Lockheed Martin Says Protracted F-35 Contract Talks Weigh on Cash -- Update

July 19 2016 - 2:35PM

Dow Jones News

By Robert Wall and Lisa Beilfuss

Protracted contract talks between the Pentagon and Lockheed

Martin Corp. over the next batch of F-35 combat jet planes are a

drag on the military contractor's cash and could force it to take

out extra loans to keep paying suppliers, the company's chief

financial officer said.

Negotiations over the multibillion-dollar, 160-aircraft deal

have been dragging for months as the sides haggle over what it

costs to build the planes. Absent a contract, Lockheed Martin has

been using its own money to keep production going.

"We will not be able to continue and have that level of cash

outflow," Lockheed Martin Chief Financial Officer Bruce Tanner

Tuesday said as the Pentagon's biggest arms supplier by sales

reported second-quarter earnings.

Lockheed Martin hopes to complete the contract or get an

alternative funding arrangement to help recoup cash before

year-end, he said, having fronted $900 million.

If Lockheed Martin were forced to continue paying suppliers out

of its own pocket, it may have to turn to commercial lenders to

help finance the payments, Mr. Tanner said. That would entail

higher cost which, he suggested, could also impact the

government.

The government's F-35 program office couldn't immediately be

reached for comment.

The F-35 Joint Strike Fighter is the Pentagon's most expensive

weapons program. The stealthy combat plane also is being bought by

a number of other countries, including the U.K., Israel and

Turkey.

Lockheed Martin Chief Executive Marillyn Hewson said she didn't

see the failed coup attempt in Turkey over the weekend harming the

company's business prospects there. "We have not seen any

indication it will impact the F-35 or any of their other programs,"

she said on an analysts call.

Despite the cash concerns on its biggest program, Lockheed

Martin further lifted its forecast for the year as the company

logged higher F-35 jet fighter deliveries and benefited from sales

in its recently acquired Sikorsky helicopter unit. It still

generated $1.5 billion cash from operations in the period.

In its latest quarter, the company said higher F-35 sales pushed

revenue in its aeronautics business, its biggest, up 5.9% to $4.38

billion. Meanwhile, revenue in its mission systems segment surged

53% thanks to Sikorsky. Performance in those two segments offset

lower sales in the company's IT and space systems businesses.

Overall, Lockheed reported a profit of $1.02 billion, or $3.32 a

share, up from $929 million, or $2.94 a share, a year earlier.

Revenue increased 11% to $12.91 billion.

Analysts anticipated $2.93 in earnings per share on $12.55

billion in sales.

Maryland-based Lockheed has been working to reshape its business

as it looks to focus on more profitable work building military

jets, helicopters and missiles. Last year Lockheed bought

helicopter maker Sikorsky Corp. for $9 billion, and it said earlier

this year that it would divest its big government

information-technology unit and merge it with Leidos Holdings Inc.,

a deal the company said Tuesday is on track to close in the third

quarter.

For the year, Lockheed now expects to report $12.15 to $12.45 in

earnings per share, up from an earlier prediction of $11.50 to

$11.80 a share. The company expects to log $50 billion to $51.5

billion in revenue this year, higher than its previous $49.6

billion to $51.1 billion forecast.

Write to Robert Wall at robert.wall@wsj.com and Lisa Beilfuss at

lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

July 19, 2016 14:20 ET (18:20 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

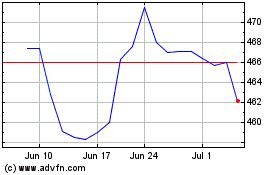

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

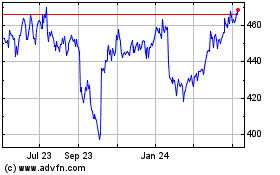

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024