Boeing Considering New 737 Model

April 21 2016 - 3:00PM

Dow Jones News

Boeing Co. is considering another version of its new

single-aisle jetliner to fend off competition from a new Bombardier

Inc. passenger jet, according to people familiar with the

situation.

The proposed plane would seat around 150 passengers in two

classes and replace the smallest version of the Boeing 737 Max,

which is due to enter service in 2019. The first model of the Max,

an update of the best-selling workhorse jet, is currently being

tested and is due to enter service first with Southwest Airlines

Co. next year.

Internally dubbed the Boeing 737 Max 7X, the plane would fly

significantly further and carry more passengers than the 126-seat

model which it would replace, the people said.

Boeing needs to win backing for the plan from United Continental

Holdings Inc., which recently purchased 45 current-generation 737s,

and Southwest, which is also due to take the first of the smallest

model, according to a senior industry executive. The smallest

version has only garnered 60 orders.

The proposed new model would include major portions of the

162-seat Max 8, including a shortened version of its fuselage. The

concept is a less-expensive option than customizing parts such as

the wings. Sharing components lowers development and production

costs, which Boeing can use to cut sale prices.

A Boeing spokesman declined to comment, citing company

policy.

Mike Van de Ven, Southwest's chief operating officer, said on an

investor call that he'd "heard rumors" about a new 737 version.

"Absolutely we'd want to go out and consider different options

out there," he said, adding that "there have been no thoughts of

adjusting" the 30 firm orders Southwest has for the smallest

version of the Max.

Boeing has employed a similar strategy to make a version of the

Max with 200 seats. The company has already signed up low-cost

carrier Ryanair Holdings PLC for that plane, which is the same size

as the Max 8, but includes two new exit doors to accommodate an

increase in the jet's cabin capacity.

Reworking its single-aisle jet lineup reflects the traction

Bombardier is getting with its CSeries jets. Boeing was forced to

offer United steep price concessions to win orders this year in the

face of competition from Bombardier. Delta Air Lines Inc. is

expected to complete a deal with Bombardier for up to 125 aircraft

later this month, according to people familiar with both

campaigns.

In addition to being used to court airlines, the design could

also serve as a military platform or an ultralong range business

jet, said one of the people familiar with the study.

Write to Jon Ostrower at jon.ostrower@wsj.com

(END) Dow Jones Newswires

April 21, 2016 14:45 ET (18:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

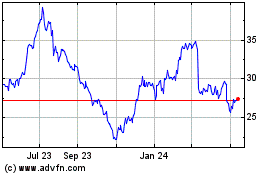

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Mar 2024 to Apr 2024

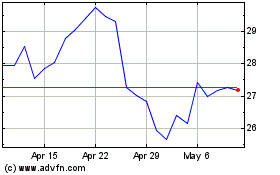

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Apr 2023 to Apr 2024