UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant

to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 1, 2015

|

| | |

LEXINGTON REALTY TRUST |

(Exact name of registrant as specified in its charter) |

| | |

Maryland | 1-12386 | 13-3717318 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

One Penn Plaza, Suite 4015, New York, New York | 10119-4015 |

(Address of principal executive offices) | (Zip Code) |

| | |

| (212) 692-7200 | |

(Registrant's telephone number, including area code) |

|

|

Not Applicable |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

___ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

___ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

___ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

___ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| |

Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On January 8, 2015, the Compensation Committee of the Board of Trustees of Lexington Realty Trust, or the Trust, granted the following annual cash incentive awards to the named executive officers of the Trust.

|

| | | |

Name and Title | Award Amount |

T. Wilson Eglin, Chief Executive Officer and President | $ | 720,000 |

|

Patrick Carroll, Executive Vice President, Chief Financial Officer and Treasurer | $ | 410,000 |

|

E. Robert Roskind, Chairman | $ | 520,000 |

|

Richard J. Rouse, Vice Chairman and Chief Investment Officer | $ | 520,000 |

|

Joseph S. Bonventre, Executive Vice President, General Counsel and Secretary | $ | 305,000 |

|

A portion of the annual cash incentive award equal to one twenty-fourth of the executive's annual base salary was paid in cash on December 15, 2014 pursuant to existing company practice. The remainder of the annual cash incentive award will be paid in January 2015.

Pursuant to the 2011 Equity-Based Award Plan, the Compensation Committee granted annual long-term incentive awards to the named executive officers of the Trust consisting of performance-based non-vested shares and service-based non-vested shares. Vesting for performance-based non-vested shares is tied to the Trust’s total shareholder return relative to other REITs for the three-year period beginning January 1, 2015 and ending December 31, 2017, and is subject to the named executive officer's continued employment and, as applicable, any employment agreement or written severance policy that is in effect. Performance comparisons for performance-based non-vested shares are made relative to all REITs in the FTSE NAREIT All Equity REITs Index and the Trust's competitor peer group (initially consisting of American Realty Capital Properties, Inc.; Chambers Street Properties; EPR Properties; Getty Realty Corp.; Gramercy Property Trust, Inc.; Monmouth Real Estate Investment Corporation; National Retail Properties, Inc.; Realty Income Corporation; Select Income REIT; Spirit Realty Capital, Inc.; Stag Industrial, Inc.; and W.P. Carey Inc.) on an equal weighted-basis. Threshold performance is set at the 33rd percentile, target performance at the 50th percentile, and maximum performance at the 75th percentile versus the respective group. No performance-based shares are earned for results below the threshold level. Straight-line interpolation is used to determine awards for results between performance levels. A pro-rata portion of the service-based non-vested shares vest annually over three years, and is subject to the named executive officer's continued employment and, as applicable, any employment agreement or written severance policy that is in effect. The annual long-term non-vested shares incentive award is as follows:

|

| | | | | |

| Performance-Based Opportunity | Service-Based Award | Split Performance/ Service(1) |

Name | Threshold | Target | Maximum |

T. Wilson Eglin | $530,250 | $1,060,500 | $2,121,000 | $454,500 | 70/30 |

Patrick Carroll | $238,000 | $476,000 | $952,000 | $204,000 | 70/30 |

E. Robert Roskind | $161,000 | $322,000 | $644,000 | $138,000 | 70/30 |

Richard J. Rouse | $266,000 | $532,000 | $1,064,000 | $228,000 | 70/30 |

Joseph S. Bonventre | $171,500 | $343,000 | $686,000 | $147,000 | 70/30 |

_________________________________________________

(1) At Target.

The number of performance-based non-vested shares (maximum) and service-based non-vested shares granted was based on the closing price of our common shares on January 8, 2015, which was $11.23 per share; with the number of performance-based non-vested shares rounded to the nearest share and the number of service-based non-vested shares rounded up to the nearest 10 shares. The named executive officers are entitled to receive dividends on service-based non-vested common shares. Dividends payable on performance-based non-vested common shares accrue and are only payable to the named executive officers if and to the extent the shares vest.

The non-vested common share awards granted to each executive are governed by a Nonvested Share Agreement. The foregoing description of the Nonvested Share Agreement is qualified in its entirety by reference to form of Nonvested Share Agreement filed as Exhibit 10.1 to this Current Report on Form 8-K, which we refer to as this Current Report.

Pursuant to the Indenture, dated as of January 29, 2007, among the Trust, certain subsidiaries of the Trust and U.S. Bank National Association, as trustee, or the Trustee, as supplemented by the Fourth Supplemental Indenture, dated as of December 31, 2008, the Sixth Supplemental Indenture, dated as of January 26, 2010, the Seventh Supplemental Indenture, dated as of September 28, 2012, the Eighth Supplemental Indenture, dated as of February 13, 2013, the Ninth Supplemental Indenture, dated as of May 6, 2013, the Tenth Supplemental Indenture, dated as of June 13, 2013, and the Tenth Supplemental Indenture, dated as of September 30, 2013, the Trust gave notice to the Trustee that the conversion rate on the Trust's 6.00% Convertible Guaranteed Notes due 2030 has adjusted, effective January 1, 2015, to a current conversion rate of 151.5965 common shares per $1,000 principal amount of the notes, representing a conversion price of $6.60 per common share.

On January 8, 2015, the Trust issued a press release containing an update of fourth quarter 2014 transaction activity. A copy of the press release is furnished as Exhibit 99.1 to this Current Report and is incorporated herein by reference solely for purposes of this Item 8.01 disclosure.

The information furnished pursuant to this “Item 8.01 - Other Events” shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing made by the Trust under the Exchange Act or Securities Act of 1933, as amended, regardless of any general incorporation language in any such filing, except as shall be expressly set forth by specific reference in such a filing.

| |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| |

10.1 | Form of Nonvested Share Agreement (Performance and Service) |

| |

99.1 | Press release issued January 8, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| | |

| Lexington Realty Trust |

| | |

| | |

Date: January 9, 2015 | By: | /s/ T. Wilson Eglin |

| | T. Wilson Eglin |

| | Chief Executive Officer |

Exhibit Index

| |

10.1 | Form of Nonvested Share Agreement (Performance and Service) |

| |

99.1 | Press release issued January 8, 2015 |

Form of

LEXINGTON REALTY TRUST

NONVESTED SHARE AGREEMENT

(Performance and Service)

This LEXINGTON REALTY TRUST NONVESTED SHARE AGREEMENT (PERFORMANCE AND SERVICE) (this “Agreement”) is effective as of ______________ ___, 20___ (the “Effective Date”) by and between Lexington Realty Trust, a Maryland real estate investment trust (the “Company”) and ____________________ (the “Participant”).

WITNESSETH THAT:

WHEREAS, the Participant, as an employee of the Company, is eligible to participate in the Lexington Realty Trust 2011 Equity-Based Award Plan (the “Plan”), and understands and recognizes that terms within the Agreement that begin with initial capital letters have the definitions set forth below or in the Plan; and

WHEREAS, the Compensation Committee of the Board of Trustees of the Company (the “Compensation Committee”) has approved this grant of an award to the Participant of the common shares of the Company, par value $0.0001 (“Company Shares”), herein, subject to the terms and conditions of the Plan and this Agreement, in order to incentivize the Participant’s performance, to enable the Participant to acquire an additional equity interest in the Company and to retain the Participant over the term of this Agreement.

NOW, THEREFORE, in consideration of the agreements hereinafter contained and other good and valuable consideration, receipt of which is hereby acknowledged, the parties hereto agree as follows:

(a)Subject to the restrictions and terms and conditions set forth in this Agreement and the Plan, including the vesting requirements set forth in Section 2 hereof, the Company hereby grants to the Participant, as of the Effective Date: (i) a Performance Compensation Award consisting of: (x) _________________ Company Shares (the “Index Shares”) and (y) _________________ Company Shares (the “Peer Group Shares,” and, together with the Index Shares, collectively, the “Performance Company Shares”), and (ii) a Restricted Share Award consisting of ________________ Company Shares (the “Restricted Shares,” and, together with the Performance Company Shares, collectively, the “Nonvested Company Shares”).

(b)The Participant agrees that the Participant’s ownership of the Nonvested Company Shares, until vesting, if any, is determined to have occurred upon the expiration of the applicable Performance Period, shall be evidenced solely by a “book entry” (i.e., a computerized or manual entry) in the records of the Company or its designated share transfer agent in the Participant’s name.

2.Vesting of Company Shares. Except as otherwise provided in Section 3 below:

(a)the Performance Company Shares shall vest and become fully vested after December 31, 20___ (the “End Date”), only if and to the extent (i) the Participant remains in Continuous Service from the Effective Date through the End Date (the “Performance Period”), and (ii) the Company attains during the Performance Period the applicable performance goals, as set forth on Appendix A hereto (the “Performance Goals”) as determined by the Compensation Committee within thirty (30) days following the End Date. Vesting shall occur only pursuant to the performance conditions, as set forth in Appendix A and as determined by the Compensation Committee in its sole and absolute discretion. The Performance Company Shares which do not vest following the Performance Period shall immediately and without notice be forfeited and the Participant shall have no rights with respect to such Performance Company Shares.

(b)One-third of the Restricted Shares shall vest and become fully vested on January 1st of each of 201__, 201__ and 201__, so long as the Participant remains in Continuous Service from the Effective Date through the applicable vesting date.

3.Nontransferability and Acceleration/Forfeiture.

(a)The Participant acknowledges that prior to the date on which vesting, if any, is determined to have occurred pursuant to Section 2 above or upon the expiration of the applicable Performance Period, the Nonvested Company Shares may not be sold, transferred, pledged, assigned, encumbered or otherwise disposed of (whether voluntarily or involuntarily or by operation of law by judgment, levy, attachment, garnishment or any other legal or equitable proceedings (including bankruptcy)). Upon the date on which vesting, if any, is determined to have occurred, as set forth in Section 2 hereof, and subject to the satisfaction of any tax obligations in accordance with Section 5 hereof, the restrictions set forth in this Agreement with respect to the applicable Nonvested Company Shares theretofore shall lapse and such Nonvested Company Shares shall be released from the Company’s restricted CUSIP file and be vested Company Shares.

(b)Subject to the terms and conditions of any definitive written employment agreement between the Participant and the Company or, if no such definitive written employment agreement exists, any written executive severance policy then in effect (a “Service Agreement”), if the Participant’s Continuous Service ends prior to vesting (if any) at the complete expiration of the Performance Period, the Participant agrees that all of the Nonvested Company Shares, that are nonvested in accordance with Section 2 hereof as of the date of such termination, together with any dividends or distributions on account of such Nonvested Company Shares held by the Company for the Participant, shall be immediately and unconditionally forfeited and will revert to the Company without any action required by the Participant or the Company.

4.Rights as Shareholder. The Participant shall have all rights of a shareholder with respect to the Nonvested Company Shares for record dates occurring on or after the date of this Agreement and prior to the date any such Nonvested Company Shares are forfeited in accordance with this Agreement, except that any and all dividends or distributions with respect to the Performance Company Shares declared prior to vesting (if any) at the expiration of the applicable Performance Period shall be held by the Company for the Participant and shall be paid, without any interest, to the Participant upon such vesting (if any) at the

expiration of the applicable Performance Period, unless either (i) not vesting pursuant to Section 2 above, or (ii) being forfeited in accordance with Section 3(b) hereof.

5.Withholding Tax Obligations. The Participant acknowledges the existence of federal, state and local income tax and employment tax withholding obligations with respect to the vesting (if any) of the Nonvested Company Shares and agrees that such obligations must be met. The Participant shall be required to pay and the Company shall have the right to withhold or otherwise require a Participant to remit to the Company any amount sufficient to pay any such taxes no later than the date as of which the value of any Nonvested Company Shares first become includible in the Participant’s gross income for income or employment tax purposes, provided however that the Board of Trustees or the Compensation Committee may permit the Participant to elect withholding vested Company Shares otherwise deliverable to the Participant in full or partial satisfaction of such tax obligations, provided further however that the amount of vested Company Shares so withheld shall not exceed the minimum statutory withholding tax obligation. If tax withholding is required by applicable law, in no event shall vested Company Shares be delivered to the Participant until he has paid to the Company in cash the amount of such tax required to be withheld by the Company or otherwise entered into an agreement satisfactory to the Company providing for payment of withholding tax. The Participant hereby notifies the Company that he will not make an election with respect to any portion of the Company Shares pursuant to Section 83(b) of the Internal Revenue Code of 1986, as amended.

6.Limitation of Rights. Nothing contained herein shall be construed as conferring upon the Participant the right to continue in the employ of the Company as an employee or in any other capacity, or to interfere with the Company’s right to discharge him at any time for any reason whatsoever.

7.Receipt and Acceptance of Plan. The Participant acknowledges receipt of a copy of the Plan and agrees to be bound by all terms and provisions thereof. If and to the extent that any provision herein is inconsistent with the Plan, the Plan shall govern.

8.Assignment. This Agreement shall be binding upon and inure to the benefits of the Company, its successors and assigns and the Participant and his heirs, executors, administrators and legal representatives.

9.Governing Law. This Agreement and the obligation of the Company to transfer Company Shares shall be subject to all applicable federal and state laws, rules and regulations and any registration, qualification, approvals or other requirements imposed by any government or regulatory agency or body which the Compensation Committee of the Company shall, in its sole discretion, determine to be necessary or applicable. This Agreement shall be construed in accordance with and governed by the law of the State of New York.

10.Amendment. Except as otherwise permitted by the Plan, this Agreement may not be modified or amended, nor may any provision hereof be waived, in any way except in writing signed by the party against whom enforcement thereof is sought.

11.Execution. This Agreement may be executed in counterparts each of which shall constitute one and the same instrument.

IN WITNESS WHEREOF, the Company has caused this Agreement to be executed by a duly authorized officer and the Participant has executed this Agreement effective as of the date first above written.

|

| |

LEXINGTON REALTY TRUST |

| |

By: | |

Name: |

Title: | Authorized Officer |

| |

PARTICIPANT |

| |

| |

Appendix A

The percentage of the Index Shares that will become vested at the end of the Performance Period will be based on the Percentile Rank of the Company’s Total Return relative to the Total Return of each of the companies in the Index for the Performance Period as set forth below:

|

| | |

Percentile Rank | Number of Index Shares Vested | |

At least the 75th percentile and including the 100th percentile | 100% | Maximum |

At least 50th percentile but less than 75th percentile | 50% | Target |

At least 33rd percentile but less than 50th percentile | 25% | Threshold |

Less than 33rd percentile | 0% | |

The percentage of the Peer Group Shares that will become vested at the end of the Performance Period will be based on the Percentile Rank of the Company’s Total Return relative to the Total Return of each of the companies in the Peer Group for the Performance Period as set forth below:

|

| | |

Percentile Rank | Number of Peer Group Shares Vested | |

At least the 75th percentile and including the 100th percentile | 100% | Maximum |

At least 50th percentile but less than 75th percentile | 50% | Target |

At least 33rd percentile but less than 50th percentile | 25% | Threshold |

Less than 33rd percentile | 0% | |

The number of Performance Company Shares that will become vested shall be interpolated on a straight line basis between the Threshold and Target and Target and Maximum set forth in the applicable chart above.

“Index” means the FTSE NAREIT All Equity REITs Index (or a successor index selected by the Compensation Committee if such index ceases to exist), except any company that (1) ceases to be publicly traded at any point during the Performance Period or (2) was added to the Index during the Performance Period, shall be excluded from the Index. In lieu of excluding any company from the Index altogether, if the Participant’s compensation is not subject to the limitations of Code Section 162(m), the Compensation Committee may adjust the calculation of Index Total Return to the extent determined by the Compensation Committee in its reasonable discretion.

“Percentile Rank” shall be calculated using the following formula:

Percentile Rank = (N-R)/(N-1)

Where:

N = the number of companies in the Index Group or Peer Group, as applicable, including the Company.

R = the numeric rank of the Company’s Total Return relative to the Index Group or Peer Group, as applicable, where the highest return in the group is ranked the 100th Percentile Rank and the lowest return in the group is ranked the 0th Percentile Rank.

The Percentile Rank shall be rounded to the nearest whole percentage.

“Peer Group” means the competitor peer group consisting of: ___________________________________________. Any such company shall be removed from the Peer Group if it ceases to be publicly traded at any point during the Performance Period. At any time and from time to time, the Compensation Committee may make equitable adjustments to the composition of the Peer Group to manage any extenuating circumstances that may develop during the Performance Period; provided that such modification shall not increase the amount otherwise payable under any Award that is designated as being intended to be exempt from Code Section 162(m).

“Share” means a share of common equity of the Company or a company in the Index or the Peer Group, as applicable.

“Share Price” means, (i) with respect to a purchase, the average closing price on the stock exchange a Share is then listed for the twenty consecutive trading days with the first day of such period on the date of purchase, or (ii) with respect to a sale, the average closing price on the stock exchange a Share is then listed for the twenty consecutive trading days with the last day of such period on the date of sale.

“Total Return” means, with respect to the Performance Period, the compounded total annual return that would have been realized by a shareholder who (1) bought one Share on the first day of the Performance Period at the Share Price, (2) reinvested each dividend or other distribution declared during the Performance Period with respect to such Share (including any other Shares previously received upon reinvestment of dividends or other distribution) in additional Shares at the Share Price on the applicable dividend payment date and (3) sold such Shares on the last day of the Performance Period at the Share Price on such date. As set forth in, and pursuant to, Section 9(d)(ii) of the Plan, appropriate adjustments to the Total Return shall be made to take into account all events contemplated therein that occur during the Performance Period. In calculating Total Return, it is the current intention of the Compensation Committee to use total return to stockholders data available from one or more third party sources, although the Compensation Committee reserves the right to retain the services of a consultant to

analyze relevant data or perform calculations in its reasonable discretion for any calculations required hereunder.

LEXINGTON REALTY TRUST

TRADED: NYSE: LXP

ONE PENN PLAZA, SUITE 4015

NEW YORK, NY 10119-4015

FOR IMMEDIATE RELEASE

LEXINGTON REALTY TRUST ANNOUNCES 2014 FOURTH QUARTER ACTIVITY

New York, NY - January 8, 2015 - Lexington Realty Trust (“Lexington”) (NYSE: LXP), a real estate investment trust (REIT) focused on single-tenant real estate investments, announced the following update on fourth quarter transaction activity, some of which was previously announced.

Highlights

| |

• | Acquired three properties for $70.4 million. |

| |

• | Generated gross disposition proceeds of $167.2 million from the sale of four office buildings. |

| |

• | Received $32.8 million from maturing loan investment. |

| |

• | Retired $59.0 million of debt. |

| |

• | Completed 1.9 million square feet of new leases and lease extensions. |

Investment Activity

|

| | | | | | | | | | | | | | | | | | |

ACQUISITIONS | | |

Tenant/Guarantor | | Location | | Property Type | | Initial Basis ($000) | | Initial Annualized Cash Rent ($000) | | Initial Cash Yield | | Estimated GAAP Yield | | Lease Term (Yrs) |

ZE-45 Ground Tenant LLC | | New York, NY | | Land | | $ | 30,426 |

| | $ | 1,500 |

| | 4.9% | | 15.2% | | 99 |

HealthSouth Corp. | | Vineland, NJ | | Rehab Hospital | | 19,100 |

| | 1,113 |

| | 5.8% | | 5.8%(1) | | 28 |

International Automotive Components Group North America | | Anniston, AL | | Industrial | | 20,907 |

| | 1,572 |

| | 7.5% | | 8.3% | | 15 |

| | | | | | $ | 70,433 |

| | $ | 4,185 |

| | 5.9% | | 10.6% | | |

| |

1. | Lease contains annual CPI increases. |

|

| | | | | | | | | | | | | | | | | |

ON-GOING BUILD-TO-SUIT PROJECTS | | | | |

Location | | Sq. Ft. | | Property Type | | Lease Term (Years) | | Maximum Commitment/Estimated Completion Cost ($000) | | GAAP Investment Balance as of 12/31/2014 ($000) | | Estimated Completion Date |

Oak Creek, WI | | 164,000 |

| | Industrial | | 20 | | $ | 22,609 |

| | $ | 11,860 |

| | 2Q 15 |

Thomson, GA | | 208,000 |

| | Industrial | | 15 | | 10,245 |

| | 3,428 |

| | 2Q 15 |

Richmond, VA | | 330,000 |

| | Office | | 15 | | 110,137 |

| | 62,225 |

| | 3Q 15 |

Lake Jackson, TX | | 664,000 |

| | Office/R&D | | 20 | | 166,164 |

| | 28,225 |

| | 4Q 16 |

Houston, TX(1) | | 274,000 |

| | Private School | | 20 | | 86,491 |

| | 11,795 |

| | 3Q 16 |

| | 1,640,000 |

| | | | | | $ | 395,646 |

| | $ | 117,533 |

| | |

| |

1. | Lexington has a 25% interest as of December 31, 2014. Lexington may provide construction financing up to $56.7 million to the joint venture. |

|

| | | | | | | | | | | | | | |

FORWARD COMMITMENTS | | | | | | | | |

Location | | Property Type | | Estimated Acquisition Cost ($000) | | Estimated Completion Date | | Estimated Initial Cash Yield | | Estimated GAAP Yield | | Lease Term (Years) |

Auburn Hills, MI | | Office | | $ | 40,025 |

| | 1Q 15 | | 7.9% | | 9.0% | | 14 |

Richland, WA | | Industrial | | $ | 155,000 |

| | 4Q 15 | | 7.1% | | 8.6% | | 20 |

| | | | $ | 195,025 |

| | | | 7.3% | | 8.7% | | |

Capital Recycling

|

| | | | | | | | | | | | | | |

PROPERTY DISPOSITIONS |

Tenant | | Location | | Property Type | | Gross Disposition Price ($000) | | Annualized NOI ($000) | | Month of Disposition |

Bank of America, National Association | | Brea, CA | | Office | | $ | 110,000 |

| | $ | 8,096 |

| | Nov-14 |

Vacant(1) | | Chicago, IL | | Office | | 34,150 |

| | — |

| | Nov-14 |

Canal Insurance Company | | Greenville, SC | | Office | | 11,550 |

| | 991 |

| | Dec-14 |

Vacant(2) | | Houston, TX | | Office | | 11,486 |

| | — |

| | Dec-14 |

| | | | | | $ | 167,186 |

| | $ | 9,087 |

| | |

| |

1. | $29.9 million secured debt satisfied at closing. |

| |

2. | Purchaser assumed an $11.5 million secured debt. |

Lexington collected $32.8 million in full satisfaction of the Norwalk, Connecticut loan investment.

Balance Sheet

During the fourth quarter of 2014, Lexington satisfied $50.5 million of secured debt, which had a weighted-average interest rate of 5.5%, including the $41.4 million of aggregate secured debt encumbering properties which were disposed.

In December 2014, Lexington converted approximately $8.6 million original principal amount 6.00% Convertible Guaranteed Notes due 2030 for 1,280,439 common shares and a cash payment of $171 thousand plus accrued interest, reducing the outstanding balance of this note issuance to $16.2 million.

During the fourth quarter of 2014, Lexington locked rate on the following secured loans:

|

| | | | | | | | | | | | | |

Tenant/Guarantor | | Location | | Property Type | | Amount ($000) | | Fixed Rate | | Term (approx.) |

ZE-45 Ground Tenant LLC(1) | | New York, NY | | Land | | $ | 29,193 |

| | 4.1 | % | | 10 years |

Federal Express Corporation(2) | | Long Island City, NY | | Industrial | | 51,650 |

| | 3.5 | % | | 13 years |

| | | | | | $ | 80,843 |

| | 3.7 | % | | |

| |

1. | Loan closed in first quarter of 2015. |

| |

2. | No assurances can be given that the loan will be funded on these terms or at all. |

Leasing

During the fourth quarter of 2014, Lexington executed the following new and extended leases:

|

| | | | | | | | | | |

| | LEASE EXTENSIONS | | | | |

| | | | | | | | | |

| | Location | | Prior Term | | Lease Expiration Date | | Sq. Ft. |

| | | | | | | | | |

| | Office/Multi-Tenant | | | | | | |

| | | | | | | | | |

1 | | Little Rock | AR | | 10/2015 | | 10/2020 | | 36,311 |

|

2 | | Pine Bluff | AR | | 10/2015 | | 10/2017 | | 27,189 |

|

3 | | Phoenix | AZ | | 11/2016 | | 11/2021 | | 6,982 |

|

3 | | Total office lease extensions | | | | | 70,482 |

|

| | | | | | | | | |

| | Industrial/Multi-Tenant | | | | | | |

| | | | | | | | | |

1 | | Moody | AL | | 12/2017 | | 12/2019 | | 595,346 |

|

2 | | Laurens | SC | | 01/2017 | | 01/2020 | | 1,164,000 |

|

3 | | Antioch | TN | | 12/2014 | | 12/2015 | | 60,000 |

|

3 | | Total industrial lease extensions | | | | | | 1,819,346 |

|

| | | | | | | | | |

6 | | Total lease extensions | | | | | | 1,889,828 |

|

| | | | | | | | | |

| | NEW LEASES | | | | | | | |

| | | | | | | | | |

| | Location | | | | Lease Expiration Date | | Sq. Ft. |

| | | | | | | | | |

2 | | Palm Beach Gardens | FL | | | | 2016-2022 | | 20,067 |

|

3 | | Various | | | | | 2015-2025 | | 5,067 |

|

5 | | Total new leases | | | | | | 25,134 |

|

| | | | | | | | | |

11 | | TOTAL NEW AND EXTENDED LEASES | | | | | | 1,914,962 |

|

Common Share Dividend/Unit Distribution

During the fourth quarter of 2014, Lexington declared a regular quarterly common share dividend/distribution for the quarter ended December 31, 2014 of $0.17 per common share/unit, which is payable on January 15, 2015 to common shareholders/unitholders of record as of December 31, 2014, and a dividend of $0.8125 per share on its Series C Cumulative Convertible Preferred Stock (“Series C Preferred Shares”), which is payable on February 17, 2015 to Series C Preferred Shareholders of record as of January 30, 2015.

Effective January 1, 2015, the conversion rate of the 6.00% Convertible Guaranteed Notes due 2030 increased to 151.5965 common shares per one thousand principal amount of the notes from 149.6190 common shares per one thousand principal amount of the notes. The new conversion price is $6.60 per common share compared to the previous conversion price of $6.68 per common share.

ABOUT LEXINGTON REALTY TRUST

Lexington Realty Trust is a real estate investment trust that owns a diversified portfolio of equity and debt interests in single-tenant commercial properties and land. Lexington seeks to expand its portfolio through acquisitions, sale-leaseback transactions, build-to-suit arrangements and other transactions. A majority of these properties and all land interests are subject to net or similar leases, where the tenant bears all or substantially all of the operating costs, including cost increases, for real estate taxes, utilities, insurance and ordinary repairs. Lexington also provides investment advisory and asset management services to investors in the single-tenant area. Lexington common shares are traded on the New York Stock Exchange under the symbol “LXP”. Additional information about Lexington is available on-line at www.lxp.com or by contacting Lexington Realty Trust, One Penn Plaza, Suite 4015, New York, New York 10119-4015, Attention: Investor Relations.

Contact:

Investor or Media Inquiries, T. Wilson Eglin, CEO

Lexington Realty Trust

Phone: (212) 692-7200 E-mail: tweglin@lxp.com

This release contains certain forward-looking statements which involve known and unknown risks, uncertainties or other factors not under Lexington's control which may cause actual results, performance or achievements of Lexington to be materially different from the results, performance, or other expectations implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed under the headings “Management's Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in Lexington's periodic reports filed with the Securities and Exchange Commission, including risks related to: (1) the successful consummation of any lease, acquisition, build-to-suit, financing or other transaction, (2) the failure to continue to qualify as a real estate investment trust, (3) changes in general business and economic conditions, including the impact of any legislation, (4) competition, (5) increases in real estate construction costs, (6) changes in interest rates, (7) changes in accessibility of debt and equity capital markets, and (8) future impairment charges. Copies of the periodic reports Lexington files with the Securities and Exchange Commission are available on Lexington's web site at www.lxp.com. Forward-looking statements, which are based on certain assumptions and describe Lexington's future plans, strategies and expectations, are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “estimates,” “projects”, “may,” “plans,” “predicts,” “will,” “will likely result,” “is optimistic,” “goal,” “objective” or similar expressions. Except as required by law, Lexington undertakes no obligation to publicly release the results of any revisions to those forward-looking statements which may be made to reflect events or circumstances after the occurrence of unanticipated events. Accordingly, there is no assurance that Lexington's expectations will be realized.

References to Lexington refer to Lexington Realty Trust and its consolidated subsidiaries. All interests in properties and loans are held through special purpose entities, which are separate and distinct legal entities, some of which are consolidated for financial statement purposes and/or disregarded for income tax purposes.

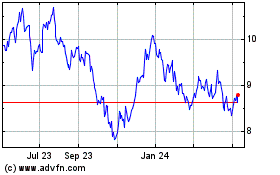

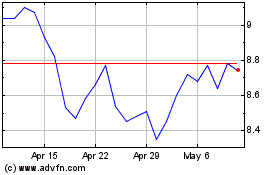

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Apr 2023 to Apr 2024