By Alexandra Berzon and Kate O'Keeffe

LAS VEGAS -- What began nearly six years ago as a

wrongful-termination complaint against casino giant Las Vegas Sands

Corp. has reverberated through the gambling business, prompting

multiple federal investigations and industrywide changes.

The company settled the case Tuesday, agreeing to pay more than

$75 million to Steve Jacobs, its former top Macau executive,

according to a person familiar with the matter.

In his suit, Mr. Jacobs alleged the company fired him for

objecting to illegal demands made by its controlling shareholder,

Republican megadonor Sheldon Adelson. Las Vegas Sands has said it

fired Mr. Jacobs because he wasn't fulfilling the terms of his

employment. An attorney for Mr. Jacobs declined to comment on this

story.

Under the terms of the settlement, Mr. Jacobs agreed to drop all

legal claims against the company, its subsidiaries and Mr. Adelson,

according to a filing, which didn't specify a figure or offer

details of the deal.

The settlement came after Sands faced multiple federal

investigations brought on by the allegations in Mr. Jacobs' case,

and incurred more than $100 million in associated legal fees,

people familiar with the matter say.

The agreement allows the company to avoid what could have been a

very messy trial, putting Mr. Adelson on the witness stand

beginning in September.

The trial also would have started at an important time for the

company, which is set to open a new casino in Macau that month and

is pushing to build both a new arena and stadium in Las Vegas, said

Ron Reese, a spokesman for Las Vegas Sands.

But people involved in the casino industry said Wednesday that

they expect the case's implications to continue even without a

trial.

Executives at Sands and its rivals have long said they wished

Mr. Adelson would settle the case, as its allegations brought

unwanted scrutiny to the entire industry.

According to some, the entire legal debacle could have been

avoided. "It didn't have to happen had it not been for a clash of

big egos," said George Koo, a member of Las Vegas Sands' board from

2008 through 2014. The company declined to comment on Mr. Koo's

assertion.

Mr. Adelson fought unsuccessfully for years to have the venue

changed to Macau and to remove the Nevada judge assigned to the

case.

All the while Mr. Adelson repeatedly said nothing would come of

Mr. Jacobs' suit or the related federal investigations. In 2011 Mr.

Adelson remarked at an investors' conference: "When the smoke

clears I am absolutely 1,000% positive that there won't be any fire

below it."

The Jacobs settlement involves between $75 million and $100

million, according to the person familiar with the matter.

That is an eye-popping amount for wrongful termination lawsuits,

said Steven Pearlman, an employment attorney at Proskauer Rose LLP

who litigates whistleblower and contract-dispute cases.

Mr. Pearlman said that even cases involving top-level executives

often settle for several million dollars, at the most. However

state jury trials can sometimes produce unexpected results once

damages are considered, he said. "To call it unusual is to put it

mildly," he said.

An official from one of the federal agencies that regulates

casinos and who is familiar with the Jacobs case reacted with an

expletive upon hearing how much the former executive had won in the

unusually large settlement.

Mr. Jacobs's allegations prompted both the Securities and

Exchange Commission and the Justice Department to investigate

whether the company had violated the Foreign Corrupt Practices Act,

which bars U.S. companies from bribing officials of foreign

governments.

In recent weeks, Sands has been resolving some of those matters,

including a $9 million settlement with the SEC involving internal

controls and a $2 million settlement with Nevada gambling

regulators, while neither admitting nor denying allegations in

either one.

The company says it is continuing to cooperate with the ongoing

Justice Department investigation, and has beefed up its compliance

policies, including the scrutiny of its biggest customers'

financial transactions.

The allegations in the former executive's suit put an

uncomfortable spotlight on the ways casinos do business in Macau,

particularly regarding their use of middlemen called junket

operators. Many of these middlemen who bring in high-rolling

gamblers, lend them money and collect debt have been known to have

ties to organized crime, according to U.S. officials.

Allegations in the Jacobs case helped spur the U.S. Treasury

Department to focus more heavily on casino companies, prompting

them to change the way they account and report on the financial

transactions of their customers, said Jim Dowling, a consultant for

casino companies on their anti-money-laundering policies.

"The case brought attention to casino operators and regulators

-- like 'Woah, what's this. We need to take a look at this,'" Mr.

Dowling said. "Both sides started looking at it."

Mr. Adelson sued Wall Street Journal reporter Kate O'Keeffe for

libel in 2013. A spokeswoman for the Journal, which wasn't named in

the suit, said the newspaper would continue to vigorously defend

Ms. O'Keeffe.

--Aruna Viswanatha contributed to this article.

(END) Dow Jones Newswires

June 01, 2016 20:58 ET (00:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

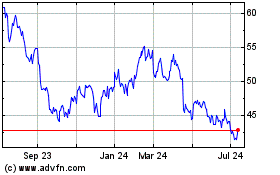

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

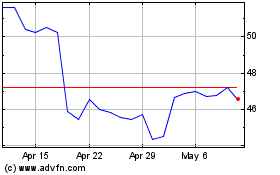

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024