Kite Realty Group Trust Announces Redemption of 8.25% Series A Cumulative Perpetual Preferred Shares

October 30 2015 - 4:17PM

Business Wire

Kite Realty Group Trust (NYSE:KRG) (the “Company”) today

announced that it intends to redeem all 4,100,000 outstanding

shares of its 8.25% Series A Cumulative Redeemable Perpetual

Preferred Shares (the “Series A Preferred Shares”) on December 7,

2015 (the “Redemption Date”). The Series A Preferred Shares will be

redeemed at a redemption price of $25.00 per share, plus the amount

equal to all dividends accrued and unpaid per share from December

2, 2015, up to, but not including, the Redemption Date.

Dividends on the Series A Preferred Shares will cease to accrue

on the Redemption Date. Upon redemption, the Series A Preferred

Shares will no longer be outstanding, and all rights of the holders

will terminate, except the right of the holders to receive, from

and after the Redemption Date, the redemption price, without

interest. Upon redemption, the Series A Preferred Shares will be

delisted from trading on the New York Stock Exchange on the

Redemption Date.

All Series A Preferred Shares are held in book-entry form

through the Depository Trust Company (“DTC”) and will be redeemed

in accordance with the procedures of DTC. Payment to DTC for the

Series A Preferred Shares will be made by Broadridge Corporate

Issuer Solutions, Inc. as redemption agent.

The address for the redemption agent is as follows:

Broadridge Corporate Issuer Solutions, Inc.51 Mercedes Way,

Edgewood, New York, 11717Attention: Reorg Dept.E-mail:

shareholder@broadridge.com

About Kite Realty Group

Trust

Kite Realty Group Trust is a full-service, vertically integrated

real estate investment trust engaged in the ownership, operation,

management, leasing, acquisition, construction, redevelopment and

development of neighborhood and community shopping centers in

selected markets in the United States. As of September 30, 2015,

the Company owned interests in a portfolio of 124 operating,

development and redevelopment properties totaling approximately 25

million total square feet across 22 states. For more information,

please visit the Company’s website at www.kiterealty.com.

Safe Harbor

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Such statements

are based on assumptions and expectations that may not be realized

and are inherently subject to risks, uncertainties and other

factors, many of which cannot be predicted with accuracy and some

of which might not even be anticipated. Future events and actual

results, performance, transactions or achievements, financial or

otherwise, may differ materially from the results, performance,

transactions or achievements, financial or otherwise, expressed or

implied by the forward-looking statements. Risks, uncertainties and

other factors that might cause such differences, some of which

could be material, include, but are not limited to: national and

local economic, business, real estate and other market conditions,

particularly in light of low growth in the U.S. economy, financing

risks, including the availability of and costs associated with

sources of liquidity, the Company’s ability to refinance, or extend

the maturity dates of, its indebtedness, the level and volatility

of interest rates, the financial stability of tenants, including

their ability to pay rent and the risk of tenant bankruptcies, the

competitive environment in which the Company operates, acquisition,

disposition, development, joint venture, property ownership and

management risks, the Company’s ability to maintain its status as a

real estate investment trust for federal income tax purposes,

potential environmental and other liabilities, impairment in the

value of real estate property the Company owns, risks related to

the geographical concentration of our properties in Florida,

Indiana and Texas, the dilutive effects of future offerings of

issuing additional securities, and other factors affecting the real

estate industry generally. The Company refers you to the documents

filed by the Company from time to time with the Securities and

Exchange Commission, specifically the section titled “Risk Factors”

in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2014, which discuss these and other factors that could

adversely affect the Company’s results. The Company undertakes no

obligation to publicly update or revise these forward-looking

statements, whether as a result of new information, future events

or otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151030005015/en/

Kite Realty Group TrustMaggie Kofkoff, CFA, Media & Investor

Relations, 317-713-7644mkofkoff@kiterealty.com

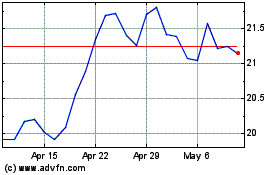

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

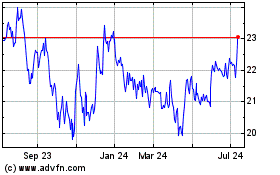

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024