Lockheed Martin 2017 Guidance Falls Short -- Update

January 24 2017 - 10:50AM

Dow Jones News

By Doug Cameron and Ezequiel Minaya

Lockheed Martin Corp. on Tuesday reported forecast-beating

fourth-quarter earnings, though its initial 2017 profit guidance

fell short of expectations and triggered a drop in the company's

shares.

The world's largest defense company by revenue said annual sales

could surpass $50 billion for the first time in 2017 and the free

cash that has powered its big stock buyback program is also set to

rise, alongside margins at the aerospace unit that makes the F-35

combat jet.

The profitability of the F-35 remains the major concern for

investors following criticism of its cost by President Donald Trump

, triggering a commitment by Lockheed and its partners to continue

trimming the price of the planes.

Lockheed's initial 2017 profit guidance included a

lower-than-expected pension tailwind, and the company also flagged

a potential accounting issue at its Sikorsky helicopter arm.

"Lockheed has exceeded its initial EPS guidance by 6% over the

past three years, and this below-consensus initial outlook could be

interpreted as its usual conservatism," said Matthew McConnell at

RBC Capital Markets.

Its shares were down 2.6% at $250.80 in early trade, erasing

most of its year-to-date gain. Other defense stocks such as F-35

partner Northrop Grumman Corp, also declined.

Lockheed didn't discuss the F-35 dust-up with the new president

in its earnings' release, though the issue was expected to dominate

its coming investor call. The company showed the planned fall in

F-35 prices in an investor presentation.

The company expects earnings per share of between $12.25 and

$12.55 for 2017, below the $12.87 consensus among analysts surveyed

by Thomson Reuters. Revenue is expected to be between $49.4 billion

and $50.6 billion as it boosts F-35 production.

For the December quarter, Lockheed reported a profit of $988

million, or $3.35 a share, up from $933 million, or $3.01 a share,

a year earlier. Revenue climbed 19% to $13.75 billion.

Analysts surveyed by Thomson Reuters expected earnings of $3.05

a share on $13.03 billion in revenue.

Sales at the aeronautics business -- its biggest segment -- rose

23% to $5.41 billion on higher F-35 sales. Meanwhile, revenue in

its mission systems segment surged 36% thanks to the addition of

Sikorsky, which it bought in 2015.

Write to Doug Cameron at doug.cameron@wsj.com and Ezequiel

Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

January 24, 2017 10:35 ET (15:35 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

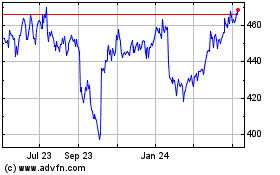

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

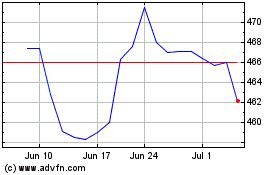

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024