Pentagon Warns About Defense Deals -- Update

September 30 2015 - 6:19PM

Dow Jones News

By Doug Cameron

The Pentagon's chief weapons buyer issued a stark warning about

the potential impact of further consolidation among large defense

companies, which he said could hurt innovation, constrict the

supplier base and inflate costs.

Frank Kendall, the Defense Department's undersecretary for

acquisition, technology and logistics, said Wednesday that recent

mergers and acquisitions have prompted the Pentagon to consider

asking for national security concerns to be among the criteria when

such deals are reviewed by competition officials.

Mr. Kendall said he backed the Justice Department's approval

last week of plans by Lockheed Martin Corp. to buy the Sikorsky

Aircraft unit of United Technologies Corp. for $9 billion, but he

said such deals have given rise to policy concerns.

"With size comes power, and the department's experience with

large defense contractors is that they are not hesitant to use this

power for corporate advantage," Mr. Kendall told reporters. He said

his concerns weren't directed at any particular transactions.

Lockheed, the world's largest defense contractor by sales and

the Pentagon's biggest supplier, responded to the veiled criticism

of its growing influence on a wider range of military programs.

"There is no evidence to support the view that larger defense

companies reduce competition or inhibit innovation," the company

said in a statement. It said contractors should "continue to be

assessed based on the performance and effectiveness of the products

and solutions offered, not on the size of their company."

Lockheed's bid to acquire Northrop Grumman Corp. was blocked on

competition grounds in 1998, effectively ending a wave of mergers

that shaped the current industry.

However, an increase in deal making over the past year has

raised concerns at the Pentagon that companies carving out parts of

their business to sell to rivals could harm the industrial base and

increase barriers to entry.

"If the trend to smaller and smaller numbers of weapon-system

prime contractors continues, one can foresee a future in which the

department has at most two or three very large suppliers for all

the major weapons systems that we acquire," Mr. Kendall said.

He said the Pentagon planned to engage Congress on the

issue.

Competition experts said the Pentagon wanted to signal that

approving the Sikorsky deal didn't change Defense Department's

long-standing opposition to deals involving the biggest defense

companies.

"The message is that it's not open season," said Jeff Bialos, a

partner at law firm Sutherland Asbill & Brennan LLP, who has

worked on a number of defense deals.

Lockheed doesn't make helicopters but supplies weapons and

communications systems to Sikorsky and other manufacturers. The

company has said it would continue to supply the government with

equipment for other helicopters,

The proposed deal concentrates even more of the Pentagon's

largest hardware programs with its biggest supplier. The Defense

Department generated almost 60% of Lockheed's revenues last year,

with other U.S. agencies and export sales adding another 20% each.

Lockheed, which makes the F-35 jet fighter, is bidding in

partnership with Boeing Co. for another huge contract, a proposed

new bomber for the Air Force.

Defense stocks were unchanged after Mr. Kendall's statement,

though analysts have long discounted a deal involving any of the

five biggest defense companies: Lockheed, Boeing, Northrop Grumman

Corp. General Dynamics Corp. and Raytheon Co.

Defense Secretary Ash Carter earlier Wednesday repeated his

opposition to mergers between the prime contractors but declined to

comment on Lockheed's planned purchase of Sikorsky.

"It was important to avoid excessive consolidation in the

defense industry to the [extent] that we didn't have multiple

vendors that could compete on programs," he said during a Pentagon

press briefing.

Write to Doug Cameron at doug.cameron@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 30, 2015 18:04 ET (22:04 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

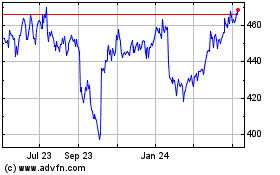

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

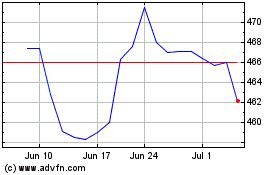

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024