UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant

to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 5, 2015

| LEXINGTON REALTY TRUST |

| (Exact name of registrant as specified in its charter) |

| |

|

|

| Maryland |

1-12386 |

13-3717318 |

|

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| One Penn Plaza, Suite 4015, New York, New York |

10119-4015 |

| (Address of principal executive offices) |

(Zip Code) |

(212) 692-7200

(Registrant's telephone number, including

area code)

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2.):

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results

of Operations and Financial Condition.

On November 5, 2015, we issued a press

release announcing our financial results for the quarter ended September 30, 2015. A copy of the press release is furnished herewith

as part of Exhibit 99.1.

The information furnished pursuant to this

“Item 2.02 - Results of Operations and Financial Condition”, including Exhibit 99.1, shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, or otherwise

subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing made by us

under the Exchange Act or Securities Act of 1933, as amended, which we refer to as the Securities Act, regardless of any general

incorporation language in any such filing, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01. Regulation

FD Disclosure.

On November 5, 2015, we made available

supplemental information, which we refer to as the Quarterly Earnings and Supplemental Operating and Financial Data, September

30, 2015, a copy of which is furnished herewith as Exhibit 99.1.

Also on November 5, 2015, our management

discussed our financial results and certain aspects of our business plan on a conference call with analysts and investors. A transcript

of the conference call is furnished herewith as Exhibit 99.2.

The information furnished pursuant to this

“Item 7.01 - Regulation FD Disclosure”, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed to be “filed”

for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, and shall not be deemed

to be incorporated by reference into any filing made by us under the Exchange Act or the Securities Act, regardless of any general

incorporation language in any such filing, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

| |

99.1 |

Quarterly Earnings and Supplemental Operating and Financial Data, September 30, 2015. |

| |

|

|

| |

99.2 |

November 5, 2015 Conference Call Transcript. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Lexington Realty Trust |

| |

|

|

| |

|

|

| Date: November 6, 2015 |

By: |

/s/ Patrick Carroll |

| |

|

Patrick Carroll |

| |

|

Chief Financial Officer |

Exhibit Index

| |

99.1 |

Quarterly Earnings and Supplemental Operating and Financial Data, September 30, 2015. |

| |

|

|

| |

99.2 |

November 5, 2015 Conference Call Transcript. |

Exhibit 99.1

Quarterly Earnings and

Supplemental Operating and Financial

Data

September 30, 2015

LEXINGTON REALTY TRUST

SUPPLEMENTAL REPORTING PACKAGE

September 30, 2015

Table of Contents

| Section |

|

Page |

| |

|

|

| Third Quarter 2015 Earnings Press Release |

|

3 |

| |

|

|

| Portfolio Data |

|

|

| 2015 Third Quarter Investment/Capital Recycling Summary |

|

13 |

| Build-To-Suit Projects/Forward Commitments |

|

14 |

| 2015 Third Quarter Financing Summary |

|

15 |

| 2015 Third Quarter Leasing Summary |

|

16 |

| Other Revenue Data |

|

17 |

| Portfolio Detail By Asset Class |

|

19 |

| Portfolio Composition |

|

20 |

| Components of Net Asset Value |

|

21 |

| Top Markets |

|

22 |

| Single-Tenant Office Markets |

|

23 |

| Tenant Industry Diversification |

|

24 |

| Top 10 Tenants or Guarantors |

|

25 |

| Lease Rollover Schedules – GAAP Basis |

|

26 |

| Property Leases and Vacancies – Consolidated Portfolio |

|

28 |

| Select Credit Metrics |

|

35 |

| Historical Credit Metrics Summary |

|

36 |

| Financial Covenants |

|

37 |

| Mortgages and Notes Payable |

|

38 |

| Debt Maturity Schedule |

|

41 |

| Mortgage Loans Receivable |

|

42 |

| Partnership Interests |

|

43 |

| Selected Balance Sheet and Income Statement Account Data |

|

44 |

| Investor Information |

|

45 |

| |

|

|

| Appendix A – Land, Infrastructure and Credit Tenant Finance Group |

|

|

This Quarterly Earnings Release and

Supplemental Reporting Package contains certain forward-looking statements which involve known and unknown risks, uncertainties

or other factors not under the control of Lexington Realty Trust “Lexington”, which may cause actual results, performance

or achievements of Lexington to be materially different from the results, performance, or other expectations implied by these

forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those

discussed under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and “Risk Factors” in Lexington’s periodic reports filed with the Securities and Exchange Commission, including

risks related to: (1) the authorization of Lexington’s Board of Trustees of future dividend declarations, including those

necessary to achieve an annualized dividend level of $0.68 per common share/unit (2) Lexington’s ability to achieve its

estimate of Company FFO for the year ending December 31, 2015, (3) the successful consummation of any lease, acquisition, build-to-suit,

disposition, financing or other transaction, (4) the failure to continue to qualify as a real estate investment trust, (5) changes

in general business and economic conditions, including the impact of any new legislation, (6) competition, (7) increases in real

estate construction costs, (8) changes in interest rates, (9) changes in accessibility of debt and equity capital markets, and

(10) future impairment charges. Copies of the periodic reports Lexington files with the Securities and Exchange Commission are

available on Lexington’s web site at www.lxp.com. Forward-looking statements, which are based on certain assumptions

and describe Lexington’s future plans, strategies and expectations, are generally identifiable by use of the words “believes,”

“expects,” “intends,” “anticipates,” “estimates,” “projects,” may,”

“plans,” “predicts,” “will,” “will likely result,” “is optimistic,”

“goal,” “objective” or similar expressions. Except as required by law, Lexington undertakes no obligation

to publicly release the results of any revisions to those forward-looking statements which may be made to reflect events or circumstances

after the occurrence of unanticipated events. Accordingly, there is no assurance that Lexington’s expectations will be realized.

| |

LEXINGTON REALTY TRUST |

| |

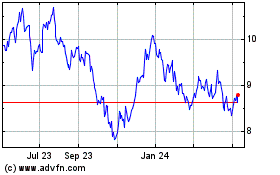

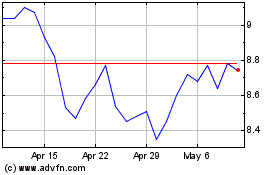

TRADED: NYSE: LXP |

| |

ONE PENN PLAZA, SUITE 4015 |

| |

NEW YORK, NY 10119-4015 |

FOR IMMEDIATE RELEASE

LEXINGTON REALTY TRUST REPORTS THIRD

QUARTER 2015 RESULTS

Raises 2015 Company FFO Guidance Range

to $1.05 - $1.07 per Share

New York, NY - Thursday, November 5,

2015 - Lexington Realty Trust (“Lexington”) (NYSE:LXP), a real estate investment trust focused on single-tenant

real estate investments, today announced results for the third quarter ended September 30, 2015.

Third Quarter 2015 Highlights

| • | Generated Company Funds From Operations (“Company FFO”) of $66.9 million, or $0.27 per diluted common share. |

| • | Disposed of three properties for gross disposition proceeds of $135.7 million. |

| • | Invested $25.5 million in on-going build-to-suit projects. |

| • | Completed an industrial build-to-suit property for $22.1 million. |

| • | Leased approximately 800,000 square feet with overall portfolio 96.5% leased. |

| • | Retired $55.0 million of secured debt. |

| • | Refinanced credit facility and term loans extending the maturities by two years and reducing interest rates by 15 to 65

basis points. |

| • | Announced a 10.0 million common share repurchase authorization and repurchased 1.6 million common shares, at an average

price of $8.34 per share, as of the date of this press release. |

T. Wilson Eglin, President and Chief Executive

Officer of Lexington, stated, “We are raising our Company FFO guidance for 2015 as a result of strong execution in all aspects

of our business. During the third quarter, same-store rent increased 2.8%, reflecting that approximately 80% of our revenue now

comes from leases with escalating rents. In the fourth quarter, we expect to close on two substantial build-to-suit projects that

are estimated to contribute approximately $22.5 million to revenue next year.”

FINANCIAL RESULTS

Revenues

For the quarter ended September 30,

2015, total gross revenues were $105.4 million, a 1.1% decrease compared with total gross revenues of $106.6 million for the quarter

ended September 30, 2014. The decrease is primarily due to 2015 property sales and lease expirations, partially offset by

revenue generated from property acquisitions and new leases signed.

Company FFO

For the quarter ended September 30,

2015, Lexington generated Company FFO of $66.9 million, or $0.27 per diluted share, compared to Company FFO for the quarter ended

September 30, 2014 of $68.7 million, or $0.28 per diluted share. The calculation of Company FFO and a reconciliation to net

income (loss) attributable to common shareholders is included later in this press release.

Dividends/Distributions

Lexington declared a regular quarterly

common share/unit dividend/distribution for the quarter ended September 30, 2015 of $0.17 per common share/unit, which was

paid on October 15, 2015 to common shareholders/unitholders of record as of September 30, 2015. Lexington also declared two

dividends of $0.8125 per share each on its Series C Cumulative Convertible Preferred Stock (“Series C Preferred Shares”),

which will be paid on November 16, 2015 and February 16, 2016 to Series C Preferred Shareholders of record as of October 30, 2015

and January 29, 2016, respectively.

Net Income (Loss) Attributable to Common Shareholders

For the quarter ended September 30,

2015, net loss attributable to common shareholders was $(7.6) million, or $(0.03) per diluted share, compared with net income attributable

to common shareholders for the quarter ended September 30, 2014 of $38.7 million, or $0.17 per diluted share.

OPERATING ACTIVITIES

Investment Activity

During the quarter, Lexington completed

the following build-to-suit project, which is subject to a lease having a term in excess of ten years (an “LTL”).

Acquisition

| Tenant | |

Location | |

Property Type | |

Initial Basis ($000) | | |

Initial Annualized Cash

Rent ($000) | | |

Initial Cash Yield | | |

GAAP Yield | | |

Lease Term

(Yrs) |

| Stella &

Chewy's LLC | |

Oak Creek,

WI | |

LTL - Industrial | |

$ | 22,139 | | |

$ | 1,865 | | |

| 8.4 | % | |

| 9.5 | % | |

20 |

In addition, Lexington acquired a consolidated

joint venture partner's interest in an office property in Philadelphia, Pennsylvania for $4.0 million, raising Lexington's ownership

in the office property from 87.5% to 100.0%.

Lexington also funded $25.5 million of the projected costs of

the following projects:

On-going Build-to-Suit Projects

| Location | |

Sq. Ft. | | |

Property Type | |

Lease Term (Years) | |

Maximum Commitment/ Estimated Completion Cost ($000) | | |

GAAP Investment Balance as of 9/30/2015 ($000) | | |

Estimated Completion/ Acquisition Date |

| Richmond, VA | |

| 330,000 | | |

LTL - Office | |

15 | |

$ | 110,137 | | |

$ | 97,830 | | |

4Q 15 |

| Anderson, SC | |

| 1,325,000 | | |

LTL - Industrial | |

20 | |

| 70,012 | | |

| 12,708 | | |

2Q 16 |

| Lake Jackson, TX | |

| 664,000 | | |

LTL - Office | |

20 | |

| 166,164 | | |

| 45,008 | | |

4Q 16 |

| Houston, TX(1) | |

| 274,000 | | |

LTL - Retail/Specialty | |

20 | |

| 86,491 | | |

| 28,602 | | |

3Q 16 |

| | |

| 2,593,000 | | |

| |

| |

$ | 432,804 | | |

$ | 184,148 | | |

|

| 1. | Lexington has a 25% interest as of September 30, 2015. Lexington may provide construction financing up to $56.7 million

to the joint venture. |

In addition, Lexington has committed to

acquire the following properties upon completion of construction:

Forward Commitments

| Location | |

Property Type | |

Estimated Acquisition Cost ($000) | | |

Lease Term (Years) | |

Estimated Initial Cash Yield | | |

Estimated GAAP Yield | | |

Estimated Acquisition Date |

| Richland, WA | |

LTL - Industrial | |

$ | 152,000 | | |

20 | |

| 7.1 | % | |

| 8.6 | % | |

4Q 15 |

| Detroit, MI | |

LTL - Industrial | |

| 29,680 | | |

20 | |

| 7.4 | % | |

| 7.4 | % | |

1Q 16 |

| | |

| |

$ | 181,680 | | |

| |

| 7.2 | % | |

| 8.4 | % | |

|

Capital Recycling

Property Dispositions

| Tenant | |

Location | |

Property Type | |

Gross Disposition Price ($000) | | |

Annualized NOI ($000) | | |

Month of

Disposition |

| Wagner Industries, Inc. | |

Jacksonville, FL | |

Industrial | |

$ | 1,850 | | |

$ | 313 | | |

July |

| Lockheed Martin Corporation | |

Orlando, FL | |

Office | |

| 12,800 | | |

| 955 | | |

July |

| Multi-tenant(1) | |

Baltimore, MD | |

Office | |

| 121,000 | | |

| 8,318 | | |

August |

| | |

| |

| |

$ | 135,650 | | |

$ | 9,586 | | |

|

| 1. | $55.0 million non-recourse mortgage loan assumed at closing. |

Balance Sheet

On September 1, 2015, Lexington entered

into a new $905.0 million unsecured credit agreement, which replaced Lexington's existing revolving credit facility and term loans.

With lender approval, Lexington can increase the size of the new facility to an aggregate $1.8 billion. A summary of the significant

terms are as follows:

|

|

Prior

Maturity Date |

|

New

Maturity Date |

|

Prior

Interest Rate |

|

Current

Interest Rate |

| $400.0 Million Revolving Credit Facility(1) |

02/2017 |

|

08/2019 |

|

L + 1.15% |

|

L + 1.00% |

| $250.0 Million Term Loan(2) |

02/2018 |

|

08/2020 |

|

L + 1.35% |

|

L + 1.10% |

| $255.0 Million Term Loan(3) |

01/2019 |

|

01/2021 |

|

L + 1.75% |

|

L + 1.10% |

| 1. | Maturity date can be extended to 08/2020 at Lexington's option. |

| 2. | Lexington previously entered into aggregate interest rate swap agreements, which fix the LIBOR component of this loan at 1.09%

through 02/2018. |

| 3. | Lexington previously entered into aggregate interest rate swap agreements, which fix the LIBOR component of this loan at 1.42%

through 01/2019. |

In July 2015, Lexington announced a new

10.0 million common share repurchase authorization (inclusive of all outstanding prior authorizations). As of the date of this

earnings release, 1,594,644 common shares have been repurchased at an average price of $8.34 per share.

In August 2015, approximately $0.4 million

original principal amount 6.00% Convertible Guaranteed Notes due 2030 (“6.00% Notes”) were satisfied for cash, reducing

the outstanding balance of this note issuance to $12.4 million. All common shares that are issuable upon conversion of the 6.00%

Notes are treated as outstanding for diluted Company FFO calculations.

Leasing

During the third quarter of 2015, Lexington

executed the following new and extended leases:

| | |

LEASE EXTENSIONS | |

| |

| |

| | |

| |

| |

| |

| |

| | |

Location | |

Prior Term | |

Lease Expiration Date | |

Sq. Ft. | |

| | |

| |

| |

| |

| |

| | |

Office/Multi-Tenant Office | |

| |

| |

| | |

| | |

| |

| |

| |

| | |

| 1 | |

Rockaway, NJ | |

06/2026 | |

12/2027 | |

| 60,258 | |

| 2-4 | |

Various (AZ, HI) | |

2015 | |

2016-2021 | |

| 34,758 | |

| 4 | |

Total office lease extensions | |

| |

| |

| 95,016 | |

| | |

| |

| |

| |

| | |

| | |

Industrial | |

| |

| |

| | |

| | |

| |

| |

| |

| | |

| 1 | |

Erwin, NY | |

11/2016 | |

11/2026 | |

| 408,000 | |

| 2 | |

Orlando, FL | |

03/2016 | |

03/2021 | |

| 205,016 | |

| 2 | |

Total industrial lease extensions | |

| |

| |

| 613,016 | |

| | |

| |

| |

| |

| | |

| | |

Retail | |

| |

| |

| | |

| | |

| |

| |

| |

| | |

| 1 | |

Tulsa, OK | |

05/2016 | |

05/2026 | |

| 43,123 | |

| 1 | |

Total retail lease extensions | |

| |

| |

| 43,123 | |

| | |

| |

| |

| |

| | |

| 7 | |

Total lease extensions | |

| |

| |

| 751,155 | |

| | |

NEW LEASES | |

| |

| |

| |

| | |

| |

| |

| |

| |

| | |

Location | |

| |

Lease Expiration Date | |

Sq. Ft. | |

| | |

| |

| |

| |

| |

| | |

Office/Multi-Tenant Office | |

| |

| |

| | |

| 1 | |

Foxboro, MA | |

| |

02/2017 | |

| 8,151 | |

| 2 | |

Rockaway, NJ | |

| |

12/2027 | |

| 32,068 | |

| 2 | |

Total new office leases | |

| |

| |

| 40,219 | |

| | |

| |

| |

| |

| | |

| 2 | |

Total new leases | |

| |

| |

| 40,219 | |

| | |

| |

| |

| |

| | |

| 9 | |

TOTAL NEW AND EXTENDED LEASES | |

| |

| |

| 791,374 | |

As of September 30, 2015, Lexington's

portfolio was 96.5% leased, excluding properties owned subject to mortgages in default.

2015 EARNINGS GUIDANCE

Lexington raised its Company FFO guidance

to an expected range of $1.05 to $1.07 from $1.02 to $1.06 to per diluted share for the year ended December 31, 2015. This guidance

is forward looking, excludes the impact of certain items and is based on current expectations.

THIRD QUARTER 2015 CONFERENCE CALL

Lexington will host a conference call today,

Thursday, November 5, 2015, at 11:00 a.m. Eastern Time, to discuss its results for the quarter ended September 30, 2015. Interested

parties may participate in this conference call by dialing 877-407-0789 or 201-689-8562. A replay of the call will be available

through November 19, 2015, at 877-870-5176 or 858-384-5517, pin: 13622695. A live webcast of the conference call will be available

at www.lxp.com within the Investors section.

ABOUT LEXINGTON REALTY TRUST

Lexington Realty Trust is a real estate

investment trust that owns a diversified portfolio of equity and debt interests in single-tenant commercial properties and land.

Lexington seeks to expand its portfolio through acquisitions, sale-leaseback transactions, build-to-suit arrangements and other

transactions. A majority of these properties and all land interests are subject to net or similar leases, where the tenant bears

all or substantially all of the operating costs, including cost increases, for real estate taxes, utilities, insurance and ordinary

repairs. Lexington also provides investment advisory and asset management services to investors in the single-tenant area. Lexington

common shares are traded on the New York Stock Exchange under the symbol “LXP”. Additional information about Lexington

is available on-line at www.lxp.com or by contacting Lexington Realty Trust, One Penn Plaza, Suite 4015, New York, New York

10119-4015, Attention: Investor Relations.

Contact:

Investor or Media Inquiries, T. Wilson Eglin, CEO

Lexington Realty Trust

Phone: (212) 692-7200 E-mail: tweglin@lxp.com

This release contains certain forward-looking

statements which involve known and unknown risks, uncertainties or other factors not under Lexington's control which may cause

actual results, performance or achievements of Lexington to be materially different from the results, performance, or other expectations

implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited

to, those discussed under the headings “Management's Discussion and Analysis of Financial Condition and Results of Operations”

and “Risk Factors” in Lexington's periodic reports filed with the Securities and Exchange Commission, including risks

related to: (1) the authorization by Lexington's Board of Trustees of future dividend declarations, including those necessary to

achieve an annualized dividend level of $0.68 per common share/unit, (2) Lexington's ability to achieve its estimate of Company

FFO for the year ending December 31, 2015, (3) the successful consummation of any lease, acquisition, build-to-suit, disposition,

financing or other transaction, (4) the failure to continue to qualify as a real estate investment trust, (5) changes in general

business and economic conditions, including the impact of any legislation, (6) competition, (7) increases in real estate construction

costs, (8) changes in interest rates, (9) changes in accessibility of debt and equity capital markets, and (10) future impairment

charges. Copies of the periodic reports Lexington files with the Securities and Exchange Commission are available on Lexington's

web site at www.lxp.com. Forward-looking statements, which are based on certain assumptions and describe Lexington's future

plans, strategies and expectations, are generally identifiable by use of the words “believes,” “expects,”

“intends,” “anticipates,” “estimates,” “projects”, “may,” “plans,”

“predicts,” “will,” “will likely result,” “is optimistic,” “goal,”

“objective” or similar expressions. Except as required by law, Lexington undertakes no obligation to publicly release

the results of any revisions to those forward-looking statements which may be made to reflect events or circumstances after the

occurrence of unanticipated events. Accordingly, there is no assurance that Lexington's expectations will be realized.

References to Lexington refer to Lexington

Realty Trust and its consolidated subsidiaries. All interests in properties and loans are held through special purpose entities,

which are separate and distinct legal entities, some of which are consolidated for financial statement purposes and/or disregarded

for income tax purposes.

LEXINGTON REALTY TRUST AND CONSOLIDATED

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited and in thousands,

except share and per share data)

| | |

Three months ended September 30, | | |

Nine months ended September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Gross revenues: | |

| | | |

| | | |

| | | |

| | |

| Rental | |

$ | 98,095 | | |

$ | 98,941 | | |

$ | 300,551 | | |

$ | 292,870 | |

| Tenant reimbursements | |

| 7,343 | | |

| 7,631 | | |

| 23,662 | | |

| 23,165 | |

| Total gross revenues | |

| 105,438 | | |

| 106,572 | | |

| 324,213 | | |

| 316,035 | |

| Expense applicable to revenues: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| (39,712 | ) | |

| (39,022 | ) | |

| (121,795 | ) | |

| (114,732 | ) |

| Property operating | |

| (13,484 | ) | |

| (15,504 | ) | |

| (45,600 | ) | |

| (46,634 | ) |

| General and administrative | |

| (6,734 | ) | |

| (6,426 | ) | |

| (22,526 | ) | |

| (21,035 | ) |

| Non-operating income | |

| 2,515 | | |

| 4,217 | | |

| 8,213 | | |

| 10,369 | |

| Interest and amortization expense | |

| (21,931 | ) | |

| (24,321 | ) | |

| (68,273 | ) | |

| (73,456 | ) |

| Debt satisfaction gains (charges), net | |

| (398 | ) | |

| (455 | ) | |

| 13,753 | | |

| (7,946 | ) |

| Impairment charges | |

| (32,818 | ) | |

| (2,464 | ) | |

| (34,070 | ) | |

| (18,864 | ) |

| Gains on sales of properties | |

| 1,733 | | |

| — | | |

| 23,307 | | |

| — | |

| Income (loss) before provision for income taxes, equity in earnings of non-consolidated entities and discontinued operations | |

| (5,391 | ) | |

| 22,597 | | |

| 77,222 | | |

| 43,737 | |

| Provision for income taxes | |

| (75 | ) | |

| (72 | ) | |

| (464 | ) | |

| (947 | ) |

| Equity in earnings of non-consolidated entities | |

| 266 | | |

| 173 | | |

| 938 | | |

| 246 | |

| Income (loss) from continuing operations | |

| (5,200 | ) | |

| 22,698 | | |

| 77,696 | | |

| 43,036 | |

| Discontinued operations: | |

| | | |

| | | |

| | | |

| | |

| Income from discontinued operations | |

| — | | |

| 1,322 | | |

| 109 | | |

| 5,601 | |

| Provision for income taxes | |

| — | | |

| (14 | ) | |

| (4 | ) | |

| (50 | ) |

| Debt satisfaction charges, net | |

| — | | |

| — | | |

| — | | |

| (299 | ) |

| Gains on sales of properties | |

| — | | |

| 18,542 | | |

| 1,577 | | |

| 22,052 | |

| Impairment charges | |

| — | | |

| (371 | ) | |

| — | | |

| (11,062 | ) |

| Total discontinued operations | |

| — | | |

| 19,479 | | |

| 1,682 | | |

| 16,242 | |

| Net income (loss) | |

| (5,200 | ) | |

| 42,177 | | |

| 79,378 | | |

| 59,278 | |

| Less net income attributable to noncontrolling interests | |

| (784 | ) | |

| (1,772 | ) | |

| (2,525 | ) | |

| (3,537 | ) |

| Net income (loss) attributable to Lexington Realty Trust shareholders | |

| (5,984 | ) | |

| 40,405 | | |

| 76,853 | | |

| 55,741 | |

| Dividends attributable to preferred shares – Series C | |

| (1,573 | ) | |

| (1,573 | ) | |

| (4,718 | ) | |

| (4,718 | ) |

| Allocation to participating securities | |

| (72 | ) | |

| (112 | ) | |

| (264 | ) | |

| (399 | ) |

| Net income (loss) attributable to common shareholders | |

$ | (7,629 | ) | |

$ | 38,720 | | |

$ | 71,871 | | |

$ | 50,624 | |

| Income (loss) per common share – basic: | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from continuing operations | |

$ | (0.03 | ) | |

$ | 0.09 | | |

$ | 0.30 | | |

$ | 0.15 | |

| Income from discontinued operations | |

| — | | |

| 0.08 | | |

| 0.01 | | |

| 0.07 | |

| Net income (loss) attributable to common shareholders | |

$ | (0.03 | ) | |

$ | 0.17 | | |

$ | 0.31 | | |

$ | 0.22 | |

| Weighted-average common shares outstanding – basic | |

| 234,018,062 | | |

| 229,463,522 | | |

| 233,457,400 | | |

| 228,337,871 | |

| Income (loss) per common share – diluted: | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from continuing operations | |

$ | (0.03 | ) | |

$ | 0.09 | | |

$ | 0.30 | | |

$ | 0.15 | |

| Income from discontinued operations | |

| — | | |

| 0.08 | | |

| 0.01 | | |

| 0.07 | |

| Net income (loss) attributable to common shareholders | |

$ | (0.03 | ) | |

$ | 0.17 | | |

$ | 0.31 | | |

$ | 0.22 | |

| Weighted-average common shares outstanding – diluted | |

| 234,018,062 | | |

| 229,922,110 | | |

| 233,776,838 | | |

| 228,830,020 | |

| Amounts attributable to common shareholders: | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from continuing operations | |

$ | (7,629 | ) | |

$ | 20,151 | | |

$ | 70,189 | | |

$ | 35,330 | |

| Income from discontinued operations | |

| — | | |

| 18,569 | | |

| 1,682 | | |

| 15,294 | |

| Net income (loss) attributable to common shareholders | |

$ | (7,629 | ) | |

$ | 38,720 | | |

$ | 71,871 | | |

$ | 50,624 | |

LEXINGTON REALTY TRUST AND CONSOLIDATED

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited and in thousands, except share

and per share data)

| | |

September 30, 2015 | | |

December 31, 2014 | |

| Assets: | |

| | | |

| | |

| Real estate, at cost | |

$ | 3,586,435 | | |

$ | 3,671,560 | |

| Real estate - intangible assets | |

| 669,341 | | |

| 705,566 | |

| Investments in real estate under construction | |

| 155,546 | | |

| 106,238 | |

| | |

| 4,411,322 | | |

| 4,483,364 | |

| Less: accumulated depreciation and amortization | |

| 1,153,841 | | |

| 1,196,114 | |

| Real estate, net | |

| 3,257,481 | | |

| 3,287,250 | |

| Assets held for sale | |

| — | | |

| 3,379 | |

| Cash and cash equivalents | |

| 86,269 | | |

| 191,077 | |

| Restricted cash | |

| 12,327 | | |

| 17,379 | |

| Investment in and advances to non-consolidated entities | |

| 28,050 | | |

| 19,402 | |

| Deferred expenses, net | |

| 62,225 | | |

| 65,860 | |

| Loans receivable, net | |

| 95,806 | | |

| 105,635 | |

| Rent receivable – current | |

| 9,896 | | |

| 6,311 | |

| Rent receivable – deferred | |

| 78,957 | | |

| 61,372 | |

| Other assets | |

| 21,614 | | |

| 20,229 | |

| Total assets | |

$ | 3,652,625 | | |

$ | 3,777,894 | |

| | |

| | | |

| | |

| Liabilities and Equity: | |

| | | |

| | |

| Liabilities: | |

| | | |

| | |

| Mortgages and notes payable | |

$ | 804,238 | | |

$ | 945,216 | |

| Credit facility borrowings | |

| 73,000 | | |

| — | |

| Term loans payable | |

| 505,000 | | |

| 505,000 | |

| Senior notes payable | |

| 497,879 | | |

| 497,675 | |

| Convertible notes payable | |

| 12,128 | | |

| 15,664 | |

| Trust preferred securities | |

| 129,120 | | |

| 129,120 | |

| Dividends payable | |

| 45,307 | | |

| 42,864 | |

| Liabilities held for sale | |

| — | | |

| 2,843 | |

| Accounts payable and other liabilities | |

| 42,692 | | |

| 37,740 | |

| Accrued interest payable | |

| 14,679 | | |

| 8,301 | |

| Deferred revenue - including below market leases, net | |

| 43,521 | | |

| 68,215 | |

| Prepaid rent | |

| 16,991 | | |

| 16,336 | |

| Total liabilities | |

| 2,184,555 | | |

| 2,268,974 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Preferred shares, par value $0.0001 per share; authorized 100,000,000 shares: | |

| | | |

| | |

| Series C Cumulative Convertible Preferred, liquidation preference $96,770; 1,935,400 shares issued and outstanding | |

| 94,016 | | |

| 94,016 | |

| Common shares, par value $0.0001 per share; authorized 400,000,000 shares, 235,179,131 and 233,278,037 shares issued and outstanding in 2015 and 2014, respectively | |

| 24 | | |

| 23 | |

| Additional paid-in-capital | |

| 2,779,836 | | |

| 2,763,374 | |

| Accumulated distributions in excess of net income | |

| (1,422,417 | ) | |

| (1,372,051 | ) |

| Accumulated other comprehensive income (loss) | |

| (6,216 | ) | |

| 404 | |

| Total shareholders’ equity | |

| 1,445,243 | | |

| 1,485,766 | |

| Noncontrolling interests | |

| 22,827 | | |

| 23,154 | |

| Total equity | |

| 1,468,070 | | |

| 1,508,920 | |

| Total liabilities and equity | |

$ | 3,652,625 | | |

$ | 3,777,894 | |

LEXINGTON REALTY TRUST AND CONSOLIDATED

SUBSIDIARIES

EARNINGS PER SHARE

(Unaudited and in thousands, except share

and per share data)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| EARNINGS PER SHARE: | |

| | | |

| | | |

| | | |

| | |

| Basic: | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from continuing operations attributable to common shareholders | |

$ | (7,629 | ) | |

$ | 20,151 | | |

$ | 70,189 | | |

$ | 35,330 | |

| Income from discontinued operations attributable to common shareholders | |

| — | | |

| 18,569 | | |

| 1,682 | | |

| 15,294 | |

| Net income (loss) attributable to common shareholders | |

$ | (7,629 | ) | |

$ | 38,720 | | |

$ | 71,871 | | |

$ | 50,624 | |

| Weighted-average number of common shares outstanding | |

| 234,018,062 | | |

| 229,463,522 | | |

| 233,457,400 | | |

| 228,337,871 | |

| Income (loss) per common share: | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from continuing operations | |

$ | (0.03 | ) | |

$ | 0.09 | | |

$ | 0.30 | | |

$ | 0.15 | |

| Income from discontinued operations | |

| — | | |

| 0.08 | | |

| 0.01 | | |

| 0.07 | |

| Net income (loss) attributable to common shareholders | |

$ | (0.03 | ) | |

$ | 0.17 | | |

$ | 0.31 | | |

$ | 0.22 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted: | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from continuing operations attributable to common shareholders - basic | |

$ | (7,629 | ) | |

$ | 20,151 | | |

$ | 70,189 | | |

$ | 35,330 | |

| Impact of assumed conversions | |

| — | | |

| — | | |

| — | | |

| — | |

| Income (loss) from continuing operations attributable to common shareholders | |

| (7,629 | ) | |

| 20,151 | | |

| 70,189 | | |

| 35,330 | |

| Income from discontinued operations attributable to common shareholders - basic | |

| — | | |

| 18,569 | | |

| 1,682 | | |

| 15,294 | |

| Impact of assumed conversions | |

| — | | |

| — | | |

| — | | |

| — | |

| Income from discontinued operations attributable to common shareholders | |

| — | | |

| 18,569 | | |

| 1,682 | | |

| 15,294 | |

| Net income (loss) attributable to common shareholders | |

$ | (7,629 | ) | |

$ | 38,720 | | |

$ | 71,871 | | |

$ | 50,624 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average common shares outstanding - basic | |

| 234,018,062 | | |

| 229,463,522 | | |

| 233,457,400 | | |

| 228,337,871 | |

| Effect of dilutive securities: | |

| | | |

| | | |

| | | |

| | |

| Share options | |

| — | | |

| 458,588 | | |

| 319,438 | | |

| 492,149 | |

| Weighted-average common shares outstanding | |

| 234,018,062 | | |

| 229,922,110 | | |

| 233,776,838 | | |

| 228,830,020 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) per common share: | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from continuing operations | |

$ | (0.03 | ) | |

$ | 0.09 | | |

$ | 0.30 | | |

$ | 0.15 | |

| Income from discontinued operations | |

| — | | |

| 0.08 | | |

| 0.01 | | |

| 0.07 | |

| Net income (loss) attributable to common shareholders | |

$ | (0.03 | ) | |

$ | 0.17 | | |

$ | 0.31 | | |

$ | 0.22 | |

LEXINGTON REALTY TRUST AND CONSOLIDATED

SUBSIDIARIES

COMPANY FUNDS FROM OPERATIONS & FUNDS

AVAILABLE FOR DISTRIBUTION

(Unaudited and in thousands, except share

and per share data)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| FUNDS FROM OPERATIONS: (1) | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted: | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) attributable to common shareholders | |

$ | (7,629 | ) | |

$ | 38,720 | | |

$ | 71,871 | | |

$ | 50,624 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 38,547 | | |

| 39,030 | | |

| 117,936 | | |

| 117,991 | |

| Impairment charges - real estate, including non-consolidated entities | |

| 32,818 | | |

| 3,115 | | |

| 34,070 | | |

| 30,856 | |

| Noncontrolling interests - OP units | |

| 452 | | |

| 1,442 | | |

| 1,542 | | |

| 2,556 | |

| Amortization of leasing commissions | |

| 1,166 | | |

| 1,580 | | |

| 3,859 | | |

| 4,506 | |

| Joint venture and noncontrolling interest adjustment | |

| 577 | | |

| 495 | | |

| 1,335 | | |

| 1,733 | |

| Gains on sales of properties | |

| (1,733 | ) | |

| (18,542 | ) | |

| (24,884 | ) | |

| (22,052 | ) |

| FFO available to common shareholders and unitholders - basic | |

| 64,198 | | |

| 65,840 | | |

| 205,729 | | |

| 186,214 | |

| Preferred dividends | |

| 1,573 | | |

| 1,573 | | |

| 4,718 | | |

| 4,718 | |

| Interest and amortization on 6.00% Convertible Guaranteed Notes | |

| 252 | | |

| 508 | | |

| 795 | | |

| 1,618 | |

| Amount allocated to participating securities | |

| 72 | | |

| 112 | | |

| 264 | | |

| 399 | |

| FFO available to common shareholders and unitholders - diluted | |

| 66,095 | | |

| 68,033 | | |

| 211,506 | | |

| 192,949 | |

| Debt satisfaction (gains) charges, net, including non-consolidated entities | |

| 398 | | |

| 455 | | |

| (13,689 | ) | |

| 8,245 | |

| Other / Transaction costs | |

| 405 | | |

| 257 | | |

| 579 | | |

| 1,514 | |

| Company FFO available to common shareholders and unitholders - diluted | |

| 66,898 | | |

| 68,745 | | |

| 198,396 | | |

| 202,708 | |

| | |

| | | |

| | | |

| | | |

| | |

| FUNDS AVAILABLE FOR DISTRIBUTION: (2) | |

| | | |

| | | |

| | | |

| | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Straight-line rents | |

| (12,899 | ) | |

| (13,478 | ) | |

| (35,242 | ) | |

| (31,057 | ) |

| Lease incentives | |

| 212 | | |

| 250 | | |

| 1,157 | | |

| 1,104 | |

| Amortization of below/above market leases | |

| 287 | | |

| 184 | | |

| (157 | ) | |

| 903 | |

| Non-cash interest, net | |

| (598 | ) | |

| (1,824 | ) | |

| 520 | | |

| (4,186 | ) |

| Non-cash charges, net | |

| 2,205 | | |

| 2,114 | | |

| 6,608 | | |

| 6,563 | |

| Tenant improvements | |

| (10,562 | ) | |

| (1,961 | ) | |

| (13,184 | ) | |

| (5,960 | ) |

| Lease costs | |

| (1,066 | ) | |

| (1,895 | ) | |

| (4,242 | ) | |

| (8,414 | ) |

| Company Funds Available for Distribution | |

$ | 44,477 | | |

$ | 52,135 | | |

$ | 153,856 | | |

$ | 161,661 | |

| | |

| | | |

| | | |

| | | |

| | |

| Per Common Share and Unit Amounts | |

| | | |

| | | |

| | | |

| | |

| Basic: | |

| | | |

| | | |

| | | |

| | |

| FFO | |

$ | 0.27 | | |

$ | 0.28 | | |

$ | 0.87 | | |

$ | 0.80 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted: | |

| | | |

| | | |

| | | |

| | |

| FFO | |

$ | 0.27 | | |

$ | 0.28 | | |

$ | 0.87 | | |

$ | 0.80 | |

| Company FFO | |

$ | 0.27 | | |

$ | 0.28 | | |

$ | 0.81 | | |

$ | 0.84 | |

| Company FAD | |

$ | 0.18 | | |

$ | 0.22 | | |

$ | 0.63 | | |

$ | 0.67 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-Average Common Shares: | |

| | | |

| | | |

| | | |

| | |

| Basic(3) | |

| 237,871,036 | | |

| 233,334,560 | | |

| 237,310,374 | | |

| 232,214,620 | |

| Diluted | |

| 244,714,549 | | |

| 242,373,712 | | |

| 244,432,218 | | |

| 241,487,119 | |

1 Lexington

believes that Funds from Operations (“FFO”), which is not a measure under generally accepted accounting principles

(“GAAP”), is a widely recognized and appropriate measure of the performance of an equity REIT. Lexington believes FFO

is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present

FFO when reporting their results. FFO is intended to exclude GAAP historical cost depreciation and amortization of real estate

and related assets, which assumes that the value of real estate diminishes ratably over time. Historically, however, real estate

values have risen or fallen with market conditions. As a result, FFO provides a performance measure that, when compared year over

year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities,

interest costs and other matters without the inclusion of depreciation and amortization, providing perspective that may not necessarily

be apparent from net income.

The National Association of Real Estate

Investment Trusts, Inc. (“NAREIT”) defines FFO as “net income (or loss) computed in accordance with GAAP, excluding

gains (or losses) from sales of property, plus real estate depreciation and amortization and after adjustments for unconsolidated

partnerships and joint ventures.” NAREIT clarified its computation of FFO to exclude impairment charges on depreciable real

estate owned directly or indirectly. FFO does not represent cash generated from operating activities in accordance with GAAP and

is not indicative of cash available to fund cash needs.

Lexington presents FFO available to common

shareholders and unitholders - basic. Lexington also presents FFO available to common shareholders and unitholders - diluted on

a company-wide basis as if all securities that are convertible, at the holder's option, into Lexington's common shares, are converted

at the beginning of the period. Lexington also presents Company FFO which adjusts FFO for certain items which Management believes

are not indicative of the operating results of its real estate portfolio. Management believes this is an appropriate presentation

as it is frequently requested by security analysts, investors and other interested parties. Since others do not calculate funds

from operations in a similar fashion, Company FFO may not be comparable to similarly titled measures as reported by others. Company

FFO should not be considered as an alternative to net income as an indicator of our operating performance or as an alternative

to cash flow as a measure of liquidity.

2 Company Funds Available for

Distribution ("FAD") is calculated by making adjustments to Company FFO for (1) straight-line rent revenue, (2) lease

incentive amortization, (3) amortization of above/below market leases, (4) cash paid for tenant improvements, (5) cash paid for

lease costs, (6) non-cash interest, net and (7) non-cash charges, net. Although FAD may not be comparable to that of other REITs,

Lexington believes it provides a meaningful indication of its ability to fund cash needs. FAD is a non-GAAP financial measure and

should not be viewed as an alternative measurement of operating performance to net income, as an alternative to net cash flows

from operating activities or as a measure of liquidity.

3 Includes OP units other than

OP units held by us.

# # #

LEXINGTON REALTY TRUST

2015 Third Quarter Investment / Capital Recycling Summary

PROPERTY INVESTMENTS - LONG TERM LEASES

("LTL")(1)

| | |

| |

| |

| |

| |

| | |

| | |

| | |

Initial | | |

| |

|

| | |

| |

| |

| |

| |

Initial Basis | | |

Initial Annualized | | |

Initial Cash | | |

GAAP | | |

| |

Lease |

| | |

Tenant (Guarantor) | |

Location | |

Property Type | |

($000) | | |

Cash Rent ($000) | | |

Yield | | |

Yield | | |

Month Closed | |

Expiration |

| 1 | |

Stella & Chewy's, LLC

| |

Oak Creek | |

WI | |

LTL - Industrial | |

$ | 22,139 | | |

$ | 1,865 | | |

| 8.4 | % | |

| 9.5 | % | |

July | |

06/2035 |

CAPITAL RECYCLING

| | |

PROPERTY DISPOSITIONS | |

| |

| |

| |

| | |

| | |

| |

| | |

| |

| | |

| |

| |

| |

| |

Gross | | |

| | |

| |

| | |

| |

| | |

| |

| |

| |

| |

Disposition | | |

| | |

| |

| | |

| |

| | |

| |

| |

| |

Property | |

Price | | |

Annualized NOI | | |

Month of | |

| | |

Gross Disposition | |

| | |

Tenant | |

Location | |

Type | |

($000) | | |

($000) | | |

Disposition | |

% Leased | | |

Price PSF | |

| 1 | |

Wagner Industries, Inc. | |

Jacksonville | |

FL | |

Industrial | |

$ | 1,850 | | |

$ | 313 | | |

July | |

| 97 | % | |

$ | 10.96 | |

| 2 | |

Lockheed Martin Corporation | |

Orlando | |

FL | |

Office | |

| 12,800 | | |

| 955 | | |

July | |

| 100 | % | |

$ | 69.57 | |

| 3 | |

Multi-Tenant | |

Baltimore | |

MD | |

Office | |

| 121,000 | | |

| 8,318 | | |

August | |

| 94 | % | |

$ | 253.96 | |

| | |

| |

| |

| |

| |

| | | |

| | | |

| |

| | | |

| | |

| 3 | |

TOTAL PROPERTY DISPOSITIONS | |

| |

| |

| |

$ | 135,650 | | |

$ | 9,586 | | |

| |

| | | |

| | |

Footnotes

| (1) | In addition, Lexington foreclosed on a loan investment and acquired the vacant office property collateral located in Westmont,

IL. Lexington also acquired a consolidated joint venture partner's interest in an office property located in Philadelphia,

PA for $4.0 million, raising Lexington's ownership interest in the property from 87.5% to 100.0%. |

LEXINGTON REALTY TRUST

BUILD-TO-SUIT PROJECTS / FORWARD COMMITMENTS

9/30/2015

BUILD-TO-SUIT PROJECTED FUNDING SCHEDULE - LONG TERM LEASES (1)

| | |

| |

| |

| | |

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

Estimated | |

| | |

| |

| | |

| |

| |

| | |

| |

| |

Maximum | | |

Investment | | |

| | |

| | |

| | |

| | |

Completion/ | |

Estimated | | |

Estimated | |

| | |

| |

| |

| | |

| |

Lease | |

Commitment/Estimated | | |

balance as of | | |

| | |

| | |

| | |

| | |

Acquisition | |

Initial | | |

GAAP | |

| | |

Location | |

Sq.

Ft | | |

Asset

Type | |

Term

(Years) | |

Completion

Cost ($000) | | |

9/30/15($000) | | |

Estimated

Cash Investment Next 12 Months ($000) | | |

Date | |

Cash

Yield | | |

Yield | |

| | |

| |

| |

| | |

| |

| |

| | |

| | |

Q4

2015 | | |

Q1

2016 | | |

Q2

2016 | | |

Q3

2016 | | |

| |

| | |

| |

| 1 | |

Richmond (7) | |

VA | |

| 330,000 | | |

LTL - Office | |

15 | |

$ | 110,137 | | |

$ | 97,830 | | |

$ | 4,227 | | |

$ | 3,895 | | |

$ | 2,136 | | |

$ | 2,067 | | |

4Q 15 | |

| 8.0 | % | |

| 8.6 | % |

| 2 | |

Anderson | |

SC | |

| 1,325,000 | | |

LTL - Industrial | |

20 | |

| 70,012 | | |

| 12,708 | | |

| 19,000 | | |

| 19,000 | | |

| 19,000 | | |

| - | | |

2Q16 | |

| 5.9 | % | |

| 7.3 | % |

| 3 | |

Lake Jackson | |

TX | |

| 664,000 | | |

LTL - Office | |

20 | |

| 166,164 | | |

| 45,008 | | |

| 27,500 | | |

| 27,500 | | |

| 27,500 | | |

| 27,500 | | |

4Q 16 | |

| 7.3 | % | |

| 8.9 | % |

| 3 | |

TOTAL CONSOLIDATED BUILD-TO-SUIT PROJECTS (2) | | |

| |

| |

$ | 346,313 | | |

$ | 155,546 | | |

$ | 50,727 | | |

$ | 50,395 | | |

$ | 48,636 | | |

$ | 29,567 | | |

| |

| | | |

| | |

| | |

| |

| |

| | | |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | |

| | |

| 1 | |

Houston (3) | |

TX | |

| 274,000 | | |

LTL - Retail/Specialty | |

20 | |

$ | 86,491 | | |

$ | 28,602 | | |

$ | 13,784 | | |

$ | 13,784 | | |

$ | 13,784 | | |

$ | 13,784 | | |

3Q 16 | |

| 7.5 | % | |

| 7.5 | % |

| 1 | |

TOTAL NON-CONSOLIDATED BUILD-TO-SUIT PROJECTS | | |

| |

| |

$ | 86,491 | | |

$ | 28,602 | | |

$ | 13,784 | | |

$ | 13,784 | | |

$ | 13,784 | | |

$ | 13,784 | | |

| |

| | | |

| | |

| | |

| |

| |

| | | |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | |

| | |

| 4 | |

TOTAL BUILD-TO-SUIT PROJECTS | | |

| |

| |

$ | 432,804 | | |

$ | 184,148 | | |

$ | 64,511 | | |

$ | 64,179 | | |

$ | 62,420 | | |

$ | 43,351 | | |

| |

| | | |

| | |

FORWARD COMMITMENTS - LONG TERM LEASES (1)

| | |

| |

| |

| |

| | |

| | |

Estimated | |

| | |

| | |

|

| | |

| |

| |

| |

| | |

| | |

Completion/ | |

Estimated | | |

| | |

|

| | |

| |

| |

| |

| | |

Estimated Acquisition | | |

Acquisition | |

Initial Cash | | |

Estimated | | |

|

| | |

Tenant | |

Location | |

Property

Type | |

Sq.

Ft. | | |

Cost

($000) | | |

Date | |

Yield | | |

GAAP

Yield | | |

Lease

Term |

| 1 | |

Preferred Freezer Services of Richland LLC (4) | |

Richland, WA | |

LTL - Industrial | |

| 456,412 | | |

$ | 152,000 | | |

4Q 15 | |

| 7.1 | % | |

| 8.6 | % | |

20 yrs |

| 2 | |

Chrysler Group LLC (5) | |

Detroit, MI | |

LTL - Industrial | |

| 189,960 | | |

| 29,680 | | |

1Q 16 | |

| 7.4 | % | |

| 7.4 | % | |

20 yrs |

| 2 | |

TOTAL FORWARD COMMITMENTS | |

| |

| |

| 646,372 | | |

$ | 181,680 | | |

| |

| 7.2 | % | |

| 8.4 | % | |

|

| BUILD-TO-SUIT NOI (6) | |

| | |

| | |

| | |

| | |

| |

| | |

2011 | | |

2012 | | |

2013 | | |

2014 | | |

3Q 2015 | |

| Net operating income ($000) | |

$ | 1,156 | | |

$ | 5,268 | | |

$ | 11,920 | | |

$ | 21,438 | | |

$ | 19,759 | |

Footnotes

| (1) | Lexington can give no assurance that any of the build-to-suit projects or other potential investments that are under commitment

or contract or in process will be completed. |

| (2) | Investment balance in accordance with GAAP included in investment in real estate under construction. Aggregate equity invested

is $161.2 million. |

| (3) | Lexington has a 25% interest as of September 30, 2015. Lexington may provide construction financing up to $56.7 million to

the joint venture. Estimated cash investments for next 12 months are Lexington's estimated contributions / loan amounts.

Lease contains annual CPI increases. |

| (4) | Lexington provided a $10.0 million letter of credit. |

| (5) | Lexington funded a $2.5 million deposit. |

| (6) | Net operating income generated from completed build-to-suit projects funded by Lexington beginning in 2010. |

| (7) | Funding estimates include fundings for earn-out leases. |

LEXINGTON REALTY TRUST

2015 Third Quarter Financing Summary

DEBT RETIRED

| | |

| |

| |

Face / Satisfaction | | |

| | |

|

| Location | |

Tenant (Guarantor) | |

Property Type | |

($000) | | |

Fixed Rate | | |

Maturity Date |

| | |

| |

| |

| | |

| | |

|

| Consolidated Mortgage Debt: | |

| |

| |

| | | |

| | | |

|

| Baltimore, MD (1) | |

Multi-Tenant | |

Office | |

$ | 55,000 | | |

| 4.32% | | |

06/2023 |

| | |

| |

| |

| | | |

| | | |

|

| Corporate Debt: | |

| |

| |

| | | |

| | | |

|

| 6% Convertible Notes | |

N/A | |

N/A | |

$ | 400 | | |

| 6.00% | | |

01/2017 |

DEBT REPLACEMENT

Lexington entered into a new $905.0 million unsecured credit agreement,

which replaced Lexington's existing revolving credit facility and term loans. (2)

| | |

Prior Maturity | |

New Maturity | |

Prior Interest | |

Current Interest | |

Current Fixed |

| | |

Date | |

Date | |

Rate | |

Rate | |

Rate |

| $400.0 million Revolving Credit Facility (3) | |

02/2017 | |

08/2019 | |

LIBOR +1.15% | |

LIBOR +1.00% | |

N/A |

| $250.0 million Term Loan (4) | |

02/2018 | |

08/2020 | |

LIBOR +1.35% | |

LIBOR +1.10% | |

2.192% |

| $255.0 million Term Loan (5) | |

01/2019 | |

01/2021 | |

LIBOR +1.75% | |

LIBOR +1.10% | |

2.523% |

Footnotes

(1) Assumed by the buyer at sale.

(2) With lender approval, the facility can be increased to $1.8

billion.

(3) Maturity date can be extended to 08/2020 at Lexington's

option.

(4) Lexington previously entered into aggregate interest rate swap

agreements, which fix the LIBOR component of the loan at 1.09% through 02/2018.

(5) Lexington previously entered into aggregate interest rate swap

agreements, which fix the LIBOR component of the loan at 1.42% through 01/2019.

LEXINGTON REALTY TRUST

2015 Third Quarter Leasing Summary

LEASE EXTENSIONS

| | |

| |

| |

| |

| |

| |

| | |

New Cash | | |

Prior Cash | | |

New GAAP | | |

Prior GAAP | |

| | |

| |

| |

| |

| |

Lease | |

| | |

Rent Per | | |

Rent Per | | |

Rent Per | | |

Rent Per | |

| | |

| |

| |

| |

Prior | |

Expiration | |

| | |

Annum | | |

Annum | | |

Annum | | |

Annum | |

| | |

Tenant | |

Location | |

Term | |

Date | |

Sq.

Ft. | | |

($000)(1) | | |

($000) | | |

($000)(1) | | |

($000) | |

| | |

| |

| |

| |

| |

| |

| | |

| | |

| | |

| | |

| |

| | |

Office / Multi-Tenant Office | |

| |

| |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| 1 | |

Atlantic Health System, Inc. | |

Rockaway | |

NJ | |

06/2026 | |

12/2027 | |

| 60,258 | | |

$ | 859 | | |

$ | 964 | | |

$ | 779 | | |

$ | 753 | |

| 2-4 | |

Various | |

Various | |

AZ/HI | |

2015 | |

2016-2021 | |

| 34,758 | | |

| 346 | | |

| 444 | | |

| 347 | | |

| 481 | |

| | |

| |

| |

| |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| 4 | |

Total office lease extensions | |

| |

| |

| |

| |

| 95,016 | | |

$ | 1,205 | | |

$ | 1,408 | | |

$ | 1,126 | | |

$ | 1,234 | |

| | |

| |

| |

| |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Industrial | |

| |

| |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| 1 | |

Corning Property Management Corporation | |

Erwin | |

NY | |

11/2016 | |

11/2026 | |

| 408,000 | | |

$ | 1,395 | | |

$ | 1,318 | | |

$ | 1,388 | | |

$ | 1,318 | |

| 2 | |

Walgreen Co. / Walgreen Eastern Co. | |

Orlando | |

FL | |

03/2016 | |

03/2021 | |

| 205,016 | | |

| 508 | | |

| 508 | | |

| 786 | | |

| 786 | |

| | |

| |

| |

| |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| 2 | |

Total industrial lease extensions | |

| |

| |

| |

| |

| 613,016 | | |

$ | 1,903 | | |

$ | 1,826 | | |

$ | 2,174 | | |

$ | 2,104 | |

| | |

| |

| |

| |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Retail | |

| |

| |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| 1 | |

Toys “R” Us, Inc. / Toys "R"

Us-Delaware, Inc. | |

Tulsa | |

OK | |

05/2016 | |

05/2026 | |

| 43,123 | | |

$ | 236 | | |

$ | 255 | | |

$ | 236 | | |

$ | 255 | |

| 1 | |

Total retail lease extension | |

| |

| |

| |

| |

| 43,123 | | |

$ | 236 | | |

$ | 255 | | |

$ | 236 | | |

$ | 255 | |

| | |

| |

| |

| |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| 7 | |

TOTAL EXTENDED LEASES | |

| |

| |

| |

| |

| 751,155 | | |

$ | 3,344 | | |

$ | 3,489 | | |

$ | 3,536 | | |

$ | 3,593 | |

NEW LEASES

| | |

| |

| |

| |

| |

| | |

| | |

| |

| | |

| |

| |

| |

| |

| | |

New Cash | | |

New GAAP | |

| | |

| |

| |

| |

Lease | |

| | |

Rent Per | | |

Rent Per | |

| | |

| |

| |

| |

Expiration | |

| | |

Annum | | |

Annum | |

| | |

Tenant | |

Location | |

Date | |

Sq. Ft. | | |

($000)(1) | | |

($000)(1) | |

| | |

Office/Multi-Tenant Office | |

| |

| |

| |

| | |

| | |

| |

| 1 | |

Kennedy-Donovan Center, Inc. | |

Foxborough | |

MA | |

02/2017 | |

| 8,151 | | |

$ | 149 | | |

$ | 149 | |

| 2 | |

Atlantic Health System, Inc. | |

Rockaway | |

NJ | |

12/2027 | |

| 32,068 | | |

| 457 | | |

| 415 | |

| | |

| |

| |

| |

| |

| | | |

| | | |

| | |

| 2 | |

TOTAL NEW LEASES | |

| |

| |

| |

| 40,219 | | |

$ | 606 | | |

$ | 564 | |

| | |

| |

| |

| |

| |

| | | |

| | | |

| | |

| 9 | |

TOTAL NEW AND EXTENDED LEASES | |

| |

| |

| |

| 791,374 | | |

$ | 3,950 | | |

$ | 4,100 | |

Footnotes

(1) Assumes twelve months rent from the later of 10/1/15

or lease commencement/extension, excluding free rent periods as applicable.

LEXINGTON REALTY TRUST

Other Revenue Data

9/30/2015

($000)

Other Revenue Data

| | |

GAAP Base Rent | |

| Asset Class | |

Nine months ended | |

| | |

| | |

9/30/15 | | |

9/30/14 | |

| | |

9/30/15 (1) | | |

Percentage | | |

Percentage | |

| Long-Term Leases (2) | |

$ | 116,350 | | |

| 40.7 | % | |

| 40.9 | % |

| Office | |

| 106,971 | | |

| 37.4 | % | |

| 38.0 | % |

| Industrial | |

| 47,409 | | |

| 16.5 | % | |

| 12.7 | % |

| Multi-tenant | |

| 9,386 | | |

| 3.3 | % | |

| 6.7 | % |

| Retail/Specialty | |

| 6,003 | | |

| 2.1 | % | |

| 1.7 | % |

| | |

$ | 286,119 | | |

| 100.0 | % | |

| 100.0 | % |

| | |

| | | |

| | | |

| | |

| | |

GAAP Base Rent | |

| Long-Term Leases (2) | |

Nine months ended | |

| | |

| | |

9/30/15 | | |

9/30/14 | |

| | |

9/30/15 (1) | | |

Percentage | | |

Percentage | |

| Land / Infrastructure | |

$ | 46,062 | | |

| 39.6 | % | |

| 41.9 | % |

| Office | |

| 36,561 | | |

| 31.4 | % | |

| 33.3 | % |

| Industrial | |

| 30,638 | | |

| 26.3 | % | |

| 23.1 | % |

| Retail/Specialty | |

| 3,089 | | |

| 2.7 | % | |

| 1.7 | % |

| | |

$ | 116,350 | | |

| 100.0 | % | |

| 100.0 | % |

| | |

| | | |

| | | |

| | |

| | |

GAAP Base Rent | |

| Asset Class (3) | |

Nine months ended | |

| | |

| | |

9/30/15 | | |

9/30/14 | |

| | |

9/30/15 (1) | | |

Percentage | | |

Percentage | |

| Land/ Infrastructure | |

$ | 46,062 | | |

| 16.1 | % | |

| 13.6 | % |

| Office | |

| 143,532 | | |

| 50.2 | % | |

| 55.1 | % |

| Industrial | |

| 78,047 | | |

| 27.3 | % | |

| 22.2 | % |

| Multi-Tenant | |

| 9,386 | | |

| 3.3 | % | |

| 6.7 | % |

| Retail/Specialty | |

| 9,092 | | |

| 3.1 | % | |

| 2.4 | % |

| | |

$ | 286,119 | | |

| 100.0 | % | |

| 100.0 | % |

| | |

| | | |

| | | |

| | |

| | |

GAAP Base Rent | |

| Credit Ratings (4) | |

Nine months ended | |

| | |

| | |

9/30/15 | | |

9/30/14 | |

| | |

9/30/15 (1) | | |

Percentage | | |

Percentage | |

| Investment Grade | |

$ | 100,033 | | |

| 35.0 | % | |

| 38.3 | % |

| Non-Investment Grade | |

| 43,111 | | |

| 15.0 | % | |

| 11.4 | % |

| Unrated | |

| 142,975 | | |

| 50.0 | % | |

| 50.3 | % |

| | |

$ | 286,119 | | |

| 100.0 | % | |

| 100.0 | % |

Footnotes

(1) Nine months ended 9/30/2015 GAAP base rent recognized for consolidated

properties owned as of 9/30/2015.

(2) Long-term leases are defined as leases having a term of ten

years or longer.

(3) Long-term leases included and reclassified by property type.

(4) Credit ratings are based upon either tenant, guarantor or parent.

Generally, multi-tenant assets are included in unrated.

LEXINGTON REALTY TRUST

Other Revenue Data (Continued)

9/30/2015

($000)

| Weighted-Average Lease Term - Cash Basis | |

| As of 9/30/15 | | |

| As of 9/30/14 | |

| | |

| 12.4 years | | |

| 11.4 years | |

| | |

| | | |

| | |

| Weighted-Average Lease Term - Cash Basis - Adjusted (1) | |

| As of 9/30/15 | | |

| As of 9/30/14 | |

| | |

| 8.7 years | | |

| 8.4 years | |

Base Rent Estimates for Current Assets

| | |

| | |

| | |

Projected | |

| | |

| | |

| | |

Straight-line / | |

| | |

| | |

| | |

GAAP Rent | |

| Year | |

Cash (2) | | |

GAAP (2) | | |

Adjustment | |

| 2015-remaining | |

$ | 84,043 | | |

$ | 95,603 | | |

$ | (11,560 | ) |

| 2016 | |

$ | 332,673 | | |

$ | 374,063 | | |

$ | (41,390 | ) |

Same-Store NOI (3)(4)

| | |

Three months ended September 30, | | |

Nine months ended September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Total Base Rent | |

$ | 78,950 | | |

$ | 77,543 | | |

$ | 231,386 | | |

$ | 232,558 | |

| Tenant Reimbursements | |

| 7,114 | | |

| 6,759 | | |

| 22,116 | | |

| 21,047 | |

| Property Operating Expenses | |

| (11,305 | ) | |

| (11,610 | ) | |

| (35,540 | ) | |

| (34,579 | ) |

| Same-Store NOI | |

$ | 74,759 | | |

$ | 72,692 | | |

$ | 217,962 | | |

$ | 219,026 | |

| | |

| | | |

| | | |

| | | |

| | |

| Change in Same-Store NOI | |

| 2.8 | % | |

| | | |

| (0.5 | )% | |

| | |

Same-Store Percent Leased (4)

| |

| As of 9/30/15 | | |

| As of 9/30/14 | | |

| | | |

| | |

| | |

| 97.3 | % | |

| 98.6 | % | |

| | | |

| | |

Lease Escalation Data (5)

Footnotes

(1) Adjusted to reflect NY land leases to first purchase option

date.

(2) Amounts assume (1) lease terms for non-cancellable periods only

and (2) no new or renegotiated leases are entered into after 9/30/2015.

(3) NOI is on a consolidated cash basis. Excludes potential foreclosures.

(4) Adjusted for potential foreclosures on Rochester, NY and Bridgewater,

NJ properties.

(5) Based on nine months consolidated Cash base rents for single-tenant

leases. Excludes parking operations and $6.5 million in step-down leases.

LEXINGTON REALTY TRUST

Portfolio Detail By Asset Class

9/30/2015

($000, except square footage)

| Asset Class | |

YE 2012 | | |

YE 2013 | | |

YE 2014 | | |

3Q 2015 | |

| | |

| | |

| | |

| | |

| |

| Office | |

| | | |

| | | |

| | | |

| | |

| % of ABR (1) | |

| 64.3 | % | |

| 61.3 | % | |

| 51.4 | % | |

| 50.2 | % |

| LTL | |

| 22.4 | % | |

| 26.8 | % | |

| 31.8 | % | |

| 25.5 | % |

| STL | |

| 77.6 | % | |

| 73.2 | % | |

| 68.2 | % | |

| 74.5 | % |

| Leased | |

| 98.6 | % | |

| 99.0 | % | |

| 98.6 | % | |

| 99.2 | % |

| Wtd. Avg. Lease Term (2) | |

| 6.6 | | |

| 7.2 | | |

| 7.4 | | |

| 7.1 | |

| Mortgage Debt | |

$ | 1,078,345 | | |

$ | 692,460 | | |

$ | 426,635 | | |

$ | 333,554 | |

| % Investment Grade (1) | |

| 62.1 | % | |

| 57.2 | % | |

| 53.7 | % | |

| 49.0 | % |

| Square Feet | |

| 15,726,609 | | |

| 15,316,875 | | |

| 13,264,134 | | |

| 12,517,508 | |

| Cash Rent | |

$ | 198,183 | | |

$ | 214,774 | | |

$ | 192,865 | | |

$ | 139,229 | |

| | |

| | | |

| | | |

| | | |

| | |

| Industrial | |

| | | |

| | | |

| | | |

| | |

| % of ABR (1) | |

| 22.9 | % | |

| 23.2 | % | |

| 23.0 | % | |

| 27.3 | % |

| LTL | |

| 33.7 | % | |

| 35.2 | % | |

| 42.8 | % | |

| 39.3 | % |

| STL | |

| 66.3 | % | |

| 64.8 | % | |

| 57.2 | % | |

| 60.7 | % |

| Leased | |

| 99.6 | % | |

| 99.8 | % | |

| 99.7 | % | |

| 99.6 | % |

| Wtd. Avg. Lease Term (2) | |

| 7.5 | | |

| 7.2 | | |

| 7.9 | | |

| 8.4 | |

| Mortgage Debt | |

$ | 221,055 | | |

$ | 206,209 | | |

$ | 177,951 | | |

$ | 183,953 | |

| % Investment Grade (1) | |

| 23.1 | % | |

| 34.1 | % | |

| 29.3 | % | |

| 30.8 | % |

| Square Feet | |

| 21,317,359 | | |

| 21,473,994 | | |

| 22,612,691 | | |

| 25,104,724 | |

| Cash Rent | |

$ | 70,600 | | |

$ | 84,039 | | |

$ | 89,991 | | |

$ | 77,237 | |

| | |

| | | |

| | | |

| | | |

| | |

| Land/Infrastructure | |

| | | |

| | | |

| | | |

| | |

| % of ABR (1) | |

| 0.5 | % | |

| 4.9 | % | |

| 14.3 | % | |

| 16.1 | % |

| LTL | |

| 100.0 | % | |

| 100.0 | % | |

| 100.0 | % | |

| 100.0 | % |

| STL | |

| 0.0 | % | |

| 0.0 | % | |

| 0.0 | % | |

| 0.0 | % |

| Leased | |

| 100.0 | % | |

| 100.0 | % | |

| 100.0 | % | |

| 100.0 | % |

| Wtd. Avg. Lease Term (2) | |

| 19.1 | | |

| 72.7 | | |

| 73.1 | | |

| 70.6 | |

| Wtd. Avg. Lease Term Adjusted (3) | |

| 19.1 | | |

| 23.7 | | |

| 22.8 | | |

| 23.0 | |

| Mortgage Debt | |

$ | - | | |

$ | 213,500 | | |

$ | 213,475 | | |

$ | 242,557 | |

| % Investment Grade (1) | |

| 0.0 | % | |

| 0.2 | % | |

| 0.4 | % | |

| 0.4 | % |

| Cash Rent | |

$ | 1,219 | | |

$ | 9,259 | | |

$ | 22,717 | | |

$ | 19,107 | |

| | |

| | | |

| | | |

| | | |

| | |

| Multi-Tenant | |

| | | |

| | | |

| | | |

| | |

| % of ABR (1) | |

| 9.0 | % | |

| 7.9 | % | |

| 8.7 | % | |

| 3.3 | % |

| Leased | |

| 67.4 | % | |

| 66.4 | % | |

| 53.9 | % | |

| 39.1 | % |

| Wtd. Avg. Lease Term (2) | |

| 7.1 | | |

| 7.0 | | |

| 6.9 | | |

| 3.6 | |

| Mortgage Debt | |

$ | 102,582 | | |

$ | 71,754 | | |

$ | 116,763 | | |

$ | 31,352 | |

| % Investment Grade (1) | |

| 33.2 | % | |

| 34.5 | % | |

| 19.3 | % | |

| 43.3 | % |

| Square Feet | |

| 2,396,631 | | |

| 2,259,189 | | |

| 2,414,889 | | |

| 2,531,834 | |

| Cash Rent | |

$ | 25,169 | | |

$ | 27,941 | | |

$ | 34,458 | | |

$ | 9,373 | |

| | |

| | | |

| | | |

| | | |

| | |

| Retail/Specialty | |

| | | |

| | | |

| | | |

| | |

| % of ABR (1) | |

| 3.3 | % | |

| 2.7 | % | |

| 2.6 | % | |

| 3.1 | % |

| LTL | |

| 15.3 | % | |

| 21.0 | % | |

| 28.1 | % | |

| 34.0 | % |

| STL | |

| 84.7 | % | |

| 79.0 | % | |

| 71.9 | % | |

| 66.0 | % |

| Leased | |

| 99.3 | % | |

| 98.5 | % | |

| 94.3 | % | |

| 97.9 | % |

| Wtd. Avg. Lease Term (2) | |

| 8.0 | | |

| 7.2 | | |

| 9.1 | | |

| 8.6 | |

| Mortgage Debt | |

$ | 13,979 | | |

$ | 13,566 | | |

$ | 13,170 | | |

$ | 12,822 | |

| % Investment Grade (1) | |

| 22.0 | % | |

| 18.7 | % | |

| 22.4 | % | |

| 16.0 | % |

| Square Feet | |

| 1,755,608 | | |

| 1,489,267 | | |

| 1,447,724 | | |

| 1,395,517 | |

| Cash Rent | |

$ | 8,186 | | |

$ | 7,947 | | |

$ | 8,948 | | |

$ | 6,764 | |

| | |

| | | |

| | | |

| | | |

| | |