As filed with the Securities and Exchange

Commission on August 14, 2015

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

LEXINGTON

REALTY TRUST

(Exact name of registrant as specified in its charter)

| Maryland |

13-3717318 |

| (State

or other jurisdiction of incorporation organization) |

(I.R.S.

Employer Identification No.) |

_______________________________________

See Additional Registrant Table

_______________________________________

One Penn Plaza, Suite 4015

New York, NY 10119

(212) 692-7200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

T. Wilson Eglin

President and Chief Executive Officer

One Penn Plaza, Suite 4015

New York, NY 10119-4015

(212) 692-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service):

Copies to:

Elizabeth

H. Noe

Paul Hastings LLP

1170 Peachtree Street, N.E. Suite 100

Atlanta, GA 30309

(404) 815-2287

(Name, address, including zip code, and telephone number, including area code, of agent for service):

Approximate date of commencement of proposed sale to the

public: From time to time after this registration statement becomes effective.

If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ¨

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933,

other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box

and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same

offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act of

1933 registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration

statement pursuant to General Instruction I.D or a post-effective amendment thereto that shall become effective upon filing with

the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.D filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box ¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x |

Accelerated filer ¨ |

Non-accelerated filer ¨ (Do

not check if smaller reporting company |

Smaller reporting company ¨

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | |

Amount to be

registered

(1)(2)(3) | | |

Proposed maximum offering price per unit

(1)(2)(3) | | |

Proposed maximum aggregate offering price

(1)(2)(3) | | |

Amount of registration fee

(3) | |

| Shares of beneficial interest classified as common stock, par value $0.0001 per share | |

| | | |

| | | |

| | | |

$ | 0 | |

| Shares of beneficial interest classified as preferred stock, par value $0.0001 per share | |

| | | |

| | | |

| | | |

$ | 0 | |

| Debt securities | |

| | | |

| | | |

| | | |

$ | 0 | |

| Guarantees of debt securities (4) | |

| | | |

| | | |

| | | |

$ | 0 | |

| Depositary shares representing preferred shares of beneficial interest, par value $0.0001 per share (5) | |

| | | |

| | | |

| | | |

$ | 0 | |

| Warrants | |

| | | |

| | | |

| | | |

$ | 0 | |

| Subscription Rights | |

| | | |

| | | |

| | | |

$ | 0 | |

| Units (6) | |

| | | |

| | | |

| | | |

$ | 0 | |

| (1) | Omitted pursuant to Form S-3 General Instruction II.E. |

| (2) | Such indeterminate number or amount of shares of beneficial interest classified as common stock, par value $0.0001 per share

(“common shares”), shares of beneficial interest classified as preferred stock, par value $0.0001 per share (“preferred

shares”), debt securities, depositary shares representing preferred shares of beneficial interest, par value $0.0001 per

share (“depositary shares”), warrants, subscription rights and units is being registered as may from time to time be

issued at indeterminate prices. This Registration Statement also includes such indeterminable amount of (i) securities of each

identified class as may be issued from time to time upon exercise of warrants or conversion or exchange of convertible or exchangeable

securities being registered hereunder and (ii) additional securities as may be issued to prevent dilution from stock splits, stock

dividends or similar transactions pursuant to Rule 416 under the Securities Act of 1933. |

| (3) | Deferred in reliance upon Rule 456(b) and Rule 457(r). In

connection with the securities offered hereby, the registrant will pay “pay-as-you-go

registration fees” in accordance with Rule 456(b). |

| (4) | Pursuant to Rule 457(n), no separate fee will be payable with respect to the guarantees of debt securities. |

| (5) | Each depositary share will be issued under a deposit agreement, will represent an interest in a fractional preferred share

and will be evidenced by a depositary receipt. |

| (6) | Each unit will be issued under a unit agreement and will represent an interest in one or more common shares, preferred shares,

debt securities, subscription rights, depositary shares, warrants and any combination of such securities. |

ADDITIONAL REGISTRANT TABLE

Exact Name of Registrant Guarantor

as Specified in its Charter |

State or Other

Jurisdiction of

Incorporation

or

Organization |

Primary

Standard

Industrial

Classification

Code Number |

I.R.S.

Employer

Identification

Number |

Address, Including Zip Code

and Telephone Number,

Including Area Code,

of Registrant’s Principal

Executive Offices |

| Lepercq Corporate Income Fund L.P. |

Delaware |

6500 |

13-3779859 |

One Penn Plaza, Suite 4015,

New York, NY 10119-4015

(212) 692-7200 |

PROSPECTUS

Lexington Realty Trust

Common Shares of Beneficial Interest

Classified as Common Stock

Preferred Shares of Beneficial Interest Classified as Preferred Stock

Debt Securities

Guarantees of Debt Securities

Depositary Shares

Warrants

Subscription Rights

Units

We are Lexington Realty Trust,

a self-managed and self-administered real estate investment trust, or REIT, formed under the laws of the State of

Maryland, that acquires, owns and manages a diversified portfolio of equity and debt investments in single-tenant commercial

properties and land. A majority of these properties and all land interests are subject to net or similar leases, where the

tenant bears all or substantially all of the costs, including cost increases, for real estate taxes, utilities, insurance

and ordinary repairs. Our executive offices are located at One Penn Plaza, Suite 4015, New York, NY 10119-4015,

and our telephone number is (212) 692-7200.

This prospectus contains a general description

of the equity and debt securities that we may offer for sale. We may from time to time offer, in one or more series or classes,

separately or together, the following:

| · | common shares of beneficial interest classified as common stock (“common shares”); |

| · | preferred shares of beneficial interest classified as preferred stock (“preferred shares”); |

| · | debt securities which may be either senior debt securities or subordinated debt securities (“debt securities”); |

| · | guarantees of debt securities; |

| · | depositary shares representing preferred shares of beneficial interest (“depositary shares”); |

| · | units consisting of combinations of any of the foregoing (“units”). |

We will offer our securities in amounts,

at prices and on terms to be determined at the time we offer those securities. The debt securities we offer may potentially be

guaranteed by our subsidiary, Lepercq Corporate Income Fund L.P. We will provide the specific terms of the securities in supplements

to this prospectus. We are organized and conduct our operations so as to qualify as a REIT for federal income tax purposes. The

specific terms of the securities may include limitations on actual, beneficial or constructive ownership and restrictions on transfer

of the securities that may be appropriate to preserve our status as a REIT. To ensure that we maintain our qualification as a REIT

under the applicable provisions of the Internal Revenue Code of 1986, as amended, or the Code, ownership of our equity securities

by any person is subject to certain limitations. See “Restrictions on Transfers of Capital Stock and Anti-Takeover Provisions,”

in this prospectus.

The securities may be offered on a delayed

or continuous basis directly by us, through agents, underwriters or dealers as designated from time to time, through a combination

of these methods or any other method as provided in the applicable prospectus supplement. You should read this prospectus and any

applicable prospectus supplement carefully before you invest.

In addition, certain selling shareholders

to be identified from time to time in a prospectus supplement may sell our securities that they own. We will not receive any of

the proceeds from the sale of our securities by selling shareholders.

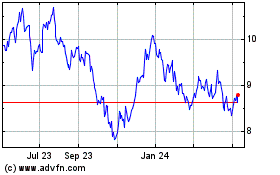

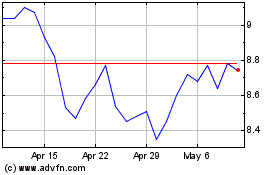

Our

common shares and our 6.50% Series C Cumulative Convertible Preferred Stock, or Series C Preferred Shares, are traded on The New

York Stock Exchange under the symbols “LXP” and “LXPPRC”, respectively. On August 13, 2015, the last reported

sale price of our common shares, as reported on The New York Stock Exchange, was $8.85 per share.

INVESTING IN OUR SECURITIES INVOLVES

RISKS. IN OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION, WHICH ARE INCORPORATED BY REFERENCE IN THIS PROSPECTUS, WE

IDENTIFY AND DISCUSS RISK FACTORS THAT YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES. SEE “RISKS FACTORS”

BEGINNING ON PAGE 9 OF THIS PROSPECTUS. INVESTING IN THESE SECURITIES INVOLVES CERTAIN RISKS. SEE THE “RISK FACTORS”

SECTION BEGINNING ON PAGE 9 OF THIS PROSPECTUS. BEFORE BUYING OUR SECURITIES, YOU SHOULD READ AND CONSIDER THE RISK FACTORS INCLUDED

IN OUR PERIODIC REPORTS, IN THE PROSPECTUS SUPPLEMENTS OR ANY OFFERING MATERIAL RELATING TO ANY SPECIFIC OFFERING, AND IN OTHER

INFORMATION THAT WE FILE WITH THE SECURITIES AND EXCHANGE COMMISSION WHICH IS INCORPORATED BY REFERENCE IN THIS PROSPECTUS. SEE

“WHERE YOU CAN FIND MORE INFORMATION.”

______________________________

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE

SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

______________________________

The date of this prospectus is

August 14, 2015

TABLE

OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement that we filed with the Securities and Exchange Commission, which we refer to as the SEC or the Commission,

using a “shelf” registration process or continuous offering process. Under this shelf registration process, we

may, from time to time, sell any combination of the securities described in this prospectus in one or more offerings and

selling securityholders may from time to time offer such securities owned by them. This prospectus provides you with a

general description of the securities that may be offered by us and/or selling securityholders. We may also file, from time

to time, a prospectus supplement or an amendment to the registration statement of which this prospectus forms a part

containing additional information about us and/or selling securityholders and the terms of the offering of the securities.

That prospectus supplement or amendment may include additional risk factors or other special considerations applicable to

the securities. Any prospectus supplement or amendment may also add, update or change information in this prospectus. If

there is any supplement or amendment, you should rely on the information in that prospectus supplement or amendment.

This prospectus and any accompanying prospectus

supplement do not contain all of the information included in the registration statement. For further information, we refer you

to the registration statement and any amendments to such registration statement, including its exhibits and schedules. Statements

contained in this prospectus and any accompanying prospectus supplement about the provisions or contents of any agreement or other

document are not necessarily complete. If the SEC’s rules and regulations require that an agreement or document be filed

as an exhibit to the registration statement, please refer to the actual exhibit for a complete description of these matters.

You should read both this prospectus and

any prospectus supplement together with additional information described below under the heading “Where You Can Find More

Information.” Federal securities laws and the SEC’s rules and regulations require us to file reports under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”) (including annual, quarterly and current reports) for both Lexington

Realty Trust and our guarantor subsidiary, Lepercq Corporate Income Fund L.P., as further described under the heading “Where

You Can Find More Information.”

Information incorporated by

reference from filings with the SEC after the date of this prospectus or after the date of any prospectus supplement, or information

included in any prospectus supplement or an amendment to the registration statement of which this prospectus forms a part,

may add, update or change information included or incorporated by reference in this prospectus or any prospectus supplement.

Any statement contained in this prospectus, any prospectus supplement or in any document incorporated by reference will be

deemed to be amended, modified or superseded for the purposes of this prospectus to the extent that a statement contained in

this prospectus, any prospectus supplement or a later document that is or is considered to be incorporated by reference

herein amends, modifies or supersedes such statement. Any statements so amended, modified or superseded will not be deemed

to constitute a part of this prospectus, except as so amended, modified or superseded. You should not assume that

the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the

respective covers of this prospectus and any such prospectus supplement.

We have not authorized anyone else to give

any information or to make any representation other than those contained or incorporated by reference in this prospectus or any

prospectus supplement. You must not rely upon any information or representation not contained or incorporated by reference in this

prospectus or any prospectus supplement as if we had authorized it. This prospectus and any prospectus supplement do not constitute

an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate.

Nor does this prospectus or any prospectus supplement constitute an offer to sell or the solicitation of an offer to buy securities

in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

All references to

the “Company,” “we,” “our” and “us” in this prospectus mean Lexington

Realty Trust and its consolidated subsidiaries, including Lepercq Corporate Income Fund L.P. and its consolidated

subsidiaries, except as otherwise provided or where it is made clear that the term means only Lexington Realty Trust. All

references to “the operating partnership” or “LCIF” in this prospectus mean Lepercq Corporate Income

Fund L.P. When we use the term “LXP” in this prospectus, we are referring to Lexington Realty Trust by itself and

not including any of its subsidiaries. References to “common shares” or similar references refer to the shares

of beneficial interest classified as common stock, par value $0.0001 per share, of LXP, and references to “OP

units” or similar references refer to the limited partnership units of LCIF. The

term “you” refers to a prospective investor.

CAUTIONARY STATEMENTS CONCERNING FORWARD-LOOKING

INFORMATION

This prospectus and the information incorporated

by reference in this prospectus include “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended, or the “Securities Act,” and Section 21E of the Securities Exchange Act of 1934, as amended,

or the “Exchange Act,” and as such may involve known and unknown risks, uncertainties and other factors that may cause

our actual results, performance or achievements to be materially different from future results, performance or achievements expressed

or implied by these forward-looking statements. Forward-looking statements, which are based on certain assumptions and describe

our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,”

“should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,”

“project,” or the negative of these words or other similar words or terms. Factors which could have a material adverse

effect on our operations and future prospects include, but are not limited to:

| · | changes in economic conditions generally and the real estate market specifically; |

| · | adverse developments with respect to our tenants; |

| · | impairments in the value of our real estate investments; |

| · | failure to consummate the transactions described in this prospectus or the failure of any transactions to perform to our expectations; |

| · | legislative/regulatory/accounting changes, including changes to laws governing and policies and guidelines applicable to the

taxation of real estate investment trusts, or REITs; |

| · | any material legal proceedings; |

| · | availability of debt and equity capital; |

| · | increases in real estate construction costs; |

| · | changes in interest rates; |

| · | supply and demand for properties in our current and proposed market areas; |

| · | a downgrade in our credit ratings; and |

| · | the other risk factors set forth in our Annual Report on Form 10-K filed with the SEC on February 26, 2015 and in

LCIF’s Annual Report on Form 10-K filed with the SEC on February 26, 2015, the section entitled “Risk

Factors”

beginning on page 9 of this prospectus and the other documents incorporated by reference herein, including documents that we

file with the

SEC in the

future that are incorporated by reference herein. |

These risks and uncertainties should be

considered in evaluating any forward-looking statements contained or incorporated by reference in this prospectus. We caution you

that any forward-looking statement reflects only our belief at the time the statement is made. Although we believe that the expectations

reflected in the forward-looking statements are reasonable, we cannot guarantee our future results, levels of activity, performance

or achievements. Except as required by law, we undertake no obligation to update any of the forward-looking statements to reflect

events or developments after the date of this prospectus.

OUR COMPANY

LXP is a REIT that owns a diversified portfolio

of equity and debt investments in single-tenant commercial properties and land. A majority of these properties and all land interests

are subject to net or similar leases, where the tenant bears all or substantially all of the costs, including cost increases,

for real estate taxes, utilities, insurance and ordinary repairs. We also provide investment advisory and asset management services

to investors in the single-tenant area.

LCIF, our operating partnership, was formed

as a limited partnership on March 14, 1986 under the laws of the State of Delaware to invest in existing real estate properties

net leased to corporations or other entities.

The purpose of LCIF includes the conduct

of any business that may be conducted lawfully by a limited partnership organized under the Delaware Revised Uniform Limited Partnership

Act, or the Delaware Act, except that the partnership agreement of LCIF requires business to be conducted in such a manner that

will permit LXP to continue to be classified as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as

amended, or the Code, unless LXP ceases to qualify as a REIT for reasons other than the conduct of the business of LCIF.

LXP is the sole equity owner of (1) Lex

GP-1 Trust, or Lex GP, a Delaware statutory trust, which is the general partner of LCIF and (2) Lex LP-1 Trust, or Lex LP, a Delaware

statutory trust. LXP, through Lex GP and Lex LP, holds, as of June 30, 2015, approximately, 95.0% of the outstanding OP units

in LCIF. The remaining OP units in LCIF are beneficially owned by E. Robert Roskind, Chairman of LXP, and certain non-affiliated

investors. As the sole equity owner of the general partner of LCIF, LXP has the ability to control all of the day-to-day operations

of LCIF subject to the terms of the LCIF partnership agreement.

The business of LCIF is substantially the

same as the business of LXP and includes investment in single-tenant assets; except that LCIF is dependent on LXP for management

of its operations and future investments. LCIF does not have any employees, executive officers or a board of directors. LXP also

invests in assets and conducts business directly and through other subsidiaries. LXP allocates investments to itself and its other

subsidiaries or to LCIF as it deems appropriate and in accordance with certain obligations under the LCIF partnership agreement,

with respect to allocations of nonrecourse liabilities.

Neither LXP nor Lex GP receives any compensation

for Lex GP’s services as general partner of LCIF. Lex GP and Lex LP, however, as partners in LCIF, have the same right to

allocations and distributions as other partners of LCIF. In addition, LCIF reimburses Lex GP and LXP for all expenses incurred

by them related to the ownership and operation of, or for the benefit of, LCIF. In the event that certain expenses are incurred

for the benefit of LCIF and other entities (including LXP and its other subsidiaries), such expenses are allocated to LCIF in proportion

to gross revenues. LXP has guaranteed the obligations of LCIF in connection with the redemption of OP units pursuant to the LCIF

partnership agreement.

The principal executive offices for LXP

and LCIF are located at One Penn Plaza, Suite 4015, New York, New York 10119-4015; our telephone number is (212) 692-7200.

RISK FACTORS

Investing in our securities

involves risks and uncertainties that could affect us and our business as well as the real estate industry generally. You

should carefully consider the risks described and discussed under the caption “Risk Factors” included in

LXP’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, filed on February 26, 2015 and

LCIF’s Annual Report on Form 10-K for the year ended December 31, 2014, filed on February 26, 2015, which are

incorporated by reference in this prospectus, and in any other documents incorporated by reference in this prospectus,

including without limitation any updated risks included in our subsequent periodic reports incorporated by reference herein. These

risks could materially affect our business, results of operations or financial condition and cause the value of our

securities to decline. You could lose all or part of your investment. These risk factors may be amended, supplemented or

superseded from time to time by risk factors contained in any prospectus supplement or post-effective amendment we may file

or in other reports we file with the Commission in the future. In addition, new risks may emerge at any time and we cannot

predict such risks or estimate the extent to which they may affect our financial performance.

USE OF PROCEEDS

Unless otherwise described in any applicable

prospectus supplement, we intend to use the net proceeds from our sale of the securities for general corporate purposes, which

may include the repayment of outstanding indebtedness, the improvement of certain properties already in our portfolio or the acquisition

of additional assets. Unless otherwise described in any applicable prospectus supplement, we will not receive the proceeds

of sales by selling securityholders, if any. Further details relating to the use of net proceeds from any specific offering will

be described in the applicable prospectus supplement.

RATIOS OF EARNINGS TO FIXED CHARGES

AND EARNINGS TO COMBINED FIXED CHARGES AND PREFERRED SHARE DIVIDENDS

The following table sets forth the

ratios of earnings to combined fixed charges and preferred dividends of LXP and LCIF for each of the last five fiscal years.

The ratios of earnings to combined fixed charges and preferred dividends were computed by dividing earnings by fixed charges

and preferred dividends. For these purposes, “earnings” consist of income (loss) before benefit (provision) for

income taxes, noncontrolling interest, equity in earnings (losses) of non-consolidated entities, gain on acquisition and

discontinued operations, plus fixed charges (excluding capitalized interest) and cash received from joint ventures.

“Fixed charges” consist of interest expense, including capitalized interest and the amortization expense on debt

issuance costs. This information is given on an historical basis.

LXP:

| |

Six Months Ended

June 30, | |

Year Ended December 31, | |

| |

2015 | |

2014 | |

2013 | |

2012 | |

2011 | |

2010 | |

| Ratio of Earnings to Combined Fixed Charges and Preferred Share Dividends (1) |

| 2.48 | |

| 1.37 | |

| N/A(1) | |

| N/A(1) | |

| N/A(1) | |

| N/A(1) | |

___________

| (1) | Ratio is below 1.0, deficit of $28,929, $20,065, $37,928, and $41,350 exists at December 31, 2013, 2012, 2011 and 2010, respectively. |

LCIF:

| |

Six Months Ended

June 30, | |

Year Ended December 31, | |

| |

2015 | |

2014 | |

2013 | |

2012 | |

2011 | |

2010 | |

|

| |

| |

| |

| |

| |

| |

| Ratio of Earnings to Fixed Charges |

| 2.52 | |

| 2.43 | |

| 1.70 | |

| 1.87 | |

| 1.92 | |

| 1.74 | |

DESCRIPTION OF OUR COMMON SHARES

The following summary of the material

terms and provisions of our common shares does not purport to be complete and is subject to the detailed provisions of our Declaration

of Trust and our By-Laws, each as supplemented, amended or restated, and each of which is incorporated by reference into this prospectus.

You should carefully read each of these documents in order to fully understand the terms and provisions of our common shares. For

information on incorporation by reference, and how to obtain copies of these documents, see the section entitled “Where You

Can Find More Information” in this prospectus.

This summary is also subject to and qualified

by reference to the descriptions of the particular terms of our securities described in the applicable prospectus supplement.

General

Under our Declaration of Trust, we

have the authority to issue up to 1,000,000,000 shares of beneficial interest, par value $0.0001 per share, of which

400,000,000 shares are classified as common shares, 500,000,000 are classified as excess stock, or excess shares,

and 100,000,000 shares are classified as preferred shares. As of the date of this prospectus, we had issued and outstanding

236,329,031 common shares.

Terms

Subject to the preferential rights of any

other shares or class or series of our equity securities and to the provisions of our Declaration of Trust regarding excess shares,

holders of common shares are entitled to receive dividends on such common shares if, as and when authorized by our board of trustees

and declared by us out of assets legally available therefor and to share ratably in those of our assets legally available for distribution

to our shareholders in the event that we liquidate, dissolve or wind up, after payment of, or adequate provision for, all of our

known debts and liabilities and the amount to which holders of any class of shares having a preference on distributions in liquidation,

dissolution or winding up of us will be entitled.

Subject to the provisions of our Declaration

of Trust regarding excess shares, each outstanding common share entitles the holder to one vote on all matters submitted to a vote

of shareholders, including the election of trustees and, except as otherwise required by law or except as otherwise provided in

our Declaration of Trust with respect to any other class or series of shares, the holders of common shares will possess exclusive

voting power. In uncontested elections of trustees at a meeting duly called at which a quorum is present, the affirmative vote

of a majority of the total votes cast by shareholders entitled to vote is sufficient to elect a trustee nominee. In contested elections

at a meeting duly called at which a quorum is present, a plurality of votes cast by shareholders entitled to vote is required for

the election of a trustee. A majority of the votes cast means that the number of shares voted “for” a trustee nominee

must exceed the number of votes cast “against” or “withheld” with respect to such trustee nominee. Votes

“against” or “withheld” with respect to a nominee will count as votes cast with respect to that nominee,

but “abstentions” and broker non-votes with respect to that nominee will not count as votes cast with respect to that

nominee. There is no cumulative voting in the election of trustees, which means that the holders of a majority of our outstanding

common shares can elect all of the trustees then standing for election, and the holders of the remaining common shares will not

be able to elect any trustees.

Subject to the provisions of our Declaration

of Trust regarding excess shares, holders of common shares have no conversion, sinking fund or redemption rights or preemptive

rights to subscribe for any of our securities.

We furnish our shareholders with annual

reports containing audited consolidated financial statements and an opinion thereon expressed by an independent registered public

accounting firm.

Subject to the provisions of our Declaration

of Trust regarding excess shares, all of the common shares have equal dividend, distribution, liquidation and other rights and

generally have no preference, appraisal or exchange rights.

Under the Maryland REIT Law, a

Maryland real estate investment trust generally cannot amend its declaration of trust or merge with, or convert into, another

entity unless advised by its board of trustees and approved by the affirmative vote of shareholders entitled to cast at least

two-thirds of the votes entitled to be cast on the matter unless a different percentage (but not less than a majority of all

of the votes entitled to be cast on the matter) is set forth in its declaration of trust. Our Declaration of Trust provides

that those actions, with the exception of certain amendments to our Declaration of Trust for which a higher vote requirement

has been set, will be valid and effective if authorized by holders of a majority of the total number of shares of all classes

outstanding and entitled to vote thereon. Under our Declaration of Trust, our dissolution and termination requires the

affirmation of shareholders entitled to cast at least two-thirds of the votes entitled to be cast on the matter.

Restrictions on Ownership

For us to qualify as a real estate investment

trust, or REIT, under the Internal Revenue Code of 1986, as amended, or the Code, among other things, not more than 50% in value

of its outstanding shares of capital stock may be owned, directly or indirectly, by five or fewer individuals (as defined in the

Code to include certain entities) during the last half of a taxable year. To assist us in meeting this requirement, among other

purposes, our Declaration of Trust contains restrictions on the ownership and transfer of our shares. See “Restrictions on

Transfers of Shares of Capital Stock and Anti-Takeover Provisions.”.

Transfer Agent

As of the date of this prospectus, the

transfer agent and registrar for the common shares is Computershare Shareowner Services, or Computershare.

DESCRIPTION OF OUR PREFERRED SHARES

The following summary of the material

terms and provisions of our preferred shares does not purport to be complete and is subject to the detailed provisions of our Declaration

of Trust (including any applicable articles supplementary, amendment or annex to our Declaration of Trust designating the terms

of a series of preferred shares) and our By-Laws, each as supplemented, amended or restated, and each of which is incorporated

by reference into this prospectus. You should carefully read each of these documents in order to fully understand the terms and

provisions of our preferred shares. For information on incorporation by reference, and how to obtain copies of these documents,

see the section entitled “Where You Can Find More Information” in this prospectus.

General

Under our Declaration of Trust,

we have the authority to issue up to 100,000,000 preferred shares, of which 3,100,000 shares are classified as Series

C Preferred Shares. As of the date of this prospectus, we have issued and outstanding 1,935,400 Series C Preferred Shares. On May 31,

2012, we completed the redemption of all of our then outstanding 8.05% Series B Cumulative Redeemable Preferred Stock, which

we refer to as Series B Preferred Shares, and on April 19, 2013, we completed the redemption of all of our then outstanding

7.55% Series D Cumulative Redeemable Preferred Stock, which we refer to as Series D Preferred Shares. As a result, as of the

date hereof, no Series B Preferred Shares or Series D Preferred Shares are issued and outstanding.

Subject to limitations prescribed

by Maryland law and our Declaration of Trust, our board of trustees is authorized to classify and reclassify any unissued

shares and to set the number of shares constituting each class or series of preferred shares and the terms, preferences,

conversion or other rights, voting powers, restrictions, limitations as to dividends or other distributions, qualifications

and terms or conditions of redemption. The preferred shares will, when issued against payment therefor, be fully paid and

nonassessable and will not be subject to preemptive rights, unless determined by our board of trustees. Our board of trustees

could authorize the issuance of preferred shares with terms and conditions that could have the effect of discouraging a

takeover or other transaction that holders of common shares might believe to be in their best interests or in which holders

of common shares might receive a premium for their common shares over the then-current market price of their shares.

Terms

Reference is made to the applicable prospectus

supplement relating to the preferred shares offered thereby for specific terms, including:

(1)

the title and stated value of the preferred shares;

(2)

the number of preferred shares offered, the liquidation preference per share and the offering price of the preferred shares;

(3)

the voting rights, if any, of the holders of the preferred shares;

(4)

the dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation thereof applicable to the preferred shares;

(5)

the date from which dividends on the preferred shares will accumulate, if applicable;

(6)

the provisions for a sinking fund, if any, for the preferred shares;

(7)

the provisions for redemption, if applicable, of the preferred shares;

(8)

any listing of the preferred shares on any securities exchange;

(9)

the terms and conditions, if applicable, upon which the preferred shares will be convertible into common shares, including

the conversion price (or manner of calculation thereof);

(10)

a discussion of material federal income tax considerations applicable to the preferred shares;

(11)

the relative ranking and preferences of the preferred shares as to dividend rights and rights upon our liquidation, dissolution

or winding-up of our affairs;

(12)

any limitations on issuance of any series of preferred shares ranking senior to or on a parity with the preferred shares

as to dividend rights and rights upon our liquidation, dissolution or winding-up of our affairs;

(13)

any limitations on direct or beneficial ownership of our securities and restrictions on transfer of our securities, in each

case as may be appropriate to preserve our status as a REIT; and

(14)

any other specific terms, preferences, rights, limitations or restrictions of the preferred shares.

Rank

Unless otherwise specified in the applicable

prospectus supplement, the preferred shares rank, with respect to dividend rights and rights upon our liquidation, dissolution

or winding-up: (i) senior to all classes or series of common shares, and to all equity securities ranking junior to the preferred

shares; (ii) on a parity with all equity securities the terms of which specifically provide that such equity securities rank on

a parity with the preferred shares; and (iii) junior to all equity securities the terms of which specifically provide that such

equity securities rank senior to the preferred shares. As used in this prospectus, the term “equity securities” does

not include convertible debt securities.

Dividends

Subject to any preferential rights of any

outstanding securities or series of securities, the holders of preferred shares will be entitled to receive dividends, when, as

and if authorized by our board of trustees and declared by us, out of assets legally available for payment. Dividends will be paid

at such rates and on such dates as will be set forth in the applicable prospectus supplement. Dividends will be payable to the

holders of record of preferred shares as they appear on our share transfer books at the close of business on the applicable record

dates fixed by our board of trustees. Dividends on any series of our preferred shares may be cumulative or non-cumulative, as provided

in the applicable prospectus supplement.

Redemption

If so provided in the applicable prospectus

supplement, the preferred shares offered thereby will be subject to mandatory redemption or redemption at our option, as a whole

or in part, in each case upon the terms and conditions, at the times and at the redemption prices set forth in such prospectus

supplement.

Liquidation Preference

Unless otherwise specified in

the applicable prospectus supplement, upon any voluntary or involuntary liquidation, dissolution or winding-up of our affairs,

and before any distribution or payment will be made to the holders of any common shares or any other class or series of

shares ranking junior to our preferred shares, the holders of our preferred shares will be entitled to receive, after payment

or provision for payment of our debts and other liabilities, out of our assets legally available for distribution to

shareholders, liquidating distributions in the amount of the liquidation preference per share, if any, set forth in the

applicable prospectus supplement, plus an amount equal to all dividends accrued and unpaid thereon, which will not include

any accumulation in respect of unpaid noncumulative dividends for prior dividend periods. After payment of the full amount of

the liquidating distributions to which they are entitled, the holders of preferred shares will have no right or claim to any

of our remaining assets. In the event that, upon any such voluntary or involuntary liquidation, dissolution or winding-up of

our affairs, the legally available assets are insufficient to pay the amount of the liquidating distributions on all of

our outstanding preferred shares and the corresponding amounts payable on all of our other outstanding equity securities

ranking on a parity with the preferred shares in the distribution of assets upon our liquidation, dissolution or winding-up

of our affairs, then the holders of our preferred shares and the holders of such other outstanding equity securities will

share ratably in any such distribution of assets in proportion to the full liquidating distributions to which they would

otherwise be respectively entitled.

If liquidating distributions are made in

full to all holders of our preferred shares, our remaining assets will be distributed among the holders of any other classes or

series of equity securities ranking junior to the preferred shares in the distribution of assets upon our liquidation, dissolution

or winding-up of our affairs, according to their respective rights and preferences and in each case according to their respective

number of shares.

If we consolidate, convert or merge with

or into, or sell, lease or convey all or substantially all of our property or business to, any corporation, trust or other entity,

such transaction will not be deemed to constitute a liquidation, dissolution or winding-up of our affairs.

Voting Rights

Unless otherwise from time to time required

by law, or as otherwise indicated in the applicable prospectus supplement, holders of our preferred shares will not have any voting

rights.

Conversion Rights

The terms and conditions, if any, upon which

our preferred shares are convertible into common shares will be set forth in the applicable prospectus supplement. Such terms will

include the number of common shares into which the preferred shares are convertible, the conversion price (or manner of calculation

thereof), the conversion period, provisions as to whether conversion will be at the option of the holders of the preferred shares

or at our option, the events requiring an adjustment of the conversion price and provisions affecting conversion in the event of

the redemption of such preferred shares.

Restrictions on Ownership

For us to qualify as a REIT under the Code,

among other things, not more than 50% in value of our outstanding shares of capital stock may be owned, directly or indirectly,

by five or fewer individuals (as defined in the Code to include certain entities) during the last half of a taxable year. To assist

us in meeting this requirement, among other purposes, our Declaration of Trust contains restrictions on the ownership and transfer

of our shares, including our preferred shares, and the prospectus supplement relating to a class or series of preferred shares

may contain additional provisions restricting the ownership and transfer of such class or series of preferred shares. See “Restrictions

on Transfers of Capital Stock and Anti-Takeover Provisions.”

Transfer Agent

As of the date of this prospectus, the

transfer agent and registrar for our Series C Preferred Shares is Computershare. The transfer agent and registrar for our

other series of preferred shares will be set forth in the applicable prospectus supplement.

Terms of Our 6.50% Series C Cumulative Convertible Preferred

Stock

General. In December

2004 and January 2005, we sold an aggregate 3,100,000 Series C Preferred Shares. The Series C Preferred Shares are

convertible into common shares and are listed on the New York Stock Exchange under the symbol “LXPPRC.” As of the

date of this prospectus, 1,935,400 Series C Preferred Shares remain outstanding.

Dividends. Subject to the

preferential rights of the holders of any class or series of shares ranking senior to the Series C Preferred Shares as to dividends,

the holders of the Series C Preferred Shares are entitled to receive, when, as and if authorized by the board of trustees and declared

by us, out of funds legally available for the payment of dividends, cumulative cash dividends at a rate of 6.50% per annum of the

$50.00 liquidation preference per share (equivalent to $3.25 per year per share).

Liquidation Preference.

Upon any voluntary or involuntary liquidation, dissolution or winding up of the affairs of us, holders of the Series C

Preferred Shares (and of the excess shares converted from Series C Preferred Shares, if any) will have the right to be paid

out of our assets legally available for distribution to our shareholders $50.00 per share, plus accrued and unpaid

dividends (whether or not declared) to and including the date of payment, before any payments are made to the holders of

common shares and any other shares ranking junior to the Series C Preferred Shares as to liquidation rights. The rights of

the holders of the Series C Preferred Shares to receive their liquidation preference will be subject to the proportionate

rights of each other series or class of our capital shares ranking, as to liquidation rights, on a parity with the Series C

Preferred Shares. The consolidation or merger of LXP with or into any other trust, corporation or entity, or the sale,

lease, transfer or conveyance of all or substantially all of our property or business, will not be deemed to constitute a

liquidation, dissolution or winding up of the affairs of us.

Redemption. We may not redeem

the Series C Preferred Shares unless necessary to preserve our status as a REIT.

Conversion Rights. The Series

C Preferred Shares may be converted by the holder, at its option (the “Optional Conversion”), into common shares,

at a conversion rate of 2.4339 common shares per $50.00 liquidation preference, as of the date of this prospectus, which is equivalent

to a conversion price of approximately $20.54 per common share (subject to adjustment in certain events).

Company Conversion Option.

We may, at our option, cause the Series C Preferred Shares to be automatically converted into that number of common shares that

are issuable at the then prevailing conversion rate (the “Company Conversion Option”) in the following circumstances.

We may exercise our conversion right only if, for at least twenty (20) trading days within any period of thirty (30) consecutive

trading days (including the last trading day of such period), the closing price of the common shares equals or exceeds 125% of

the then prevailing conversion price of the Series C Preferred Shares. In addition, if there are fewer than 25,000 Series C Preferred

Shares outstanding, we may, at our option, cause all of the outstanding Series C Preferred Shares to be automatically converted

into that number of common shares equal to $50.00 divided by the lesser of the then prevailing conversion price and the current

market price for the five trading day period ending on the second trading day immediately prior to the conversion date.

Settlement. Upon conversion

(whether pursuant to an Optional Conversion or the Company Conversion Option), we may choose to deliver the conversion value to

investors in cash, common shares or a combination of cash and common shares.

We can elect at any time to obligate ourself

to satisfy solely in cash, the portion of the conversion value that is equal to 100% of the liquidation preference amount of the

Series C Preferred Shares, with any remaining amount of the conversion value to be satisfied in cash, common shares or a combination

of cash and common shares. If we elect to do so, we will notify holders at any time that we intend to settle in cash the portion

of the conversion value that is equal to the liquidation preference amount of the Series C Preferred Shares. This notification,

once provided to holders, will be irrevocable and will apply to future conversions of the Series C Preferred Shares even if the

shares cease to be convertible but subsequently become convertible again.

Payment of Dividends Upon Conversion.

With respect to an Optional Conversion, upon delivery of the Series C Preferred Shares for conversion, those Series C Preferred

Shares will cease to accumulate dividends as of the end of the day immediately preceding the conversion date and a holder of such

converted Series C Preferred Shares will not receive any cash payment representing accrued and unpaid dividends on the Series C

Preferred Shares, whether or not in arrears, except in certain limited circumstances. With respect to the Company Conversion Option,

a holder of such converted Series C Preferred Shares will receive a cash payment for all unpaid dividends in arrears. If we exercise

the Company Conversion Option and the conversion date is on or after the record date for payment of dividends and before the corresponding

dividend payment date, such holder will also receive a cash payment for the dividend payable for such period. If we exercise the

Company Conversion Option and the conversion date is prior to the record date for payment of dividends, such holder will not receive

payment for any portion of the dividend payable for such period.

Conversion Rate Adjustments.

The conversion rate is subject to adjustment upon the occurrence of certain events, including if we distribute in any quarter to

all or substantially all holders of common shares, any cash, including quarterly cash dividends, in excess of an amount per common

share (subject to adjustment), which is currently approximately $0.34.

Fundamental Change. Upon the

occurrence of certain fundamental changes in LXP, a holder may require us to purchase for cash all or part of its Series C Preferred

Shares at a price equal to 100% of their liquidation preference plus accrued and unpaid dividends, if any, up to, but not including,

the fundamental change purchase date.

Rank. With respect to the

payment of dividends and amounts upon liquidation, dissolution or winding up, the Series C Preferred Shares rank (i) senior to

all classes or series of common shares and to all equity securities ranking junior to the Series C Preferred Shares, (ii) on a

parity with all equity securities the terms of which specifically provide that such equity securities rank on a parity with the

Series C Preferred Shares, and (iii) junior to all equity securities the terms of which specifically provide that such equity securities

rank senior to the Series C Preferred Shares.

Voting Rights. Holders

of the Series C Preferred Shares generally have no voting rights. However, if we do not pay dividends on the Series C

Preferred Shares for six or more quarterly periods (whether or not consecutive), the holders of the Series C Preferred Shares

voting together as a class with all other classes or series of our equity securities ranking on parity with the Series C

Preferred Shares which are entitled to similar voting rights, will be entitled to vote at the next annual meeting of our

shareholders and at each subsequent annual meeting for the election of two additional trustees to serve on our board of

trustees until all unpaid cumulative dividends have been paid or declared and set apart for payment. The holders of Series C

Preferred Shares and all other classes or series of our equity securities ranking on parity with the Series C Preferred

Shares which are entitled to similar voting rights will be entitled to one vote per $25.00 of liquidation preference (i.e.,

two votes for each Series C Preferred Share). In addition, the affirmative vote of at least two-thirds of the Series C

Preferred Shares, and all other classes or series of our equity securities ranking on parity with the Series C Preferred

Shares which are entitled to similar voting rights, voting together as a class, is required for us (i) to authorize, create

or increase the authorized or issued amount of any class or series of shares ranking senior to the Series C Preferred Shares

with respect to payment of dividends or the distribution of assets upon liquidation, dissolutions or winding up of our affairs or (ii) to amend our Declaration of Trust (whether by merger, consolidation, transfer or conveyance of all or

substantially all of its assets or otherwise) in a manner that materially and adversely affects the rights of the Series C

Preferred Shares; provided, however, with respect to the occurrence of any event described in clause (ii) above, so long as

the Series C Preferred Shares remain outstanding with the terms thereof materially unchanged (taking into account that, upon

the occurrence of such an event, we may not be the surviving entity), the occurrence of such an event will not be deemed to

materially and adversely affect the rights of the Series C Preferred Shares and holders of Series C Preferred Shares will not

have any voting rights with respect to the occurrence of the event or the holders thereof.

DESCRIPTION OF OUR DEBT

SECURITIES AND RELATED GUARANTEES

The following description contains general

terms and provisions of the debt securities and, as applicable, related guarantees to which any prospectus supplement may relate.

The particular terms of the debt securities and related guarantees offered by any prospectus supplement and the extent, if

any, to which such general provisions may not apply to the debt securities and related guarantees so offered will be described

in the prospectus supplement relating to such debt securities and related guarantees. For more information, please refer to the

senior indentures we have entered into with U.S. Bank National Association, as trustee, relating to the issuance of the senior

notes, and the subordinated indenture we will enter into with a trustee to be selected, relating to issuance of the subordinated

notes. Forms of these documents are filed as exhibits to the registration statement, which includes this prospectus. Any such

notes may or may not be guaranteed by one or more of our Subsidiaries.

As used in this prospectus, the

term indentures refers to both the senior indentures and the subordinated indenture. The senior indenture is and

the subordinated indenture will be qualified under and governed by the Trust Indenture Act. As used in this prospectus, the

term trustee refers to either the senior trustee or the subordinated trustee, as applicable.

The following are summaries

of material provisions of the senior indenture and provisions that are anticipated to be included in the senior indentures and

the subordinated indenture. As summaries, they do not purport to be complete or restate the indentures in their entirety and

are subject to, and qualified in their entirety by reference to, all provisions of the indentures and the debt securities

and related guarantees. We urge you to read the indentures applicable to a particular series of debt securities and

related guarantees because they, and not this description, define your rights as the holders of the debt securities. Except

as otherwise indicated, the terms of the senior indenture and the subordinated indenture are identical.

Debt Securities

Reference is made to the applicable prospectus

supplement for the following terms of the debt securities (if applicable):

| · | title and aggregate principal amount; |

| · | whether the securities are subject to subordination and applicable subordination provisions, if any; |

| · | conversion or exchange into any securities or property; |

| · | percentage or percentages of principal amount at which such securities will be issued; |

| · | interest rate(s) or the method for determining the interest rate(s); |

| · | dates on which interest will accrue or the method for determining dates on which interest will accrue and dates on which interest

will be payable; |

| · | whether interest will be payable in cash or in additional debt securities of the same series, or will accrue and increase the

aggregate principal amount outstanding of such series (including if the debt securities were originally issued at a discount); |

| · | redemption or early repayment provisions; |

| · | authorized denominations; |

| · | amount of discount or premium, if any, with which such securities will be issued; |

| · | whether such securities will be issued in whole or in part in the form of one or more global securities; |

| · | identity of the depositary(ies) for global securities; |

| · | whether a temporary security is to be issued with respect to such series and whether any interest payable prior to the issuance

of definitive securities of the series will be credited to the account of the persons entitled thereto; |

| · | the terms upon which beneficial interests in a temporary global security may be exchanged in whole or in part for beneficial

interests in a definitive global security or for individual definitive securities; |

| · | any covenants applicable to the particular debt securities being issued; |

| · | any defaults and events of default applicable to the particular debt securities being issued; |

| · | currency, currencies or currency units in which the purchase price for, the principal of and any premium and any interest on

such securities will be payable; |

| · | securities exchange(s) on which the securities will be listed, if any; |

| · | our obligation or right to redeem, purchase or repay securities under a sinking fund, amortization or analogous provision; |

| · | provisions relating to covenant defeasance and legal defeasance of securities of the series; |

| · | provisions relating to satisfaction and discharge of the indenture; |

| · | provisions relating to the modification of the indenture both with and without the consent of holders of debt securities issued

under the indenture; |

| · | provisions, if any, granting special rights upon the occurrence of specified events; |

| · | any restriction of transferability of the series; and |

| · | additional terms not inconsistent with the provisions of the indenture. |

In addition, the applicable prospectus supplement

will describe whether any underwriter will act as a market maker for the securities, and the extent to which a secondary market

for the securities is or is not expected to develop.

General

The debt securities may consist of debentures,

notes, bonds or other types of indebtedness. One or more series of debt securities may be sold at a substantial discount below

its stated principal amount, bearing no interest or interest at a rate which at the time of issuance is below market rates. One

or more series of debt securities may be variable rate debt securities that may be exchanged for fixed rate debt securities.

United States federal income tax consequences

and special considerations, if any, applicable to any such series will be described in the applicable prospectus supplement.

Debt securities may be issued where the

amount of principal and/or interest payable is determined by reference to one or more currency or other indices or other formulas.

Holders of such securities may receive a principal amount or a payment of interest that is greater than or less than the amount

of principal or interest otherwise payable on such dates, depending upon the value of the applicable currency or other reference

factor. Information as to the methods for determining the amount of principal or interest, if any, payable on any date, the currency

or other reference factor to which the amount payable on such date is linked and certain additional United States federal income

tax considerations will be set forth in the applicable prospectus supplement.

The term “debt securities” includes

debt securities denominated in U.S. dollars or, if specified in the applicable prospectus supplement, in any other freely transferable

currency or currency unit.

We expect most debt securities to be issued

in fully registered form without coupons and in denominations of $1,000 and any integral multiples thereof. Subject to the limitations

provided in the indenture and in the applicable prospectus supplement, debt securities that are issued in registered form may be

transferred or exchanged at the corporate office of the trustee or the principal corporate trust office of the trustee, without

the payment of any service charge, other than any tax or other governmental charge payable in connection therewith.

Global Securities

The debt securities of a series may be issued

in whole or in part in the form of one or more global securities that will be deposited with, or on behalf of, a depositary identified

in the applicable prospectus supplement. Global securities will be issued in registered form and in either temporary or definitive

form. Unless and until it is exchanged in whole or in part for the individual debt securities, a global security may not be transferred

except as a whole by the depositary for such global security to a nominee of such depositary or by a nominee of such depositary

to such depositary or another nominee of such depositary or by such depositary or any such nominee to a successor of such depositary

or a nominee of such successor. The specific terms of the depositary arrangement with respect to any debt securities of a series

and the rights of and limitations upon owners of beneficial interests in a global security will be described in the applicable

prospectus supplement.

Guarantees

Each prospectus supplement will describe

any guarantees of debt securities for the benefit of the series of debt securities to which it relates. If so provided in a prospectus

supplement, the debt securities will be guaranteed by each of the guarantors named in such prospectus supplement. The obligations

of a guarantor under its guarantee will be limited to the extent necessary to prevent the obligations of such guarantor from constituting

a fraudulent conveyance or fraudulent transfer under federal or state law.

Governing Law

The indentures and the debt securities will

be construed in accordance with and governed by the laws of the State of New York.

6.00% Convertible Guaranteed Notes due 2030

In January and February 2010, we

issued an aggregate principal amount of $115.0 million in 6.00% Convertible Guaranteed Notes due 2030, or the “2030

Notes.” As of the date of this prospectus, $12.4 million principal amount of the 2030 Notes remain outstanding.

The 2030 Notes, which mature on January

15, 2030, are unsecured obligations of us and our subsidiary guarantors, and the interest on the 2030 Notes, at the rate of 6.00%

per year, is payable semi-annually on January 15 and July 15 of each year.

Holders of the 2030 Notes may convert

the 2030 Notes at the conversion rate for each $1,000 principal amount of the 2030 Notes of 153.8603 common shares as of the

date of this prospectus, payable in cash, our common shares or a combination of cash and our common shares, at our election, prior

to the close of business on the second business day prior to the stated maturity date at any time on or after January 15,

2029 and also under the following circumstances:

(a)

Conversion Upon Satisfaction of Market Price Condition. A holder may surrender any of its 2030 Notes for conversion

during any calendar quarter (and only during such calendar quarter), if, and only if, the closing sale price of the common shares

for at least 20 trading days (whether or not consecutive) in the period of 30 consecutive trading days ending on the last trading

day of the preceding calendar quarter as determined by us is more than 130% of the conversion price per common share in effect

on the applicable trading day;

(b)

Conversion Upon Satisfaction of Trading Price Condition. A holder may surrender any of its 2030 Notes for conversion

during the five consecutive trading-day period following any five consecutive trading-day period in which the trading price per

$1,000 principal amount of 2030 Notes (as determined following a reasonable request by a holder of the 2030 Notes) was less than

98% of the product of the closing sale price of the common shares multiplied by the applicable conversion rate;

(c)

Conversion Upon Notice of Redemption. A holder may surrender for conversion any of the 2030 Notes called for redemption

at any time prior to the close of business on the second business day prior to the redemption date, even if the 2030 Notes are

not otherwise exchangeable at such time.

(d)

Conversion if Common Shares Are Not Listed. A holder may surrender any of its 2030 Notes for conversion at any time

beginning on the first business day after the common shares have ceased to be listed on a U.S. national or regional securities

exchange for a 30 consecutive trading-day period.

(e)

Conversion Upon Specified Transactions. A holder may surrender any of its 2030 Notes for conversion if we engage in

certain specified corporate transactions, including a change in control (as defined in the 2030 Notes). Holders converting 2030

Notes in connection with certain change in control transactions occurring prior to January 15, 2017 may be entitled to receive

additional common shares as a “make whole premium.”

We may not redeem any 2030 Notes prior to

January 15, 2017, except to preserve our status as a REIT. After that time, we may redeem the 2030 Notes, in whole or in part,

for cash equal to 100% of the principal amount of the 2030 Notes plus any accrued and unpaid interest (including additional interest,

if any) to, but not including, the redemption date.

Holders of the 2030 Notes may require us

to repurchase their 2030 Notes, in whole or in part (in principal amounts of $1,000 and integrals thereof) on January 15, 2017,

January 15, 2020 and January 15, 2025 for cash equal to 100% of the principal amount of the 2030 Notes to be repurchased plus any

accrued and unpaid interest (including additional interest, if any) to, but not including, the repurchase date.

Subject to the terms of the applicable

Indenture and the 2030 Notes, upon certain events of default, including, but not limited to, (i) default by us in the

delivery when due of the conversion value, on the terms set forth in the applicable Indenture and the 2030 Notes, upon

exercise of a holder’s conversion right in accordance with the applicable Indenture and the continuation of such

default for 10 days and (ii) our failure to provide notice of the occurrence of a change of control when required under the

applicable Indenture, and such failure continues for 5 business days, the trustee or the holders of not less than 25% in

principal amount of the outstanding 2030 Notes may declare the principal and accrued and unpaid interest on all of the 2030

Notes to be due and payable immediately by written notice to us (and to the trustee if given by the holders). Upon certain

events of bankruptcy, insolvency or reorganization, or court appointment of a receiver, liquidator or trustee of us, our

operating partnership, or any other significant subsidiary, the principal (or such portion thereof) of and accrued and unpaid

interest on all of the 2030 Notes will become and be immediately due and payable without any declaration or other act on the

part of the trustee or any holders.

Our payment obligations with respect to the Notes are irrevocably

and unconditionally guaranteed on an unsecured and unsubordinated basis by LCIF. The guarantee is LCIF’s direct obligation,

ranking equally and ratably with all of its existing and future unsecured and unsubordinated obligations, other than obligations

mandatorily preferred by law.

In addition, the Notes are cross-defaulted

with certain of our indebtedness.

4.25% Senior Notes due 2023

On June 10, 2013, we issued $250.0 million

aggregate principal amount of our 4.25% Senior Notes due 2023, which we refer to as the “2023 Notes.” The 2023 Notes

were issued by us at an initial offering price of 99.026% of their face value.

The terms of the 2023 Notes are governed

by an indenture, dated as of June 10, 2013, as supplemented by the first supplemental indenture, dated September 30, 2013, which

we collectively refer to as the 2023 Indenture, by and among us, as issuer, LCIF, as guarantor, and U.S. Bank National Association,

as trustee. The 2023 Notes mature on June 15, 2023, and accrue interest at a rate of 4.25% per annum, payable semi-annually on

June 15 and December 15 of each year. Interest payments commenced on December 15, 2013.

Prior to March 15, 2023, we may redeem the

2023 Notes, in whole at any time or in part from time to time, at our option, at a redemption price equal to the greater of (1)

100% of the aggregate principal amount of the 2023 Notes being redeemed and (2) the sum of the present values of the remaining

scheduled payments of principal and interest thereon (not including any portion of such payments of interest accrued as of the

date of redemption) discounted to its present value, on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day

months) at an adjusted treasury rate plus 35 basis points, plus, in each case, accrued and unpaid interest thereon to the date

of redemption. At any time on or after March 15, 2023, the 2023 Notes will be redeemable, in whole at any time or in part from

time to time, at our option, at a redemption price equal to 100% of the principal amount of the 2023 Notes to be redeemed plus

accrued and unpaid interest on the amount being redeemed to, but not including, the date of redemption.

The Indenture under which the

2023 Notes were issued (the “2023 Indenture”) contains certain covenants that, among other things, limit our ability to

consummate a merger, consolidation or sale of all or substantially all of its assets, and incur secured and unsecured

indebtedness.

Subject to the terms of the 2023

Indenture and the 2023 Notes, upon certain events of default, including, but not limited to, failure to comply with any of

our other agreements in the 2023 Notes or the 2023 Indenture, upon receipt by us of notice of such default from the trustee

or from holders of not less than 25% in aggregate principal amount of the 2023 Notes then outstanding and our failure to cure

(or obtain a waiver of) such default within 60 days after we receive such notice, the trustee or the holders of not less than

25% in principal amount of the outstanding 2023 Notes may declare the principal and accrued and unpaid interest on all of the

2023 Notes to be due and payable immediately by written notice to us (and to the trustee if given by the holders). Upon

certain events of bankruptcy, insolvency or reorganization, or court appointment of a receiver, liquidator or trustee of us,

our operating partnership, or any other significant subsidiary, the principal (or such portion thereof) of and accrued and

unpaid interest on all of the 2023 Notes will become and be immediately due and payable without any declaration or other act

on the part of the trustee or any holders.

Our payment obligations with respect

to the 2023 Notes are irrevocably and unconditionally guaranteed on an unsecured and unsubordinated basis by LCIF. The

guarantee is LCIF’s direct obligation, ranking equally and ratably with all of its existing and future unsecured and

unsubordinated obligations, other than obligations mandatorily preferred by law.

In addition, the 2023 Notes are

cross-defaulted with certain of our indebtedness.

In connection with the issuance and sale

of the 2023 Notes, we also entered into a registration rights agreement with Wells Fargo Securities, LLC and J.P. Morgan Securities

LLC, in their capacity as representatives of the initial purchasers, dated as of June 10, 2013, which we refer to as the Registration

Rights Agreement. Pursuant to the Registration Rights Agreement, on March 4, 2014, we completed the offer to exchange notes for

an issue of registered notes with terms identical to the 2023 Notes.

4.40% Senior Notes due 2024

On May 20, 2014, we issued $250.0 million aggregate

principal amount of our 4.40% Senior Notes due 2024, which we refer to as the “2024 Notes.” The 2024 Notes were issued

by us at an initial offering price of 99.883% of their face value.

The terms of the 2024 Notes are governed by

an indenture, dated as of May 9, 2014, as supplemented by the first supplemental indenture, dated May 20, 2014, which we collectively

refer to as the 2024 Indenture, by and among us, as issuer, LCIF, as guarantor, and U.S. Bank National Association, as trustee.

The 2024 Notes mature on June 15, 2024, and accrue interest at a rate of 4.40% per annum, payable semi-annually on June 15 and

December 15 of each year. Interest payments commenced on December 15, 2014.

Prior to March 15, 2024, we may redeem the 2024

Notes, in whole at any time or in part from time to time, at our option, at a redemption price equal to the greater of (1) 100%

of the aggregate principal amount of the 2024 Notes being redeemed and (2) the sum of the present values of the remaining scheduled

payments of principal and interest thereon (not including any portion of such payments of interest accrued as of the date of redemption)

discounted to its present value, on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at an adjusted

treasury rate plus 35 basis points, plus, in each case, accrued and unpaid interest thereon to the date of redemption. At any time

on or after March 15, 2024, the 2024 Notes will be redeemable, in whole at any time or in part from time to time, at our option,

at a redemption price equal to 100% of the principal amount of the 2024 Notes to be redeemed plus accrued and unpaid interest on

the amount being redeemed to, but not including, the date of redemption.

The 2024 Indenture contains certain covenants

that, among other things, limit our ability to consummate a merger, consolidation or sale of all or substantially all of its assets,

and incur secured and unsecured indebtedness.

Subject to the terms of the 2024 Indenture

and the 2024 Notes, upon certain events of default, including, but not limited to, failure to comply with any of our other

agreements in the 2024 Notes or the 2024 Indenture, upon receipt by us of notice of such default from the trustee or from

holders of not less than 25% in aggregate principal amount of the 2024 Notes then outstanding and our failure to cure (or

obtain a waiver of) such default within 60 days after we receive such notice, the trustee or the holders of not less than 25%

in principal amount of the outstanding 2024 Notes may declare the principal and accrued and unpaid interest on all of the