Macy’s, Inc. to Redeem 8.125% Senior Notes Due 2035

June 22 2015 - 10:47AM

Business Wire

Macy’s, Inc. (NYSE:M) today announced that its wholly owned

subsidiary, Macy’s Retail Holdings, Inc., will redeem for cash the

entire $76.016 million aggregate principal amount outstanding of

its 8.125% Debentures due 2035 (CUSIP 577778BC6) on August 17,

2015. The 2035 debentures were issued in August 1995 by The May

Department Stores Company and assumed by Macy’s in conjunction with

its acquisition of May in August 2005.

The 2035 debentures will be redeemed at par together with

interest accrued and unpaid to the redemption date. They become

redeemable at 100% of the principal amount thereof at any time on

or after August 15, 2015, pursuant to the terms of the

debentures.

A notice of redemption is being sent to all currently registered

holders of the 2035 debentures by the trustee, The Bank of New York

Mellon Trust Company, N.A. Copies of the notice of redemption and

additional information related to the procedure for redemption may

be obtained from The Bank of New York Mellon Trust Company, N.A. by

calling 1-800-254-2826.

Macy’s, Inc., with corporate offices in Cincinnati and New York,

is one of the nation’s premier retailers, with fiscal 2014 sales of

$28.105 billion. The company operates about 885 stores in 45

states, the District of Columbia, Guam and Puerto Rico under the

names of Macy’s, Bloomingdale’s, Bloomingdale’s Outlet and

Bluemercury, as well as the macys.com, bloomingdales.com and

bluemercury.com websites. Bloomingdale’s in Dubai is operated by Al

Tayer Group LLC under a license agreement.

All statements in this press release that are not statements of

historical fact are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. Such

statements are based upon the current beliefs and expectations of

Macy’s management and are subject to significant risks and

uncertainties. Actual results could differ materially from those

expressed in or implied by the forward-looking statements contained

in this release because of a variety of factors, including

conditions to, or changes in the timing of, proposed transactions,

prevailing interest rates and non-recurring charges, competitive

pressures from specialty stores, general merchandise stores,

off-price and discount stores, manufacturers’ outlets, the

Internet, mail-order catalogs and television shopping and general

consumer spending levels, including the impact of the availability

and level of consumer debt, the effect of weather and other factors

identified in documents filed by the company with the Securities

and Exchange Commission.

(NOTE: Additional information on Macy’s, Inc., including past

news releases, is available at www.macysinc.com/pressroom).

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150622005918/en/

Macy’s, Inc.Media - Jim Sluzewski, 513-579-7764orInvestor - Matt

Stautberg, 513-579-7780

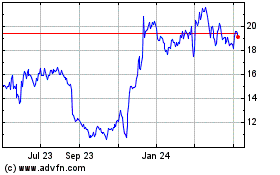

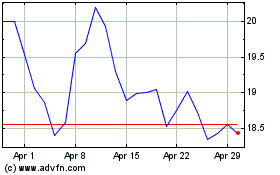

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024