Kite Realty Group Trust (NYSE: KRG) (the “Company”) announced

today operating results for the third quarter ended September 30,

2015. Financial statements and exhibits attached to this release

include the details of the results.

“Our robust third quarter performance is a direct result of

our leasing momentum, balance sheet initiatives and continued

operational excellence,” said John Kite, Chief Executive

Officer. “We gained 130 basis points in small shop leasing

and grew same-property net operating income by 3.1%, with over 90%

of our portfolio contributing to the same-property pool.

Upon funding the recently announced $200 million term loan, we

will only have approximately $100 million of securitized debt

maturities through 2020. Our investment grade credit metrics

continue to improve ahead of our scheduled objectives. With

over $50 million in annual free cash flow expected, we are

energized about the future and the shareholder value we will

create.”

Third Quarter And Other Recent

Highlights

- Generated Funds From Operations

(“FFO”), as adjusted, of $43.9 million, or $0.51 per diluted common

share.

- Generated Adjusted Funds From

Operations (“AFFO”) of $39.1 million, or $0.46 per diluted common

share.

- Achieved same-property net operating

income (“NOI”) growth of 3.1% (3.6%, excluding redevelopment

initiatives) year-over-year.

- Increased leased small shop space by

130 basis points to 87.5%.

- Executed a record 107 leases across

796,233 square feet.

- Produced new cash rent spreads of 36.9%

and comparable renewal cash rent spreads of 7.7%.

- Completed the redeployment of the

15-asset disposition proceeds via the previously announced

acquisitions of Livingston Shopping Center (New York-Northern New

Jersey) and Chapel Hill Shopping Center (Fort Worth-Dallas).

- Issued $250 million of senior unsecured

notes via a private placement at a blended fixed rate of 4.41% for

an average maturity of approximately 9.8 years.

- Significantly reduced floating rate

debt exposure to 8% from 19% last quarter.

- In October, closed on a $200 million

7-year unsecured term loan at a rate of LIBOR plus 160 basis

points, which, combined with other financing transactions,

substantially satisfies all near-term securitized maturities.

Third Quarter Financial

Results

FFO, as adjusted, for the three months ended September 30, 2015,

was $43.9 million, or $0.51 per diluted common share, for real

estate properties in which the Company’s operating subsidiaries own

an interest (to which we refer as the “Kite Portfolio”), compared

to $43.8 million, or $0.51 per diluted common share, for the same

period in the prior year.

FFO, as defined by NAREIT, was $42.8 million, or $0.50 per

diluted common share, for the Kite Portfolio, compared to $24.7

million, or $0.29 per diluted common share, for the same period in

the prior year. The primary difference between FFO, as defined by

NAREIT, and FFO, as adjusted, in the prior year was due to merger

and acquisition costs.

Portfolio Activity During The Third

Quarter

Development and Redevelopment

The Company’s three development projects, Phase II of Parkside

Town Commons, Phase II of Holly Springs Towne Center, and Tamiami

Crossing, were in aggregate 86.3% pre-leased or committed as of

September 30, 2015. These three projects have a total estimated

cost of approximately $170.0 million, of which approximately $136.4

million, or 80%, had been incurred as of September 30, 2015.

The Company continues to maintain a pipeline of projects with an

expected total cost of approximately $120 million across

redevelopment, reposition and repurpose categories. As of the end

of the third quarter, 12 of the 16 properties included in the

pipeline remain in the operating portfolio. The Company anticipates

commencing active construction on these projects within the next 18

months.

Portfolio Transactions

While being a net seller of over $100 million of non-core

properties since December of 2014, the Company completed its tax

efficient redeployment of disposition proceeds during the third

quarter. The final two acquisitions are outlined below.

Livingston Shopping Center (New York-Northern New

Jersey)

Livingston Shopping Center is a 140,000 square foot power center

located in a prime retail corridor of Livingston, New Jersey.

Located in close proximity to one of the top-10-sales-grossing

malls in the country, the center is 95.4% leased and anchored by

Nordstrom Rack, DSW, TJ Maxx, Buy Buy Baby, Cost Plus and Ulta

Salon. The transaction closed July 24, 2015.

The Town of Livingston is located in affluent Essex County near

New York City and the Newark, New Jersey airport in an area with a

median home value over $535,000 in 2014. The power center benefits

from strong demographics, with an estimated population over 150,000

and average household incomes of more than $170,000 within a 5-mile

radius.

Chapel Hill Shopping Center (Fort Worth-Dallas)

Chapel Hill Shopping Center is an approximately 200,000 square

foot shopping center located in the MSA of Fort Worth-Dallas,

Texas. The center is 97.8% leased and anchored by HEB Grocery’s

premier Central Market, The Container Store and Cost Plus World

Market. The shopping center also includes a strong lineup of other

high-quality retailers such as Ann Taylor, Beauty Brands, New

Balance and Men’s Warehouse. The transaction closed August 21,

2015.

Chapel Hill Shopping Center is located at the intersection of

I-30 and Hulen Street, one of the area’s most highly traveled

crossroads, and benefits from multiple access points and ease of

entry. The densely inhabited area has an estimated population of

275,000 residents within a 5-mile radius.

Capital Markets

Since June 30, 2015, the Company completed the previously

announced $250 million senior unsecured private placement offering

at a blended fixed rate of 4.41% across 8-year, 10-year and 12-year

tranches. The notes have an average maturity of approximately 9.8

years which extended the Company’s total weighted average debt

maturity to 5.5 years from 4.8 years last quarter and reduced

floating rate debt to 8% from 19% last quarter.

In October, the Company announced the completion of a $200

million 7-year unsecured term loan bearing an interest rate of

LIBOR plus 160 basis points. Similar to the private placement

notes, the term loan includes a delayed draw feature which is

expected to be utilized to closely match future funding needs. The

Company intends to hedge a portion of or the entire term loan.

In aggregate, these unsecured offerings will be used to repay

all 2016 securitized debt maturities as well as unencumber the

Company’s largest asset, City Center at White Plains in New

York.

Portfolio Operations

As of September 30, 2015, the Company owned interests in 115

operating properties totaling approximately 23 million square feet.

The owned GLA in the Company’s retail operating portfolio was 95.4%

leased as of September 30, 2015, and the Company’s overall

portfolio was 94.8% leased, excluding ground leases and non-owned

anchors.

Same-property NOI, which includes 110 operating properties,

increased 3.1% in the third quarter of 2015 compared to the same

period in the prior year. The leased percentage of these properties

was 95.4% at September 30, 2015, compared to 94.9% at September 30,

2014, and the economic occupancy was 93.6% at September 30, 2015

compared to 93.5% at September 30, 2014.

The Company executed 107 leases totaling 796,233 square feet

during the third quarter of 2015. There were 72 comparable new and

renewal leases executed during the quarter for 584,275 square feet.

Cash rent spreads on new and renewal leases executed in the quarter

were approximately 36.9% and 7.7%, respectively, for a blended cash

rent spread of 13.1%.

2015 Earnings Guidance

The Company is revising its guidance for FFO, as adjusted, for

the year ending December 31, 2015, to $1.98 to $2.00 per diluted

common share. In July, the Company had communicated its

expectations for FFO, as adjusted, to be between $1.95 to $2.00 per

diluted common share.

The Company’s 2015 guidance is based on a number of factors,

many of which are outside the Company’s control and all of which

are subject to change. The Company may change its guidance during

the year if actual or anticipated results vary from these

assumptions.

Following is a reconciliation of the range of 2015 estimated net

income per diluted common share to estimated FFO per diluted common

share:

Updated Guidance Range for Full Year 2015

Low

High

Consolidated net income per diluted common share $ 0.17 $ 0.19 Add:

Depreciation, amortization and other 1.93 1.93 Add: Debt

extinguishment and preferred redemption costs 0.04 0.04 Less: Gain

on sale of operating property (0.04 ) (0.04 ) Less: Gain on

settlement (0.05 ) (0.05 ) Less: Dividends on preferred shares

(0.09 ) (0.09 ) Add: Acquisition costs 0.02 0.02

FFO, as adjusted, per diluted common share1 $

1.98 $ 2.00 ____________________ 1

Excludes acquisition costs.

Non-GAAP Financial Measures

Given the nature of the Company’s business as a real estate

owner and operator, the Company believes that FFO, FFO, as

adjusted, and AFFO are helpful to investors when measuring

operating performance because they exclude various items included

in net income or loss that do not relate to or are not indicative

of operating performance, such as gains or losses from sales and

impairments of operating properties and depreciation and

amortization, which can make periodic and peer analyses of

operating performance more difficult. We believe this supplemental

information provides a more meaningful measure of our operating

performance. The Company believes presenting FFO, FFO, as adjusted,

and AFFO in this manner allows investors and other interested

parties to form a more meaningful assessment of the Company’s

operating results. Reconciliations of net income to FFO, FFO, as

adjusted, and AFFO are included in the attached table.

Earnings Conference Call

The Company will conduct a conference call to discuss its

financial results on Friday, October 30, 2015, at 9:30 a.m. Eastern

Time. A live webcast of the conference call will be available

online on the Company’s corporate website at www.kiterealty.com.

The dial-in numbers are (866) 840-7637 for domestic callers and

(704) 908-0456 for international callers (passcode 15302034). In

addition, a webcast replay link will be available on the corporate

website.

About Kite Realty Group

Trust

Kite Realty Group Trust is a full-service, vertically integrated

real estate investment trust engaged in the ownership, operation,

management, leasing, acquisition, construction, redevelopment and

development of neighborhood and community shopping centers in

selected markets in the United States. As of September 30, 2015,

the Company owned interests in a portfolio of 124 operating,

development and redevelopment properties totaling approximately 25

million total square feet across 22 states. For more information,

please visit the Company’s website at www.kiterealty.com.

Safe Harbor

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Such statements

are based on assumptions and expectations that may not be realized

and are inherently subject to risks, uncertainties and other

factors, many of which cannot be predicted with accuracy and some

of which might not even be anticipated. Future events and actual

results, performance, transactions or achievements, financial or

otherwise, may differ materially from the results, performance,

transactions or achievements, financial or otherwise, expressed or

implied by the forward-looking statements. Risks, uncertainties and

other factors that might cause such differences, some of which

could be material, include, but are not limited to: national and

local economic, business, real estate and other market conditions,

particularly in light of low growth in the U.S. economy, financing

risks, including the availability of and costs associated with

sources of liquidity, the Company’s ability to refinance, or extend

the maturity dates of, its indebtedness, the level and volatility

of interest rates, the financial stability of tenants, including

their ability to pay rent and the risk of tenant bankruptcies, the

competitive environment in which the Company operates, acquisition,

disposition, development, joint venture, property ownership and

management risks, the Company’s ability to maintain its status as a

real estate investment trust for federal income tax purposes,

potential environmental and other liabilities, impairment in the

value of real estate property the Company owns, risks related to

the geographical concentration of our properties in Florida,

Indiana and Texas, the dilutive effects of future offerings of

issuing additional securities, and other factors affecting the real

estate industry generally. The Company refers you to the documents

filed by the Company from time to time with the Securities and

Exchange Commission, specifically the section titled “Risk Factors”

in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2014, which discuss these and other factors that could

adversely affect the Company’s results. The Company undertakes no

obligation to publicly update or revise these forward-looking

statements, whether as a result of new information, future events

or otherwise.

Kite Realty Group

TrustConsolidated Balance Sheets(Unaudited)

September 30,2015 December

31,2014 ($ in thousands) Assets:

Investment properties, at cost $ 3,980,886 $ 3,732,748 Less:

accumulated depreciation (410,328 ) (315,093 ) 3,570,558 3,417,655

Cash and cash equivalents 42,951 43,826 Tenant and other

receivables, including accrued straight-line rent of $23,312 and

$18,630 respectively, net of allowance for uncollectible accounts

47,353 48,097 Restricted cash and escrow deposits 15,713 16,171

Deferred costs and intangibles, net 150,983 159,978 Prepaid and

other assets 10,089 8,847 Assets held for sale — 179,642

Total Assets $ 3,837,647 $ 3,874,216

Liabilities and Shareholders’ Equity: Mortgage and other

indebtedness1 $ 1,679,843 $ 1,554,263 Accounts payable and accrued

expenses 90,148 75,150 Deferred revenue and other liabilities

137,554 136,409 Liabilities held for sale — 81,164

Total Liabilities 1,907,545 1,846,986 Commitments and

contingencies Limited Partners’ interests in the Operating

Partnership and other redeemable noncontrolling interests 86,957

125,082

Shareholders’ Equity: Kite Realty Group Trust

Shareholders’ Equity: Preferred Shares, $.01 par value,

40,000,000 shares authorized, 4,100,000 shares issued and

outstanding at September 30, 2015 and December 31, 2014,

respectively 102,500 102,500 Common Shares, $.01 par value,

225,000,000 shares authorized, 83,323,563 and 83,490,663 shares

issued and outstanding at September 30, 2015 and December 31, 2014,

respectively 833 835 Additional paid in capital 2,050,915 2,044,425

Accumulated other comprehensive loss (6,209 ) (1,175 ) Accumulated

deficit (305,902 ) (247,801 )

Total Kite Realty Group Trust

Shareholders’ Equity 1,842,137 1,898,784 Noncontrolling

Interests 1,008 3,364

Total Equity 1,843,145

1,902,148

Total Liabilities and Shareholders'

Equity $ 3,837,647 $ 3,874,216

____________________ 1 Includes debt premium of $23.9

million at September 30, 2015.

Kite Realty Group

TrustConsolidated Statements of OperationsFor the

Three and Nine Months Ended September 30, 2015 and

2014(Unaudited)

Three Months EndedSeptember 30, Nine

Months EndedSeptember 30, 2015 2014

2015 2014 ($ in thousands, except per share

data) Revenue: Minimum rent $ 66,279 $ 69,033 $ 196,656

$ 131,515 Tenant reimbursements 16,787 17,605 51,891 35,083 Other

property related revenue 4,081 1,938 9,163

5,481

Total revenue 87,147 88,576 257,710 172,079

Expenses: Property operating 11,994 11,850 36,519 26,057

Real estate taxes 10,045 10,632 29,821 20,048 General,

administrative, and other 4,559 3,939 14,131 9,358 Merger and

acquisition costs 1,089 19,088 1,550 26,849 Depreciation and

amortization 42,549 44,383 124,196 81,559

Total expenses 70,236 89,892 206,217

163,871

Operating income 16,911 (1,316 )

51,493 8,208 Interest expense (13,881 ) (15,386 ) (40,995 ) (30,291

) Income tax expense of taxable REIT subsidiary (9 ) (14 ) (134 )

(37 ) Gain on settlement — — 4,520 — Other expense, net (60 ) (13 )

(189 ) (119 )

Income (loss) from continuing operations 2,961

(16,729 ) 14,695 (22,239 )

Discontinued operations: Gain on

sale of operating property — — — 3,199

Income from discontinued operations — — —

3,199

Income (loss) before gain on sale of

operating properties 2,961 (16,729 ) 14,695 (19,040 ) Gain on

sales of operating properties — 2,749 3,363

6,336

Net income (loss) 2,961 (13,980 ) 18,058

(12,704 ) Net income attributable to noncontrolling interest (435 )

(304 ) (1,626 ) (224 ) Dividends on preferred shares (2,114 )

(2,114 ) (6,342 ) (6,342 )

Net income (loss) attributable to

Kite Realty Group Trust common shareholders $ 412 $

(16,398 ) $ 10,090 $ (19,270 )

Income (loss) per

common share - basic and diluted: Continuing operations $ 0.00

$ (0.20 ) $ 0.12 $ (0.45 ) Discontinued operations — —

— 0.06 $ 0.00 $ (0.20 ) $ 0.12 $

(0.39 ) Weighted average common shares outstanding - basic

83,325,074 83,455,900 83,453,660 49,884,469

Weighted average common shares outstanding - diluted

83,433,379 83,718,735 83,566,554 50,145,571

Common Dividends declared per common share $ 0.2725

$ 0.2600 $ 0.8175 $ 0.7600

Amounts attributable to Kite Realty Group Trust common

shareholders: Income (loss) from continuing operations $ 412 $

(16,398 ) $ 10,090 $ (22,366 ) Income from discontinued operations

— — — 3,096

Net income (loss) $

412 $ (16,398 ) $ 10,090 $ (19,270 )

Kite Realty Group TrustFunds

From OperationsFor the Three and Nine Months Ended September

30, 2015 and 2014 (Unaudited)

Three Months EndedSeptember 30, Nine

Months EndedSeptember 30, 2015 2014

2015 2014 ($ in thousands, except share and

per share data) Funds From Operations Consolidated net

income (loss) $ 2,961 $ (13,980 ) $ 18,058 $ (12,704 ) Less:

dividends on preferred shares (2,114 ) (2,114 ) (6,342 ) (6,342 )

Less: net income attributable to noncontrolling interests in

properties (415 ) (679 ) (1,416 ) (757 ) Less: gains on sales of

operating properties — (2,749 ) (3,363 ) (9,534 ) Add: depreciation

and amortization of consolidated entities, net of noncontrolling

interests 42,387 44,208 123,812 81,161

Funds From Operations of the Kite Portfolio 42,819 24,686 130,749

51,824 Less: Limited Partners' interests in Funds From Operations

(967 ) (354 ) (2,698 ) (1,658 ) Funds From Operations attributable

to Kite Realty Group Trust common shareholders1 $ 41,852 $

24,332 $ 128,051 $ 50,166 FFO per share of the

Operating Partnership - basic $ 0.50 $ 0.29 $ 1.53

$ 1.01 FFO per share of the Operating Partnership -

diluted $ 0.50 $ 0.29 $ 1.53 $ 1.00

Funds From Operations of the Kite Portfolio $ 42,819 $

24,686 $ 130,749 $ 51,824 Less: gain on settlement $ — $ — $ (4,520

) $ — Add: merger and acquisition costs 1,089 19,088

1,550 26,849 Funds From Operations of the Kite

Portfolio, as adjusted $ 43,908 $ 43,774 $ 127,779

$ 78,673 FFO per share of the Operating Partnership,

as adjusted - basic $ 0.52 $ 0.51 $ 1.50 $

1.53 FFO per share of the Operating Partnership, as adjusted

- diluted $ 0.51 $ 0.51 $ 1.50 $ 1.52

Weighted average Common Shares outstanding - basic

83,325,074 83,455,900 83,453,660 49,884,469

Weighted average Common Shares outstanding - diluted

83,433,379 83,718,735 83,566,554 50,145,571

Weighted average Common Shares and Units outstanding - basic

85,238,537 85,114,237 85,214,390 51,543,952

Weighted average Common Shares and Units outstanding -

diluted 85,346,842 85,377,073 85,327,283

51,805,054 ____________________ 1 “Funds From

Operations of the Kite Portfolio measures 100% of the operating

performance of the Operating Partnership’s real estate properties

and construction and service subsidiaries in which the Company owns

an interest. “Funds From Operations attributable to Kite Realty

Group Trust common shareholders” reflects a reduction for the

redeemable noncontrolling weighted average diluted interest in the

Operating Partnership.

Kite Realty Group TrustSame

Property Net Operating IncomeFor the Three and Nine Months

Ended September 30, 2015 and 2014(Unaudited)

Three Months Ended September 30, Nine

Months Ended September 30, 2015 2014

%Change

2015 2014

%Change

($ in thousands) ($ in thousands) Number of

properties at period end1

110

110 110 110

Leased percentage at period end 95.4 %

94.9 % 95.4 % 94.9 %

Economic Occupancy percentage at period

end2 93.6 % 93.5 % 93.6 % 93.5 % Minimum rent $

58,606 $ 57,681 $ 117,214 $ 114,528 Tenant recoveries 15,908 15,826

32,961 32,713 Other income, including specialty leasing and overage

rental income 1,009 726 2,390 2,275

75,523 74,233 152,565 149,516 Property operating expenses

(9,079 ) (9,532 ) (22,118 ) (23,288 ) Real estate taxes (9,432 )

(9,380 ) (19,439 ) (19,007 ) (18,511 ) (18,912 ) (41,557 ) (42,295

)

Net operating income - same properties3 $

57,012 $ 55,321 3.1 % $

111,008 $ 107,221 3.5 %

Reconciliation of Same Property NOI to Most Directly Comparable

GAAP Measure: Net operating income - same properties $ 57,012 $

55,321 $ 111,008 $ 107,221 Net operating income - non-same

activity4 8,096 10,773 80,362 18,753 General, administrative and

other (4,559 ) (3,939 ) (14,131 ) (9,358 ) Merger and acquisition

costs (1,089 ) (19,088 ) (1,550 ) (26,849 ) Depreciation expense

(42,549 ) (44,383 ) (124,196 ) (81,559 ) Interest expense (13,881 )

(15,386 ) (40,995 ) (30,291 ) Gain on settlement — — 4,520 — Other

expense, net (69 ) (27 ) (323 ) (156 ) Discontinued operations — —

— 3,199 Gains on sales of operating properties — 2,749 3,363 6,336

Net income attributable to noncontrolling interests (435 ) (304 )

(1,626 ) (224 ) Dividends on preferred shares (2,114 ) (2,114 )

(6,342 ) (6,342 ) Net income (loss) attributable to common

shareholders $ 412 $ (16,398 ) $ 10,090 $ (19,270 )

____________________ 1 Same property analysis excludes

operating properties in redevelopment. 2 Excludes leases that are

signed but for which tenants have not commenced payment of cash

rent. 3 Same property net operating income excludes net gains from

outlot sales, straight-line rent revenue, bad debt expense and

recoveries, lease termination fees, amortization of lease

intangibles and significant prior year expense recoveries and

adjustments, if any. 4 Includes non-cash accounting items across

the portfolio as well as net operating income from properties not

included in the same store pool.

The Company believes that Net Operating Income is helpful to

investors as a measure of its operating performance because it

excludes various items included in net income that do not relate to

or are not indicative of its operating performance, such as

depreciation and amortization, interest expense, and impairment, if

any. The Company believes that Same Property NOI is helpful to

investors as a measure of its operating performance because it

includes only the NOI of properties that have been owned for the

full period presented, which eliminates disparities in net income

due to the redevelopment, acquisition or disposition of properties

during the particular period presented, and thus provides a more

consistent metric for the comparison of the Company's properties.

NOI and Same Property NOI should not, however, be considered as

alternatives to net income (calculated in accordance with GAAP) as

indicators of the Company's financial performance.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151029006061/en/

Kite Realty Group TrustMaggie Kofkoff, CFA, 317-713-7644Media

& Investor Relationsmkofkoff@kiterealty.com

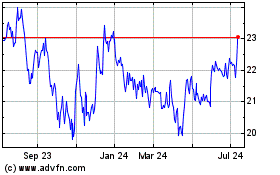

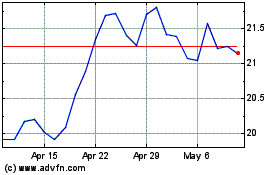

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024