UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant To Section 13 or 15 (d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 19, 2015

LOWE'S COMPANIES, INC.

(Exact name of registrant as specified in its charter)

|

| | | | | | |

| North Carolina | | 1-7898 | | 56-0578072 | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) | |

|

| | | |

| 1000 Lowe's Blvd., Mooresville, NC | 28117 | |

| (Address of principal executive offices) | (Zip Code) | |

| | | |

| Registrant's telephone number, including area code | (704) 758-1000 | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| | |

Item 2.02 | | Results of Operations and Financial Condition |

On August 19, 2015, Lowe’s Companies, Inc. (the “Company”) issued a press release, furnished as Exhibit 99.1 and incorporated herein by reference, announcing the Company’s financial results for its second quarter ended July 31, 2015.

The information contained in this Current Report on Form 8-K, including the exhibit attached hereto, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. Furthermore, the information contained in this Item 2.02 shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended.

|

| | |

Item 9.01 | | Financial Statements and Exhibits |

| | |

(d) | | Exhibits |

| | |

99.1 | | Press Release dated August 19, 2015 announcing the financial results of the Company for its second quarter ended July 31, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| LOWE'S COMPANIES, INC. | |

| | | |

Date: August 19, 2015 | By: | /s/ Matthew V. Hollifield | |

| | Matthew V. Hollifield Senior Vice President and Chief Accounting Officer | |

Exhibit 99.1

August 19, 2015

For 6:00 am ET Release

|

| | | |

Contacts: | Shareholders’/Analysts’ Inquiries: | | Media Inquiries: |

| Tiffany Mason | | Chris Ahearn |

| 704-758-2033 | | 704-758-2304 |

| tiffany.l.mason@lowes.com | | chris.c.ahearn@lowes.com |

LOWE’S REPORTS SECOND QUARTER SALES AND EARNINGS RESULTS

-- Comparable Sales Increased 4.3 Percent --

-- Reiterates Fiscal Year 2015 Guidance --

MOORESVILLE, N.C. - Lowe’s Companies, Inc. (NYSE: LOW) today reported net earnings of $1.13 billion for the quarter ended July 31, 2015, an 8.4 percent increase over the same period a year ago. Diluted earnings per share increased 15.4 percent to $1.20 from $1.04 in the second quarter of 2014. For the six months ended July 31, 2015, net earnings increased 8.2 percent from the same period a year ago to $1.80 billion, and diluted earnings per share increased 15.9 percent to $1.90.

Sales for the second quarter increased 4.5 percent to $17.3 billion from $16.6 billion in the second quarter of 2014, and comparable sales increased 4.3 percent. For the six month period, sales were $31.5 billion, a 4.9 percent increase over the same period a year ago, and comparable sales increased 4.7 percent. Comparable sales for the U.S. home improvement business increased 4.6 percent for the second quarter and 4.9 percent for the six month period.

“We posted solid results for the quarter and were able to capitalize on big-ticket market share opportunities with strong growth in categories like appliances and outdoor power equipment,” commented Robert A. Niblock, Lowe’s chairman, president and CEO. “I would like to thank our employees for their hard work and commitment to serving customers during this important selling season.”

“Our year-to-date earnings per share performance was in line with our expectations. This, together with the execution of our strategic priorities, gives us confidence in our Business Outlook for 2015,” Niblock added.

Delivering on its commitment to return excess cash to shareholders, the company repurchased $1.5 billion of stock under its share repurchase program and paid $218 million in dividends in the second quarter. For the six month period, the company repurchased $2.5 billion of stock under its share repurchase program and paid $440 million in dividends.

As of July 31, 2015, Lowe’s operated 1,846 home improvement and hardware stores in the United States, Canada and Mexico representing 201.4 million square feet of retail selling space.

A conference call to discuss second quarter 2015 operating results is scheduled for today (Wednesday, August 19) at 9:00 am ET. The conference call will be available by webcast and can be accessed by visiting Lowe’s website at www.Lowes.com/investor and clicking on Lowe’s Second Quarter 2015 Earnings Conference Call Webcast. Supplemental slides will be available fifteen minutes prior to the start of the conference call. A replay of the call will be archived on Lowes.com/investor until November 17, 2015.

Fiscal Year 2015 (comparisons to fiscal year 2014; based on U.S. GAAP unless otherwise noted)

| |

• | Total sales are expected to increase 4.5 to 5 percent. |

| |

• | Comparable sales are expected to increase 4 to 4.5 percent. |

| |

• | The company expects to add 15 to 20 home improvement and hardware stores. |

| |

• | Earnings before interest and taxes as a percentage of sales (operating margin) are expected to increase 80 to 100 basis points. |

| |

• | The effective income tax rate is expected to be approximately 38.1%. |

| |

• | Diluted earnings per share of approximately $3.29 are expected for the fiscal year ending January 29, 2016. |

|

|

Disclosure Regarding Forward-Looking Statements |

This news release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”), which the words “believe”, “expect”, “project”, “will”, “should”, “could”, and similar expressions are intended to imply. Statements of the company’s expectations for sales growth, comparable sales, earnings and performance, shareholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, the Company’s strategic initiatives and any statement of an assumption underlying any of the foregoing, constitute “forward-looking statements” under the Act. Although we believe that the expectations, opinions, projections, and comments reflected in these forward-looking statements are reasonable, we can give no assurance that such statements will prove to be correct. A wide variety of potential risks, uncertainties, and other factors could materially affect our ability to achieve the results either expressed or implied by our forward-looking statements including, but not limited to, changes in general economic conditions, such as the rate of unemployment, interest rate and currency fluctuations, fuel and other energy costs, slower growth in personal income, changes in consumer spending, changes in the rate of housing turnover, the availability of consumer credit and of mortgage financing, inflation or deflation of commodity prices, and other factors which can negatively affect our customers, as well as our ability to: (i) respond to adverse trends in the housing industry, such as a demographic shift from single family to multi-family housing, a reduced rate of growth in household formation, and slower rates of growth in housing renovation and repair activity, as well as uneven recovery in commercial building activity; (ii) secure, develop, and otherwise implement new technologies and processes necessary to realize the benefits of our strategic initiatives and enhance our efficiency; (iii) attract, train, and retain highly-qualified associates; (iv) manage our business effectively as we adapt our traditional operating model to meet the changing expectations of our customers; (v) maintain, improve, upgrade and protect our critical information systems from data security breaches and other cyber threats; (vi) respond to fluctuations in the prices and availability of services, supplies, and products; (vii) respond to the growth and impact of competition; (viii) address changes in existing or new laws or regulations that affect consumer credit, employment/labor, trade, product safety, transportation/logistics, energy costs, health care, tax or environmental issues; and (ix) respond appropriately to unanticipated failures to maintain a high level of product and service quality that could result in a negative impact on customer confidence and adversely affect sales. In addition, we could experience additional impairment losses if either the actual results of our operating stores are not consistent with the assumptions and judgments we have made in estimating future cash flows and determining asset fair values, or we are required to reduce the carrying amount of our investment in certain unconsolidated entities that are accounted for under the equity method. For more information about these and other risks and uncertainties that we are exposed to, you should read the “Risk Factors” and “Critical Accounting Policies and Estimates” included in our Annual Report on Form 10-K to the United States Securities and Exchange Commission (the “SEC”) and the description of material changes therein or updated version thereof, if any, included in our Quarterly Reports on Form 10-Q.

The forward-looking statements contained in this news release are based upon data available as of the date of this release or other specified date and speak only as of such date. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf about any of the matters covered in this release are qualified by these cautionary statements and the “Risk Factors” included in our Annual Report on Form 10-K to the SEC and the description of material changes, if any, therein included in our Quarterly Reports on Form 10-Q. We expressly disclaim any obligation to update or revise any forward-looking statement, whether as a result of new information, change in circumstances, future events, or otherwise.

Lowe’s Companies, Inc. (NYSE: LOW) is a FORTUNE® 50 home improvement company serving approximately 16 million customers a week in the United States, Canada and Mexico through its stores and online at Lowes.com, Lowes.ca and Lowes.com.mx. With fiscal year 2014 sales of $56.2 billion, Lowe’s has more than 1,845 home improvement and hardware stores and 265,000 employees. Founded in 1946 and based in Mooresville, N.C., Lowe’s supports the communities it serves through programs that focus on K-12 public education and community improvement projects. For more information, visit Lowes.com.

###

Lowe’s Companies, Inc.

Consolidated Statements of Current and Retained Earnings (Unaudited)

In Millions, Except Per Share and Percentage Data

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 31, 2015 | | August 1, 2014 | | July 31, 2015 | | August 1, 2014 |

Current Earnings | Amount | | % Sales | | Amount | | % Sales | | Amount | | % Sales | | Amount | | % Sales |

Net sales | $ | 17,348 |

| | 100.00 | | $ | 16,599 |

| | 100.00 | | $ | 31,478 |

| | 100.00 | | $ | 30,001 |

| | 100.00 |

Cost of sales | 11,367 |

| | 65.53 | | 10,864 |

| | 65.45 | | 20,486 |

| | 65.08 | | 19,508 |

| | 65.02 |

Gross margin | 5,981 |

| | 34.47 | | 5,735 |

| | 34.55 | | 10,992 |

| | 34.92 | | 10,493 |

| | 34.98 |

Expenses: | | | | | | | | | | | | | | | |

Selling, general and administrative | 3,634 |

| | 20.94 | | 3,541 |

| | 21.33 | | 7,047 |

| | 22.39 | | 6,859 |

| | 22.87 |

Depreciation | 375 |

| | 2.16 | | 375 |

| | 2.26 | | 741 |

| | 2.35 | | 748 |

| | 2.49 |

Interest - net | 133 |

| | 0.77 | | 126 |

| | 0.76 | | 267 |

| | 0.85 | | 250 |

| | 0.83 |

Total expenses | 4,142 |

| | 23.87 | | 4,042 |

| | 24.35 | | 8,055 |

| | 25.59 | | 7,857 |

| | 26.19 |

Pre-tax earnings | 1,839 |

| | 10.60 | | 1,693 |

| | 10.20 | | 2,937 |

| | 9.33 | | 2,636 |

| | 8.79 |

Income tax provision | 713 |

| | 4.11 | | 654 |

| | 3.94 | | 1,138 |

| | 3.62 | | 973 |

| | 3.25 |

Net earnings | $ | 1,126 |

| | 6.49 | | $ | 1,039 |

| | 6.26 | | $ | 1,799 |

| | 5.71 | | $ | 1,663 |

| | 5.54 |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Weighted average common shares outstanding - basic | 931 |

| | | | 995 |

| | | | 940 |

| | | | 1,005 |

| | |

Basic earnings per common share (1) | $ | 1.20 |

| | | | $ | 1.04 |

| | | | $ | 1.90 |

| | | | $ | 1.65 |

| | |

Weighted average common shares outstanding - diluted | 933 |

| | | | 996 |

| | | | 942 |

| | | | 1,007 |

| | |

Diluted earnings per common share (1) | $ | 1.20 |

| | | | $ | 1.04 |

| | | | $ | 1.90 |

| | | | $ | 1.64 |

| | |

Cash dividends per share | $ | 0.28 |

| | | | $ | 0.23 |

| | | | $ | 0.51 |

| | | | $ | 0.41 |

| | |

| | | | | | | | | | | | | | | |

Retained Earnings | | | | | | | | | | | | | | | |

Balance at beginning of period | $ | 9,085 |

| | | | $ | 10,985 |

| | | | $ | 9,591 |

| | | | $ | 11,355 |

| | |

Net earnings | 1,126 |

| | | | 1,039 |

| | | | 1,799 |

| | | | 1,663 |

| | |

Cash dividends | (260 | ) | | | | (229 | ) | | | | (478 | ) | | | | (411 | ) | | |

Share repurchases | (1,418 | ) | | | | (1,046 | ) | | | | (2,379 | ) | | | | (1,858 | ) | | |

Balance at end of period | $ | 8,533 |

| | | | $ | 10,749 |

| | | | $ | 8,533 |

| | | | $ | 10,749 |

| | |

| | | | | | | | | | | | | | | |

| |

(1) | Under the two-class method, earnings per share is calculated using net earnings allocable to common shares, which is derived by reducing net earnings by the earnings allocable to participating securities. Net earnings allocable to common shares used in the basic and diluted earnings per share calculation were $1,121 million for the three months ended July 31, 2015 and $1,033 million for the three months ended August 1, 2014. Net earnings allocable to common shares used in the basic and diluted earnings per share calculation were $1,790 million for the six months ended July 31, 2015 and $1,654 million for the six months ended August 1, 2014. |

Lowe’s Companies, Inc.

Consolidated Statements of Comprehensive Income (Unaudited)

In Millions, Except Percentage Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 31, 2015 | | August 1, 2014 | | July 31, 2015 | | August 1, 2014 |

| Amount | | % Sales | | Amount | | % Sales | | Amount | | % Sales | | Amount | | % Sales |

Net earnings | $ | 1,126 |

| | 6.49 |

| | $ | 1,039 |

| | 6.26 | | $ | 1,799 |

| | 5.71 |

| | $ | 1,663 |

| | 5.54 |

Foreign currency translation adjustments - net of tax | (229 | ) | | (1.32 | ) | | 4 |

| | 0.02 | | (207 | ) | | (0.66 | ) | | 12 |

| | 0.04 |

Other comprehensive income/(loss) | (229 | ) | | (1.32 | ) | | 4 |

| | 0.02 | | (207 | ) | | (0.66 | ) | | 12 |

| | 0.04 |

Comprehensive income | $ | 897 |

| | 5.17 |

| | $ | 1,043 |

| | 6.28 | | $ | 1,592 |

| | 5.05 |

| | $ | 1,675 |

| | 5.58 |

| | | | | | | | | | | | | | | |

Lowe’s Companies, Inc.

Consolidated Balance Sheets

In Millions, Except Par Value Data |

| | | | | | | | | | | | | | |

| | | (Unaudited) | | (Unaudited) | | |

| | | July 31, 2015 | | August 1, 2014 | | January 30, 2015 |

Assets | | | | | | | |

Current assets: | | | | | | | |

Cash and cash equivalents | | | $ | 901 |

| | $ | 1,039 |

| | $ | 466 |

|

Short-term investments | | | 188 |

| | 90 |

| | 125 |

|

Merchandise inventory - net | | | 9,704 |

| | 9,315 |

| | 8,911 |

|

Deferred income taxes - net | | | 251 |

| | 276 |

| | 230 |

|

Other current assets | | | 322 |

| | 355 |

| | 348 |

|

Total current assets | | | 11,366 |

| | 11,075 |

| | 10,080 |

|

Property, less accumulated depreciation | | | 19,751 |

| | 20,368 |

| | 20,034 |

|

Long-term investments | | | 412 |

| | 382 |

| | 354 |

|

Other assets | | | 1,216 |

| | 1,312 |

| | 1,359 |

|

Total assets | | | $ | 32,745 |

| | $ | 33,137 |

| | $ | 31,827 |

|

| | | | | | | |

Liabilities and shareholders’ equity | | | | | | | |

Current liabilities: | | | | | | | |

Current maturities of long-term debt | | | $ | 1,014 |

| | $ | 54 |

| | $ | 552 |

|

Accounts payable | | | 7,123 |

| | 6,191 |

| | 5,124 |

|

Accrued compensation and employee benefits | | | 667 |

| | 635 |

| | 773 |

|

Deferred revenue | | | 1,146 |

| | 1,039 |

| | 979 |

|

Other current liabilities | | | 2,191 |

| | 2,094 |

| | 1,920 |

|

Total current liabilities | | | 12,141 |

| | 10,013 |

| | 9,348 |

|

Long-term debt, excluding current maturities | | | 10,345 |

| | 10,063 |

| | 10,815 |

|

Deferred income taxes - net | | | — |

| | 187 |

| | 97 |

|

Deferred revenue - extended protection plans | | | 739 |

| | 743 |

| | 730 |

|

Other liabilities | | | 833 |

| | 891 |

| | 869 |

|

Total liabilities | | | 24,058 |

| | 21,897 |

| | 21,859 |

|

| | | | | | | |

Shareholders’ equity: | | | | | | | |

Preferred stock - $5 par value, none issued | | | — |

| | — |

| | — |

|

Common stock - $.50 par value; | | | | | | | |

Shares issued and outstanding | | | | | | | |

July 31, 2015 | 928 |

| | | | | | |

August 1, 2014 | 991 |

| | | | | | |

January 30, 2015 | 960 |

| | 464 |

| | 496 |

| | 480 |

|

Capital in excess of par value | | | — |

| | — |

| | — |

|

Retained earnings | | | 8,533 |

| | 10,749 |

| | 9,591 |

|

Accumulated other comprehensive loss | | | (310 | ) | | (5 | ) | | (103 | ) |

Total shareholders’ equity | | | 8,687 |

| | 11,240 |

| | 9,968 |

|

Total liabilities and shareholders’ equity | | | $ | 32,745 |

| | $ | 33,137 |

| | $ | 31,827 |

|

| |

| | |

| | |

| | |

|

Lowe’s Companies, Inc.

Consolidated Statements of Cash Flows (Unaudited)

In Millions |

| | | | | | | |

| Six Months Ended |

| July 31, 2015 | | August 1, 2014 |

Cash flows from operating activities: | | | |

Net earnings | $ | 1,799 |

| | $ | 1,663 |

|

Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

Depreciation and amortization | 791 |

| | 798 |

|

Deferred income taxes | (102 | ) | | (137 | ) |

Loss on property and other assets - net | 17 |

| | 29 |

|

Loss on equity method investments | 31 |

| | 31 |

|

Share-based payment expense | 57 |

| | 53 |

|

Changes in operating assets and liabilities: | | | |

Merchandise inventory - net | (804 | ) | | (182 | ) |

Other operating assets | 27 |

| | 90 |

|

Accounts payable | 2,005 |

| | 1,180 |

|

Other operating liabilities | 343 |

| | 398 |

|

Net cash provided by operating activities | 4,164 |

| | 3,923 |

|

| | | |

Cash flows from investing activities: | | | |

Purchases of investments | (488 | ) | | (300 | ) |

Proceeds from sale/maturity of investments | 366 |

| | 293 |

|

Capital expenditures | (570 | ) | | (384 | ) |

Contributions to equity method investments - net | (39 | ) | | (151 | ) |

Proceeds from sale of property and other long-term assets | 20 |

| | 24 |

|

Other - net | (25 | ) | | (7 | ) |

Net cash used in investing activities | (736 | ) | | (525 | ) |

| | | |

Cash flows from financing activities: | | | |

Net decrease in short-term borrowings | — |

| | (386 | ) |

Repayment of long-term debt | (31 | ) | | (25 | ) |

Proceeds from issuance of common stock under share-based payment plans | 62 |

| | 68 |

|

Cash dividend payments | (440 | ) | | (369 | ) |

Repurchase of common stock | (2,629 | ) | | (2,051 | ) |

Other - net | 50 |

| | 12 |

|

Net cash used in financing activities | (2,988 | ) | | (2,751 | ) |

| | | |

Effect of exchange rate changes on cash | (5 | ) | | 1 |

|

| | | |

Net increase in cash and cash equivalents | 435 |

| | 648 |

|

Cash and cash equivalents, beginning of period | 466 |

| | 391 |

|

Cash and cash equivalents, end of period | $ | 901 |

| | $ | 1,039 |

|

| | | |

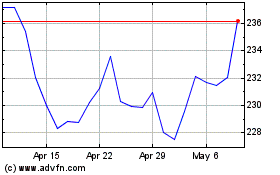

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

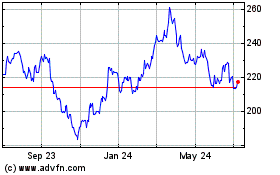

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024