KB Home's Sales Soar, but Profit Hurt by Land Costs, Impairments

September 24 2015 - 10:00AM

Dow Jones News

KB Home said profit fell in its latest quarter as higher land

costs and an impairment charge offset surging revenue.

Like its larger rival Lennar Corp., the Los Angeles-based

builder reported double-digit percentage gains in orders and

deliveries, although those increases fell short of analysts'

expectations. New orders, up 19%, increased across all geographic

regions. Deliveries jumped 24%, bolstered by strength in the West

and southwest.

KB's average selling price, meanwhile, increased 9% to $357,200.

Higher sales prices and stronger delivery volume pushed revenue up

43% from a year earlier.

However, a spike in land costs, to $40.3 million from $3.4

million last year, helped offset the revenue increase and led to a

steeper-than-expected drop in the builder's gross profit margin.

Margin fell to 16.2% from 18.8%; RBC Capital Markets analyst Robert

Wetenhall had projected a margin decline to 16.6%. Earlier this

week, Lennar similarly pointed to more expensive land for its

margin contraction.

In addition to higher land costs, $3.5 million in charges

stemming from housing inventory impairments and contract

abandonments bit into the bottom line.

Overall, the company reported a profit of $23.3 million, or 23

cents a share, down from $28.4 million, or 28 cents, a year

earlier. Revenue increased 43% to $843.2 million.

Analysts projected 22 cents in per-share earnings on $818.5

million in sales, according to Thomson Reuters.

Shares in the company, down about 14% this year and lagging its

peers, slipped 0.7% premarket.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 24, 2015 09:45 ET (13:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

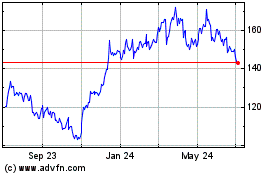

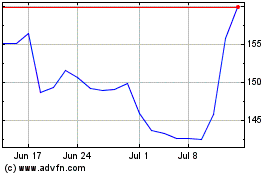

Lennar (NYSE:LEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lennar (NYSE:LEN)

Historical Stock Chart

From Apr 2023 to Apr 2024