Current Report Filing (8-k)

November 23 2015 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 23, 2015

LOCKHEED MARTIN CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Maryland |

|

1-11437 |

|

52-1893632 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 6801 Rockledge Drive

Bethesda, Maryland |

|

20817 |

| (Address of principal executive offices) |

|

(Zip Code) |

(301) 897-6000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.02 |

Termination of a Material Definitive Agreement. |

On November 23, 2015, in accordance with the terms

of the 364-Day Credit Agreement (the “364-Day Credit Agreement”) dated as of October 9, 2015, among Lockheed Martin Corporation (“Lockheed Martin” or the “Corporation”), as Borrower, the lenders listed therein,

Citibank, N.A., as Syndication Agent, Goldman Sachs Bank USA, JPMorgan Chase Bank, N.A., Morgan Stanley MUFG Loan Partners, LLC, Credit Agricole Corporate & Investment Bank, Mizuho Bank, Ltd. and Wells Fargo Bank, N.A., as Documentation

Agents, and Bank of America, N.A., as Administrative Agent, Lockheed Martin repaid all outstanding borrowings under the 364-Day Credit Agreement in the amount of $6.0 billion with the proceeds from its issuance on November 23, 2015 of $7.0

billion of fixed interest-rate long-term notes in a public offering, as described in the Corporation’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 19, 2015 (the “Debt Issuance”). In

accordance with the terms of the 364-Day Credit Agreement, net proceeds from the Debt Issuance also resulted in a mandatory reduction of the total commitments under the 364-Day Credit Agreement. Effective November 23, 2015, the Corporation also

terminated any remaining commitments of the lenders under the 364-Day Credit Agreement. No material early termination penalties were incurred by the Corporation as a result of the termination of the 364-Day Credit Agreement.

The foregoing description of the 364-Day Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of

the 364-Day Credit Agreement, which was filed as Exhibit 10.1 to the Corporation’s Current Report on Form 8-K filed with the SEC on October 13, 2015 and which is incorporated herein by reference.

In the ordinary course of their respective businesses, one or more of the lenders under the 364-Day Credit Agreement, or their affiliates, have or may have

various relationships with the Corporation and the Corporation’s subsidiaries involving the provision of a variety of financial services, including cash management, commercial banking, investment banking, trust or agency, foreign exchange,

advisory or other financial services, for which they received, or will receive, customary fees and expenses. In particular, affiliates of each of the lenders under the 364-Day Credit Agreement acted as underwriters in connection with the Debt

Issuance.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Lockheed Martin Corporation |

|

|

|

|

| Date: November 23, 2015 |

|

|

|

by: |

|

/s/ Stephen M. Piper |

|

|

|

|

Stephen M. Piper |

|

|

|

|

Vice President and Associate General Counsel |

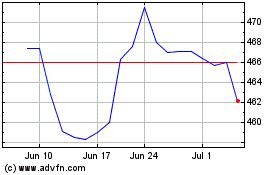

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

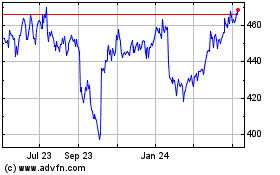

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024