Sands to Pay $9 Million In SEC Settlement -- WSJ

April 08 2016 - 2:31AM

Dow Jones News

By Aruna Viswanatha,Alexandra Berzon and Kate O'Keeffe

Casino giant Las Vegas Sands Corp. will pay $9 million to settle

Securities and Exchange Commission allegations that its Chinese

operations had poor accounting controls from 2006 through at least

2011, the agency said Thursday.

The allegations focused primarily on the company's sponsorship

of a Chinese basketball team, plans for a business center in

Beijing, and a ferry deal in Macau.

The SEC said the gambling company, controlled by Republican

megadonor Sheldon Adelson, transferred more than $62 million to a

consultant in China, often without supporting documents or

appropriate authorization, and "despite knowledge by senior LVSC

management that they could not account for significant funds

previously transferred to the consultant."

The settlement, which also requires an independent monitor for

the company for two years, ends one piece of a saga that started

more than five years ago, when a former Sands executive set off a

firebomb by alleging improprieties in Macau, a Chinese territory

that is the world's largest gambling hub.

The allegations by Sands's former top Macau executive, Steve

Jacobs, prompted the SEC and the Justice Department to investigate

whether the company had violated the Foreign Corrupt Practices Act,

which bars U.S. companies from bribing officials of foreign

governments.

While the Justice Department investigation is still open, it

appears unlikely that it will result in any criminal charges,

according to people familiar with the matter.

Sands said it is continuing to respond to the Justice Department

inquiry.

A wrongful termination lawsuit filed by Mr. Jacobs in 2010 that

includes bribery allegations is scheduled to go to trial this

summer. The company has denied wrongdoing in that matter and says

Mr. Jacobs was fired for legitimate reasons.

Mr. Jacobs's attorneys said in a statement that they are looking

forward to introducing evidence on the alleged FCPA issues in

court.

The SEC didn't accuse Sands of paying bribes, but said it

violated provisions of the law that require companies to maintain

proper controls. The company neither admitted nor denied the

allegations, according to the settlement.

In a statement issued Thursday, the company said it has enhanced

its financial controls and anticorruption policies.

"The projects were orchestrated through a consultant whose

activities under a former company president and other former

employees were not sufficiently monitored," the statement said.

The former Sands president, William Weidner, said in an

interview with The Wall Street Journal that he isn't responsible

for any wrongdoing alleged by the SEC. He said that while he

oversaw the projects in question, he didn't supervise the

accountants and lawyers who handled the payments and structured the

deals.

The Wall Street Journal first reported on the deals criticized

by the SEC in a 2012 story.

Among them was Las Vegas Sands's 2007 effort to buy a

professional basketball team in China to improve its image. Since

Chinese authorities barred gambling companies from buying teams,

the company had a consultant do it for them and subsequently fired

an executive who had raised concerns about the transaction, the SEC

said.

The SEC also flagged the company's use of the consultant, who

claimed to be a former Chinese government official, to buy portions

of a Beijing building from a Chinese state-owned company to develop

a business center bearing Mr. Adelson's name, the SEC said.

Employees raised concerns that the Beijing real-estate deal was

done solely for "political purposes," but the company still

transferred $61 million in connection with the deal, the SEC said.

After the Adelson Center project was cancelled, the company got

back around $44 million of that sum from the consultant.

The SEC also took issue with a 2007 deal in which it alleges

Sands signed a contract with a high-speed ferry company partially

owned by a Chinese state-owned company in the hopes that it would

be "politically advantageous," according to the settlement.

Sands's internal auditors found that the ferry company, which

shuttled gamblers to Macau, provided meals to government officials

and gave them envelopes filled with cash around Lunar New Year, the

settlement said.

Mr. Adelson sued Wall Street Journal reporter Kate O'Keeffe for

libel in 2013. A spokeswoman for the Journal, which wasn't named in

the suit, said the newspaper would continue to vigorously defend

Ms. O'Keeffe.

Write to Aruna Viswanatha at Aruna.Viswanatha@wsj.com and

Alexandra Berzon at alexandra.berzon@wsj.com

(END) Dow Jones Newswires

April 08, 2016 02:16 ET (06:16 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

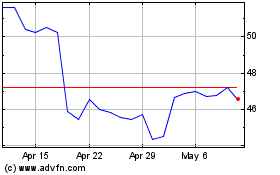

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

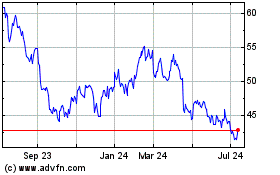

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024