Target Corp. Settles Abandoned Canadian Leases

November 23 2015 - 2:30PM

Dow Jones News

TORONTO—RioCan Real Estate Investment Trust said Monday it had

reached a settlement with Target Corp. over 18 leases the

Minneapolis-based retail giant abandoned when it exited the

Canadian market this year.

RioCan, which owns and manages the largest portfolio of shopping

centers in Canada, said Target paid 132 million Canadian dollars

(US$99 million) as part of the settlement, including C$92 million

to RioCan and the balance to various co-owners. Target in turn has

been released from indemnity agreements covering those

locations.

Target had 26 leases with RioCan when it decided in January to

close the more than 130 stores it had in Canada. The REIT said in

June that the Canadian unit of Lowe's Cos. and Toronto-based

retailer Canadian Tire Corp. agreed to take up to eight former

Target store locations. It said Monday that six locations had been

assigned to Lowe's and one to Canadian Tire, and that it was

working to fill the remaining 19 premises.

"The proceeds of the settlement will be utilized by RioCan and

its co-owners to mitigate losses caused by Target Canada's

departure and disclaimer of the subject Leases," the REIT said.

Write to Carolyn King at carolyn.king@wsj.com

Access Investor Kit for "RIOCAN REAL ESTATE INVESTMENT

TRUST"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=CA7669101031

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 23, 2015 14:15 ET (19:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

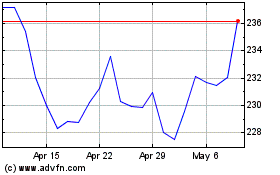

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

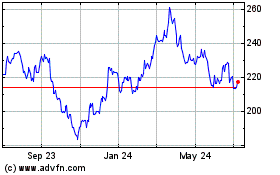

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024