Southwest Airlines Revamps Aircraft Order Book

June 23 2016 - 2:36PM

Dow Jones News

By Susan Carey

Southwest Airlines Co., finalizing a revamp of its fleet

strategy that began in 2012, on Thursday told investors it is

deferring delivery of Boeing Co.'s new 737-Max aircraft to take

fewer than earlier planned through 2022, in part to reduce its

near-term capital expenditure budget.

The nation's leading discount carrier has 330 Boeing 737s on

firm order for delivery through 2025, as compared with 328 through

2024, its previously reported delivery schedule. Its number of

planes on option remains the same. But the new plan will

significantly lower the number of new planes entering the fleet

from 2018 through 2022, Southwest Chief Financial Officer Tammy

Romo said at an investor day presentation Thursday.

This year and next, the Dallas-based carrier plans to boost

deliveries, in part to compensate for the previously announced

early retirement of about 50 older-version 737s by 2017. It will

add 67 planes in 2017, compared with the previously envisioned 61.

Some of the additional planes are used 737-700s Southwest has found

on the market at good prices. Others are new 737-800s it had on

firm order and the third tranche, starting next year, are Boeing's

new-engined version of the 737, the so-called Max-8.

Ms. Romo said the new fleet plan will defer $1.9 billion of

aircraft capital spending by 2020. Southwest's aircraft capex this

year will be $1.3 billion, rise next year and then retreat. Beyond

2020, the company will be able to keep that spending at manageable

levels, she said. The deferral of 67 firm deliveries over the next

several years supports the goal of 2% annual net fleet growth.

Southwest, which flies only variants of Boeing 737s, expects to

end this year with 723 planes in its fleet, a number that will dip

to 700 in 2017 before rising again to between 730 and 750 aircraft

in 2018.

Boeing, in a statement, said its strong 737 order book gave it

the flexibility to help Southwest accelerate deliveries in the near

term, then sequence its receipt of 737s over the longer term. The

manufacturer said it continues to see healthy demand in the

single-aisle aircraft market. Industry experts believe because the

Max model is in such demand, Southwest's deferrals in taking some

of those models could help Boeing work with other airline customers

who want to move up their delivery positions.

Bringing in the new planes will boost fuel efficiency and lower

maintenance costs, Ms. Romo said. In an earlier investor

presentation, she said the Max has 14% more fuel efficiency than

Southwest's 737-700s and 737-800s. The Max is about 20% more fuel

efficient that the 737-300s that are being retired.

The airline, No. 4 in the U.S. by traffic, had intended to

retire about 50 old-model 737s by mid-2018. But in January, it

moved up that date to the third quarter of 2017, so those planes

will be out of the system before it starts taking new Max-8 planes.

The decision to accelerate those retirements was made to alleviate

the need to have separate training regimes for the pilots.

Ms. Romo also said Southwest, which plans to add a new

reservation system in 2017, expects that IT cost to reach $500

million. But the benefits of the modern technology and new

functionality should allow the carrier to recoup that investment by

2020, she said.

Write to Susan Carey at susan.carey@wsj.com

(END) Dow Jones Newswires

June 23, 2016 14:21 ET (18:21 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

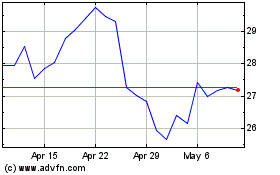

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Mar 2024 to Apr 2024

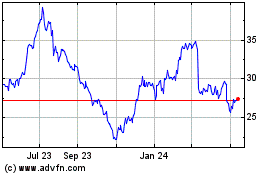

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Apr 2023 to Apr 2024