Lennar Expects Housing Recovery to Continue Despite Raising Interest Rates

December 19 2016 - 7:49AM

Dow Jones News

By Austen Hufford

Home builder Lennar Corp. posted another quarter of key metric

gains as the U.S. housing market continues to recover.

The company also said that it expects the incoming Trump

administration to "focusing on accelerating economic growth."

Still, Lennar warned that it would face rising interest rates in

the coming years. The Federal Reserve decided to raise the

federal-funds target rate by a quarter of a percentage point last

week, which means borrowing will get more expensive for

consumers.

Chief Executive Stuart Miller said the housing market continues

a "slow and steady recovery."

Gross margin on home sales fell to 23.3% from 24.6% on rising

land and construction costs.

The number and average price of homes delivered rose in the

quarter, driving revenue growth. The number of deliveries rose 7.5%

for the fourth quarter from a year before as the average price of a

delivered home increased 2.6% to $358,000.

The number of new orders increased 9%.

In recent quarters, the company's results had been hurt by its

Houston segment, whose large energy sector has been challenged by

low energy prices in recent quarters. The company said that unit

would be reported as part of its larger Homebuilding Central

segment as it no longer meets the criteria for separate

reporting.

Lennar reported a quarterly profit of $313.5 million, or $1.34 a

share, up from $281.6 million, or $1.21 a share, a year prior.

Analysts polled by Thomson Reuters projected $1.28 in per-share

profit

Revenue grew 15% to $3.38 billion.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

December 19, 2016 07:34 ET (12:34 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

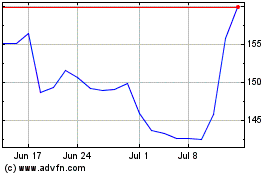

Lennar (NYSE:LEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

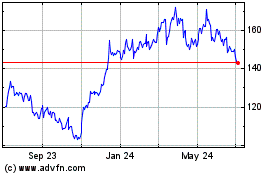

Lennar (NYSE:LEN)

Historical Stock Chart

From Apr 2023 to Apr 2024