Lexington Realty Trust (“Lexington”) (NYSE:LXP), a real estate

investment trust focused on single-tenant real estate investments,

today announced results for the first quarter ended March 31,

2016.

First Quarter 2016 Highlights

- Generated Company Funds From Operations (“Company FFO”)

of $72.1 million, or $0.30 per diluted common share.

- Disposed of three properties and a non-consolidated

investment in an office property for aggregate gross disposition

proceeds of $64.9 million.

- Acquired an industrial property in Detroit, Michigan

for $29.7 million.

- Invested $33.7 million in on-going build-to-suit

projects.

- Completed 1.7 million square feet of new leases and

lease extensions with overall portfolio 96.7% leased at quarter

end.

- Obtained $57.5 million 15-year non-recourse financing,

which bears interest at a 5.2% fixed rate and is secured by the

Richmond, Virginia property.

- Retired $8.3 million of secured debt and $30.0 million

of credit facility borrowings.

- Repurchased 1.2 million common shares at an average

price of $7.56 per share.

Subsequent Events

- Entered into an agreement to fund the construction of

an industrial facility in Opelika, Alabama for a maximum commitment

of $37.0 million. Upon completion, the property will be net leased

for a 25-year term.

- Disposed of 15 W. 45th Street land investment for gross

proceeds of $37.5 million and an office property for gross proceeds

of $19.0 million.

T. Wilson Eglin, President and Chief Executive

Officer of Lexington, stated “We had an excellent first quarter

with increased revenues and strong Company FFO of $0.30 per share.

Our disposition program is fully underway, and during the quarter

we sold approximately $58 million of consolidated properties at an

average cap rate of 6.5% and we just announced the $37.5 million

sale of our West 45th Street land investment at a 4.1% cap rate.

Our overall portfolio was 96.7% leased with elevated leasing volume

of 1.7 million square feet including some significant 2016 and 2017

lease renewals. Given a strong first quarter and our expectations

for the remainder of the year, we are tightening our 2016 Company

FFO guidance to an expected range of $1.03-$1.08 per share.”

Mr. Eglin added, “Looking ahead, we are making

good progress with our sales program and the execution of our plan

is expected to reduce leverage, generate strong cash flows in

relation to our dividend and share price, and improve the overall

quality of our portfolio.”

FINANCIAL RESULTS

Revenues

For the quarter ended March 31, 2016, total

gross revenues were $111.6 million, a 3.0% increase compared with

total gross revenues of $108.4 million for the quarter ended

March 31, 2015. The increase is primarily attributable to

revenue generated from property acquisitions and new leases signed,

offset by 2015 and 2016 property sales and lease expirations.

Company FFO

For the quarter ended March 31, 2016,

Lexington generated Company FFO of $72.1 million, or $0.30 per

diluted share, compared to Company FFO for the quarter ended

March 31, 2015 of $64.5 million, or $0.26 per diluted share.

The calculation of Company FFO and a reconciliation to net income

attributable to common shareholders is included later in this press

release.

Dividends/Distributions

Lexington declared a regular quarterly common

share/unit dividend/distribution for the quarter ended

March 31, 2016 of $0.17 per common share/unit, which was paid

on April 15, 2016 to common shareholders/unitholders of record as

of March 31, 2016. Lexington also declared a dividend of

$0.8125 per share on its Series C Cumulative Convertible Preferred

Stock (“Series C Preferred Shares”), which is payable on August 15,

2016 to Series C Preferred Shareholders of record as of July 29,

2016.

Net Income Attributable to Common

Shareholders

For the quarter ended March 31, 2016, net

income attributable to common shareholders was $48.1 million, or

$0.21 per diluted share, compared with net income attributable to

common shareholders for the quarter ended March 31, 2015 of

$31.8 million, or $0.14 per diluted share.

OPERATING ACTIVITIES

During the quarter, Lexington acquired the

following property:

|

|

|

ACQUISITIONS |

|

Tenant |

|

Location |

|

Property Type |

|

Initial Basis ($000) |

|

Initial Annualized Cash Rent

($000) |

|

InitialCashYield |

|

EstimatedGAAPYield |

|

ApproximateLeaseTerm

(Yrs) |

| FCA US LLC (f/k/a

Chrysler Group LLC) |

|

Detroit, MI |

|

Industrial |

|

$ |

29,697 |

|

|

$ |

2,204 |

|

|

|

7.4 |

% |

|

|

7.4 |

% |

|

20 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

During the quarter, Lexington funded $33.7

million of the projected costs of the following projects:

|

|

|

|

|

|

|

ON-GOING BUILD-TO-SUIT PROJECTS |

|

|

|

|

|

Location |

|

Sq. Ft. |

|

Property Type |

|

Lease Term(Years) |

|

Maximum Commitment/Estimated Completion

Cost($000) |

|

GAAP Investment Balance as

of3/31/2016 ($000) |

|

Estimated Acquisition/ Completion Date |

|

Estimated Initial Cash Yield |

|

Estimated GAAP Yield |

| Anderson, SC |

|

1,325,000 |

|

|

Industrial |

|

20 |

|

$ |

70,012 |

|

|

$ |

37,051 |

|

|

2Q

16 |

|

|

5.9 |

% |

|

|

7.3 |

% |

| Lake Jackson, TX |

|

664,000 |

|

|

Office |

|

20 |

|

166,164 |

|

|

63,278 |

|

|

4Q

16 |

|

|

7.3 |

% |

|

|

8.9 |

% |

| Charlotte, NC |

|

201,000 |

|

|

Office |

|

15 |

|

62,445 |

|

|

14,968 |

|

|

1Q

17 |

|

|

8.3 |

% |

|

|

9.5 |

% |

| Houston, TX(1) |

|

274,000 |

|

|

Retail/Specialty |

|

20 |

|

86,491 |

|

|

53,536 |

|

|

3Q

16 |

|

|

7.5 |

% |

|

|

7.5 |

% |

| |

|

2,464,000 |

|

|

|

|

|

|

$ |

385,112 |

|

|

$ |

168,833 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)

Lexington has a 25% interest as of March 31, 2016. Lexington is

providing construction financing up to $56.7 million to the joint

venture of which $23.6 million has been funded as of March 31,

2016. Lease contains annual CPI increases. |

Subsequent to March 31, 2016, Lexington entered

into an agreement to fund the construction of a 165,000 square foot

industrial facility in Opelika, Alabama for a maximum cost of $37.0

million (7.05% initial capitalization rate). Upon completion,

estimated to be May 2017, the property will be net leased for a

25-year term and the lease provides for 2.0% annual

escalations.

During the quarter, Lexington sold the following

properties:

|

|

|

PROPERTY DISPOSITIONS |

|

Primary Tenant |

|

Location |

|

Property Type |

|

Gross

SalePrice($000) |

|

|

AnnualizedNOI(1)($000) |

|

Month of Disposition |

| Parkway Chevrolet,

Inc. |

|

Tomball, TX |

|

Specialty/ Retail |

|

$ |

17,575 |

|

|

(2 |

) |

|

$ |

1,459 |

|

|

February |

| Multi-Tenant / The

Weiss Group, LLC |

|

Palm

Beach Gardens, FL |

|

Multi-tenant/ Office |

|

30,050 |

|

|

|

1,457 |

|

|

March |

| AT&T Services,

Inc. |

|

Harrisburg, PA |

|

Office |

|

10,600 |

|

|

|

887 |

|

|

March |

| |

|

|

|

|

|

$ |

58,225 |

|

|

|

$ |

3,803 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)

Quarter prior to sale annualized. |

| (2)

Mortgage of $8.3 million was satisfied at closing and the gross

sale price excludes mortgage defeasance costs of $0.3 million

reimbursed by purchaser. |

In addition, Lexington disposed of its interest in a

non-consolidated investment in an office property in Russellville,

Arkansas, receiving $6.7 million in connection with the sale, and

sold a vacant land parcel for $0.4 million.

In April 2016, Lexington sold its 15 West 45th

Street land investment for gross proceeds of $37.5 million at a

4.1% capitalization rate. The buyer assumed the $29.2 million

mortgage in connection with the sale. In May 2016, Lexington sold

an office property in Lake Forest, California for gross proceeds of

$19.0 million at a 7.9% capitalization rate.

LEASING

As of March 31, 2016, Lexington's portfolio

was 96.7% leased, excluding properties subject to secured mortgage

loans currently in default.

During the first quarter of 2016, Lexington

executed the following new and extended leases:

| |

|

LEASE

EXTENSIONS |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Prior |

|

Lease |

|

|

| |

|

Location |

|

|

Primary Tenant(1) |

|

Term |

|

Expiration Date |

|

Sq. Ft. |

| |

|

Office |

|

|

|

|

|

|

|

|

|

| 1 |

|

Phoenix |

AZ |

|

Avnet, Inc. |

|

02/2023 |

|

08/2026 |

|

176,402 |

|

2 |

|

Milford |

OH |

|

Siemens Corporation |

|

09/2016 |

|

04/2026 |

|

221,215 |

|

2 |

|

Total office lease extensions |

|

|

|

|

|

|

|

|

397,617 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Industrial/Multi-Tenant |

|

|

|

|

|

|

|

|

|

| 1 |

|

Rockford |

IL |

|

Pierce Packaging Co. |

|

12/2016 |

|

12/2019 |

|

93,000 |

| 2 |

|

Antioch |

TN |

|

Wirtgen America, Inc. |

|

MTM |

|

12/2016 |

|

73,500 |

| 3 |

|

Memphis |

TN |

|

Sears, Roebuck and

Co./Sears Logistic Services |

|

02/2017 |

|

02/2027 |

|

780,000 |

| 4 |

|

Winchester |

VA |

|

Kraft Heinz Foods

Company |

|

05/2016 |

|

05/2021 |

|

344,700 |

|

4 |

|

Total industrial lease extensions |

|

|

|

|

|

|

|

|

1,291,200 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

Total lease extensions |

|

|

|

|

|

|

|

|

1,688,817 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

NEW

LEASES |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Lease |

|

|

| |

|

Location |

|

|

|

|

|

|

Expiration Date |

|

Sq. Ft. |

| |

|

Office/Multi-Tenant |

|

|

|

|

|

|

|

|

|

| 1 |

|

Honolulu |

HI |

|

N/A |

|

|

|

QTQ |

|

1,900 |

| 2 |

|

Philadelphia |

PA |

|

N/A |

|

|

|

01/2027 |

|

1,975 |

|

3 |

|

Charleston |

SC |

|

Hagemeyer North America,

Inc. |

|

|

|

06/2019 |

|

20,424 |

|

3 |

|

Total new office leases |

|

|

|

|

|

|

|

|

24,299 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

TOTAL NEW AND EXTENDED LEASES |

|

|

|

|

|

|

|

1,713,116 |

| |

|

|

|

|

|

|

|

|

|

|

| (1) Leases

greater than 10,000 square feet. |

BALANCE SHEET/CAPITAL MARKETS

In February 2016, Lexington financed its office

property in Richmond, Virginia with a $57.5 million non-recourse

secured mortgage. The loan bears interest at a fixed rate of 5.2%

and matures in 2031.

During 2015, Lexington announced a 10.0 million

common share repurchase authorization. In the first quarter of

2016, Lexington repurchased 1,184,113 common shares at an

average price of $7.56 per share, bringing the total common shares

repurchased under this authorization to 3,400,912 common shares at

an average price of $8.04 per share.

2016 EARNINGS GUIDANCE

Lexington is tightening its Company FFO guidance

for the year ended March 31, 2016 to an expected range of

$1.03 to $1.08 per diluted share from a range of $1.00 to $1.10 per

diluted share. This guidance is forward looking, excludes the

impact of certain items and is based on current expectations.

FIRST QUARTER 2016 CONFERENCE

CALL

Lexington will host a conference call today,

Thursday, May 5, 2016, at 8:30 a.m. Eastern Time, to discuss its

results for the quarter ended March 31, 2016. Interested

parties may participate in this conference call by dialing

877-407-0789 or 201-689-8562. A replay of the call will be

available through May 19, 2016, at 877-870-5176 or 858-384-5517,

pin code for both numbers is 13635173. A live webcast of the

conference call will be available at www.lxp.com within the

Investors section.

ABOUT LEXINGTON REALTY TRUST

Lexington Realty Trust (NYSE:LXP) is a publicly

traded real estate investment trust (REIT) that owns a diversified

portfolio of real estate assets consisting primarily of equity and

debt investments in single-tenant net-leased commercial properties

and land across the United States. Lexington seeks to expand its

portfolio through build-to-suit transactions, sale-leaseback

transactions and acquisitions. For more information or to follow

Lexington on social media, visit www.lxp.com.

This release contains certain forward-looking

statements which involve known and unknown risks, uncertainties or

other factors not under Lexington's control which may cause actual

results, performance or achievements of Lexington to be materially

different from the results, performance, or other expectations

implied by these forward-looking statements. Factors that could

cause or contribute to such differences include, but are not

limited to, those discussed under the headings “Management's

Discussion and Analysis of Financial Condition and Results of

Operations” and “Risk Factors” in Lexington's periodic reports

filed with the Securities and Exchange Commission, including risks

related to: (1) the authorization by Lexington's Board of Trustees

of future dividend declarations, (2) Lexington's ability to achieve

its estimate of Company FFO for the year ending December 31, 2016,

(3) the successful consummation of any lease, acquisition,

build-to-suit, disposition, financing or other transaction, (4) the

failure to continue to qualify as a real estate investment trust,

(5) changes in general business and economic conditions, including

the impact of any legislation, (6) competition, (7) increases in

real estate construction costs, (8) changes in interest rates, (9)

changes in accessibility of debt and equity capital markets, and

(10) future impairment charges. Copies of the periodic reports

Lexington files with the Securities and Exchange Commission are

available on Lexington's web site at www.lxp.com. Forward-looking

statements, which are based on certain assumptions and describe

Lexington's future plans, strategies and expectations, are

generally identifiable by use of the words “believes,” “expects,”

“intends,” “anticipates,” “estimates,” “projects”, “may,” “plans,”

“predicts,” “will,” “will likely result,” “is optimistic,” “goal,”

“objective” or similar expressions. Except as required by law,

Lexington undertakes no obligation to publicly release the results

of any revisions to those forward-looking statements which may be

made to reflect events or circumstances after the occurrence of

unanticipated events. Accordingly, there is no assurance that

Lexington's expectations will be realized.

References to Lexington refer to Lexington

Realty Trust and its consolidated subsidiaries. All interests in

properties and loans are held through special purpose entities,

which are separate and distinct legal entities, some of which are

consolidated for financial statement purposes and/or disregarded

for income tax purposes.

| |

| LEXINGTON REALTY TRUST AND CONSOLIDATED

SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (Unaudited and in thousands, except share and per share

data) |

| |

| |

Three months ended |

| |

March 31, |

| |

2016 |

|

2015 |

| Gross revenues: |

|

|

|

| Rental |

$ |

103,559 |

|

|

$ |

100,016 |

|

| Tenant reimbursements |

8,057 |

|

|

8,426 |

|

| Total gross revenues |

111,616 |

|

|

108,442 |

|

| Expense applicable to

revenues: |

|

|

|

| Depreciation and amortization |

(43,127 |

) |

|

(40,274 |

) |

| Property operating |

(12,078 |

) |

|

(16,582 |

) |

| General and

administrative |

(7,775 |

) |

|

(7,822 |

) |

| Non-operating

income |

2,867 |

|

|

2,614 |

|

| Interest and

amortization expense |

(22,893 |

) |

|

(23,003 |

) |

| Debt satisfaction gains

(charges), net |

(162 |

) |

|

10,375 |

|

| Impairment charges |

— |

|

|

(1,139 |

) |

| Gains on sales of

properties |

17,015 |

|

|

148 |

|

| Income before provision

for income taxes, equity in earnings of non-consolidated entities

and discontinued operations |

45,463 |

|

|

32,759 |

|

| Provision for income

taxes |

(413 |

) |

|

(441 |

) |

| Equity in earnings of

non-consolidated entities |

5,742 |

|

|

366 |

|

| Income from continuing

operations |

50,792 |

|

|

32,684 |

|

| Discontinued

operations: |

|

|

|

| Income from discontinued

operations |

— |

|

|

110 |

|

| Gain on sale of property |

— |

|

|

1,577 |

|

| Total discontinued operations |

— |

|

|

1,687 |

|

| Net income |

50,792 |

|

|

34,371 |

|

| Less net income attributable to

noncontrolling interests |

(1,023 |

) |

|

(866 |

) |

| Net income attributable

to Lexington Realty Trust shareholders |

49,769 |

|

|

33,505 |

|

| Dividends attributable

to preferred shares – Series C |

(1,572 |

) |

|

(1,572 |

) |

| Allocation to

participating securities |

(90 |

) |

|

(104 |

) |

| Net income attributable

to common shareholders |

$ |

48,107 |

|

|

$ |

31,829 |

|

| Income per common share

– basic: |

|

|

|

| Income from continuing

operations |

$ |

0.21 |

|

|

$ |

0.13 |

|

| Income from discontinued

operations |

— |

|

|

0.01 |

|

| Net income attributable to common

shareholders |

$ |

0.21 |

|

|

$ |

0.14 |

|

| Weighted-average common

shares outstanding – basic |

232,642,803 |

|

|

232,525,675 |

|

| Income per common share

– diluted: |

|

|

|

| Income from continuing

operations |

$ |

0.21 |

|

|

$ |

0.13 |

|

| Income from discontinued

operations |

— |

|

|

0.01 |

|

| Net income attributable to common

shareholders |

$ |

0.21 |

|

|

$ |

0.14 |

|

| Weighted-average common

shares outstanding – diluted |

238,885,171 |

|

|

232,957,265 |

|

| Amounts attributable to

common shareholders: |

|

|

|

| Income from continuing

operations |

$ |

48,107 |

|

|

$ |

30,142 |

|

| Income from discontinued

operations |

— |

|

|

1,687 |

|

| Net income attributable to common

shareholders |

$ |

48,107 |

|

|

$ |

31,829 |

|

| LEXINGTON REALTY TRUST AND CONSOLIDATED

SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (Unaudited and in thousands, except share and per share

data) |

| |

| |

March 31, 2016 |

|

December 31, 2015 |

|

Assets: |

|

|

|

| Real estate, at

cost |

$ |

3,773,333 |

|

|

$ |

3,789,711 |

|

| Real estate -

intangible assets |

692,654 |

|

|

692,778 |

|

| Investments in real

estate under construction |

115,297 |

|

|

95,402 |

|

| |

4,581,284 |

|

|

4,577,891 |

|

| Less: accumulated

depreciation and amortization |

1,201,220 |

|

|

1,179,969 |

|

| Real estate, net |

3,380,064 |

|

|

3,397,922 |

|

| Assets held for

sale |

10,147 |

|

|

24,425 |

|

| Cash and cash

equivalents |

80,894 |

|

|

93,249 |

|

| Restricted cash |

42,830 |

|

|

10,637 |

|

| Investment in and

advances to non-consolidated entities |

44,926 |

|

|

31,054 |

|

| Deferred expenses,

net |

39,839 |

|

|

42,000 |

|

| Loans receivable,

net |

95,770 |

|

|

95,871 |

|

| Rent receivable –

current |

20,094 |

|

|

7,193 |

|

| Rent receivable –

deferred |

93,320 |

|

|

87,547 |

|

| Other assets |

18,176 |

|

|

18,505 |

|

| Total assets |

$ |

3,826,060 |

|

|

$ |

3,808,403 |

|

| |

|

|

|

| Liabilities and

Equity: |

|

|

|

| Liabilities: |

|

|

|

| Mortgages and notes

payable, net |

$ |

922,320 |

|

|

$ |

872,643 |

|

| Revolving credit

facility borrowings |

147,000 |

|

|

177,000 |

|

| Term loans payable,

net |

500,330 |

|

|

500,076 |

|

| Senior notes payable,

net |

493,735 |

|

|

493,526 |

|

| Convertible guaranteed

notes payable, net |

12,192 |

|

|

12,126 |

|

| Trust preferred

securities, net |

127,021 |

|

|

126,996 |

|

| Dividends payable |

45,673 |

|

|

45,440 |

|

| Liabilities held for

sale |

— |

|

|

8,405 |

|

| Accounts payable and

other liabilities |

35,688 |

|

|

41,479 |

|

| Accrued interest

payable |

14,746 |

|

|

8,851 |

|

| Deferred revenue -

including below market leases, net |

44,026 |

|

|

42,524 |

|

| Prepaid rent |

19,783 |

|

|

16,806 |

|

| Total liabilities |

2,362,514 |

|

|

2,345,872 |

|

| |

|

|

|

| Commitments and

contingencies |

|

|

|

| Equity: |

|

|

|

| Preferred shares, par

value $0.0001 per share; authorized 100,000,000 shares: |

|

|

|

| Series C Cumulative Convertible

Preferred, liquidation preference $96,770; 1,935,400 shares issued

and outstanding |

94,016 |

|

|

94,016 |

|

| Common shares, par

value $0.0001 per share; authorized 400,000,000 shares, 235,009,739

and 234,575,225 shares issued and outstanding in 2016 and 2015,

respectively |

24 |

|

|

23 |

|

| Additional

paid-in-capital |

2,773,788 |

|

|

2,776,837 |

|

| Accumulated

distributions in excess of net income |

(1,420,554 |

) |

|

(1,428,908 |

) |

| Accumulated other

comprehensive loss |

(6,564 |

) |

|

(1,939 |

) |

| Total shareholders’ equity |

1,440,710 |

|

|

1,440,029 |

|

| Noncontrolling

interests |

22,836 |

|

|

22,502 |

|

| Total equity |

1,463,546 |

|

|

1,462,531 |

|

| Total liabilities and

equity |

$ |

3,826,060 |

|

|

$ |

3,808,403 |

|

| LEXINGTON REALTY TRUST AND CONSOLIDATED

SUBSIDIARIES |

| EARNINGS PER SHARE |

| (Unaudited and in thousands, except share and per share

data) |

| |

|

|

|

|

Three Months EndedMarch 31, |

|

|

|

|

2016 |

|

2015 |

|

EARNINGS PER SHARE: |

|

|

|

|

| |

|

|

|

|

|

Basic: |

|

|

|

|

| Income from

continuing operations attributable to common shareholders |

$ |

48,107 |

|

$ |

30,142 |

|

| Income from

discontinued operations attributable to common shareholders |

|

— |

|

|

1,687 |

|

| Net income

attributable to common shareholders |

$ |

48,107 |

|

$ |

31,829 |

|

| |

|

|

|

|

|

|

Weighted-average number of common shares outstanding |

|

232,642,803 |

|

|

232,525,675 |

|

| |

|

|

|

|

| Income per

common share: |

|

|

|

|

| Income from continuing

operations |

$ |

0.21 |

|

$ |

0.13 |

|

| Income from

discontinued operations |

|

— |

|

|

0.01 |

|

| Net income attributable

to common shareholders |

$ |

0.21 |

|

$ |

0.14 |

|

| |

|

|

|

|

|

|

Diluted: |

|

|

|

|

|

| Income from

continuing operations attributable to common shareholders -

basic |

$ |

48,107 |

|

$ |

30,142 |

|

| Impact of

assumed conversions |

|

1,058 |

|

|

— |

|

| Income from

continuing operations attributable to common shareholders |

|

49,165 |

|

|

30,142 |

|

| Income from

discontinued operations attributable to common shareholders -

basic |

|

— |

|

|

1,687 |

|

| Impact of

assumed conversions |

|

— |

|

|

— |

|

| Income from

discontinued operations attributable to common shareholders |

|

— |

|

|

1,687 |

|

| Net income

attributable to common shareholders |

$ |

49,165 |

|

$ |

31,829 |

|

| |

|

|

|

|

|

|

Weighted-average common shares outstanding - basic |

|

232,642,803 |

|

|

232,525,675 |

|

| Effect of

dilutive securities: |

|

|

|

|

| Share options |

|

132,191 |

|

|

431,590 |

|

| 6.00% Convertible

Guaranteed Notes |

|

1,941,237 |

|

|

— |

|

| Non-vested shares |

|

348,748 |

|

|

— |

|

| Operating Partnership

Units |

|

3,820,192 |

|

|

— |

|

|

Weighted-average common shares outstanding |

|

238,885,171 |

|

|

232,957,265 |

|

| |

|

|

|

|

|

| Income per

common share: |

|

|

|

|

| Income from continuing

operations |

$ |

0.21 |

|

$ |

0.13 |

|

| Income from

discontinued operations |

|

— |

|

|

0.01 |

|

| Net income attributable

to common shareholders |

$ |

0.21 |

|

$ |

0.14 |

|

| LEXINGTON REALTY TRUST AND CONSOLIDATED

SUBSIDIARIES |

| COMPANY FUNDS FROM OPERATIONS & FUNDS

AVAILABLE FOR DISTRIBUTION |

| (Unaudited and in thousands, except share and per share

data) |

| |

|

|

|

|

|

|

| |

|

|

Three Months Ended March 31, |

| |

|

|

2016 |

|

2015 |

|

FUNDS FROM OPERATIONS: (1) |

|

|

|

Basic and Diluted: |

|

|

|

|

| Net income

attributable to common shareholders |

$ |

48,107 |

|

$ |

31,829 |

|

|

Adjustments: |

|

|

|

|

| |

Depreciation and

amortization |

|

41,193 |

|

|

38,922 |

|

| |

Impairment charges -

real estate |

|

— |

|

|

1,139 |

|

| |

Noncontrolling

interests - OP units |

|

747 |

|

|

550 |

|

| |

Amortization of leasing

commissions |

|

1,934 |

|

|

1,352 |

|

| |

Joint venture and

noncontrolling interest adjustment |

|

236 |

|

|

321 |

|

| |

Gains on sales of

properties, net of tax, including non-consolidated entities |

|

(22,343 |

) |

|

(1,725 |

) |

| FFO

available to common shareholders and unitholders -

basic |

|

69,874 |

|

|

72,388 |

|

| |

Preferred

dividends |

|

1,572 |

|

|

1,572 |

|

| |

Interest and

amortization on 6.00% Convertible Notes |

|

252 |

|

|

319 |

|

| |

Amount allocated to

participating securities |

|

90 |

|

|

104 |

|

| FFO

available to common shareholders and unitholders -

diluted |

|

71,788 |

|

|

74,383 |

|

| |

Debt satisfaction

(gains) charges, net |

|

162 |

|

|

(10,375 |

) |

| |

Transaction

costs/other |

|

146 |

|

|

468 |

|

|

Company FFO available to common shareholders and

unitholders - diluted |

|

72,096 |

|

|

64,476 |

|

| |

|

|

|

|

|

FUNDS AVAILABLE FOR DISTRIBUTION: (2) |

|

|

|

|

|

Adjustments: |

|

|

|

|

| |

Straight-line

rents |

|

(11,139 |

) |

|

(5,309 |

) |

| |

Lease incentives |

|

423 |

|

|

457 |

|

| |

Amortization of

below/above market leases |

|

456 |

|

|

(621 |

) |

| |

Lease termination

payments, net |

|

(2,749 |

) |

|

(806 |

) |

| |

Non-cash interest,

net |

|

(382 |

) |

|

(635 |

) |

| |

Non-cash charges,

net |

|

2,207 |

|

|

2,256 |

|

| |

Tenant

improvements |

|

(720 |

) |

|

(1,081 |

) |

| |

Lease costs |

|

(1,230 |

) |

|

(1,420 |

) |

|

Company Funds Available for Distribution |

$ |

58,962 |

|

$ |

57,317 |

|

| |

|

|

|

|

|

|

|

| Per

Common Share and Unit Amounts |

|

|

|

|

|

|

| Basic: |

|

|

|

|

|

|

| |

FFO |

$ |

0.30 |

|

$ |

0.31 |

|

| |

|

|

|

|

|

|

|

|

|

Diluted: |

|

|

|

|

|

|

| |

FFO |

$ |

0.29 |

|

$ |

0.30 |

|

| |

Company FFO |

$ |

0.30 |

|

$ |

0.26 |

|

| |

Company FAD |

$ |

0.24 |

|

$ |

0.23 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted-Average Common Shares: |

|

|

|

|

|

|

| |

Basic(3) |

|

|

236,462,995 |

|

|

236,378,649 |

|

| |

Diluted |

|

|

243,595,741 |

|

|

244,045,197 |

|

| |

|

|

|

|

|

|

|

|

1 Lexington believes that Funds from Operations

(“FFO”), which is not a measure under generally accepted accounting

principles (“GAAP”), is a widely recognized and appropriate measure

of the performance of an equity REIT. Lexington believes FFO is

frequently used by securities analysts, investors and other

interested parties in the evaluation of REITs, many of which

present FFO when reporting their results. FFO is intended to

exclude GAAP historical cost depreciation and amortization of real

estate and related assets, which assumes that the value of real

estate diminishes ratably over time. Historically, however, real

estate values have risen or fallen with market conditions. As a

result, FFO provides a performance measure that, when compared year

over year, reflects the impact to operations from trends in

occupancy rates, rental rates, operating costs, development

activities, interest costs and other matters without the inclusion

of depreciation and amortization, providing perspective that may

not necessarily be apparent from net income.

The National Association of Real Estate

Investment Trusts, Inc. (“NAREIT”) defines FFO as “net income (or

loss) computed in accordance with GAAP, excluding gains (or losses)

from sales of property, plus real estate depreciation and

amortization and after adjustments for unconsolidated partnerships

and joint ventures.” NAREIT clarified its computation of FFO to

exclude impairment charges on depreciable real estate owned

directly or indirectly. FFO does not represent cash generated from

operating activities in accordance with GAAP and is not indicative

of cash available to fund cash needs.

Lexington presents FFO available to common

shareholders and unitholders - basic. Lexington also presents FFO

available to common shareholders and unitholders - diluted on a

company-wide basis as if all securities that are convertible, at

the holder's option, into Lexington's common shares, are converted

at the beginning of the period. Lexington also presents Company FFO

which adjusts FFO for certain items which Management believes are

not indicative of the operating results of its real estate

portfolio. Management believes this is an appropriate presentation

as it is frequently requested by security analysts, investors and

other interested parties. Since others do not calculate funds from

operations in a similar fashion, Company FFO may not be comparable

to similarly titled measures as reported by others. Company FFO

should not be considered as an alternative to net income as an

indicator of our operating performance or as an alternative to cash

flow as a measure of liquidity.

2 Company Funds Available for Distribution

("FAD") is calculated by making adjustments to Company FFO for (1)

straight-line rent revenue, (2) lease incentive amortization, (3)

amortization of above/below market leases, (4) lease termination

payments, net, (5) non-cash interest, net, (6) non-cash charges,

net, (7) cash paid for tenant improvements, and (8) cash paid for

lease costs. Although FAD may not be comparable to that of other

REITs, Lexington believes it provides a meaningful indication of

its ability to fund cash needs. FAD is a non-GAAP financial measure

and should not be viewed as an alternative measurement of operating

performance to net income, as an alternative to net cash flows from

operating activities or as a measure of liquidity.

3 Includes OP units other than OP units held by

Lexington.

Contact:

Investor or Media Inquiries for Lexington Realty Trust:

Heather Gentry, Senior Vice President of Investor Relations

Lexington Realty Trust

Phone: (212) 692-7200 E-mail: hgentry@lxp.com

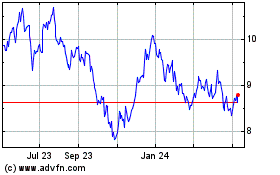

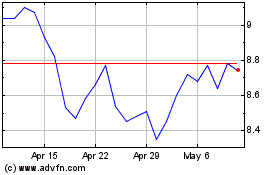

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Apr 2023 to Apr 2024