Las Vegas Sands Profit Hurt by Macau Weakness

October 21 2015 - 5:30PM

Dow Jones News

Las Vegas Sands Corp. on Wednesday reported a

smaller-than-expected slide in profit for its third quarter, though

revenue tumbled 18% amid continued weakness in Macau.

Shares of the company added 2.5% in after-hours trading.

Las Vegas Sands said Macau remains challenging, particularly in

high-end and VIP gaming. A corruption crackdown and weakening

economy on the mainland have cut into business in Macau, the only

place in China where casinos are legal. Casino operators have been

re-evaluating costs amid the pressures on their revenue and

margins.

Third-quarter revenue at the Sands China business slid 29% to

$1.66 billion. Profit in the segment plunged 47% to $343.2

million.

The company's U.S. properties include the Venetian in Las Vegas

and Pennsylvania's Sands Bethlehem.

Overall, Las Vegas Sands reported a profit of $519.4 million, or

65 cents a share, down from $671.7 million, or 84 cents a share, a

year earlier.

Excluding pre-opening expenses and other items, per-share

earnings fell to 66 cents from 84 cents a year earlier.

Revenue dropped to $2.89 billion from $3.53 billion a year

earlier.

Analysts polled by Thomson Reuters expected per-share profit of

64 cents and revenue of $2.97 billion.

Write to Chelsea Dulaney at chelsea.dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 21, 2015 17:15 ET (21:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

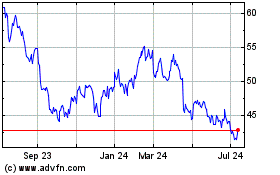

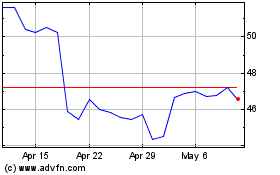

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024