CACI Taking a Break From Deals

February 04 2016 - 4:30PM

Dow Jones News

CACI International Inc. plans to focus on integrating its latest

acquisition, but the federal information technology specialist's

chief executive said Thursday that it is open to more deals in a

year or so.

The company this week completed the $550 million purchase of an

intelligence-focused services business from L-3 Communications

Holdings Inc., the latest in a series of deals in the sector as

contractors seek to build scale and extra capabilities in what has

become a cutthroat business as a result of federal agencies

toughening their procurement rules.

"As of this week, we're sort of a digester," said CACI CEO Ken

Asbury in an interview after the company reported forecast-beating

quarterly earnings alongside a return to organic growth for the

year and a bullish 2016 financial outlook.

CACI's shares rose almost 20% at one point during Thursday's

session, erasing a year-to-date decline that has afflicted most of

the defense contractor community.

"The best thing we can do as a business is to figure out how to

grow organically," said Mr. Asbury, a former Lockheed Martin Corp.

executive who has led the company since 2013 and established it as

one of the prime consolidators in the federal IT business.

CACI's 2013 purchase of intelligence specialist Six3 Systems for

$820 million kicked off a string of deal making in the segment that

accelerated last year as larger contractors including Lockheed

looked to unload lower-margin services business, while smaller

players looked for scale.

Leidos Inc. last week agreed to buy the Lockheed services

business in a complex deal that will double annual sales to $10

billion, while Computer Sciences Corp. last year combined its

government unit with SRA International to form CSRA Inc.

CACI's purchase of the L-3 business will boost its own annual

sales to $4.4 billion and is expected to be accretive in the first

year.

"They were us, trapped in a product company," Mr. Asbury said of

the new acquisition.

The deal boosts CACI's leverage to around four times operating

earnings, and though Mr. Asbury said the company was prepared to go

a little higher, it would assess over the next 12 to 18 months what

could be added to the portfolio while feeling no pressure to match

Leidos in scale.

"We think investors have been nervous that CACI's results would

point to broader issues in the industry," said Rob Stallard at RBC

Capital. He said investors should be relieved by the rise in

revenue and order bookings in what is traditionally a seasonally

weak quarter for news business.

CACI's profit rose to $33.3 million from $24.6 million in its

fiscal second quarter, with per-share earnings rising to $1.23 from

$1.01.

The company's shares were recently up 13.8% at $91.85.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

February 04, 2016 16:15 ET (21:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

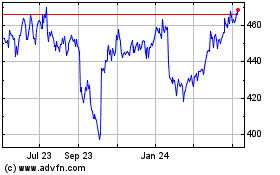

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

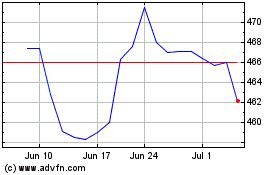

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024