UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

LEAR

CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-11311 |

|

13-3386776 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

|

|

|

| 21557 Telegraph Road, Southfield, MI |

|

48033 |

| (Address of principal executive offices) |

|

(Zip code) |

Terrence B. Larkin

Executive Vice President, Business Development, General Counsel and Corporate Secretary

(248) 447-1500

(Name and

telephone number, including area code, of the person to contact in connection with this report.)

Check the appropriate box to

indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

x Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014.

Introduction

Lear Corporation (“Lear” or the “Company”) is a leading Tier 1 supplier to the global automotive industry. Our business spans all major

automotive markets, and we supply seating and electrical distribution systems and related components to virtually every major automotive manufacturer in the world. As of December 31, 2014, we have manufacturing, engineering and administrative

capabilities in 34 countries with 219 locations and are continuing to grow our business in all automotive producing regions of the world.

Lear is a

recognized global leader in complete automotive seat systems and key individual seat component parts. Our seating business consists of the design, development, engineering, just-in-time assembly and delivery of complete seat systems, as well as the

design, development, engineering and manufacture of all major seat components, including seat structures and mechanisms, seat covers and surface materials such as fabric and leather, seat foam and headrests. Our electrical business consists of the

design, development, engineering and manufacture of complete electrical distribution systems that route electrical signals and manage electrical power within a vehicle. Key components of our electrical business include wiring harnesses, terminals

and connectors, junction boxes, battery chargers, electronic control modules and wireless control devices.

Lear Corporation’s policy on Conflict

Minerals can be found at:

http://www.lear.com/en/supplier_info/conflict-minerals.aspx?cat_id=20

Information included on the Company’s website is provided for informational purposes only and is not incorporated by reference herein.

Section 1- Conflict Mineral Disclosure and Report

Item 1.01 – Conflict Minerals Disclosure

In

accordance with Rule 13p-1 under the Securities Exchange Act of 1934 (“Rule 13p-1”), Lear has filed this Specialized Disclosure Form (“Form SD”) and the associated Conflict Minerals Report and both reports are posted to the

Company’s publically available Internet site at: www.lear.com.

Information included on the Company’s website is provided for

informational purposes only and is not incorporated by reference herein.

Item 1.02 – Exhibit

Exhibit 1.01 – Conflict Minerals Report dated May 29, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned

thereunto duly authorized.

|

|

|

|

|

| |

|

Lear Corporation |

|

|

|

| Date: May 29, 2015 |

|

By: |

|

/s/ Jeffrey H. Vanneste |

|

|

Name: |

|

Jeffrey H. Vanneste |

|

|

Title: |

|

Senior Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 1.01 |

|

Conflict Minerals Report dated May 29, 2015. |

Exhibit 1.01

CONFLICT MINERALS REPORT

Year Ended December 31, 2014

Section 1:

Introduction and Company Overview

This Conflict Minerals Report (the “Report”) covers the period of January 1, 2014 through

December 31, 2014 in compliance with Rule 13p-1 (the “Conflict Minerals Rule”) under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). Under the Dodd-Frank Wall Street Reform Act (the “Dodd-Frank

Act”), the Securities and Exchange Commission (the “SEC”) issued the Conflict Minerals Rule to require certain companies to disclose their use of conflict minerals if those minerals are “necessary to the functionality or

production of a product” manufactured by those companies. Under the Dodd-Frank Act, those minerals include tin, tungsten, tantalum, or gold (together, such minerals are referred to as “3TG”). Congress enacted the Conflict Minerals

Rule due to concerns that the exploitation and trade of conflict minerals by armed groups is helping to finance conflict in the Democratic Republic of Congo (“DRC”) region. The Conflict Minerals Rule focuses on 3TG emanating from the DRC

and nine adjoining countries (together, the “DRC Covered Countries”).

Lear Corporation (“Lear”) is a leading Tier 1 supplier to the

global automotive industry. Our business spans all major automotive markets, and we supply seating and electrical distribution systems and related components to virtually every major automotive manufacturer in the world. As of

December 31, 2014, we have manufacturing, engineering and administrative capabilities in 34 countries with 219 locations and are continuing to grow our business in all automotive producing regions of the world.

Lear is a recognized global leader in complete automotive seat systems and key individual seat component parts. Our seating business consists of the design,

development, engineering, just-in-time assembly and delivery of complete seat systems, as well as the design, development, engineering and manufacture of all major seat components, including seat structures and mechanisms, seat covers and surface

materials such as fabric and leather, seat foam and headrests. We are one of only two independent seat suppliers with global scale and the capability to design, develop, engineer, manufacture and deliver complete seat systems and components in every

major automotive producing region in the world.

Our electrical business consists of the design, development, engineering and manufacture of complete

electrical distribution systems that route electrical signals and manage electrical power within a vehicle. Key components of our electrical business include wiring harnesses, terminals and connectors, junction boxes, battery chargers, electronic

control modules and wireless control devices. We are one of only four suppliers with complete electrical distribution system and component capabilities in every major automotive producing region in the world.

Our products are more fully described in our Annual Report, which can be accessed at: http://lear.com/.

Under the Conflict Minerals Rule adopted by the SEC, companies (including Lear) are required to publicly disclose their use of conflict minerals, including

through filing a “conflict minerals report” as an exhibit to Form SD, the form created for conflict minerals disclosure.

1

Section 2: Due Diligence Framework

The final Conflict Minerals Rule adopted by the SEC requires that an issuer undertake a due diligence process and such due diligence follow a nationally or

internationally recognized due diligence framework. Lear designed its due diligence measures to be in conformity, in all material respects, with the internationally recognized due diligence framework established by the Organisation for Economic

Co-operation and Development (“OECD”), the Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (the “OECD Guidance”), which satisfies the Conflict Minerals Rule requirements

regarding due diligence. Because Lear’s products, like those of many of our peers in the automotive industry, contain 3TG minerals, Lear also undertook to conduct a “Reasonable Country of Origin Inquiry” (as described in further

detail below) regarding the origin of the 3TG minerals used in its products.

Section 3: Due Diligence Measures Undertaken

The following explains Lear’s due diligence process.

Step 1: Strong Management System

A.

Conflict Minerals Policy

| |

• |

|

Lear developed and adopted a “Conflict Minerals Policy” that is published on Lear’s public website at: http://lear.com/ and is contained in Attachment A to this report. |

| |

• |

|

The policy states that Lear will comply with the disclosure and reporting requirements of the conflict minerals rule of the Dodd-Frank Act, as well as the rules of the SEC promulgated under such Act. |

| |

• |

|

The policy also states Lear requires legal and ethical sourcing of materials in our supply chain and, as part of our Conflict Minerals Sourcing Policy, imposes an obligation on Lear’s suppliers to engage in due

diligence of their respective supply chains to understand and report the content of the parts such suppliers provide to Lear. |

B. Internal Management Structure

| |

• |

|

A “Cross Functional Team” was appointed to support the supply chain due diligence undertaken by Lear. Representatives from Lear’s Purchasing, Engineering, Finance, Corporate Compliance, Non-Production

Purchasing, Information Technology, Environmental, Health and Safety, Philippines Engineering Technical Center and Legal departments serve on the team. |

| |

• |

|

The purpose of the Cross Functional Team is to ensure availability of resources necessary to support Lear’s supply chain due diligence process. The team monitors the execution and effectiveness of Lear’s due

diligence process and collaborates to develop improvements. |

2

| |

• |

|

Report Findings to Designated Senior Management and Board of Directors |

| |

• |

|

During 2014, Lear’s Audit Committee and Board of Directors were provided an update relating to Lear’s conflict minerals activities. |

C. Controls and Transparency Over the Mineral Supply Chain

| |

• |

|

Industry Driven Programs |

| |

• |

|

The OECD Guidelines encourage participation in industry-driven programs to establish an industry-wide system of controls and transparency over the mineral supply chain including either a chain of custody or a

traceability system. As outlined in the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Area, the internationally recognized standard on which our company’s system is based, we support

an industry initiative that audits smelters’ and refiners’ due diligence activities. The industry initiative is the Electronic Industry Citizenship Coalition ® (EICC®) and the Global e-Sustainability CoalitionGeSi’s Conflict-Free Sourcing Initiative® (CFSI®). |

| |

• |

|

Lear participates in the Automotive Industry Action Group (“AIAG”), an automotive industry group whose members include original equipment manufacturers (“OEM”) and “Tier 1” suppliers. Lear

participates in the AIAG Conflict Minerals Work Group (“CMWG”) which was established to prepare suppliers for reporting that will enable compliance with provisions of the conflict minerals rule. Lear participates in AIAG’s Smelter

Engagement Team (“SET”), a sub group of the CMWG. The SET conducts research and outreach encouraging smelters to participate in the CFSI which supports the validation and certification of smelters as conflict free. Certification through

the CFSI validates chain of custody and/or traceability of the minerals from the mine to the smelter. This is the primary methodology for downstream suppliers (such as Lear) to have influence on the upstream supply base (such as the smelters).

|

D. Company Engagement With Suppliers

| |

• |

|

Lear has established an online supplier portal to strengthen Lear’s engagement with its suppliers. |

| |

• |

|

The supplier portal is available at Lear’s website at: http://lear.com/en/supplierinfo/ under the “Supplier Information” tab. |

3

| |

• |

|

The “Supplier Information” tab provides updated web guides for suppliers. Web guides are referred to in the “Terms and Conditions” used by Lear when contracting with suppliers, and such web guides

contain requirements not specifically identified in the Terms and Conditions. Also, under the “Supplier Information” tab, additional conflict mineral documents are provided (e.g., Lear’s conflict mineral policy, supplier expectations,

and communication requests to the supplier). |

| |

• |

|

Suppliers are able to contact a Lear conflict minerals representative anytime via e-mail at: conflictminerals@lear.com. |

E. Grievance Mechanism

| |

• |

|

The conflictminerals@lear.com mailbox is a mechanism available for any interested party to communicate their concerns/grievances regarding Lear’s conflict minerals process. |

| |

• |

|

This mailbox is checked daily for communications from interested parties. |

| |

• |

|

No grievances were received during 2014. However, in the event that a grievance is submitted, the established process is to review the contents of the grievance, discuss with appropriate Lear individuals to seek

resolution and communicate back to the person submitting the grievance. |

Step 2 Identify and Assess Risk in Our Supply Chain

Lear engaged in a number of steps to identify which of its suppliers are known to have 3TG in their products and request that such suppliers complete a

template to assist Lear in identifying and assessing risks in its supply chain.

A. Identification of Suppliers and Point of Contact

| |

• |

|

To identify and assess risk in Lear’s supply chain, as an initial step, Lear utilized the International Material Data System (“IMDS”) list of suppliers to identify suppliers that provide components to

Lear. Lear communicated by e-mail with its suppliers identified in the IMDS list known to have 3TG in their products. Lear also communicated by e-mail with the top 100

suppliers within Lear’s seating and electrical businesses based on amounts spent. |

| |

• |

|

Suppliers were requested to identify the individual(s) responsible for providing conflict mineral information for their company. |

| |

• |

|

Non-responsive suppliers received a request from Lear a minimum of two times. |

| |

• |

|

A listing of non-responsive suppliers was sent to Lear’s “Purchasing Commodity Managers” to assist in obtaining the requested information. |

| |

• |

|

Once contact names and e-mail addresses were obtained, a Reasonable Country of Origin Inquiry (“RCOI”) was made using the Electronic Industry Citizenship

Coalition® (“EICC®”) and The Global e-Sustainability Initiative (“GeSi”) template known as the CFSI Conflict

Mineral Reporting Template (the “Template”), which is described in further detail below. |

4

| |

• |

|

A Reasonable Country of Origin Inquiry (“RCOI”) is an inquiry regarding the origin of conflict minerals that is designed to determine where the minerals used by Lear’s suppliers originated or if they are

from recycled or scrap sources. |

| |

• |

|

The Template was developed by EICC and GeSi as a standard reporting template for companies to use to facilitate disclosure and communication of information regarding smelters that provide material to a company’s

supply chain. It includes questions regarding a company’s conflict mineral free policy, engagement with its direct suppliers and a listing of the smelters the company and its suppliers use. In addition, the Template contains questions about the

origin of conflict minerals included in suppliers’ products, as well as about the due diligence conducted by suppliers. |

B. Assessment of Risk

| |

• |

|

Lear considered the following risk elements in its due diligence process: |

| |

• |

|

Completeness of the submission of information by Lear’s suppliers, especially for those suppliers known to have 3TG in their components. The AIAG’s Conflict Minerals Reporting Template (“CMRT”)

Assessment Process was used to determine completeness of submission by analyzing the supplier’s answers to each question contained in the CMRT. |

| |

• |

|

Submission of smelter data and determination if smelters had been validated as conflict mineral free in accordance with the CFSI. |

| |

• |

|

Consistency and substantiation of information by cross-checking submissions with the IMDS data. |

| |

• |

|

As questions arose regarding supplier submissions, Lear communicated by e-mail with the supplier for clarification and understanding. |

Step 3: Design and Implement a Strategy to Respond to Identified Risks

| |

• |

|

Lear’s conflict minerals due diligence is an on-going, proactive process. During 2014, Lear’s strategy for identifying risks focused on the following: |

| |

• |

|

An assessment of all responses received from suppliers using the CMRT Assessment Process (Decision Tree) developed by AIAG’s Conflict Minerals Work Group and the IMDS data information. Supplier responses were

placed into four categories: accepted, inconsistent, incomplete, and rejected. Categorizing a response is prompted by the completeness of the answer. Suppliers were notified by e-mail of the status of their CMRT responses and if rejected, or if

incomplete or inconsistent submissions, suppliers were asked to correct and resubmit. |

5

| |

• |

|

Following up with 3TG suppliers as determined by the IMDS within Lear’s supply chain that did not provide a completed Template in response to Lear’s request for such information. |

| |

• |

|

Lear’s Purchasing Commodity Managers communicated by e-mail to engage non-responsive 3TG suppliers to provide Lear with a completed Template. Upon receipt of the Template, Lear utilized a decision tree process to

assess the submission. |

| |

• |

|

A listing of smelter information provided to Lear by its supply chain was compiled. The listing contains conflict free smelters as well as facilities that are not on the CFSI conflict mineral free smelter list. As

noted, the Company supports the CFSI and their independently verified list of conflict free smelters. |

Step 4: Independent Third Party

Audit of Supply Chain Due Diligence

| |

• |

|

As a downstream supplier, Lear does not have a direct relationship with 3TG smelters and does not perform or direct audits of these entities within our supply chain. |

Step 5: Report on Supply Chain Due Diligence

Lear has

prepared this Report and the associated Form SD and made such documents available online at: http://ir.lear.com/sec.cfm

Continuous

Improvement Efforts to Mitigate Risk

As a result of our 2013 due diligence, Lear identified two continuous improvement efforts to improve the due

diligence process and further mitigate risk for 2014 conflict mineral reporting:

| |

• |

|

Enhance and improve our RCOI and due diligence survey response rate by strengthening our engagement with suppliers. |

| |

• |

|

Results: Lear saw improvement in the 2014 supplier response rates in the categories identified as “All Suppliers” and “Suppliers Known To Have 3TG”. The improved response rate is attributed to

Lear’s “Purchasing Commodity Managers” interaction with supplier contacts. |

| |

• |

|

Continue to participate in the AIAG (as discussed in item C on page 3 of this report). |

6

| |

• |

|

Results: Lear participated on the AIAG CMWG by attending meetings in person and participating in conference calls. As a member of the CMWG, Lear provided input on the various topics and projects. Additionally during

2014, Lear became a member of the AIAG SET and contributed to research and outreach encouraging smelters to participate in the CFSI. |

During

2015, Lear’s continuous improvement efforts to mitigate risk will focus on:

| |

• |

|

Implementing improvements of data analysis and reporting tools, including increased use of technology to facilitate identification of the status of suppliers’ smelters. |

| |

• |

|

Continue participation in the AIAG SET and contribute to research and outreach projects which encourage smelters to participate in the CFSI. |

Forward-Looking Statements

This Report contains

“forward-looking statements” about activities, events or developments that Lear intends, expects, projects, believes or anticipates will occur in the future. Forward-looking statements include all statements that do not relate solely to

historical or current facts and can generally be identified by the use of future dates or words such as “may,” “should,” “could,” “will,” “expects,” “seeks to,” “anticipates,”

“plans,” “believes,” “estimates,” “intends,” “predicts,” “projects,” “potential” or “continue” or the negative of such terms and other comparable terminology. Such

statements are only our expectation of the outcome of future events. The outcome of the events described in these forward-looking statements is subject to substantial known and unknown risks, uncertainties and other factors that may cause results

and developments to differ materially from those anticipated in our forward-looking statements. Lear’s Form 10-K and subsequent filings with the SEC discuss some of the factors that could contribute to these differences. You are cautioned not

to unduly rely on such forward-looking statements, which speak only as of the date made, when evaluating the information presented in this Report. Lear expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein, to reflect any change in its expectations with regard thereto, or any other change in events, conditions or circumstances on which any statement is based.

7

Attachment A

CONFLICT MINERALS POLICY

On August 22, 2012, under the Dodd-Frank Wall Street Reform and Consumer Protection Act, the U. S. Securities and Exchange Commission (SEC) approved the

final rule to impose disclosure and reporting requirements related to conflict minerals (tin, tungsten, tantalum, and gold). The rule requires U. S. publicly traded companies to disclose the presence of conflict minerals originating in the

Democratic Republic of the Congo (DRC) or adjoining countries in the products they manufacture, if the conflict minerals are necessary to the functionality or production of such products.

As a supplier in the automotive and non-automotive industries, Lear uses a variety of materials in the products it manufactures. The supply chain for these

materials is complex.

It is Lear’s policy to comply with the disclosure and reporting requirements of Section 1502 of the Dodd-Frank Wall

Street Reform and Consumer Protection Act, as well as all rules of the SEC promulgated under such Act. Lear requires legal and ethical sourcing of materials in our supply chain and, as part of our Conflict Minerals Sourcing Policy, Lear requires its

suppliers to engage in due diligence of their supply chain to understand and report the content of their parts supplied to Lear.

By: /s/ Matthew J. Simoncini

President and Chief Executive Officer

8

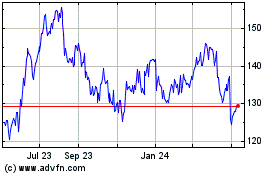

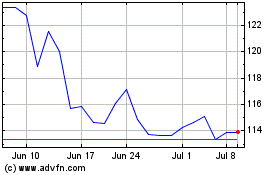

Lear (NYSE:LEA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lear (NYSE:LEA)

Historical Stock Chart

From Apr 2023 to Apr 2024