have to answer a thorny question: what to do

with its prized asset, the landmark building at New York's Herald

Square?

Its decision could point the way for other retailers that own

trophy properties, a group that includes Nordstrom Inc. and Neiman

Marcus Group Inc. Like Macy's, their crown jewels are in prime

locations in major metropolitan areas, making them more valuable

than look-alike properties in malls or smaller cities.

Unloading the Herald Square building could make a lot of money

for Macy's shareholders now, while finding a way to extract some

value without ceding control of such a prime location could pay off

more in the long run, according to analysts.

Herald Square is especially tricky because there is no consensus

on precisely how much the property is worth, with estimates ranging

from less than $3 billion to more than $4 billion.

"The hard part is, there's nothing like Macy's Herald Square,"

said Jim Costello, senior vice president at Real Capital Analytics,

a real-estate research firm.

Investors have been pressuring Macy's and other retailers in

recent years to spin off their real-estate assets into separate

companies. The aim is to make the most of those assets at a time

when commercial real-estate values are soaring and the retailers

face long-term challenges from online rivals.

Macy's earlier this month said real-estate prices have prompted

it to study its options. The company owns 556 stores from Puerto

Rico to Guam, most of them nondescript. Its flagship store,

however, covers almost an entire New York City block, features

about 1.1 million square feet of retail space, includes additional

space for offices and storage, and serves as the endpoint for

Macy's annual Thanksgiving Day parade.

That distinguishes its portfolio from those of retailers whose

strategy revolves around owning and operating stores of a similar

size in residential neighborhoods or strip malls around the

country.

Some other retailers also have crown jewels. Nordstrom owns its

flagship store on Pine Street in Seattle, which has 383,000 square

feet of retail space. Tiffany & Co. bought its store on Fifth

Avenue in Manhattan in 1999, after it had been sold by the jeweler

and leased back in a previous deal. Neiman Marcus, which is

planning an initial public offering of its stock, has a portfolio

that includes stores in San Francisco, Dallas and Beverly Hills,

Calif.

"Often, there's additional value that can be gained from having

those primary locations," said Adam Silverman, a retail analyst at

Forrester Research. "The cookie-cutter locations may not drive as

much traffic or the right kind of clientele."

Activist investor Starboard Value LP last month said it had

taken a stake in Macy's, and chief executive Jeff Smith said at the

time the building was worth about $4 billion, based on an

assessment by real-estate experts.

Analysts at investment bank Cowen & Co., where Mr. Smith

once worked, were less bullish, pegging the value at $3.3 billion

in a July report. And Robert Von Ancken, chairman of Landauer

Valuation & Advisory, a unit of real-estate firm Newmark Grubb

Knight Frank, said in an interview he was skeptical the Herald

Square building was worth more than $3 billion.

"The real answer is, we don't know," said Jim Sluzewski, a

Macy's spokesman. "And that's why we have teams of people looking

at the question."

The company has hired real-estate firm Green Street Advisors,

tax experts at law firm Skadden, Arps, Slate, Meagher & Flom

LLP, and bankers including Goldman Sachs Group Inc. and Credit

Suisse Group AG, among others, to study its real-estate

portfolio.

Investors have bid down Macy's shares amid questions about its

real estate and its financial results. Since hitting a peak for the

year on July 16, the day after Starboard Value disclosed its stake,

Macy's shares have dropped 22%, through Monday's close. At that

share price, Macy's market value is about $19 billion, according to

FactSet, less than the $21 billion Starboard believes the company's

real estate alone is worth, and roughly equal to Cowen's estimate

of nearly $19 billion. Cowen concluded that the company's second

most-valuable store, in Chicago, is worth about $1.7 billion.

Creating a new company to own the real estate is one option, but

that could saddle Macy's with rent payments and force it to cede

control of the building.

This month, Macy's announced a different real-estate deal that

could be a model. The company said it was selling off part of its

store in downtown Brooklyn and a nearby parking garage to developer

Tishman Speyer for $170 million in cash and another $100 million

over three years. It will compress its existing retail operations

at the site into 310,000 square feet on five floors, down from

378,000 square feet on eight floors.

A similar plan could be lucrative in Herald Square, where the

upper floors could be converted into condominiums or a hotel,

according to analysts.

"There is clearly impressive potential," said James Sullivan, a

senior real-estate analyst at Cowen. "That is the path to the

highest value creation for the Herald Square store."

Write to Liam Pleven at liam.pleven@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 25, 2015 12:59 ET (16:59 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

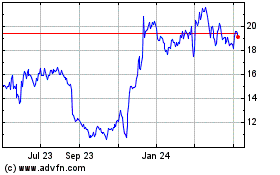

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

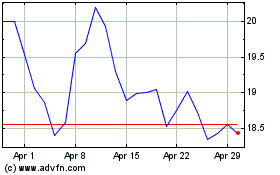

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024