Current Report Filing (8-k)

May 18 2016 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant

to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 17, 2016

|

|

|

|

|

|

|

LEXINGTON REALTY TRUST

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Maryland

|

1-12386

|

13-3717318

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

One Penn Plaza, Suite 4015, New York, New York

|

10119-4015

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

|

|

(212) 692-7200

|

|

|

(Registrant's telephone number, including area code)

|

|

|

|

|

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

___ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

___ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

___ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

___ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.07.

Submission of Matters to a Vote of Security Holders.

On May 17, 2016, Lexington Realty Trust, which we refer to as the Trust, held its 2016 Annual Meeting of Shareholders, which we refer to as the Annual Meeting. As of March 8, 2016, the record date for shareholders entitled to vote at the Annual Meeting, there were 235,226,539 shares of beneficial interest, par value $0.0001 per share, classified as common stock, which we refer to as Common Shares, outstanding and entitled to vote at the Annual Meeting. Of the Common Shares entitled to vote at the Annual Meeting, 216,991,558, or approximately 92.25% of the Common Shares entitled to vote were present or represented by proxy at the Annual Meeting. There were three matters presented and voted on at the Annual Meeting. Set forth below is a brief description of each matter voted on at the Annual Meeting and the voting results with respect to each matter:

Proposal No. 1.

Election of eight trustees to serve until the Trust's 2017 Annual Meeting of Shareholders or their earlier removal or resignation and until their respective successors, if any, are elected and qualify. The eight trustees elected, and the number of votes cast for, withheld and broker non-votes, with respect to each of them, were as follows:

|

|

|

|

|

|

|

|

Nominee for Trustee

|

For

|

Withhold

|

Broker

Non-Votes

|

|

E. Robert Roskind

|

175,769,009

|

12,369,042

|

28,853,507

|

|

T. Wilson Eglin

|

179,819,703

|

8,318,348

|

28,853,507

|

|

Richard J. Rouse

|

162,757,079

|

25,380,972

|

28,853,507

|

|

Harold First

|

185,876,662

|

2,261,389

|

28,853,507

|

|

Richard S. Frary

|

185,867,453

|

2,270,598

|

28,853,507

|

|

Lawrence L. Gray

|

186,317,776

|

1,820,275

|

28,853,507

|

|

Claire A. Koeneman

|

185,685,899

|

2,452,152

|

28,853,507

|

|

Kevin W. Lynch

|

185,514,281

|

2,623,770

|

28,853,507

|

Proposal No. 2.

To vote upon an advisory resolution to approve, on a non-binding basis, the compensation of the named executive officers of the Trust, as disclosed in the related proxy statement. The number of votes cast for, against, abstained and broker non-votes, with respect to Proposal No. 2 were as follows:

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

182,628,760

|

|

4,895,288

|

|

614,003

|

|

28,853,507

|

Proposal No. 3.

To ratify the appointment of KPMG LLP as the Trust's independent registered public accounting firm for the fiscal year ending December 31, 2016. The number of votes cast for, against, or abstained, with respect to Proposal No. 3 were as follows:

|

|

|

|

|

|

|

For

|

Against

|

Abstain

|

|

213,365,967

|

3,295,554

|

330,037

|

Item 7.01. Regulation FD Disclosure.

On May 18, 2016, we made available a presentation entitled “Lexington Realty Trust, Investor Presentation, May 2016” on the “Investors” section of our web site (www.LXP.com). A copy of the presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference solely for purposes of this Item 7.01 disclosure.

The information furnished pursuant to this “Item 7.01 - Regulation FD Disclosure”, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing made by us under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in any such filing, except as shall be expressly set forth by specific reference in such a filing. Information contained on our web site is not incorporated by reference into this Current Report on Form 8-K.

|

|

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

99.1

|

Lexington Realty Trust, Investor Presentation, May 2016

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Lexington Realty Trust

|

|

|

|

|

|

|

|

|

|

Date: May 18, 2016

|

By:

|

/s/ Patrick Carroll

|

|

|

|

Patrick Carroll

|

|

|

|

Chief Financial Officer

|

Exhibit Index

|

|

|

|

99.1

|

Lexington Realty Trust, Investor Presentation, May 2016

|

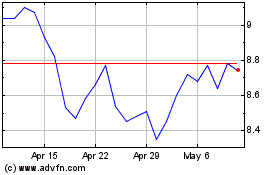

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

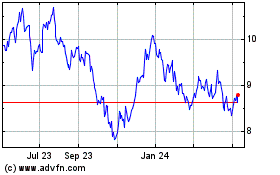

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Apr 2023 to Apr 2024