United's Revenue Declines on Passenger Fare Weakness

October 17 2016 - 6:40PM

Dow Jones News

United Continental Holdings Inc., grappling like other U.S.

airlines with too much capacity, a strong U.S. dollar and

competitive pricing, said its third-quarter passenger revenue

declined $357 million from a year ago, helping to pull down total

revenue to $9.9 billion in its seasonally best quarter from $10.3

billion a year ago.

The third-largest U.S. airline by traffic said it saw some

improvement in its September unit revenue, the much-watched metric

of total passenger revenue for each seat flown a mile. Last-minute

business bookings were stronger than expected, due in part because

a calendar shift moved two Jewish holidays into October this year.

During those holidays business traffic usually declines.

United's quarterly unit revenue declined 5.8% from a year

earlier, within the range of its most recent guidance, which was

down 5.5% to 6%. Earlier, the company had expected a decline of

5.5% to 7.5%.

The Chicago-based company also said on Monday that it expects

its unit revenue to be down 4% to 6% in the current quarter, and

plans to trim trans-Atlantic capacity by up to 3.4% from the prior

year's period.

In the current quarter, United expects its capacity to be up 1%

to 2%, which would bring its full-year capacity up a modest 1.2% to

1.4%, the company said.

Delta Air Lines Inc., the No. 2 airline, last week said its unit

revenue should turn positive early next year, helped by further

trims to its capacity. In the third quarter, Delta's unit revenue

fell 6.8% from a year earlier, with nearly 2 percentage points of

impact from a technology outage in August that forced it to cancel

more than 2,000 flights.

United had a small technology issue last week when it was

loading flight schedule updates. But it was quickly fixed and only

led to 16 flight cancellations, the company said. United has

suffered from other outages in the past, but not nearly as severe

as Delta's recent experience or a similar one that hit Southwest

Airlines Co. in July.

United's third-quarter unit cost, excluding fuel and

profit-sharing, rose 3.4%, including 2 percentage points of impact

from new, costlier labor contracts with pilots, flight attendants,

ramp workers and customer-service agents. United's mechanics are

expected to vote soon on a new contract. United said it expects its

fourth-quarter unit cost, excluding fuel and other items, to be up

4.75% to 5.75% from a year ago.

Andrew Levy, the chief financial officer, said United expects

next year "to see a step up in our labor costs" as the company

strives to motivate its employees and help it close its margin gap

with its peers. He said 4 percentage points of the expected

fourth-quarter increase will be due to the new contracts, not

including a tentative deal with the mechanics.

Chicago-based United earned $965 million in the September

quarter, or $3.01 a share. Excluding items, its earnings of $997

million, or $3.11 a share, beat Wall Street estimates. Revenue was

in line with forecasts.

A year ago, the company earned $4.8 billion, but that figure was

boosted by a one-time $3.2 billion noncash income-tax benefit. The

company began booking taxes on its earnings this year, which caused

net income to decline compared with earlier periods when it didn't

book taxes. But it pays minimal to no cash taxes while it works off

its billions of dollars of net operating loss carryforwards, tax

credits accrued during earlier years of heavy losses.

In Monday trading, United shares closed down 0.3% at $53.03.

Write to Susan Carey at susan.carey@wsj.com

(END) Dow Jones Newswires

October 17, 2016 18:25 ET (22:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

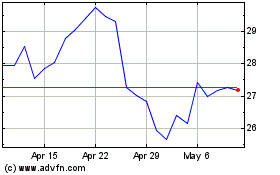

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Mar 2024 to Apr 2024

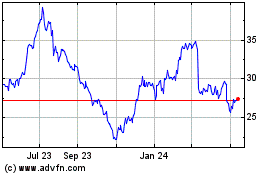

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Apr 2023 to Apr 2024