Kite Realty Group Trust Completes $250 Million of Private Unsecured Notes

September 10 2015 - 4:05PM

Business Wire

Kite Realty Group Trust (NYSE:KRG) (the “Company”) and Kite

Realty Group, L.P. (the “Operating Partnership”) announced today

completion of the sale of a $250 million private placement of

senior unsecured notes (collectively the “notes” or “private

placement”) with a blended interest rate of approximately 4.41% and

a blended maturity of approximately 9.8 years.

The Operating Partnership issued $95 million in notes with an

8-year term, $80 million in notes with a 10-year term and $75

million in notes with a 12-year term. The 8-year, 10-year and

12-year notes will bear interest at fixed annual rates of 4.23%,

4.47% and 4.57%, respectively.

The Company intends to use the proceeds from the private

placement for repayment of amounts outstanding under its Unsecured

Revolving Credit Facility, other outstanding indebtedness and

general corporate purposes.

J.P. Morgan Securities LLC, Citigroup Global Markets Inc. and

Wells Fargo Securities, LLC were Joint Placement Agents for the

offering.

“The execution of our unsecured debt offering further enhances

our investment grade balance sheet and continues our strategy of

creating maximum financial flexibility,” said Dan Sink, Chief

Financial Officer.

About Kite Realty Group

Trust

Kite Realty Group Trust is a full-service, vertically integrated

real estate investment trust engaged in the ownership, operation,

management, leasing, acquisition, construction, redevelopment and

development of neighborhood and community shopping centers in

selected markets in the United States. As of June 30, 2015, the

Company owned interests in a portfolio of 122 operating,

development and redevelopment properties totaling approximately 25

million total square feet across 22 states. For more information,

please visit the Company’s website at www.kiterealty.com.

Safe Harbor

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Such statements

are based on assumptions and expectations that may not be realized

and are inherently subject to risks, uncertainties and other

factors, many of which cannot be predicted with accuracy and some

of which might not even be anticipated. Future events and actual

results, performance, transactions or achievements, financial or

otherwise, may differ materially from the results, performance,

transactions or achievements, financial or otherwise, expressed or

implied by the forward-looking statements. Risks, uncertainties and

other factors that might cause such differences, some of which

could be material, include, but are not limited to: national and

local economic, business, real estate and other market conditions,

particularly in light of low growth in the U.S. economy, financing

risks, including the availability of and costs associated with

sources of liquidity, the Company’s ability to refinance, or extend

the maturity dates of, its indebtedness, the level and volatility

of interest rates, the financial stability of tenants, including

their ability to pay rent and the risk of tenant bankruptcies, the

competitive environment in which the Company operates, acquisition,

disposition, development, joint venture, property ownership and

management risks, the Company’s ability to maintain its status as a

real estate investment trust for federal income tax purposes,

potential environmental and other liabilities, impairment in the

value of real estate property the Company owns, risks related to

the geographical concentration of our properties in Florida,

Indiana and Texas, the dilutive effects of future offerings of

issuing additional securities, and other factors affecting the real

estate industry generally. The Company refers you to the documents

filed by the Company from time to time with the Securities and

Exchange Commission, specifically the section titled “Risk Factors”

in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2014, which discuss these and other factors that could

adversely affect the Company’s results. The Company undertakes no

obligation to publicly update or revise these forward-looking

statements, whether as a result of new information, future events

or otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150910005143/en/

Kite Realty Group TrustMedia & Investor RelationsMaggie

Kofkoff, CFA, 317-713-7644mkofkoff@kiterealty.com

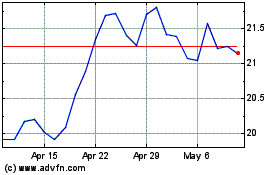

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

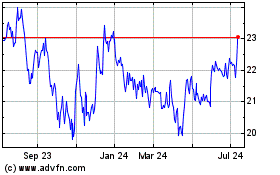

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024