Lowe's to Cut Thousands of Store Workers, Shuffle Jobs--Update

January 12 2017 - 5:20PM

Dow Jones News

By Sarah Nassauer and Paul Ziobro

Lowe's Cos. is cutting thousands of workers and shuffling the

jobs of thousands more, according to people familiar with the

matter, as the home-improvement retailer tries to adapt to shifting

shopping habits.

The company plans to eliminate less than 1% of its workforce, or

fewer than 3,000 jobs, said a person familiar with the matter. But

it also will shift many workers' "back-of-house responsibilities

and activities to customer-facing ones," the person familiar said,

aiming to redeploy them to help answer shoppers' questions about

products or home-improvement projects.

The move comes after the Mooresville, N.C.-based hardware

retailer in November cut its profit outlook for the year, citing

weaker-than-expected store traffic.

"We've got to make sure that as the consumer is changing the

ways they engage with us, we continue to be nimble," said Lowe's

Chief Executive Robert Niblock in an interview at the time. Lowe's

employs around 285,000 people.

CNBC reported earlier about Lowe's layoff plans.

Several big retailers are cutting jobs as they struggle to cut

costs while investing in their e-commerce operations and store

improvements in efforts to better compete with Amazon.com Inc. and

other online rivals.

The Wall Street Journal reported earlier this week that Wal-Mart

Stores Inc. plans to cut nearly 1,000 corporate jobs before the end

of the month, after it cut around 7,000 back-of-house jobs at its

stores late last year. Last week, Macy's said it would eliminate

more than 10,000 jobs and close dozens of stores.

In November, Lowe's cut its full-year earnings-per-share

guidance to $3.52 from $4.06, the second such decrease in as many

quarters. Same-store sales expectations were also lowered to

between 3% and 4%, down from 4% previously.

Lowe's has lagged behind its Atlanta-based rival Home Depot Inc.

in recent years, a deficit that analysts largely attribute to Home

Depot's better locations. Home Depot also does more business with

home builders and contractors, which has given its sales a bigger

lift as homeowners take on larger remodeling projects.

While the housing market remains strong, Lowe's is still trying

to navigate a retail market where consumers increasingly turn to

the internet rather than physical stores to buy materials and

research projects. It is using video cameras and other technology

to help it analyze store traffic and adjust its staffing to match

customer needs.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Paul

Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

January 12, 2017 17:05 ET (22:05 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

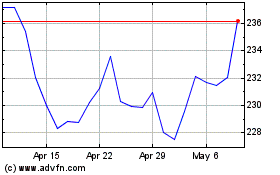

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

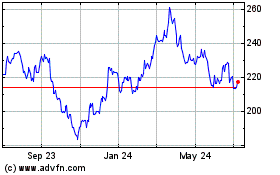

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024