Kite Realty Group Trust Announces Tax Reporting Information for 2015 Dividend Distributions

January 15 2016 - 4:17PM

Business Wire

Kite Realty Group Trust (NYSE: KRG) announced today that the

taxation of its 2015 dividend distributions for the Company’s

common shares of beneficial interest represents 74.03 percent

ordinary income, 12.38 percent capital gain, and 13.59 percent

return of capital. The tax allocations on the common shares for

2015 were based upon the annual dividend of $1.0775 per share.

The tax allocations of its 2015 dividend distributions for the

Company’s Series A cumulative redeemable perpetual preferred shares

(the “Series A Preferred Shares”) represents 100 percent ordinary

income. The allocations on the Series A Preferred Shares for 2015

were based upon the total dividend of $2.093029 per share.

Common Shares

Total Capital Record Payable

Distribution Ordinary Gain Non-Taxable CUSIP Date Date per Share

Dividend Distribution Distribution 49803T300 1/6/2015 1/13/2015 $

0.2600 $ 0.192484 $ 0.032175 $ 0.035341

49803T300 4/6/2015 4/13/2015 0.2725 0.201738 0.033722 0.037040

49803T300 7/7/2015 7/14/2015 0.2725 0.201738 0.033722 0.037040

49803T300 10/6/2015 10/13/2015 0.2725 0.201738 0.033722 0.037040 $

1.0775 $ 0.797698 $ 0.133341 $ 0.146461 74.03% 12.38% 13.59%

Preferred Shares Payable/ Total Capital Record Redemption

Distribution Ordinary Gain Non-Taxable CUSIP Date Date per Share

Dividend Distribution Distribution 49803T201 2/17/2015 3/1/2015 $

0.515625 $ 0.515625 $ 0.000000 $ 0.000000 49803T201 5/22/2015

6/1/2015 0.515625 0.515625 0.000000 0.000000 49803T201 8/21/2015

9/1/2015 0.515625 0.515625 0.000000 0.000000 49803T201 11/23/2015

12/1/2015 0.515625 0.515625 0.000000 0.000000 49803T201 * 12/7/2015

0.030529 0.030529 0.000000 0.000000 $ 2.093029 $ 2.093029 $

0.000000 $ 0.000000 100.00% 0.00% 0.00%

* The Series A Preferred Shares were redeemed on December 7,

2015 for a redemption price that included accrued dividends from

December 2, 2015 up to, but not including, the redemption date.

This release is based on the preliminary results of work on the

Company’s tax filings and is subject to correction or adjustment

when the filings are completed. The Company is releasing

information at this time to aid those required to distribute Forms

1099 on the Company’s distributions. No material change in these

classifications is expected.

About Kite Realty Group

Trust

Kite Realty Group Trust is a full-service, vertically integrated

real estate investment trust engaged in the ownership, operation,

management, leasing, acquisition, construction, redevelopment and

development of neighborhood and community shopping centers in

selected markets in the United States. As of September 30, 2015,

the Company owned interests in a portfolio of 124 operating,

development and redevelopment properties totaling approximately 25

million total square feet across 22 states. For more information,

please visit the Company’s website at www.kiterealty.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160115005809/en/

Kite Realty Group TrustDan Sink, Chief Financial Officer,

317-577-5609dsink@kiterealty.comorInvestors/Media:Maggie Daniels,

317-713-7644Investor Relationsmdaniels@kiterealty.com

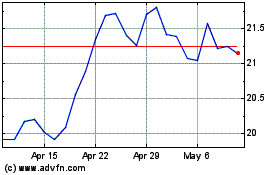

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

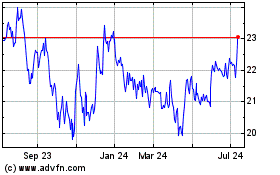

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024