Aerojet's Pursuit of Rocket Venture Fails to Lift Off -- Update

September 16 2015 - 6:36PM

Dow Jones News

By Andy Pasztor

Aerojet Rocketdyne Holdings Inc.'s $2 billion offer for the

Pentagon's premier rocket-making venture collapsed Wednesday, with

Boeing Co. announcing it wasn't interested in selling its stake and

never took the bid seriously.

Starting in August, rocket-engine maker Aerojet Rocketdyne had

quietly pursued United Launch, a 50-50 joint venture between Boeing

and Lockheed Martin Corp., which the U.S. military and spy agencies

currently rely on to launch nearly all of their satellites.

After word of the unsolicited bid leaked out last week-- roiling

the global satellite-launch market and raising a multitude of

questions among Pentagon brass--Lockheed Martin was leaning toward

divesting its stake, according to people familiar with the

discussions.

But on Wednesday, in a stinging rejection of Aerojet's move,

senior Boeing space and defense officials took the unusual step of

publicly saying they didn't even consider the offer worthy of

detailed negotiations or analysis.

It was "not something we seriously entertained," according to

Boeing spokesman Todd Blecher. On the sidelines of an

industry-government conference in suburban Washington, D.C., on

Wednesday, Chris Chadwick, head of Boeing's sprawling defense

operations, reiterated to reporters that Boeing didn't give the bid

any serious consideration, wasn't looking for other offers and was

committed to the joint venture. Boeing and Lockheed Martin together

invested an estimated $4 billion to develop the families of Atlas V

and Delta IV rockets that formed the backbone of the joint venture

created with the Pentagon's blessing roughly a decade ago.

Lockheed Martin has declined to comment on the matter, but

industry officials previously said members of its executive suite

were leaning toward selling assets of the joint venture as part of

a broader, companywide portfolio reshaping. When the partners

formally rejected the bid earlier this week, however, both

delivered the same unequivocal message and rejected further

discussions, according to one person familiar with the details.

Aerojet Rocketdyne's first statement after days of intense,

behind-the-scenes maneuvering and discussions with Air Force

officials shed little light on what happened. A spokesman said the

company "routinely evaluates" possible acquisitions but "won't

comment on potential business combinations until such a point [as]

there is a definitive agreement in place."

Before the rejection, Aerojet Rocketdyne representatives weren't

offered access to the joint venture's books as part of typical due

diligence, according to several people familiar with the

details.

For Boeing and Lockheed Martin, which have balked at making

long-term commitments to develop a new generation of rockets for

the venture, major financial challenges remain. Amid the Pentagon's

shrinking satellite-launch business and escalating competition from

lower-cost rocket providers, the partners confront decisions about

further cuts to the venture's overhead.

The number of launchpads used by the venture is being reduced,

and industrial partners are being asked to shoulder more investment

in next-generation hardware. Against this backdrop, the venture's

management is scrambling to adjust personnel levels and institute

procedural changes to speed up assembly of rocket stages before

liftoff.

More important, United Launch's fate over the next decade relies

on a risky strategy: sharply increasing its share of commercial and

nonmilitary government launches.

Doug Cameron contributed to this article.

Write to Doug Cameron at doug.cameron@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 16, 2015 18:21 ET (22:21 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

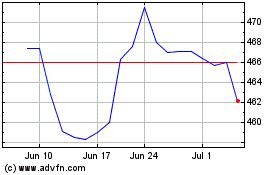

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

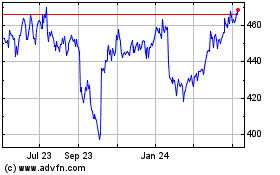

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024