Lowe's Trails Home Depot as Housing Values Revive -- WSJ

August 18 2016 - 3:04AM

Dow Jones News

By Paul Ziobro

The rising housing market isn't boosting home-improvement

retailer Lowe's Cos. as much as Home Depot Inc.

Second-quarter sales at existing stores rose 2% for the

Mooresville, N.C., do-it-yourself chain, trailing that of Home

Depot, which on Tuesday reported its sales at established stores

gained 4.7% and profit rose 9.3%, both during the same period

compared with a year earlier.

Lowe's weaker performance widened the gap between the two

retailers, both of which are betting that improving home values

will help to overcome weak shopping trends elsewhere.

Lowe's Chief Executive Robert Niblock cited several factors:

Cooler weather in May hurt its lawn and garden business and it has

a smaller professional business than Home Depot, so it isn't

getting as big a lift from home-renovation projects. The Western

part of the U.S., where Lowe's has fewer stores compared with its

bigger rival, also was one of the strongest regions in terms of

industry sales.

The retailer maintained its forecast for sales at existing

stores to rise 4% this year. Mr. Niblock said most consumers

continue to believe their home values are increasing, which will

prompt them to spend more on big-ticket projects.

"We feel good about where the consumer is at from a macro

standpoint," Mr. Niblock said in an interview. "They're continuing

to invest in their home, continue to see the value of their home

increasing."

Shares of Lowe's, which cut its earnings guidance for the year

to reflect its acquisition of the Canadian chain Rona, fell $4.60,

or nearly 6%, to $76.88 at 4 p.m. in New York trading on

Wednesday.

Lowe's and Atlanta-based Home Depot are counting on housing

trends to insulate them from broader retail weakness. On Wednesday,

Target Corp. said sales at its existing stores fell for the first

time in two years due to what Chief Executive Brian Cornell called

a "difficult retail environment." Last week, Kohl's Corp., Macy's

Inc. and Nordstrom Inc. all posted drops in sales and challenges

getting people into stores.

Home-improvement retailers say their project-based business is

outpacing smaller purchases. Lowe's said it logged a 2.9% increase

in transactions of more than $500 in the second quarter, while

transactions of less than $50 were flat. Home Depot also reported a

wide gap between big- and small-ticket purchases last quarter.

Mr. Niblock said the lack of growth in smaller transactions was

mostly due to a decline in the lawn and garden business, rather

than from online competitors like Amazon.com Inc. picking off

smaller purchases.

In all for the quarter ended July 29, Lowe's posted a 3.6%

increase in profit to $1.17 billion. The quarter's results were

dented by an $84 million loss on a foreign-currency hedge entered

into in advance of the company's Rona acquisition. Revenue climbed

5.3% to $18.26 billion.

For the full year, the company now expects earnings of about

$4.06 a share, down from previous guidance for $4.11 a share. Total

annual sales are expected climb 10%, above analyst estimates for 8%

growth.

Anne Steele contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

August 18, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

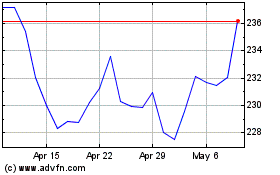

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

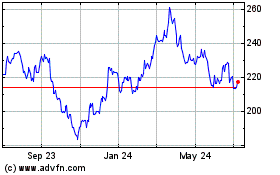

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024