Sands to Pay $6.96 Million to Settle U.S. Investigation

January 20 2017 - 1:24AM

Dow Jones News

By Chris Kirkham and Alexandra Berzon

Casino giant Las Vegas Sands Corp. agreed Thursday to pay a

$6.96 million criminal penalty to settle a U.S. Justice Department

investigation into violations of the antibribery law over payments

the company made to a business consultant in China.

The DOJ didn't accuse Sands of paying bribes but said it

violated provisions of the law that require companies to maintain

proper controls.

The agreement closes a long-running episode that entangled the

company in state and federal investigations, and cost it tens of

millions of dollars.

Ron Reese, a Sands spokesman, said the company is "pleased that

its cooperation and long-term commitment to compliance were

recognized in reaching this resolution. We are equally pleased that

all inquiries related to these issues have now been completely

resolved."

As part of the nonprosecution agreement with the Justice

Department, the company admitted it paid approximately $5.8 million

to the consultant, a former Chinese government official, between

2006 and 2009 even though there was no "discernible legitimate

business purpose."

The gambling company, controlled by Republican donor Sheldon

Adelson, also acknowledged it failed to monitor and account for

those payments.

Separately, Sands last year paid $9 million to settle a U.S.

Securities and Exchange Commission investigation into similar

dealings with the same business consultant. The consultant was

involved in helping secure the company's sponsorship of a Chinese

basketball team and securing an office building in Beijing, along

with other business ventures.

Sands also settled a related matter last year with the Nevada

gambling regulators, paying $2 million to the state. A.G. Burnett,

chairman of the Nevada Gaming Control Board, said the agency will

review the DOJ settlement.

The DOJ's investigation originated from statements made in a

wrongful-termination lawsuit from a former Macau executive. The

executive alleged in the lawsuit that began more than six years ago

that the company was engaging in improprieties in Macau, the

Chinese gambling hub.

The company settled the wrongful termination case with that

employee last year for more than $75 million.

The Wall Street Journal first reported on the deals criticized

by the DOJ in a 2012 article. The company first said in SEC filings

in 2013 that an internal board review had showed it likely had

violated accounting provisions of the Foreign Corrupt Practices

Act, the law that bans bribery of foreign officials, because it

didn't have proper accounting controls related to the deals.

As part of the agreement, federal officials said Sands will

continue cooperating with the DOJ in any ongoing investigations or

prosecutions related to the business dealings and will continue to

update the DOJ on its compliance efforts.

In a DOJ document released Thursday, the agency said the

nonprosecution agreement doesn't apply to any of the individuals

involved in the case.

Part of the questionable payments stemmed from a deal involving

the purchase of a Chinese basketball team. In 2007, Sands was

interested in purchasing a team as a way to promote its operations

in Macau, but learned it was unable to do so under league rules

because it is a gambling company, according to DOJ documents. The

company arranged to pay the consultant to buy the team, but

employees started to notice irregularities into how the money was

being accounted for, according to the DOJ.

The company brought in an accounting firm to investigate the

payments, but encountered resistance from the consultant and an

executive of its Macau subsidiary, according to the DOJ.

By the time the accounting firm was told to complete its

investigation in early 2008, the firm still couldn't account for

$700,000 in payments to the consultant, according to DOJ documents

outlining the agreement.

In a separate transaction, companies controlled by Sands wired

$3.6 million to one of the consultant's companies as prepayment on

a building lease in Beijing, even though the consultant provided no

documentation to support that he had purchased the building,

according to the agreement.

When an outside lawyer and a Sands finance employee raised

concerns about the irregularities, a Sands executive in China had

them removed and replaced with less-experienced employees,

according to the agreement.

The DOJ said Sands no longer employs any of those involved in

the investigation and credited the company with completing

"extensive remedial measures," including an expansion of its

compliance and auditing departments.

Write to Chris Kirkham at chris.kirkham@wsj.com and Alexandra

Berzon at alexandra.berzon@wsj.com

(END) Dow Jones Newswires

January 20, 2017 01:09 ET (06:09 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

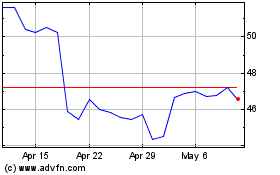

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

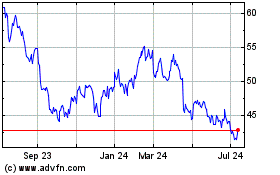

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024