UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 23, 2015

Southwest Airlines Co.

__________________________________________

(Exact name of registrant as specified in its charter)

|

| | |

Texas | 1-7259 | 74-1563240 |

_____________________ | _____________ | ______________ |

(State or other jurisdiction | (Commission | (I.R.S. Employer |

of incorporation) | File Number) | Identification No.) |

|

| |

P. O. Box 36611, Dallas, Texas | 75235-1611 |

_________________________________ | ___________ |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (214) 792-4000

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On July 23, 2015 the Registrant issued a press release announcing its financial results for the second quarter 2015. The press release is furnished herewith as Exhibit 99.1 and is incorporated by reference into this Item 2.02.

The information furnished in this Item 2.02 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

99.1 Registrant’s Second Quarter 2015 Earnings Release.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| SOUTHWEST AIRLINES CO. |

| | |

July 23, 2015 | By | /s/ Tammy Romo |

| | |

| | Tammy Romo |

| | Senior Vice President Finance & Chief Financial Officer |

| | (On behalf of the Registrant and in |

| | her capacity as Principal Financial |

| | and Accounting Officer) |

Exhibit Index

|

| |

Exhibit No. | Description |

| |

99.1 | Registrant’s First Quarter 2015 Earnings Release. |

SOUTHWEST AIRLINES REPORTS RECORD QUARTERLY PROFIT

DALLAS, TEXAS - July 23, 2015 - Southwest Airlines (NYSE:LUV) (the “Company”) today reported its second quarter 2015 results:

| |

• | Record quarterly net income, excluding special items1, of $691 million, or $1.03 per diluted share. This represented a $206 million increase from second quarter 2014 and exceeded the First Call consensus estimate of $1.02 per diluted share. |

| |

• | Record quarterly GAAP2 net income of $608 million, or $.90 per diluted share. |

| |

• | Record quarterly GAAP operating income of $1.1 billion. Excluding special items, record quarterly operating income of $1.1 billion, resulting in an operating margin3 of 22.5 percent. |

| |

• | Returned $430 million to Shareholders through dividends and share repurchases during second quarter 2015, and $811 million during first half 2015. |

| |

• | Return on invested capital, before taxes and excluding special items (ROIC)1, for the 12 months ended June 30, 2015, of 28.2 percent, compared with 17.1 percent for the 12 months ended June 30, 2014. |

| |

• | Subsequent to June 30, 2015, the Company amended and extended its co-branded credit card agreement with Chase Bank USA, N.A. (Chase), which is expected to provide generous rewards to the Company's co-branded credit cardholders and significant future value to the Company's Shareholders. The Company currently estimates its second half 2015 GAAP operating revenues will increase approximately $400 million from the combined impact of the amended agreement and the effect of a change in accounting methodology4. |

Gary C. Kelly, Chairman of the Board, President, and Chief Executive Officer, stated, "We are delighted to report another strong quarter of earnings. Our net income, excluding special items, of $691 million, or $1.03 per diluted share, is an all-time quarterly high and represents our ninth consecutive quarter of record profits. Operating income, excluding special items, increased 40.2 percent year-over-year, producing a strong 22.5 percent operating margin. We significantly expanded our margins and generated very strong cash flows during first half 2015, allowing us to return $811 million to Shareholders through dividends and share repurchases so far this year. In addition, we intend to launch a $500 million accelerated share repurchase program soon. We have a solid investment grade balance

sheet, and we are pleased with the recent upgrade to Baa1 by Moody's. For first half 2015, our record profits have earned our outstanding Employees a record $308 million profitsharing accrual, nearly doubling first half 2014’s contribution. For the 12 months ended June 30, 2015, our ROIC was an outstanding 28.2 percent, far surpassing our cost of capital. Our 2015 results, thus far, are exceptional, and our current outlook for the second half of 2015 is also strong, laying a solid foundation to surpass 2014's ROIC.

“Fuel savings5 in second quarter 2015 were nearly $500 million, which led to a reduction in our second quarter 2015 unit costs, excluding special items, of almost 12 percent year-over-year. Second quarter 2015 economic fuel costs were $2.02 per gallon, compared with $3.02 per gallon in second quarter 2014. Based on our existing fuel derivative contracts and market prices as of July 20, 2015, we expect significant year-over-year fuel savings again in third quarter 2015, with economic fuel costs currently estimated to be approximately $2.20 per gallon, as compared with third quarter 2014's $2.94 per gallon.

“We also were very pleased with our overall cost performance. Our cost control efforts, ongoing fleet modernization, and improved aircraft utilization resulted in a 1.8 percent year-over-year decline in our second quarter 2015 unit costs, excluding fuel and oil expense, special items, and second quarter 2015's record profitsharing expense of $182 million. Based on current cost trends, and excluding fuel and oil expense, special items, and profitsharing, we expect third quarter 2015 unit costs to decline approximately one percent and full year 2015 unit costs to decline approximately two percent, both compared with the same year-ago periods.

“Our second quarter 2015 operating unit revenue performance was impacted by challenging year-over-year comparisons, longer average stage length, higher average seats per trip (gauge), and a softer yield environment. Still, we grew second quarter 2015 operating revenues 2.0 percent to a record $5.1 billion on a year-over-year increase in available seat miles (ASMs) of 7.0 percent. Demand for our popular low fares remained strong throughout the quarter resulting in a record 84.6 percent load factor. Our second quarter 2015 unit revenues declined 4.7 percent, as expected, driven largely by the 5.4 percent decline in passenger revenue yields, both as compared with second quarter last year. The year-ago results included $47 million in additional passenger revenue due to a change to previously recorded estimates of tickets expected to spoil in the future, which impacted second quarter 2015 year-over-year unit revenue comparisons by approximately one percent. Another two to three percent of the

second quarter 2015 year-over-year unit revenue decline was driven by a 4.6 percent increase in average stage length and a 2.4 percent increase in gauge, both as compared with second quarter 2014.

“We continue to be extremely pleased with our development markets in Dallas. They are remarkably strong, surpassing system average margins and returns. In April, we launched nine additional daily nonstop flights, bringing our total daily flights out of Love Field to 166. By August 2015, we are scheduled to operate 180 weekday departures to 50 nonstop destinations.

"Our international expansion is also progressing, as planned, and producing expected results. We began service to Puerto Vallarta (PVR) in June and announced daily service between PVR and Denver beginning in November 2015, pending foreign government approval. We are excited to begin service by the end of this year between eight international cities and Houston (Hobby), including inaugural service to Belize City, Belize in October 2015, and Liberia, Costa Rica in November 2015, both pending foreign government approvals.

"Earlier this month, we were delighted to amend and extend our long-standing partnership with Chase for our co-branded credit card agreement. Beginning in third quarter 2015 and continuing thereafter, we expect to realize significant revenue enhancements. Since we re-launched our award-winning frequent flyer program in 2011, we have nearly doubled the size of our program, in terms of membership, and grown our credit card program, proportionately.

"While some yield softness has continued into July, demand thus far remains strong. Based on current bookings and revenue trends, and including the estimated benefit to operating revenues from our amended co-branded credit card agreement, we are currently estimating third quarter 2015 unit revenues to decline a modest one percent from third quarter 2014. Taking into consideration the ongoing impact of increased stage and gauge, as well as 18 percent of our network under development in third quarter 2015, we are very pleased with our third quarter revenue outlook.

"Overall, our network performance is exceptional. For this year, we are growing our ASMs approximately seven percent, year-over-year. The annualized impact of our 2015 expansion is

expected to contribute the majority of 2016's year-over-year capacity growth. As we continue to optimize our network, we are currently planning to grow our total 2016 ASMs in the five to six percent range, year-over-year, with the goal to sustain strong margins and ROIC levels in line with 2015."

Financial Results

The Company's second quarter 2015 total operating revenues were $5.1 billion, a 2.0 percent increase compared with second quarter 2014, largely driven by second quarter 2015 passenger revenues of $4.9 billion. In second quarter 2014, the Company recorded $47 million in additional passenger revenues due to a change to previously recorded estimates of tickets expected to spoil in the future, contributing to the challenging year-over-year comparisons in second quarter 2015 revenue trends.

Subsequent to June 30, 2015, the Company executed an amended co-branded credit card agreement with Chase, through which the Company sells loyalty points and other items to Chase. For accounting purposes, the amended agreement materially modifies the previously existing agreement between Chase and the Company and is subject to Accounting Standards Update 2009-13, "Multiple-Deliverable Revenue Arrangements - a consensus of the FASB Emerging Issues Task Force" (ASU 2009-13). The Company currently estimates that the combined impact from the amended agreement and the effect of the change in accounting methodology to ASU 2009-13 will increase its GAAP operating revenues by approximately $400 million in second half 2015, as compared with the same period last year.

Under the transition provisions of ASU 2009-13, the existing deferred revenue liability will be revalued to reflect the estimated selling price of the undelivered elements of the contract at the date of the amended agreement. As a result, and included within the estimated increase to GAAP operating revenues of approximately $400 million in second half 2015, the Company expects to record a one-time non-cash reduction to the deferred revenue liability with a corresponding increase to operating revenues in third quarter 2015 of approximately $150 million, which will be recorded as a special revenue item and is, therefore, excluded from the Company's outlook on third quarter 2015 unit revenues. The remaining approximately $250 million estimated benefit will be included in second half 2015 unit revenues. The estimated portion of that amount related to third quarter 2015 was included in the Company's current outlook for a third quarter 2015 unit revenue decline of approximately one percent, year-over-year.

Total operating expenses in second quarter 2015 decreased 5.0 percent to $4.0 billion, compared with second quarter 2014. During second quarter 2015, the Company expensed $55 million (before profitsharing and taxes) related to the proposed ratification bonuses included in the tentative collective-bargaining agreement recently reached with the Company's Flight Attendants and related to the ratification bonuses paid to Dispatchers, Meteorologists, and Flight Simulator Technicians, which are special items. Excluding special items in both periods, total operating expenses in second quarter 2015 decreased 5.5 percent to $4.0 billion, compared with second quarter 2014.

Second quarter 2015 economic fuel costs were $2.02 per gallon, including $.08 per gallon in unfavorable cash settlements from fuel derivative contracts, compared with $3.02 per gallon in second quarter 2014, including $.05 per gallon in favorable cash settlements from fuel derivative contracts. As of July 20, 2015, the fair market value of the Company's fuel derivative contracts was a net liability of approximately $1.3 billion for the fuel hedge portfolio through 2018, including a $308 million net liability related to the remainder of 2015. Additional information regarding the Company's fuel derivative contracts is included in the accompanying tables.

Excluding fuel and oil expense and special items in both periods, second quarter 2015 operating costs increased 6.9 percent from second quarter 2014, partially due to the second quarter 2015 profitsharing expense of $182 million, compared with $127 million in second quarter 2014. Excluding fuel and oil expense, special items, and profitsharing in both periods, second quarter 2015 operating costs increased 5.1 percent from second quarter 2014, and decreased 1.8 percent on a unit basis.

Operating income in second quarter 2015 was a record $1.1 billion, compared with $775 million in second quarter 2014. Excluding special items, operating income was also a record $1.1 billion in second quarter 2015, compared with $819 million in second quarter 2014.

Other expenses in second quarter 2015 were $108 million, compared with $29 million in second quarter 2014. The $79 million increase primarily resulted from $88 million in other losses recognized in second quarter 2015, compared with $3 million in second quarter 2014. In both periods, these losses included ineffectiveness and unrealized mark-to-market amounts associated with a portion of the Company's fuel hedge portfolio, which are special items. Excluding these special items, second quarter 2015 had $19 million in other losses, compared with $15 million in second quarter 2014, primarily attributable to the

premium costs associated with the Company's fuel derivative contracts. Third quarter 2015 premium costs related to fuel derivative contracts are currently estimated to be in the $30 million to $35 million range, compared with $15 million in third quarter 2014. Net interest expense in second quarter 2015 was $20 million, compared with $26 million in second quarter 2014.

Second quarter 2015 net income was $608 million, or $.90 per diluted share, which included $83 million (net) of unfavorable special items, compared with second quarter 2014 net income of $465 million, or $.67 per diluted share, which included $20 million (net) of unfavorable special items. Excluding special items, second quarter 2015 net income was $691 million, or $1.03 per diluted share, compared with second quarter 2014 net income, excluding special items, of $485 million, or $.70 per diluted share.

For the six months ended June 30, 2015, total operating revenues increased 3.8 percent to $9.5 billion, while total operating expenses decreased 6.4 percent to $7.7 billion, resulting in operating income of $1.9 billion, compared with $991 million for the same period last year. Excluding special items, operating income was $1.9 billion for first half 2015, compared with $1.1 billion for first half 2014.

Net income for first half 2015 was $1.1 billion, or $1.57 per diluted share, compared with $617 million, or $0.88 per diluted share, for the same period last year. Excluding special items, net income for first half 2015 was $1.1 billion, or $1.69 per diluted share, compared with $611 million, or $0.87 per diluted share, for the same period last year.

Balance Sheet and Cash Flows

As of June 30, 2015, the Company had approximately $3.1 billion in cash and short-term investments, and a fully available unsecured revolving credit line of $1 billion. Net cash provided by operations during second quarter 2015 was $627 million, capital expenditures were $428 million, and assets constructed for others, net of reimbursements, were $19 million, resulting in free cash flow1 of $180 million. The Company repaid $40 million in debt and capital lease obligations during second quarter 2015, and intends to repay approximately $95 million in debt and capital lease obligations during the remainder of 2015. The Company funded $355 million to its ProfitSharing Plan during second quarter 2015 as a result of its 2014 results. In past years, the Company's annual profitsharing contribution was funded in third quarter.

During second quarter 2015, the Company returned $430 million to its Shareholders through the payment of $50 million in dividends and the repurchase of $380 million in common stock. The Company completed its previous $1.0 billion share repurchase program with the repurchase of $80 million in common stock, or 1.9 million shares, during second quarter 2015. On May 13, 2015, the Company's Board of Directors authorized a new $1.5 billion share repurchase program, along with a 25 percent increase in the Company's quarterly dividend. Under the new $1.5 billion share repurchase program, the Company repurchased $300 million in common stock, or 8.1 million shares, pursuant to an accelerated share repurchase (ASR) program launched and completed during the quarter, bringing total shares repurchased during second quarter 2015 to approximately 10 million. In addition, during second quarter 2015, the Company received the remaining 1.8 million shares pursuant to the first quarter 2015 $300 million ASR program, bringing the total shares repurchased under that ASR program to 6.9 million. For first half 2015, free cash flow was a strong $1.0 billion which enabled the Company to return $811 million to Shareholders through the payment of $131 million in dividends and the repurchase of $680 million in common stock. The Company intends to repurchase an additional $500 million of Southwest common stock under an ASR program expected to be launched soon, which would bring total repurchases of common stock in 2015 to nearly $1.2 billion. Subsequent to the launch of the planned $500 million ASR program, the Company will have $700 million remaining under its existing $1.5 billion share repurchase program.

Fleet

During second quarter 2015, the Company's fleet increased by ten to 689 aircraft at period end. This reflects the second quarter delivery of six new Boeing 737-800s and five pre-owned Boeing 737-700s, as well as the retirement of one Boeing 737 Classic aircraft. The Company continues to manage to roughly 700 aircraft in 2015 and continues to expect to grow its net fleet approximately two percent, year-over-year, in 2016. As an extension of its fleet modernization initiatives, during second quarter 2015, the Company designated its 31 Boeing firm orders in 2016 as 737-800s rather than 737-700s and added 31 pre-owned 737-700 aircraft scheduled for delivery through 2018. In addition, subsequent to June 30, 2015, the Company canceled the 12 737NG options scheduled for delivery in 2016. Additional information regarding these revisions to the Company's aircraft delivery schedule is included in the accompanying tables.

Awards and Recognitions

| |

• | Recognized for Best Redemption Ability, Best Airline Customer Service, and Best Loyalty Credit Card by InsideFlyer for its Rapid Rewards program |

| |

• | Named as one of CR’s 100 Best Corporate Citizens 2015 |

| |

• | Designated a 2015 Most Valuable Employer for military by CivilianJobs.com |

| |

• | Received CIO 100 Award from CIO Magazine |

| |

• | Named to BetterInvesting’s Top 100 Company list |

| |

• | Received a 2015 Texas Excellence Award from the U.S. Commerce & Trade Research Institute |

Conference Call

The Company will discuss its second quarter 2015 results on a conference call at 12:30 p.m. Eastern Time today. A live broadcast of the conference call also will be available at

http://southwest.investorroom.com.

1See Note Regarding Use of Non-GAAP Financial Measures for additional information on special items, ROIC, and free cash flow. In addition, information regarding special items and ROIC is included in the accompanying reconciliation tables.

2Generally Accepted Accounting Principles in the United States.

3Operating margin, excluding special items, is calculated as operating income, excluding special items, divided by operating revenues. See Note Regarding Use of Non-GAAP Financial Measures.

4Additional information regarding the co-branded credit card agreement and the change in accounting methodology is included in the Financial Results section of this release.

5Fuel savings is calculated as second quarter 2015 fuel consumed, in gallons, multiplied by the year-over-year change in economic fuel costs per gallon, including fuel tax.

Cautionary Statement Regarding Forward-Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Specific forward-looking statements include, without limitation, statements related to (i) the Company's financial outlook, expectations, and projected results of operations, including specific factors expected to impact the Company’s results of operations; (ii) the Company's plans and goals with respect to returning value to Shareholders, including its share repurchase plans; (iii) the Company's plans and expectations related to managing risk associated with changing jet fuel prices; (iv) the Company's network plans, goals, opportunities, and expectations, including its plans and expectations with respect to international operations; (v) the Company's capacity and fleet plans and expectations; (vi) the Company's expectations with respect to liquidity (including its plans for the repayment of debt and capital lease obligations); and (vii) the Company's aircraft delivery schedule. These forward-looking statements are based on the Company's current intent, expectations, and projections and are not guarantees of future performance. These statements involve risks, uncertainties, assumptions, and other factors that are difficult to predict and that could cause actual results to vary materially from those expressed in or indicated by them. Factors include, among others, (i) changes in demand for the Company's services and other changes in consumer behavior (including with respect to the Company’s co-branded credit card); (ii) the impact of economic conditions, fuel prices, actions of competitors (including without limitation pricing, scheduling, and capacity

decisions and consolidation and alliance activities), and other factors beyond the Company's control, on the Company's business decisions, plans, and strategies; (iii) changes in aircraft fuel prices, the impact of hedge accounting, and any changes to the Company's fuel hedging strategies and positions; (iv) the impact of governmental regulations and other governmental actions related to the Company's operations; (v) the Company's ability to timely and effectively implement, transition, and maintain the necessary information technology systems and infrastructure to support its operations and initiatives; (vi) the Company's dependence on third parties, in particular with respect to its technology and fleet plans; (vii) the Company's ability to timely and effectively prioritize its strategic initiatives and related expenditures; and (viii) other factors, as described in the Company's filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

Investor Contact:

Southwest Airlines Investor Relations

214-792-4415

Media Contact:

Southwest Airlines Media Relations

214-792-4847

swamedia@wnco.com

Southwest Airlines Co.

Condensed Consolidated Statement of Income

(in millions, except per share amounts)

(unaudited) |

| | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | Six months ended | | |

| June 30, | | | | June 30, | | |

| 2015 | | 2014 | | Percent Change | | 2015 | | 2014 | | Percent Change |

OPERATING REVENUES: | | | | | | | | | | | |

Passenger | $ | 4,852 |

| | $ | 4,752 |

| | 2.1 | | $ | 9,030 |

| | $ | 8,685 |

| | 4.0 |

Freight | 46 |

| | 44 |

| | 4.5 | | 90 |

| | 84 |

| | 7.1 |

Other | 213 |

| | 215 |

| | (0.9) | | 405 |

| | 409 |

| | (1.0) |

Total operating revenues | 5,111 |

| | 5,011 |

| | 2.0 | | 9,525 |

| | 9,178 |

| | 3.8 |

| | | | | | | | | | | |

OPERATING EXPENSES: | | | | | | | | | | | |

Salaries, wages, and benefits | 1,607 |

| | 1,406 |

| | 14.3 | | 3,026 |

| | 2,680 |

| | 12.9 |

Fuel and oil | 1,005 |

| | 1,425 |

| | (29.5) | | 1,882 |

| | 2,739 |

| | (31.3) |

Maintenance materials and repairs | 240 |

| | 236 |

| | 1.7 | | 469 |

| | 486 |

| | (3.5) |

Aircraft rentals | 59 |

| | 75 |

| | (21.3) | | 119 |

| | 156 |

| | (23.7) |

Landing fees and other rentals | 299 |

| | 295 |

| | 1.4 | | 584 |

| | 560 |

| | 4.3 |

Depreciation and amortization | 250 |

| | 228 |

| | 9.6 | | 494 |

| | 449 |

| | 10.0 |

Acquisition and integration | 3 |

| | 38 |

| | (92.1) | | 26 |

| | 56 |

| | (53.6) |

Other operating expenses | 563 |

| | 533 |

| | 5.6 | | 1,060 |

| | 1,061 |

| | (0.1) |

Total operating expenses | 4,026 |

| | 4,236 |

| | (5.0) | | 7,660 |

| | 8,187 |

| | (6.4) |

| | | | | | | | | | | |

OPERATING INCOME | 1,085 |

| | 775 |

| | 40.0 | | 1,865 |

| | 991 |

| | 88.2 |

| | | | | | | | | | | |

OTHER EXPENSES (INCOME): | | | | | | | | | | | |

Interest expense | 29 |

| | 34 |

| | (14.7) | | 62 |

| | 66 |

| | (6.1) |

Capitalized interest | (7 | ) | | (6 | ) | | 16.7 | | (14 | ) | | (12 | ) | | 16.7 |

Interest income | (2 | ) | | (2 | ) | | — | | (3 | ) | | (3 | ) | | — |

Other (gains) losses, net | 88 |

| | 3 |

| | n.m. | | 121 |

| | (50 | ) | | n.m. |

Total other expenses (income) | 108 |

| | 29 |

| | 272.4 | | 166 |

| | 1 |

| | n.m. |

| | | | | | | | | | | |

INCOME BEFORE INCOME TAXES | 977 |

| | 746 |

| | 31.0 | | 1,699 |

| | 990 |

| | 71.6 |

PROVISION FOR INCOME TAXES | 369 |

| | 281 |

| | 31.3 | | 638 |

| | 373 |

| | 71.0 |

NET INCOME | $ | 608 |

| | $ | 465 |

| | 30.8 | | $ | 1,061 |

| | $ | 617 |

| | 72.0 |

| | | | | | | | | | | |

NET INCOME PER SHARE: | | | | | | | | | | | |

Basic | $ | 0.91 |

| | $ | 0.67 |

| | 35.8 | | $ | 1.58 |

| | $ | 0.89 |

| | 77.5 |

Diluted | $ | 0.90 |

| | $ | 0.67 |

| | 34.3 | | $ | 1.57 |

| | $ | 0.88 |

| | 78.4 |

| | | | | | | | | | | |

WEIGHTED AVERAGE SHARES OUTSTANDING: | | | | | | | | |

Basic | 665 |

| | 690 |

| | (3.6) | | 670 |

| | 694 |

| | (3.5) |

Diluted | 673 |

| | 698 |

| | (3.6) | | 678 |

| | 703 |

| | (3.6) |

Southwest Airlines Co.

Reconciliation of Reported Amounts to Non-GAAP Items

(See Note Regarding Use of Non-GAAP Financial Measures)

(in millions, except per share amounts)(unaudited) |

| | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | Six months ended | | |

| June 30, | | | | June 30, | | |

| 2015 | | 2014 | | Percent Change | | 2015 | | 2014 | | Percent Change |

Fuel and oil expense, unhedged | $ | 962 |

| | $ | 1,444 |

| | | | $ | 1,792 |

| | $ | 2,776 |

| | |

Add (Deduct): Fuel hedge (gains) losses included in Fuel and oil expense | 43 |

| | (19 | ) | | | | 90 |

| | (37 | ) | | |

Fuel and oil expense, as reported | $ | 1,005 |

| | $ | 1,425 |

| | | | $ | 1,882 |

| | $ | 2,739 |

| | |

Deduct: Net impact from fuel contracts (1) | (5 | ) | | (6 | ) | | | | (9 | ) | | (14 | ) | | |

Fuel and oil expense, (economic) | $ | 1,000 |

| | $ | 1,419 |

| | (29.5) | | $ | 1,873 |

| | $ | 2,725 |

| | (31.3) |

| | | | | | | | | | | |

Total operating expenses, as reported | $ | 4,026 |

| | $ | 4,236 |

| | | | $ | 7,660 |

| | $ | 8,187 |

| | |

Deduct: Net impact from fuel contracts (1) | (5 | ) | | (6 | ) | | | | (9 | ) | | (14 | ) | | |

Deduct: Acquisition and integration costs | (3 | ) | | (38 | ) | | | | (26 | ) | | (56 | ) | | |

Add: Litigation settlement | — |

| | — |

| | | | 37 |

| | — |

| | |

Deduct: Labor ratification bonuses | (55 | ) | | — |

| | | | (55 | ) | | — |

| | |

Total operating expenses, non-GAAP | $ | 3,963 |

| | $ | 4,192 |

| | (5.5) | | $ | 7,607 |

| | $ | 8,117 |

| | (6.3) |

Deduct: Fuel and oil expense, non-GAAP (economic) | (1,000 | ) | | (1,419 | ) | | | | (1,873 | ) | | (2,725 | ) | | |

Operating expenses, non-GAAP, excluding Fuel and oil expense | $ | 2,963 |

| | $ | 2,773 |

| | 6.9 | | $ | 5,734 |

| | $ | 5,392 |

| | 6.3 |

Deduct: Profitsharing expense | (182 | ) | | (127 | ) | | | | (308 | ) | | (156 | ) | | |

Operating expenses, non-GAAP, excluding Profitsharing and Fuel and oil expense | $ | 2,781 |

| | $ | 2,646 |

| | 5.1 | | $ | 5,426 |

| | $ | 5,236 |

| | 3.6 |

| | | | | | | | | | | |

Operating income, as reported | $ | 1,085 |

| | $ | 775 |

| | | | $ | 1,865 |

| | $ | 991 |

| | |

Add : Net impact from fuel contracts (1) | 5 |

| | 6 |

| | | | 9 |

| | 14 |

| | |

Add: Acquisition and integration costs | 3 |

| | 38 |

| | | | 26 |

| | 56 |

| | |

Deduct: Litigation settlement | — |

| | — |

| | | | (37 | ) | | — |

| | |

Add: Labor ratification bonuses | 55 |

| | — |

| | | | 55 |

| | — |

| | |

Operating income, non-GAAP | $ | 1,148 |

| | $ | 819 |

| | 40.2 | | $ | 1,918 |

| | $ | 1,061 |

| | 80.8 |

| | | | | | | | | | | |

Other (gains) losses, net, as reported | $ | 88 |

| | $ | 3 |

| | | | $ | 121 |

| | $ | (50 | ) | | |

Add (Deduct): Net impact from fuel contracts (1) | (69 | ) | | 12 |

| | | | (76 | ) | | 81 |

| | |

Other (gains) losses, net, non-GAAP | $ | 19 |

| | $ | 15 |

| | 26.7 | | $ | 45 |

| | $ | 31 |

| | 45.2 |

| | | | | | | | | | | |

Net income, as reported | $ | 608 |

| | $ | 465 |

| | | | $ | 1,061 |

| | $ | 617 |

| | |

Add (Deduct): Net impact from fuel contracts (1) | 74 |

| | (6 | ) | | | | 85 |

| | (67 | ) | | |

Add (Deduct): Income tax impact of fuel contracts | (27 | ) | | 2 |

| | | | (31 | ) | | 26 |

| | |

Add: Acquisition and integration costs (2) | 2 |

| | 24 |

| | | | 16 |

| | 35 |

| | |

Deduct: Litigation settlement (2) | — |

| | — |

| | | | (23 | ) | | — |

| | |

Add: Labor ratification bonuses (2) | 34 |

| | — |

| | | | 34 |

| | — |

| | |

Net income, non-GAAP | $ | 691 |

| | $ | 485 |

| | 42.5 | | $ | 1,142 |

| | $ | 611 |

| | 86.9 |

| | | | | | | | | | | |

Net income per share, diluted, as reported | $ | 0.90 |

| | $ | 0.67 |

| | | | $ | 1.57 |

| | $ | 0.88 |

| | |

Add (Deduct): Net impact from fuel contracts (2) | 0.07 |

| | (0.01 | ) | | | | 0.07 |

| | (0.06 | ) | | |

Add: Impact of special items (2) | 0.06 |

| | 0.04 |

| | | | 0.05 |

| | 0.05 |

| | |

Net income per share, diluted, non-GAAP | $ | 1.03 |

| | $ | 0.70 |

| | 47.1 | | $ | 1.69 |

| | $ | 0.87 |

| | 94.3 |

(1) See Reconciliation of Impact from Fuel Contracts.

(2) Amounts net of tax.

Southwest Airlines Co.

Reconciliation of Impact from Fuel Contracts

(See Note Regarding Use of Non-GAAP Financial Measures)

(in millions)

(unaudited)

|

| | | | | | | | | | | | | | | |

| Three months ended | | Six months ended |

| June 30, | | June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Fuel and oil expense | | | | | | | |

Reclassification between Fuel and oil and Other (gains) losses, net, associated with current period settled contracts | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Contracts settling in the current period, but for which gains have been recognized in a prior period (1) | (5 | ) | | (6 | ) | | (9 | ) | | (14 | ) |

Impact from fuel contracts to Fuel and oil expense | $ | (5 | ) | | $ | (6 | ) | | $ | (9 | ) | | $ | (14 | ) |

| | | | | | | |

Operating Income | | | | | | | |

Reclassification between Fuel and oil and Other (gains) losses, net, associated with current period settled contracts | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Contracts settling in the current period, but for which gains have been recognized in a prior period (1) | 5 |

| | 6 |

| | 9 |

| | 14 |

|

Impact from fuel contracts to Operating Income | $ | 5 |

| | $ | 6 |

| | $ | 9 |

| | $ | 14 |

|

| | | | | | | |

Other (gains) losses, net | | | | | | | |

Mark-to-market impact from fuel contracts settling in future periods | $ | (71 | ) | | $ | (16 | ) | | $ | (91 | ) | | $ | 40 |

|

Ineffectiveness from fuel hedges settling in future periods | 2 |

| | 28 |

| | 15 |

| | 41 |

|

Reclassification between Fuel and oil and Other (gains) losses, net,

associated with current period settled contracts | — |

| | — |

| | — |

| | — |

|

Impact from fuel contracts to Other (gains) losses, net | $ | (69 | ) | | $ | 12 |

| | $ | (76 | ) | | $ | 81 |

|

| | | | | | | |

Net Income | | | | | | | |

Mark-to-market impact from fuel contracts settling in future periods | $ | 71 |

| | $ | 16 |

| | $ | 91 |

| | $ | (40 | ) |

Ineffectiveness from fuel hedges settling in future periods | (2 | ) | | (28 | ) | | (15 | ) | | (41 | ) |

Other net impact of fuel contracts settling in the current or a prior period (excluding reclassifications) | 5 |

| | 6 |

| | 9 |

| | 14 |

|

Impact from fuel contracts to Net Income (2) | $ | 74 |

| | $ | (6 | ) | | $ | 85 |

| | $ | (67 | ) |

(1) As a result of prior hedge ineffectiveness and/or contracts marked-to-market through the income statement.

(2) Before income tax impact of unrealized items.

Southwest Airlines Co.

Comparative Consolidated Operating Statistics

(unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | Six months ended | | |

| June 30, | | | | June 30, | | |

| 2015 | | 2014 | | Change | | 2015 | | 2014 | | Change |

Revenue passengers carried | 30,800,742 |

| | 29,155,114 |

| | 5.6% | | 57,243,738 |

| | 54,210,923 |

| | 5.6% |

Enplaned passengers | 37,670,284 |

| | 35,790,140 |

| | 5.3% | | 69,769,242 |

| | 66,446,721 |

| | 5.0% |

Revenue passenger miles (RPMs) (000s) (1) | 30,858,381 |

| | 28,589,997 |

| | 7.9% | | 56,719,247 |

| | 52,745,314 |

| | 7.5% |

Available seat miles (ASMs) (000s) (2) | 36,476,030 |

| | 34,096,212 |

| | 7.0% | | 68,773,495 |

| | 64,570,794 |

| | 6.5% |

Load factor (3) | 84.6 | % | | 83.9 | % | | 0.7 pts. | | 82.5 | % | | 81.7 | % | | 0.8 pts. |

Average length of passenger haul (miles) | 1,002 |

| | 981 |

| | 2.1% | | 991 |

| | 973 |

| | 1.8% |

Average aircraft stage length (miles) | 756 |

| | 723 |

| | 4.6% | | 748 |

| | 717 |

| | 4.3% |

Trips flown | 326,309 |

| | 327,343 |

| | (0.3)% | | 622,879 |

| | 626,981 |

| | (0.7)% |

Seats flown (4) | 47,612,415 |

| | 46,662,111 |

| | 2.0% | | 90,856,819 |

| | 89,208,921 |

| | 1.8% |

Seats per trip (5) | 145.91 |

| | 142.55 |

| | 2.4% | | 145.87 |

| | 142.28 |

| | 2.5% |

Average passenger fare | $ | 157.51 |

| | $ | 163.00 |

| | (3.4)% | | $ | 157.74 |

| | $ | 160.21 |

| | (1.5)% |

Passenger revenue yield per RPM (cents) (6) | 15.72 |

| | 16.62 |

| | (5.4)% | | 15.92 |

| | 16.47 |

| | (3.3)% |

RASM (cents) (7) | 14.01 |

| | 14.70 |

| | (4.7)% | | 13.85 |

| | 14.21 |

| | (2.5)% |

PRASM (cents) (8) | 13.30 |

| | 13.94 |

| | (4.6)% | | 13.13 |

| | 13.45 |

| | (2.4)% |

CASM (cents) (9) | 11.04 |

| | 12.42 |

| | (11.1)% | | 11.14 |

| | 12.68 |

| | (12.1)% |

CASM, excluding Fuel and oil expense (cents) | 8.29 |

| | 8.25 |

| | 0.5% | | 8.40 |

| | 8.44 |

| | (0.5)% |

CASM, excluding special items (cents) | 10.86 |

| | 12.30 |

| | (11.7)% | | 11.06 |

| | 12.57 |

| | (12.0)% |

CASM, excluding Fuel and oil expense and special items (cents) | 8.13 |

| | 8.14 |

| | (0.1)% | | 8.34 |

| | 8.35 |

| | (0.1)% |

CASM, excluding Fuel and oil expense, special items, and profitsharing (cents) | 7.63 |

| | 7.77 |

| | (1.8)% | | 7.89 |

| | 8.11 |

| | (2.7)% |

Fuel costs per gallon, including fuel tax (unhedged) | $ | 1.94 |

| | $ | 3.07 |

| | (36.8)% | | $ | 1.93 |

| | $ | 3.10 |

| | (37.7)% |

Fuel costs per gallon, including fuel tax | $ | 2.03 |

| | $ | 3.03 |

| | (33.0)% | | $ | 2.02 |

| | $ | 3.06 |

| | (34.0)% |

Fuel costs per gallon, including fuel tax (economic) | $ | 2.02 |

| | $ | 3.02 |

| | (33.1)% | | $ | 2.01 |

| | $ | 3.05 |

| | (34.1)% |

Fuel consumed, in gallons (millions) | 493 |

| | 469 |

| | 5.1% | | 927 |

| | 892 |

| | 3.9% |

Active fulltime equivalent Employees | 47,645 |

| | 45,508 |

| | 4.7% | | 47,645 |

| | 45,508 |

| | 4.7% |

Aircraft at end of period (10) | 689 |

| | 683 |

| | 0.9% | | 689 |

| | 683 |

| | 0.9% |

(1) A revenue passenger mile is one paying passenger flown one mile. Also referred to as "traffic," which is a measure of demand for a given period.

(2) An available seat mile is one seat (empty or full) flown one mile. Also referred to as "capacity," which is a measure of the space available to carry passengers in a given period.

(3) Revenue passenger miles divided by available seat miles.

(4) Seats flown is calculated using total number of seats available by aircraft type multiplied by the total trips flown by the same aircraft type during a particular period.

(5) Seats per trip is calculated using seats flown divided by trips flown. Also referred to as “gauge.”

(6) Calculated as passenger revenue divided by revenue passenger miles. Also referred to as "yield," this is the average cost paid by a paying passenger to fly one mile, which is a measure of revenue production and fares.

(7) RASM (unit revenue) - Operating revenue yield per ASM, calculated as operating revenue divided by available seat miles. Also referred to as "operating unit revenues," this is a measure of operating revenue production based on the total available seat miles flown during a particular period.

(8) PRASM (Passenger unit revenue) - Passenger revenue yield per ASM, calculated as passenger revenue divided by available seat miles. Also referred to as “passenger unit revenues,” this is a measure of passenger revenue production based on the total available seat miles flown during a particular period.

(9) CASM (unit costs) - Operating expenses per ASM, calculated as operating expenses divided by available seat miles. Also referred to as "unit costs" or "cost per available seat mile," this is the average cost to fly an aircraft seat (empty or full) one mile, which is a measure of cost efficiencies.

(10) Aircraft in the Company's fleet at period end, less Boeing 717-200s removed from service in preparation for transition out of the fleet.

Southwest Airlines Co.

Return on Invested Capital (ROIC)

(See Note Regarding Use of Non-GAAP Financial Measures)

(in millions)

(unaudited)

|

| | | | | | | |

| | | |

| Twelve Months Ended | | Twelve Months Ended |

| June 30, 2015 | | June 30, 2014 |

Operating income, as reported | $ | 3,100 |

| | $ | 1,766 |

|

Net impact from fuel contracts | 23 |

| | 49 |

|

Acquisition and integration costs | 96 |

| | 103 |

|

Labor ratification bonuses | 64 |

| | — |

|

Litigation settlement | (37 | ) | | — |

|

Operating income, non-GAAP | $ | 3,246 |

| | $ | 1,918 |

|

Net adjustment for aircraft leases (1) | 117 |

| | 140 |

|

Adjustment for fuel hedge premium expense | (76 | ) | | (78 | ) |

Adjusted Operating income, non-GAAP | $ | 3,287 |

| | $ | 1,980 |

|

| | | |

Average invested capital (2) | $ | 11,196 |

| | $ | 11,581 |

|

Equity adjustment for hedge accounting | 473 |

| | (25 | ) |

Adjusted average invested capital | $ | 11,669 |

| | $ | 11,556 |

|

| | | |

ROIC, pre-tax | 28.2 | % | | 17.1 | % |

(1) Net adjustment related to presumption that all aircraft in fleet are owned (i.e., the impact of eliminating aircraft rent expense and replacing with estimated depreciation expense for those same aircraft).

(2) Average Invested Capital is an average of the five most recent quarter end balances of debt, net present value of aircraft leases, and equity adjusted for hedge accounting.

Southwest Airlines Co.

Condensed Consolidated Balance Sheet

(in millions)

(unaudited) |

| | | | | | | |

| June 30, 2015 | | December 31, 2014 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 1,772 |

| | $ | 1,282 |

|

Short-term investments | 1,360 |

| | 1,706 |

|

Accounts and other receivables | 462 |

| | 365 |

|

Inventories of parts and supplies, at cost | 326 |

| | 342 |

|

Deferred income taxes | 421 |

| | 477 |

|

Prepaid expenses and other current assets | 255 |

| | 232 |

|

Total current assets | 4,596 |

| | 4,404 |

|

Property and equipment, at cost: | | | |

Flight equipment | 19,148 |

| | 18,473 |

|

Ground property and equipment | 2,972 |

| | 2,853 |

|

Deposits on flight equipment purchase contracts | 658 |

| | 566 |

|

Assets constructed for others | 745 |

| | 621 |

|

| 23,523 |

| | 22,513 |

|

Less allowance for depreciation and amortization | 8,663 |

| | 8,221 |

|

| 14,860 |

| | 14,292 |

|

Goodwill | 970 |

| | 970 |

|

Other assets | 649 |

| | 534 |

|

| $ | 21,075 |

| | $ | 20,200 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

Current liabilities: | | | |

Accounts payable | $ | 1,134 |

| | $ | 1,203 |

|

Accrued liabilities | 1,651 |

| | 1,565 |

|

Air traffic liability | 3,815 |

| | 2,897 |

|

Current maturities of long-term debt | 276 |

| | 258 |

|

Total current liabilities | 6,876 |

| | 5,923 |

|

| | | |

Long-term debt less current maturities | 2,411 |

| | 2,434 |

|

Deferred income taxes | 3,290 |

| | 3,259 |

|

Construction obligation | 632 |

| | 554 |

|

Other noncurrent liabilities | 708 |

| | 1,255 |

|

Stockholders' equity: | | | |

Common stock | 808 |

| | 808 |

|

Capital in excess of par value | 1,319 |

| | 1,315 |

|

Retained earnings | 8,387 |

| | 7,416 |

|

Accumulated other comprehensive loss | (664 | ) | | (738 | ) |

Treasury stock, at cost | (2,692 | ) | | (2,026 | ) |

Total stockholders' equity | 7,158 |

| | 6,775 |

|

| $ | 21,075 |

| | $ | 20,200 |

|

Southwest Airlines Co.

Condensed Consolidated Statement of Cash Flows

(in millions)

(unaudited)

|

| | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | |

Net income | $ | 608 |

| | $ | 465 |

| | $ | 1,061 |

| | $ | 617 |

|

Adjustments to reconcile net income to cash provided by (used in) operating activities: | | | | | | | |

Depreciation and amortization | 250 |

| | 228 |

| | 494 |

| | 449 |

|

Unrealized/realized (gain) loss on fuel derivative instruments | 74 |

| | (7 | ) | | 85 |

| | (67 | ) |

Deferred income taxes | 23 |

| | (11 | ) | | 43 |

| | 81 |

|

Changes in certain assets and liabilities: | | | | | | | |

Accounts and other receivables | 41 |

| | 10 |

| | (90 | ) | | (61 | ) |

Other assets | (7 | ) | | (21 | ) | | 6 |

| | (14 | ) |

Accounts payable and accrued liabilities | (134 | ) | | 424 |

| | 43 |

| | 448 |

|

Air traffic liability | 201 |

| | 153 |

| | 918 |

| | 914 |

|

Cash collateral received from (provided to) derivative counterparties | (377 | ) | | 95 |

| | (394 | ) | | 106 |

|

Other, net | (52 | ) | | 2 |

| | (87 | ) | | (15 | ) |

Net cash provided by operating activities | 627 |

| | 1,338 |

| | 2,079 |

| | 2,458 |

|

| | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | |

Capital expenditures | (428 | ) | | (481 | ) | | (1,001 | ) | | (876 | ) |

Assets constructed for others | (22 | ) | | (19 | ) | | (44 | ) | | (31 | ) |

Purchases of short-term investments | (562 | ) | | (1,159 | ) | | (877 | ) | | (1,929 | ) |

Proceeds from sales of short-term and other investments | 614 |

| | 803 |

| | 1,223 |

| | 1,622 |

|

Other, net | (9 | ) | | (1 | ) | | (9 | ) | | (1 | ) |

Net cash used in investing activities | (407 | ) | | (857 | ) | | (708 | ) | | (1,215 | ) |

| | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | |

Proceeds from Employee stock plans | 8 |

| | 25 |

| | 21 |

| | 73 |

|

Proceeds from termination of interest rate derivative instruments | — |

| | — |

| | 12 |

| | — |

|

Reimbursement for assets constructed for others | 3 |

| | — |

| | 5 |

| | — |

|

Payments of long-term debt and capital lease obligations | (40 | ) | | (73 | ) | | (92 | ) | | (119 | ) |

Payments of cash dividends | (50 | ) | | (42 | ) | | (131 | ) | | (97 | ) |

Repayment of construction obligation | (3 | ) | | (2 | ) | | (5 | ) | | (5 | ) |

Repurchase of common stock | (380 | ) | | (240 | ) | | (680 | ) | | (555 | ) |

Other, net | (11 | ) | | (8 | ) | | (11 | ) | | (13 | ) |

Net cash used in financing activities | (473 | ) | | (340 | ) | | (881 | ) | | (716 | ) |

| | | | | | | |

NET CHANGE IN CASH AND CASH EQUIVALENTS | (253 | ) | | 141 |

| | 490 |

| | 527 |

|

| | | | | | | |

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 2,025 |

| | 1,741 |

| | 1,282 |

| | 1,355 |

|

| | | | | | | |

CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 1,772 |

| | $ | 1,882 |

| | $ | 1,772 |

| | $ | 1,882 |

|

Southwest Airlines Co.

Fuel Derivative Contracts

As of July 20, 2015

|

| | |

| Estimated economic jet fuel price per gallon, including taxes |

Average Brent Crude Oil price per barrel | 3Q 2015 (2) | Full Year 2015 (2) |

$40 | $2.00 - $2.05 | $1.95 - $2.00 |

$50 | $2.10 - $2.15 | $2.05 - $2.10 |

Current Market (1) | $2.15 - $2.20 | $2.10 - $2.15 |

$70 | $2.40 - $2.45 | $2.20 - $2.25 |

$80 | $2.55 - $2.60 | $2.30 - $2.35 |

| | |

| | |

Period | Average percent of estimated fuel consumption covered by fuel derivative contracts at varying WTI/Brent Crude Oil, Heating Oil, and Gulf Coast Jet Fuel-equivalent price levels |

Third quarter 2015 | Approx. 65% |

Full Year 2015 | Approx. 30% |

2016 | Approx. 40% |

2017 | Approx. 40% |

2018 (3) | — |

(1) Brent crude oil average market price as of July 20, 2015, was approximately $57 per barrel for third quarter 2015 and $59 per barrel for full year 2015.

(2) The economic fuel price per gallon sensitivities provided assume the relationship between Brent crude oil and refined products based on market prices as of July 20, 2015.

(3) In response to the precipitous decline in oil and jet fuel prices during the second half of 2014, the Company took action to offset its 2018 fuel derivative portfolio and remains effectively unhedged for 2018 at current price levels. While the Company still holds derivative contracts as of July 20, 2015, that will settle during 2018, the losses associated with those contracts are locked in.

Southwest Airlines Co.

737 Delivery Schedule

As of July 20, 2015

|

| | | | | | | | | | | | | | | | | | | |

| The Boeing Company | | The Boeing Company | | |

| 737 NG | | 737 MAX | | |

| -700 Firm Orders | | -800 Firm Orders | Options | Additional -700s | -7 Firm Orders | -8 Firm Orders | | Options | Total | |

2015 | — |

| | 19 |

| — |

| 21 |

| — |

| — |

| | — |

| 40 |

| (3) |

2016 | — |

| | 31 |

| — |

| 13 |

| — |

| — |

| | — |

| 44 |

| |

2017 | 15 |

| | — |

| 12 |

| 14 |

| — |

| 14 |

| | — |

| 55 |

| |

2018 | 10 |

| | — |

| 12 |

| 4 |

| — |

| 13 |

| | — |

| 39 |

| |

2019 | — |

| | — |

| — |

| — |

| 15 |

| 10 |

| | — |

| 25 |

| |

2020 | — |

| | — |

| — |

| — |

| 14 |

| 22 |

| | — |

| 36 |

| |

2021 | — |

| | — |

| — |

| — |

| 1 |

| 33 |

| | 18 |

| 52 |

| |

2022 | — |

| | — |

| — |

| — |

| — |

| 30 |

| | 19 |

| 49 |

| |

2023 | — |

| | — |

| — |

| — |

| — |

| 24 |

| | 23 |

| 47 |

| |

2024 | — |

| | — |

| — |

| — |

| — |

| 24 |

| | 23 |

| 47 |

| |

2025 | — |

| | — |

| — |

| — |

| — |

| — |

| | 36 |

| 36 |

| |

2026 | — |

| | — |

| — |

| — |

| — |

| — |

| | 36 |

| 36 |

| |

2027 | — |

|

| — |

| — |

| — |

| — |

| — |

| | 36 |

| 36 |

| |

| 25 |

| (1) | 50 |

| 24 |

| 52 |

| 30 |

| 170 |

| (2) | 191 |

| 542 |

| |

(1) The Company has flexibility to substitute 737-800s in lieu of 737-700 firm orders.

(2) The Company has flexibility to substitute MAX 7 in lieu of MAX 8 firm orders beginning in 2019.

(3) Includes 13 737-800s and 13 737-700s delivered as of July 20, 2015.

NOTE REGARDING USE OF NON-GAAP FINANCIAL MEASURES

The Company's unaudited consolidated financial statements are prepared in accordance with GAAP. These GAAP financial statements include (i) unrealized non-cash adjustments and reclassifications, which can be significant, as a result of accounting requirements and elections made under accounting pronouncements relating to derivative instruments and hedging and (ii) other charges the Company believes are not indicative of its ongoing operational performance.

As a result, the Company also provides financial information in this release that was not prepared in accordance with GAAP and should not be considered as an alternative to the information prepared in accordance with GAAP. The Company provides supplemental non-GAAP financial information, including results that it refers to as “economic,” which the Company's management utilizes to evaluate its ongoing financial performance and the Company believes provides greater transparency to investors as supplemental information to its GAAP results. The Company's economic financial results differ from GAAP results in that they only include the actual cash settlements from fuel hedge contracts--all reflected within Fuel and oil expense in the period of settlement. Thus, Fuel and oil expense on an economic basis reflects the Company's actual net cash outlays for fuel during the applicable period, inclusive of settled fuel derivative contracts. Any net premium costs paid related to option contracts are reflected as a component of Other (gains) losses, net, for both GAAP and non-GAAP (including economic) purposes in the period of contract settlement. The Company believes these economic results provide a better measure of the impact of the Company's fuel hedges on its operating performance and liquidity since they exclude the unrealized, non-cash adjustments and reclassifications that are recorded in GAAP results in accordance with accounting guidance relating to derivative instruments, and they reflect all cash settlements related to fuel derivative contracts within Fuel and oil expense. This enables the Company's management, as well as investors, to consistently assess the Company's operating performance on a year-over-year or quarter-over-quarter basis after considering all efforts in place to manage fuel expense. However, because these measures are not determined in accordance with GAAP, such measures are susceptible to varying calculations and not all companies calculate the measures in the same manner. As a result, the aforementioned measures, as presented, may not be directly comparable to similarly titled measures presented by other companies.

Further information on (i) the Company's fuel hedging program, (ii) the requirements of accounting for derivative instruments, and (iii) the causes of hedge ineffectiveness and/or mark-to-market gains or losses from derivative instruments is included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

In addition to its “economic” financial measures, as defined above, the Company has also provided other non-GAAP financial measures, including results that it refers to as “excluding special items,” as a result of items that the Company believes are not indicative of its ongoing operations. These include expenses associated with the Company's acquisition and integration of AirTran, collective bargaining ratification bonuses for certain workgroups, and a gain resulting from a litigation settlement received in January 2015. The Company believes that evaluation of its financial performance can be enhanced by a presentation of results that exclude the impact of these items in order to evaluate the results on a comparative basis with results in prior periods that do not include such items and as a basis for evaluating operating results in future periods. As a result of the Company's acquisition of AirTran, which closed on May 2, 2011, the Company has incurred substantial charges associated with integration of the two companies. Given that the AirTran integration process has been effectively completed, the Company does not anticipate significant future integration expenditure requirements, but may incur smaller incremental costs associated primarily with the continuing conversion and sublease of the Boeing 717 fleet throughout 2015. While the Company cannot predict the exact timing or amounts of such charges, it does expect to treat the charges as special items in its future presentation of non-GAAP results.

The Company has also provided free cash flow and ROIC, which are non-GAAP financial measures. The Company believes free cash flow is a meaningful measure because it demonstrates the Company's ability to service its debt, pay dividends and make investments to enhance Shareholder value. Although free cash flow is commonly used as a measure of liquidity, definitions of free cash flow may differ; therefore, the Company is providing an explanation of its calculation for free cash flow. For the three months ended June 30, 2015, the Company generated $180 million in free cash flow, calculated as operating cash flows of $627 million less capital expenditures of $428 million less assets constructed for others of $22 million plus reimbursements for assets constructed for others of $3 million.

For the six months ended June 30, 2015, the Company generated $1,039 million in free cash flow, calculated as operating cash flows of $2,079 million less capital expenditures of $1,001 million less assets constructed for others of $44 million plus reimbursements for assets constructed for others of $5 million.

The Company believes ROIC is a meaningful measure because it quantifies how well the Company generates operating income relative to the capital it has invested in its business. Although ROIC is commonly used as a measure of capital efficiency, definitions of ROIC may differ; therefore, the Company is providing an explanation of its calculation for ROIC in the accompanying reconciliation tables to the press release (See Return on Invested Capital).

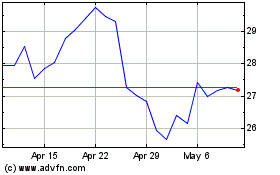

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Mar 2024 to Apr 2024

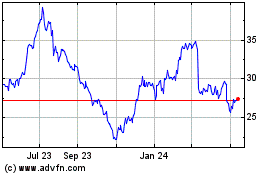

Southwest Airlines (NYSE:LUV)

Historical Stock Chart

From Apr 2023 to Apr 2024