Current Report Filing (8-k)

August 03 2015 - 12:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Date of Report (Date of earliest event reported)

|

|

August 3, 2015

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

1-6541

|

|

13-2646102

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

667 Madison Avenue, New York, N.Y.

|

10065-8087

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code:

|

(212) 521-2000

|

|

NOT APPLICABLE

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

[ ]

|

Pre-commencement communications pursuant to rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 2.02

|

Results of Operations and Financial Condition.

|

|

On August 3, 2015, Registrant issued a press release for Loews Corporation providing information on its results of operations for the second quarter of 2015. The press release is furnished as Exhibit 99.1 to this Form 8-K.

The information under Item 2.02 and in Exhibit 99.1 in this Current Report is being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information under Item 2.02 and in Exhibit 99.1 in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

(a)

|

Not applicable.

|

|

(b)

|

Not applicable.

|

|

(c)

|

Exhibit:

|

|

Exhibit Reference

|

|

|

|

|

|

| |

|

|

|

|

|

| |

Number

|

|

|

|

Exhibit Description

|

|

|

| |

|

|

99.1

|

Loews Corporation press release, issued August 3, 2015, providing information on its results of operations for the second quarter of 2015.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

LOEWS CORPORATION

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: August 3, 2015

|

By:

|

/s/ Gary W. Garson

|

|

|

|

Gary W. Garson

|

|

|

|

Senior Vice President

|

| |

|

General Counsel

|

| |

|

and Secretary

|

2

Exhibit 99.1

|

|

Contact:

|

Mary Skafidas

Investor and Public Relations

(212) 521-2788

|

NEWS RELEASE

LOEWS CORPORATION REPORTS NET INCOME OF

$170 MILLION FOR THE SECOND QUARTER OF 2015

NEW YORK, August 3, 2015—Loews Corporation (NYSE:L) today reported net income for the three months ended June 30, 2015 of $170 million, or $0.46 per share, compared to $116 million, or $0.30 per share, in the prior year period. Net income for the six months ended June 30, 2015 was $279 million, or $0.75 per share, compared to $175 million, or $0.45 per share, in the prior year period. Net income for the three and six month periods in 2014 included losses from discontinued operations of $187 million and $393 million reflecting the disposition by Loews of HighMount Exploration & Production, LLC and by CNA Financial Corporation of its annuity and pension deposit business.

Book value per share excluding accumulated other comprehensive income (AOCI) increased to $51.77 at June 30, 2015 from $50.95 at December 31, 2014 and $49.74 at June 30, 2014.

CONSOLIDATED HIGHLIGHTS

| |

|

June 30,

|

|

| |

|

Three Months

|

|

|

Six Months

|

|

|

(In millions, except per share data)

|

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before net investment gains (losses)

|

|

$ |

167 |

|

|

$ |

312 |

|

|

$ |

268 |

|

|

$ |

553 |

|

|

Net investment gains (losses)

|

|

|

3 |

|

|

|

(9 |

) |

|

|

11 |

|

|

|

15 |

|

|

Income from continuing operations

|

|

|

170 |

|

|

|

303 |

|

|

|

279 |

|

|

|

568 |

|

|

Discontinued operations, net

|

|

|

|

|

|

|

(187 |

) |

|

|

|

|

|

|

(393 |

) |

|

Net income attributable to Loews Corporation

|

|

$ |

170 |

|

|

$ |

116 |

|

|

$ |

279 |

|

|

$ |

175 |

|

|

Net income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$ |

0.46 |

|

|

$ |

0.79 |

|

|

$ |

0.75 |

|

|

$ |

1.47 |

|

|

Discontinued operations, net

|

|

|

|

|

|

|

(0.49 |

) |

|

|

|

|

|

|

(1.02 |

) |

|

Net income per share

|

|

$ |

0.46 |

|

|

$ |

0.30 |

|

|

$ |

0.75 |

|

|

$ |

0.45 |

|

| |

|

June 30,

|

|

|

Year Ended

|

|

| |

|

2015

|

|

|

2014

|

|

|

December 31, 2014

|

|

| |

|

|

|

|

|

|

|

|

|

|

Book value per share

|

|

$ |

51.91 |

|

|

$ |

51.85 |

|

|

$ |

51.70 |

|

|

Book value per share excluding AOCI

|

|

|

51.77 |

|

|

|

49.74 |

|

|

|

50.95 |

|

Three Months Ended June 30, 2015 Compared to 2014

Income from continuing operations for the three months ended June 30, 2015 was $170 million, or $0.46 per share, compared to $303 million, or $0.79 per share, in the 2014 second quarter. Income from continuing operations decreased primarily due to lower earnings at CNA and less favorable performance of the parent company trading portfolio as a result of lower returns on equities and limited partnership investments.

CNA’s earnings decreased primarily due to an $84 million ($49 million after tax and noncontrolling interests) charge related to a retroactive reinsurance agreement to cede its legacy asbestos and environmental pollution liabilities (loss portfolio transfer or LPT). Under retroactive reinsurance accounting, amounts ceded through the LPT in excess of the consideration paid result in a deferred benefit that is recognized in income in proportion to paid recoveries over future periods. The year-over-year earnings comparison was also impacted by a gain of $86 million ($50 million after tax and noncontrolling interests) in 2014 from a postretirement plan curtailment. The decline in the second quarter of 2015 as compared to the prior year was partially offset by an improvement in net prior year development in CNA’s commercial business segment.

Diamond Offshore’s earnings were relatively flat as lower rig utilization and increased depreciation and interest expense were offset by significantly reduced contract drilling expenses.

Boardwalk Pipeline’s earnings decreased primarily as a result of lower parking and lending revenue and increased depreciation and interest costs. Boardwalk Pipeline recorded $12 million of higher transportation revenue due to business interruption insurance proceeds received and new rates taking effect as a result of the Gulf South rate case.

Loews Hotels’ earnings increased primarily due to higher income from joint venture properties.

Discontinued operations in 2014 included an impairment charge related to the divested HighMount business.

Six Months Ended June 30, 2015 Compared to 2014

Income from continuing operations for the six months ended June 30, 2015 was $279 million, or $0.75 per share, compared to $568 million, or $1.47 per share, in the prior year period. Income from continuing operations decreased primarily due to lower earnings at CNA and Diamond Offshore.

CNA’s earnings decreased primarily due to the reasons discussed above in the three month comparison.

Diamond Offshore’s earnings decreased primarily due to a $158 million (after tax and noncontrolling interests) asset impairment charge taken in the first quarter of 2015 related to the carrying value of eight drilling rigs as well as lower rig utilization and increased depreciation and interest expense.

Boardwalk Pipeline’s earnings increase stemmed from the impact in 2014 of a $55 million charge (after tax and noncontrolling interests) related to the write off of all capitalized costs associated with the terminated Bluegrass project. Absent this charge, earnings decreased primarily due to the unusually cold and sustained winter of 2014 as compared to the relatively normal 2015 winter season and lower natural gas storage revenues.

Loews Hotels’ earnings increased primarily due to higher income from joint venture properties partially offset by higher interest expense.

Discontinued operations in 2014 included impairment charges related to the sale of both CNA’s annuity and pension deposit business and HighMount.

SHARE REPURCHASES

At June 30, 2015, there were 365.6 million shares of Loews common stock outstanding. During the three and six months ended June 30, 2015, the Company repurchased 5.8 million and 7.6 million shares of its

common stock at an aggregate cost of $233 million and $305 million. From July 1, 2015 to July 31, 2015, the Company repurchased an additional 3.3 million shares of its common stock at an aggregate cost of $127 million. Depending on market conditions, the Company may from time to time purchase shares of its and its subsidiaries’ outstanding common stock in the open market or otherwise.

CONFERENCE CALLS

A conference call to discuss the second quarter results of Loews Corporation has been scheduled for today at 11:00 a.m. ET. A live webcast of the call will be available online at the Loews Corporation website (www.loews.com). Please go to the website at least ten minutes before the event begins to register and to download and install any necessary audio software. Those interested in participating in the question and answer session should dial (877) 692-2592, or for international callers, (973) 582-2757. The conference ID number is 74859424. An online replay will also be available on the Loews Corporation’s website following the call.

A conference call to discuss the second quarter results of CNA has been scheduled for today at 10:00 a.m. ET. A live webcast will be available at www.cna.com. Those interested in participating in the question and answer session should dial (888) 397-5352, or for international callers, (719) 457-2727.

A conference call to discuss the second quarter results of Boardwalk Pipeline has been scheduled for today at 9:30 a.m. ET. A live webcast will be available at www.bwpmlp.com. Those interested in participating in the question and answer session should dial (855) 793-3255 or for international callers, (631) 485-4925. The conference ID number is 74493272.

A conference call to discuss the second quarter results of Diamond Offshore has been scheduled for today at 8:30 a.m. ET. A live webcast will be available at www.diamondoffshore.com. Those interested in participating in the question and answer session should dial (800) 247-9979, or for international callers, (973) 321-1100. The conference ID number is 77534754.

# # #

ABOUT LOEWS CORPORATION

Loews Corporation is a diversified company with three publicly-traded subsidiaries: CNA Financial Corporation (NYSE: CNA), Diamond Offshore Drilling, Inc. (NYSE: DO) and Boardwalk Pipeline Partners, LP (NYSE: BWP); and one wholly owned subsidiary, Loews Hotels & Resorts. For more information please visit www.loews.com.

# # #

FORWARD-LOOKING STATEMENTS

Statements contained in this press release which are not historical facts are “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are inherently uncertain and subject to a variety of risks that could cause actual results to differ materially from those expected by management of the Company. A discussion of the important risk factors and other considerations that could materially impact these matters as well as the Company’s overall business and financial performance can be found in the Company’s reports filed with the Securities and Exchange Commission and readers of this release are urged to review those reports carefully when considering these forward-looking statements. Copies of these reports are available through the Company’s website (www.loews.com). Given these risk factors, investors and analysts should not place undue reliance on forward-looking statements. Any such forward-looking statements speak only as of the date of this press release. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based.

Loews Corporation and Subsidiaries

Selected Financial Information

| |

|

June 30,

|

|

|

(In millions)

|

|

Three Months

|

|

|

Six Months

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CNA Financial

|

|

$ |

2,329 |

|

|

$ |

2,454 |

|

|

$ |

4,671 |

|

|

$ |

4,875 |

|

|

Diamond Offshore

|

|

|

632 |

|

|

|

701 |

|

|

|

1,259 |

|

|

|

1,411 |

|

|

Boardwalk Pipeline

|

|

|

299 |

|

|

|

295 |

|

|

|

629 |

|

|

|

652 |

|

|

Loews Hotels

|

|

|

167 |

|

|

|

112 |

|

|

|

306 |

|

|

|

217 |

|

|

Investment income and other

|

|

|

10 |

|

|

|

45 |

|

|

|

40 |

|

|

|

98 |

|

| |

|

|

3,437 |

|

|

|

3,607 |

|

|

|

6,905 |

|

|

|

7,253 |

|

|

Investment gains (losses) – CNA Financial

|

|

|

(2 |

) |

|

|

(14 |

) |

|

|

8 |

|

|

|

28 |

|

|

Total

|

|

$ |

3,435 |

|

|

$ |

3,593 |

|

|

$ |

6,913 |

|

|

$ |

7,281 |

|

|

Income (Loss) Before Income Tax:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CNA Financial (a)

|

|

$ |

167 |

|

|

$ |

379 |

|

|

$ |

471 |

|

|

$ |

638 |

|

|

Diamond Offshore (b)

|

|

|

106 |

|

|

|

112 |

|

|

|

(181 |

) |

|

|

280 |

|

|

Boardwalk Pipeline (c)

|

|

|

38 |

|

|

|

54 |

|

|

|

115 |

|

|

|

77 |

|

|

Loews Hotels

|

|

|

14 |

|

|

|

9 |

|

|

|

24 |

|

|

|

14 |

|

|

Investment income, net

|

|

|

10 |

|

|

|

46 |

|

|

|

39 |

|

|

|

97 |

|

|

Other (d)

|

|

|

(38 |

) |

|

|

(40 |

) |

|

|

(76 |

) |

|

|

(74 |

) |

| |

|

|

297 |

|

|

|

560 |

|

|

|

392 |

|

|

|

1,032 |

|

|

Investment gains (losses) – CNA Financial

|

|

|

(2 |

) |

|

|

(14 |

) |

|

|

8 |

|

|

|

28 |

|

|

Total

|

|

$ |

295 |

|

|

$ |

546 |

|

|

$ |

400 |

|

|

$ |

1,060 |

|

|

Net Income (Loss) Attributable to Loews Corporation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CNA Financial (a)

|

|

$ |

121 |

|

|

$ |

244 |

|

|

$ |

323 |

|

|

$ |

420 |

|

|

Diamond Offshore (b)

|

|

|

45 |

|

|

|

42 |

|

|

|

(81 |

) |

|

|

111 |

|

|

Boardwalk Pipeline (c)

|

|

|

12 |

|

|

|

17 |

|

|

|

37 |

|

|

|

(1 |

) |

|

Loews Hotels

|

|

|

8 |

|

|

|

5 |

|

|

|

13 |

|

|

|

8 |

|

|

Investment income, net

|

|

|

7 |

|

|

|

30 |

|

|

|

26 |

|

|

|

64 |

|

|

Other (d)

|

|

|

(26 |

) |

|

|

(26 |

) |

|

|

(50 |

) |

|

|

(49 |

) |

| |

|

|

167 |

|

|

|

312 |

|

|

|

268 |

|

|

|

553 |

|

|

Investment gains (losses) – CNA Financial

|

|

|

3 |

|

|

|

(9 |

) |

|

|

11 |

|

|

|

15 |

|

|

Income from continuing operations

|

|

|

170 |

|

|

|

303 |

|

|

|

279 |

|

|

|

568 |

|

|

Discontinued operations, net (e)

|

|

|

|

|

|

|

(187 |

) |

|

|

|

|

|

|

(393 |

) |

|

Net income attributable to Loews Corporation

|

|

$ |

170 |

|

|

$ |

116 |

|

|

$ |

279 |

|

|

$ |

175 |

|

|

(a)

|

Includes a charge of $84 million ($49 million after tax and noncontrolling interests) for the three and six months ended June 30, 2015 related to retroactive reinsurance accounting for the Loss Portfolio Transfer. Includes an $86 million curtailment gain ($50 million after tax and noncontrolling interests) related to a negative plan amendment and the re-measurement of postretirement benefit obligations at CNA for the three and six months ended June 30, 2014.

|

|

(b)

|

Includes an asset impairment charge of $359 million ($158 million after tax and noncontrolling interests) for the six months ended June 30, 2015 related to the carrying value of eight drilling rigs.

|

|

(c)

|

Includes a loss of $94 million ($55 million after tax and noncontrolling interests) for the six months ended June 30, 2014 to write off all capitalized costs associated with the terminated Bluegrass project.

|

|

(d)

|

Consists primarily of corporate interest expense and other unallocated expenses.

|

|

(e)

|

See table on page six for a summary of items comprising discontinued operations for 2014.

|

Loews Corporation and Subsidiaries

Consolidated Financial Review

| |

|

June 30,

|

|

|

(In millions, except per share data)

|

|

Three Months

|

|

|

Six Months

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurance premiums

|

|

$ |

1,735 |

|

|

$ |

1,811 |

|

|

$ |

3,422 |

|

|

$ |

3,617 |

|

|

Net investment income

|

|

|

510 |

|

|

|

597 |

|

|

|

1,098 |

|

|

|

1,174 |

|

|

Investment gains (losses)

|

|

|

(2 |

) |

|

|

(14 |

) |

|

|

8 |

|

|

|

28 |

|

|

Contract drilling revenues

|

|

|

617 |

|

|

|

650 |

|

|

|

1,217 |

|

|

|

1,335 |

|

|

Other

|

|

|

575 |

|

|

|

549 |

|

|

|

1,168 |

|

|

|

1,127 |

|

|

Total

|

|

|

3,435 |

|

|

|

3,593 |

|

|

|

6,913 |

|

|

|

7,281 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurance claims and policyholders’ benefits (a)

|

|

|

1,469 |

|

|

|

1,441 |

|

|

|

2,808 |

|

|

|

2,887 |

|

|

Contract drilling expenses

|

|

|

344 |

|

|

|

395 |

|

|

|

695 |

|

|

|

765 |

|

|

Other (b) (c) (d)

|

|

|

1,327 |

|

|

|

1,211 |

|

|

|

3,010 |

|

|

|

2,569 |

|

|

Total

|

|

|

3,140 |

|

|

|

3,047 |

|

|

|

6,513 |

|

|

|

6,221 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income tax

|

|

|

295 |

|

|

|

546 |

|

|

|

400 |

|

|

|

1,060 |

|

|

Income tax expense

|

|

|

(48 |

) |

|

|

(145 |

) |

|

|

(104 |

) |

|

|

(248 |

) |

|

Income from continuing operations

|

|

|

247 |

|

|

|

401 |

|

|

|

296 |

|

|

|

812 |

|

|

Discontinued operations, net of income tax

|

|

|

|

|

|

|

(186 |

) |

|

|

|

|

|

|

(413 |

) |

|

Net income

|

|

|

247 |

|

|

|

215 |

|

|

|

296 |

|

|

|

399 |

|

|

Amounts attributable to noncontrolling interests

|

|

|

(77 |

) |

|

|

(99 |

) |

|

|

(17 |

) |

|

|

(224 |

) |

|

Net income attributable to Loews Corporation

|

|

$ |

170 |

|

|

$ |

116 |

|

|

$ |

279 |

|

|

$ |

175 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Loews Corporation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$ |

170 |

|

|

$ |

303 |

|

|

$ |

279 |

|

|

$ |

568 |

|

|

Discontinued operations, net (e)

|

|

|

|

|

|

|

(187 |

) |

|

|

|

|

|

|

(393 |

) |

|

Net income

|

|

$ |

170 |

|

|

$ |

116 |

|

|

$ |

279 |

|

|

$ |

175 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$ |

0.46 |

|

|

$ |

0.79 |

|

|

$ |

0.75 |

|

|

$ |

1.47 |

|

|

Discontinued operations, net

|

|

|

|

|

|

|

(0.49 |

) |

|

|

|

|

|

|

(1.02 |

) |

|

Diluted income per share attributable to Loews

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporation

|

|

$ |

0.46 |

|

|

$ |

0.30 |

|

|

$ |

0.75 |

|

|

$ |

0.45 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted diluted number of shares

|

|

|

369.97 |

|

|

|

386.37 |

|

|

|

371.57 |

|

|

|

387.21 |

|

|

(a)

|

Includes a charge of $84 million ($49 million after tax and noncontrolling interests) for the three and six months ended June 30, 2015 related to retroactive reinsurance accounting for the Loss Portfolio Transfer.

|

|

(b)

|

Includes an $86 million curtailment gain ($50 million after tax and noncontrolling interests) related to a negative plan amendment and the re-measurement of postretirement benefit obligations at CNA for the three and six months ended June 30, 2014.

|

|

(c)

|

Includes an asset impairment charge of $359 million ($158 million after tax and noncontrolling interests) for the six months ended June 30, 2015 related to the carrying value of eight drilling rigs.

|

|

(d)

|

Includes a loss of $94 million ($55 million after tax and noncontrolling interests) for the six months ended June 30, 2014 to write off all capitalized costs associated with the terminated Bluegrass project.

|

|

(e)

|

See table on page six for a summary of items comprising discontinued operations for 2014.

|

Loews Corporation and Subsidiaries

Discontinued Operations Review

| |

|

June 30, 2014

|

|

|

(In millions)

|

|

Three Months

|

|

|

Six Months

|

|

|

CNA Financial

|

|

|

|

|

|

|

|

Continental Assurance Company (“CAC”) operations

|

|

$ |

5 |

|

|

$ |

12 |

|

|

Impairment loss on sale of CAC

|

|

|

|

|

|

|

(193 |

) |

|

CNA Financial - Discontinued operations, net

|

|

|

5 |

|

|

|

(181 |

) |

| |

|

|

|

|

|

|

|

|

|

HighMount

|

|

|

|

|

|

|

|

|

|

Operations

|

|

|

(25 |

) |

|

|

(26 |

) |

|

Ceiling test impairment

|

|

|

|

|

|

|

(19 |

) |

|

Impairment loss

|

|

|

(167 |

) |

|

|

(167 |

) |

|

HighMount – Discontinued operations, net

|

|

|

(192 |

) |

|

|

(212 |

) |

| |

|

|

|

|

|

|

|

|

|

Discontinued operations, net

|

|

$ |

(187 |

) |

|

$ |

(393 |

) |

Page 6 of 6

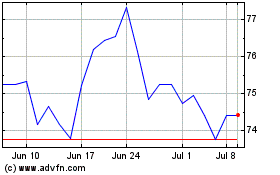

Loews (NYSE:L)

Historical Stock Chart

From Mar 2024 to Apr 2024

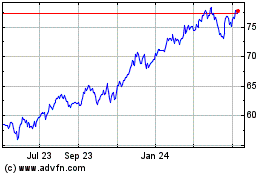

Loews (NYSE:L)

Historical Stock Chart

From Apr 2023 to Apr 2024