SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month

of March 2016

Commission

File Number 001-15246

LLOYDS BANKING GROUP plc

5th Floor

25 Gresham Street

London

EC2V 7HN

United Kingdom

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F x

Form 40-F ¨

Indicate by check mark whether

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark whether

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

EXPLANATORY

NOTE

In connection with the issuance

from time to time by Lloyds Bank plc (as issuer) of notes under its Series A medium-term notes program, fully and unconditionally

guaranteed by Lloyds Banking Group plc, Lloyds Banking Group plc is filing opinions of counsel relating to the issuance and sale

from time to time of such notes and the related guarantees as exhibits to this report on Form 6-K.

This report on Form 6-K shall

be deemed incorporated by reference into the Registration Statement of Lloyds Banking Group plc and Lloyds Bank plc on Form F-3

(File Nos. 333-189150 and 333-189150-01) and to be a part thereof from the date on which this report is filed, to the extent not

superseded by documents or reports subsequently filed or furnished.

Exhibit 5.1: Opinion of

CMS Cameron McKenna LLP

Exhibit 5.2: Opinion of

Linklaters LLP

Exhibit 5.3: Opinion of

Davis Polk & Wardwell LLP

Signature

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| LLOYDS

BANKING GROUP plc |

| (Registrant) |

March 11, 2016

| By: |

/s/ Suzy Margretts |

| |

Name: |

Suzy Margretts |

|

Title: |

Senior Director, MTNs, Group Corporate Treasury |

Exhibit 5.1

Lloyds

Banking Group plc

25

Gresham Street

London

EC2V

7HN |

CMS Cameron McKenna LLP

Saltire Court

20 Castle Terrace

Edinburgh

EH1 2EN

DX 553001 EDINBURGH

LP 2 EDINBURGH 6

|

| |

|

|

| |

T |

+44 131 228 8000 |

| |

F |

+44 131 228 8888 |

| |

|

|

| |

www.cms-cmck.com |

| |

|

| |

11 March 2016 |

| Your ref |

| Our ref - DOCS/EDN/LLO015.00032 |

Dear Sirs

We have been asked by Lloyds Banking Group

plc (the Guarantor) to deliver an opinion of Scottish counsel in connection with the issuance by Lloyds Bank plc (the Issuer),

on or after the date hereof, of notes under its Series A medium-term notes programme (such notes as may be issued from time to

time, the Notes).

The Notes are issued with the full and

unconditional guarantee of the Guarantor (the Guarantees, and together with the Notes, the Securities), and are covered

by the Registration Statement which the Guarantor and the Issuer filed on Form F-3 with the Securities and Exchange Commission

(the Commission) on 7 June 2013.

The Notes are to be issued pursuant to

a Senior Debt Securities Indenture dated as of 21 January 2011 (the Senior Indenture) between the Issuer, the Guarantor

and The Bank of New York Mellon, acting through its London branch, as trustee (the Trustee), as amended and supplemented

by the first supplemental indenture dated as of 6 June 2011 among the Issuer, the Guarantor and the Trustee (the First Supplemental

Indenture), the Third Supplemental Indenture dated as of 5 September 2014 (the Third Supplemental Indenture), the Fourth

Supplemental Indenture dated as of 29 September 2014 (the Fourth Supplemental Indenture), the Fifth Supplemental Indenture

dated as of 14 May 2015 (the Fifth Supplemental Indenture), the Sixth Supplemental Indenture dated as of 17 August 2015

(the Sixth Supplemental Indenture) and the Seventh Supplemental Indenture dated as of 22 January 2016 (the Seventh Supplemental

Indenture and, together with the Senior Indenture, the First Supplemental Indenture, the Third Supplemental Indenture, the

Fourth Supplemental Indenture, the Fifth Supplemental

CMS Cameron

McKenna LLP is a limited liability partnership registered in England and Wales with registration number OC310335. It is a body

corporate which uses the word “partner” to refer to a member, or an employee or consultant with equivalent standing

and qualifications. It is authorised and regulated by the Solicitors Regulation Authority of England and Wales with SRA number

423370. A list of members and their professional qualifications is open to inspection at the registered office, Cannon Place,

78 Cannon Street, London, EC4N 6AF. Members are either solicitors or registered foreign lawyers. VAT registration number: 974

899 925. Further information about the firm can be found at www.cms-cmck.com

CMS Cameron

McKenna LLP is a member of CMS Legal Services EEIG (CMS EEIG), a European Economic Interest Grouping that coordinates an organisation

of independent law firms. CMS EEIG provides no client services. Such services are solely provided by CMS EEIG’s member firms

in their respective jurisdictions. CMS EEIG and each of its member firms are separate and legally distinct entities, and no such

entity has any authority to bind any other. CMS EEIG and each member firm are liable only for their own acts or omissions and

not those of each other. The brand name “CMS” and the term “firm” are used to refer to some or all of

the member firms or their offices. Further information can be found at www.cmslegal.com

Notice: the

firm does not accept service by e-mail of court proceedings, other processes or formal notices of any kind without specific prior

written agreement.

Indenture, the Sixth Supplemental Indenture

and the Seventh Supplemental Indenture, the Series A Indenture).

We, as your solicitors, have examined originals

or copies, certified or otherwise identified to our satisfaction, of such documents, corporate records, certificates of public

officials and other instruments as we have deemed necessary for the purposes of rendering this opinion (collectively, the Documentation),

including an Officer's Certificate dated 11 March 2016 in respect of the Guarantor (the Officer's Certificate), and the

power of attorney, dated 17 December 2013 (the Power of Attorney), which sets forth the persons authorised to sign, execute,

grant, and deliver various instruments, including the Securities, on behalf of the Guarantor. We have relied on the Documentation

in respect of the accuracy of the matters stated therein, which we have not independently established. We also conducted a search

against the statutory records of the Guarantor in its electronic file maintained at Companies House in Edinburgh on the date hereof,

and we have assumed that file is up-to-date in all respects.

On the basis of the foregoing, and the

assumptions state below, and subject to any matters not disclosed to us, we hereby advise you that, in our opinion:

| 1. | as at the date hereof, the Guarantor is duly incorporated and validly existing under the laws of

Scotland; and |

| 2. | the Guarantor has corporate power to enter into and to perform its obligations under the Guarantees

and, provided that (i) each Guarantee is authorised and executed as provided in the extract minutes attached to the Officer's

Certificate, the Power of Attorney and the articles of association of the Guarantor, and (ii) the Notes are executed and authenticated,

and the Guarantee endorsed thereon, in accordance with the provisions of the Series A Indenture, the Guarantor will have duly authorised,

executed and delivered the Guarantees. |

In giving the opinion in 2 above, we have

assumed that, at the time of the issuance of a tranche of Securities, (a) the Power of Attorney and the Series A Indenture

continue to be in effect and have not been amended, added to, varied or (in the case of the Power of Attorney) revoked; (b) the

certifications and assertions made in the Officer's Certificate remain true, accurate and not misleading or out-of-date, and (c) there

has been no change in Scots law subsequent to the date of this opinion that would affect the authorisation of the Securities.

This opinion is limited to the laws of

Scotland as applied by the Scottish courts and in effect on the date of this opinion, and we have made no investigation of the

laws of any jurisdiction other than Scotland and neither express nor imply any opinion as to any other laws and in particular the

laws of England, the laws of the State of New York and the laws of the United States of America.

This opinion is subject to the provisions

of the Banking Act 2009 and any secondary legislation, instruments or orders made, or which may be made, under it.

This opinion is addressed to you for your

benefit, and is not to be relied upon by any other person without our express consent, except that it may be relied upon by initial

purchasers of Notes issued during a period of four months commencing on the date of this opinion, and by Davis Polk & Wardwell

LLP (Davis Polk) for the purposes of its opinions delivered during that period of four months with respect to certain matters

of the laws of the State of New York and United States federal law pertaining to the Securities.

This opinion is rendered solely in connection

with future issuances of Securities, and may not be relied upon for any other purpose without our prior written consent.

We hereby consent to the filing of this

opinion as an exhibit to a report on Form 6-K to be filed by the Guarantor with the Commission on 11 March 2016, and further consent

to the reference to our name in (i) any pricing supplement, or (ii) any report on Form 6-K pursuant to which an opinion

delivered by Davis Polk is filed by the Guarantor, in either case relating to an issue of Securities that has been reviewed by

Davis Polk, as United States counsel to the Issuer and the Guarantor, and with respect to which Davis Polk has given its consent

in writing to be named therein, provided always that such issue of Securities is made within the abovementioned period of four

months, and that any such reference to us is substantially in the form set out in the opinion of Davis Polk to the Issuer and the

Guarantor dated 11 March 2016 and to be filed by the Guarantor as an exhibit to the abovementioned Form 6-K to be filed on 11 March

2016. In giving this consent, we do not admit that we are in the category of persons whose consent is required under Section 7

of the US Securities Act of 1933, as amended. Save as aforementioned, our opinion is not to be transmitted by you to any other

person, nor quoted or referred to in any public document or filed with anyone without our express consent.

Yours faithfully

/s/ Donald I. Cumming

Partner, for and on behalf of CMS Cameron

McKenna LLP

Exhibit 5.2

|

Linklaters LLP

One Silk Street

London EC2Y 8HQ

Telephone (+44) 20 7456 2000

Facsimile (+44) 20 7456 2222

DX Box Number 10 CDE |

| To: |

Lloyds

Bank plc

25 Gresham

Street

London

EC2V 7HN |

11 March 2016

Dear Sirs

Lloyds Bank plc (the “Issuer”)

Medium Term Notes, Series A (the “Notes”) to be issued pursuant to the registration statement filed with the U.S. Securities

and Exchange Commission (the “SEC”) on 7 June 2013 (the “Programme”).

| 1 | We have acted as English legal advisers to the

Issuer in connection with the Programme and have taken instructions solely from the Issuer. |

| 2 | This opinion is limited to English law as applied

by the English courts and in effect on the date of this opinion. It is given on the basis that it will be governed by and construed

in accordance with English law. In particular, we express no opinion herein with regard to any system of law (including, for the

avoidance of doubt, Scots law, the federal laws of the United States of America and the laws of the State of New York) other than

the laws of England as currently applied by the English courts. |

| 3 | For the purpose of this opinion we have examined

the documents listed and, where appropriate, defined in the Schedule to this opinion. |

| 4.1 | (except in the case of the Issuer) all relevant documents are within the capacity and powers of,

and have been validly authorised by, each party; and |

| 4.2 | the meetings of the Board of Directors of the Issuer held on 17 December 2010 and 29 November 2012

(in respect of which extracts of the minutes have been supplied to us) were duly convened and constituted, a quorum was present

and acting throughout and the resolutions referred to in the minutes were duly and validly passed and have not been amended, modified

or rescinded. |

| 5 | References in this opinion to the “Notes”

include the global certificates representing the Notes upon issue unless the context indicates otherwise. |

| 6 | Based on the documents referred to, and assumptions

made, in paragraphs 3 and 4 above and subject to the qualification in paragraph 7 below and to any matters not disclosed to us,

we are of the following opinion: |

This

communication is confidential and may be privileged or otherwise protected by work product immunity.

Linklaters

LLP is a limited liability partnership registered in England and Wales with registered number OC326345. It is a law firm authorised

and regulated by the Solicitors Regulation Authority. The term partner in relation to Linklaters LLP is used to refer to a member

of Linklaters LLP or an employee or consultant of Linklaters LLP or any of its affiliated firms or entities with equivalent standing

and qualifications. A list of the names of the members of Linklaters LLP together with a list of those non-members who are designated

as partners and their professional qualifications is open to inspection at its registered office, One Silk Street, London EC2Y

8HQ or on www.linklaters.com and such persons are either solicitors, registered foreign lawyers or European lawyers.

Please

refer to www.linklaters.com/regulation for important information on our regulatory position.

| 6.1 | As at the date hereof, the Issuer is a company incorporated in England under the Companies Acts

1862 and 1985. |

| 6.2 | The Issuer has corporate power to enter into and to perform its obligations under the Notes and,

provided that each Note is authorised, executed and delivered as provided in the minutes, the sealing memos and powers of attorney

referred to in the Schedule hereto and the Articles of Association of the Issuer, the Issuer will have duly authorised, executed

and delivered the Notes. |

| 7 | This opinion is subject to the provisions of

the Banking Act 2009 and any secondary legislation, instruments and orders made, or which may be made, under it. |

| 8 | This opinion extends to Notes issued within

four months from the date hereof and is given on the basis that there will be no amendment to or termination or replacement of

the documents, authorisations, consents and opinions referred to in the Schedule to this opinion. This opinion is also given on

the basis that, unless otherwise agreed between us, we undertake no responsibility to notify you of any change in English law after

the date of this opinion. |

| 9 | This opinion is addressed to you for your benefit

in connection with the issue of the Notes. It is not to be relied upon by any other person without our express consent except that

this opinion may be relied upon by initial purchasers of Notes issued within four months from the date hereof, and by Davis Polk

& Wardwell LLP for the purposes of any opinions it delivers with respect to certain matters of the laws of the State of New

York and the federal laws of the United States of America pertaining to any such Notes. |

| 10 | We hereby consent to the filing of this opinion

as an exhibit to a report on Form 6-K to be filed by Lloyds Banking Group plc (the “Guarantor”)

and further consent to the reference to our name in (i) any pricing supplement or (ii) any report on Form 6-K pursuant to which

an opinion delivered by Davis Polk & Wardwell LLP is filed by the Guarantor, in either case, relating to a tranche of Notes

issued within four months from the date hereof. In giving this consent we do not admit that we are within the category of persons

whose consent is required within section 7 of the United States Securities Act of 1933 or the rules and regulations of the SEC

thereunder. |

Yours faithfully

/s/ Linklaters LLP

Linklaters LLP

SCHEDULE

| 1 | A certified copy of the Articles of Association of the Issuer. |

| 2 | Extracts of the minutes of meetings of the Board of Directors of the Issuer held on 17 December

2010 (adding the Issuer to the Programme), 29 November 2012 and 26 November 2015. |

| 3 | Sealing memo dated 4 January 2011 containing the power of attorney for the Issuer in respect of

the Programme. |

| 4 | Power of attorney for the Issuer in respect of the Programme dated 7 January 2016. |

| 5 | Officer’s certificate of the Issuer dated 11 March 2016. |

Exhibit

5.3

| |

New York

Menlo Park

Washington DC

São Paulo

London |

Paris

Madrid

Tokyo

Beijing

Hong Kong |

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017 |

212 450 4000 tel

212 701 5800 fax |

|

Lloyds Bank plc

Lloyds Banking Group plc

25 Gresham Street

London EC2V 7HN

United Kingdom

Ladies and Gentlemen:

Lloyds Bank plc, a public limited company organized under the

laws of England and Wales (the “Issuer”), and Lloyds Banking Group plc, a public limited company organized under

the laws of Scotland (the “Guarantor”) have filed on June 7, 2013 with the Securities and Exchange Commission

(the “Commission”) a registration statement on Form F-3 (as it may be amended or supplemented from time to time,

the “Registration Statement”) for the purpose of registering under the Securities Act of 1933, as amended (the

“Securities Act”), debt securities to be issued from time to time in one or more series by the Issuer and guaranteed

by the Guarantor (such debt securities, together with the corresponding guarantees, the “Shelf Securities”).

The Shelf Securities include securities designated as Series A Notes (the “Series A Notes”), and such Series

A Notes have been or are to be issued on or after the date hereof. The Series A Notes have been and are to be issued pursuant to

the senior debt securities indenture dated as of January 21, 2011 (the “Senior Indenture”) among the Issuer,

the Guarantor and The Bank of New York Mellon, acting through its London Branch, as trustee (the “Trustee”),

as amended and supplemented by the first supplemental indenture dated as of June 6, 2011 (the “First Supplemental Indenture”),

the third supplemental indenture dated as of September 5, 2014 (the “Third Supplemental Indenture”), the fourth

supplemental indenture dated as of September 29, 2014 (the “Fourth Supplemental Indenture”), the fifth supplemental

indenture dated as of May 14, 2015 (the “Fifth Supplemental Indenture”), the sixth supplemental indenture dated

as of August 17, 2015 (the “Sixth Supplemental Indenture”) and the seventh supplemental indenture dated as of

January 22, 2016 (the “Seventh Supplemental Indenture”), each among the Issuer, the Guarantor and the Trustee.

We refer to the Senior Indenture, as amended and supplemented by the First Supplemental Indenture, the Third Supplemental Indenture,

the Fourth Supplemental Indenture, the Fifth Supplemental Indenture, the Sixth Supplemental Indenture and the Seventh Supplemental

Indenture as the “Indenture.”

We, as your United States counsel, have examined originals or

copies of such documents, corporate records, certificates of public officials and other instruments as we have deemed necessary

or advisable for the purpose of rendering this opinion.

Lloyds Bank plc Lloyds Banking Group plc | 2 | March 11, 2016 |

In rendering the opinion expressed herein, we have, without independent

inquiry or investigation, assumed that (i) all documents submitted to us as originals are authentic and complete, (ii) all documents

submitted to us as copies conform to authentic, complete originals, (iii) all documents filed as exhibits to the Registration Statement

that have not been executed will conform to the forms thereof, (iv) all signatures on all documents that we reviewed are genuine,

(v) all natural persons executing documents had and have the legal capacity to do so, (vi) all statements in certificates of public

officials and officers of the Issuer and the Guarantor that we reviewed were and are accurate and (vii) all representations made

by the Issuer and the Guarantor as to matters of fact in the documents that we reviewed were and are accurate.

Based upon the foregoing, and subject to the additional assumptions

and qualifications set forth below, we advise you that, in our opinion, when

| (i) | the specific terms of a particular tranche of Series A Notes have been duly authorized and established in accordance with the

Indenture; and |

| (ii) | such Series A Notes have been duly authorized, executed, authenticated, issued and delivered in accordance with the Indenture

and the applicable underwriting or other distribution agreement against payment therefor; |

such Series A Notes will constitute valid and binding obligations

of the Issuer and the Guarantor, enforceable in accordance with their respective terms, subject to applicable bankruptcy, insolvency

and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable principles of general applicability

(including, without limitation, concepts of good faith, fair dealing and the lack of bad faith) and possible judicial or regulatory

actions giving effect to governmental actions or foreign laws affecting creditors’ rights, provided that we express

no opinion as to (i) the effect of fraudulent conveyance, fraudulent transfer or similar provision of applicable law on the conclusions

expressed above and (ii) the validity, legally binding effect or enforceability of any provision that permits holders to collect

any portion of the stated principal amount upon acceleration of Series A Notes to the extent determined to constitute unearned

interest.

In connection with the opinion expressed above, we have assumed

that at or prior to the time of the delivery of any such Series A Notes, (1) the terms have been established and the offer and

sale of such Series A Notes have been duly authorized by the Issuer and the Guarantor, in each case as a matter of English law

and Scots law, and such authorization shall not have been modified or rescinded, (2) the Issuer is validly existing as a company

in good standing under the laws of England and Wales, (3) the Guarantor is validly existing as a company in good standing under

the laws of Scotland, (4) the Trustee is validly existing as a corporation in good standing under the laws of its jurisdiction

of incorporation, (5) the Registration Statement is effective and such effectiveness shall not have been terminated or rescinded,

(6) such Series A Notes will be executed in substantially the form reviewed by us, (7) the execution, delivery and performance

by the Issuer, the Guarantor and the Trustee of the Indenture and the execution, delivery and performance by the Issuer and the

Guarantor of the Series A Notes (a) are within the corporate powers of the Issuer, the Guarantor and the Trustee, (b) do not contravene,

or constitute a default under, the articles or certificate of incorporation or bylaws or other constitutive documents of the Issuer,

the Guarantor or the Trustee, (c) do not require any action by or in respect of, or

Lloyds Bank plc Lloyds Banking Group plc | 3 | March 11, 2016 |

filing with, any governmental body, agency or official, and (d)

do not and will not contravene, or constitute a default under, any provision of applicable law or regulation, public policy or

any judgment, injunction, order or decree or any agreement or other instrument binding upon the Issuer, the Guarantor or the Trustee,

(8) the Indenture has been duly authorized, executed and delivered by the Trustee, (9) the Indenture is a valid, binding and enforceable

agreements of the Trustee and (10) no change in law affecting the validity or enforceability of the Indenture or the Series A Notes

has occurred.

We express no opinion as to (i) provisions in the Indenture that

purport to waive objections to venue, claims that a particular jurisdiction is an inconvenient forum or the like, (ii) whether

a United States federal court would have subject-matter or personal jurisdiction over a controversy arising under the Notes or

(iii) the effectiveness of any service of process made other than in accordance with applicable law.

We express no opinion as to (i) whether a New York State or United

States federal court would render or enforce a judgment in a currency other than U.S. Dollars or (ii) the exchange rate that such

a court would use in rendering a judgment in U.S. Dollars in respect of an obligation in any other currency.

We are members of the Bar of the State of New York, and we express

no opinion as to the laws of any jurisdiction other than the laws of the State of New York. Insofar as the foregoing opinion involves

matters governed by English law, we have relied, without independent inquiry or investigation, on the opinion of Linklaters LLP,

English legal counsel for the Issuer, dated March 11, 2016, to be filed by the Guarantor with the Commission on the date hereof

as an exhibit to a report on Form 6-K, and our opinion is subject to the qualifications, assumptions and limitations set forth

therein. Insofar as the foregoing opinion and the opinion expressed in the quoted paragraph below involves matters governed by

Scots law, we have relied, without independent inquiry or investigation, on the opinion of CMS Cameron McKenna LLP, Scots legal

counsel for the Guarantor, dated March 11, 2016, to be filed by the Guarantor with the Commission on the date hereof as an exhibit

to a report on Form 6-K, and our opinion is subject to the qualifications, assumptions and limitations set forth therein.

We hereby consent to the filing of this opinion as an exhibit

to a report on Form 6-K filed by the Guarantor with the Commission on the date hereof and further consent to the reference to our

name under the caption “Legal Opinions” in the prospectus, which is a part of the Registration Statement. In addition,

if a pricing supplement is filed by the Issuer or the Guarantor with the Commission on this date or any future date forming part

of the Registration Statement relating to the offer and sale of any particular tranche of Series A Notes and the pricing supplement

contains our opinion substantially in the form set forth below, we consent to including that opinion as part of the Registration

Statement and further consent to the reference to our name in the opinion.

“In the opinion of Davis Polk & Wardwell LLP, as

United States counsel, when the notes offered by this pricing supplement have been executed and issued by the Issuer, authenticated

by the trustee pursuant to the Indenture, delivered against payment as contemplated herein and the related guarantee has been executed

by the Guarantor, such notes will constitute valid and binding obligations of the

Lloyds Bank plc Lloyds Banking Group plc | 4 | March 11, 2016 |

Issuer, and the related guarantee will constitute a valid and

binding obligation of the Guarantor, in each case enforceable in accordance with their terms, subject to applicable bankruptcy,

insolvency and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable principles of

general applicability (including without limitation, concepts of good faith, fair dealing and the lack of bad faith) and possible

judicial or regulatory actions giving effect to governmental actions or foreign laws affecting creditors’ rights, provided

that such counsel expresses no opinion as to [(i)] the effect of fraudulent conveyance, fraudulent transfer or similar provision

of applicable law on the conclusions expressed above [and (ii) the validity, legally binding effect or enforceability of any provision

that permits holders to collect any portion of the stated principal amount upon acceleration of the notes to the extent determined

to constitute unearned interest]. This opinion is given as of the date hereof and is limited to the laws of the State of New York.

Insofar as this opinion involves matters governed by Scots law, Davis Polk & Wardwell LLP has relied, without independent inquiry

or investigation, on the opinion of CMS Cameron McKenna LLP, dated March 11, 2016 and filed as an exhibit to a report on Form 6-K

filed by the Guarantor on March 11, 2016. Insofar as this opinion involves matters governed by English law, Davis Polk & Wardwell

LLP has relied, without independent inquiry or investigation, on the opinion of Linklaters LLP, dated March 11, 2016 and filed

as an exhibit to a report on Form 6-K filed by the Guarantor on March 11, 2016. The opinion of Davis Polk & Wardwell LLP is

subject to the same assumptions, qualifications and limitations with respect to such matters as are contained in the opinions of

CMS Cameron McKenna LLP and Linklaters LLP. In addition, the opinion of Davis Polk & Wardwell LLP is subject to customary assumptions

about the establishment of the terms of the notes, the trustee’s authorization, execution and delivery of the Indenture and

its authentication of the notes, and the validity, binding nature and enforceability of the Indenture with respect to the trustee,

all as stated in the opinion of Davis Polk & Wardwell LLP dated March 11, 2016, which was filed as an exhibit to a report on

Form 6-K filed by the Guarantor on March 11, 2016. [This opinion is also subject to the discussion, as stated in such opinion,

of the enforcement of notes denominated in a foreign currency.]”

In giving our consents above, we do not admit that we are in

the category of persons whose consent is required under Section 7 of the Securities Act.

Very truly yours,

/s/ Davis Polk & Wardwell LLP

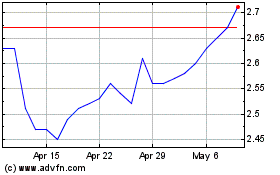

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Mar 2024 to Apr 2024

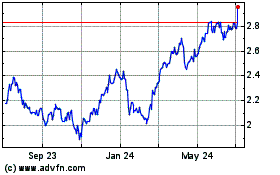

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Apr 2023 to Apr 2024