Lowe's Top Views on Comparable Sales Growth

May 18 2016 - 7:20AM

Dow Jones News

Lowe's Cos. reported a strong earnings beat in the latest

quarter and lifted its guidance for the year as the

home-improvement retailer logged impressive growth in comparable

sales.

For 2016, the company now expects earnings of about $4.11 a

share, up from previous guidance for $4 a share. Lowe's backed its

guidance for comparable-store sales to rise 4%.

Lowe's results come on the heels of a strong report from bigger

rival Home Depot this week. The home-improvement retailers have

enjoyed rising sales while companies in other corners of the retail

sector struggle. Though Americans have curbed spending on things

like apparel, they have been willing to shell out for refurbishing

their dwellings amid favorable housing trends.

Home prices are rising, giving owners more confidence to spend

on larger projects. More people are moving and starting new homes,

and America's old housing stock means plenty of opportunities for

other improvement projects.

In the latest quarter, Lowe's said "project expertise and

commitment to customer service allowed us to capitalize on strong

home-improvement demand during the quarter."

"We executed well in the quarter, growing both transaction and

average ticket to achieve comparable sales growth that exceeded our

expectations," said Chief Executive Robert Niblock

Sales at stores open at least a year climbed 7.3%. And U.S.

same-store sales at Lowe's rose 7.5%, edging out Home Depot—whose

U.S. same-store sales grew 7.4% in the quarter—for the first time

in a decade.

In all, Lowe's posted a profit of $884 million, or 98 cents a

share, up from $673 million, or 70 cents, a year earlier. The

quarter's results were padded by $160 million, or 11 cents a share,

due to an unrealized gain on a foreign-currency hedge entered into

in advance of the company's pending acquisition of Canadian

home-improvement chain Rona Inc.

Revenue rose 7.8% to $15.2 billion. Analysts polled by Thomson

Reuters had projected 85 cents a share in adjusted earnings on

$14.87 billion in revenue.

Lowe's shares, inactive premarket, have added 12% over the last

three months to $76.07.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

May 18, 2016 07:05 ET (11:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

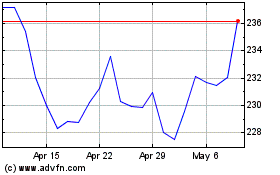

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

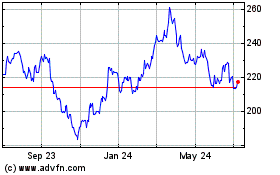

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024