UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 29, 2015

KITE REALTY GROUP TRUST

KITE REALTY GROUP, L.P.

(Exact name of registrant as specified in its charter)

|

Maryland |

|

001-32268 |

|

11-3715772 |

|

Delaware |

|

333-202666-01 |

|

20-1453863 |

|

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of incorporation) |

|

File Number) |

|

Identification Number) |

30 S. Meridian Street

Suite 1100

Indianapolis, IN 46204

(Address of principal executive offices) (Zip Code)

(317) 577-5600

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

Second Amendment to Fourth Amended and Restated Credit Agreement

On June 29, 2015, Kite Realty Group Trust (the “Company”) and Kite Realty Group, L.P. (the “Operating Partnership”) entered into the Second Amendment (the “Amendment”) to the Fourth Amended and Restated Credit Agreement (the “Amended Credit Agreement”), dated as of July 1, 2014, by and among the Operating Partnership, as borrower, the Company, as guarantor, KeyBank National Association, as a lender and Administrative Agent (the “Agent”), and the other lenders party thereto.

The Amendment increased the unsecured term loan facility from $230 million to $400 million (the “Amended Term Loan”) pursuant to the Operating Partnership’s exercise of its option to request such increase under the Amended Credit Agreement. The scheduled maturity of the Amended Term Loan remains July 1, 2019, which maturity date may be extended until January 1, 2020 at the Operating Partnership’s option, subject to certain conditions. The $170 million of additional proceeds, which was drawn on June 29, 2015, was used to retire the loans secured by the Company’s Beacon Hill and Draper Peaks operating properties and to pay down amounts outstanding under the Company’s unsecured revolving credit facility.

The Amendment also modified two financial covenants applicable to the Company to permit, in each case, only once during the term of the Amended Credit Agreement for up to four consecutive fiscal quarters following a material acquisition, (i) an increase in the maximum leverage ratio from 60% to 65%, and (ii) an increase in the unsecured indebtedness to unencumbered pool value ratio from .60 to 1.00 to .65 to 1.00.

The Amendment also removes two financial covenants to which the Company had been subject: (i) that the number of properties included in the unencumbered pool of properties not be fewer than 20 at any time, and (ii) that the aggregate value of the properties included in the unencumbered pool of properties not be less than $650,000,000 at any time. Additionally, the Amendment provides the Company, the Operating Partnership and the Company’s subsidiaries with more flexibility to make certain payments and distributions during the term of the Amended Credit Agreement, so long as no default or event of default exists or would result therefrom.

In addition to the foregoing, the Amendment eliminates certain reporting requirements triggered by the addition of new properties to the unencumbered pool. The Amendment also clarifies that the obligation to preserve the right to pledge the interests of the Company or its subsidiaries, including the Operating Partnership, in the unencumbered pool properties to the Agent does not prohibit a provision contained in an agreement evidencing unsecured indebtedness which contains restrictions on encumbering assets that are substantially similar to, or less restrictive than, the restrictions in the Amended Credit Agreement.

The foregoing summary is not complete and is qualified in its entirety by reference to the copy of the Amendment, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information under Item 1.01 of this Current Report on Form 8-K is incorporated into this Item 2.03 by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number |

|

Description |

|

10.1 |

|

Second Amendment to Fourth Amended and Restated Credit Agreement, dated as of June 29, 2015, by and among Kite Realty Group, L.P., Kite Realty Group Trust, KeyBank National Association, as Administrative Agent, and the other lenders party thereto. |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

KITE REALTY GROUP TRUST |

|

|

|

|

Date: July 2, 2015 |

By: |

/s/ Daniel R. Sink |

|

|

|

Daniel R. Sink |

|

|

|

Executive Vice President and |

|

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

KITE REALTY GROUP, L.P. |

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

Daniel R. Sink |

|

|

|

Executive Vice President and |

|

|

|

Chief Financial Officer |

3

EXHIBIT INDEX

|

Exhibit Number |

|

Description |

|

10.1 |

|

Second Amendment to Fourth Amended and Restated Credit Agreement, dated as of June 29, 2015, by and among Kite Realty Group, L.P., Kite Realty Group Trust, KeyBank National Association, as Administrative Agent, and the other lenders party thereto. |

4

Exhibit 10.1

SECOND AMENDMENT TO

FOURTH AMENDED AND RESTATED CREDIT AGREEMENT

THIS SECOND AMENDMENT TO FOURTH AMENDED AND RESTATED CREDIT AGREEMENT (this “Amendment”) made as of the 29th day of June, 2015, by and among KITE REALTY GROUP, L.P., a Delaware limited partnership (“Borrower”), KITE REALTY GROUP TRUST, a real estate investment trust formed under the laws of the State of Maryland (“Guarantor”), KEYBANK NATIONAL ASSOCIATION, a national banking association (“KeyBank”), THE OTHER LENDERS WHICH ARE SIGNATORIES HERETO (KeyBank and the other lenders which are signatories hereto, collectively, the “Lenders”), and KEYBANK NATIONAL ASSOCIATION, a national banking association, as Administrative Agent for the Lenders (the “Agent”).

W I T N E S S E T H:

WHEREAS, Borrower, Agent, the Lenders and certain other parties entered into that certain Fourth Amended and Restated Credit Agreement dated as of July 1, 2014, as amended by that certain First Amendment to Fourth Amended and Restated Credit Agreement dated as of March 12, 2015 (as amended, the “Credit Agreement”); and

WHEREAS, Borrower desires to increase the Term Loan Commitment and has requested that the Agent and the Lenders make certain other modifications to the terms of the Credit Agreement; and

WHEREAS, certain of the Lenders desire to increase their Term Loan Commitments, and the Agent and the Lenders have agreed to make such other modifications subject to the execution and delivery by Borrower and Guarantor of this Amendment.

NOW, THEREFORE, for and in consideration of the sum of TEN and NO/100 DOLLARS ($10.00), and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto do hereby covenant and agree as follows:

1. Definitions. All the terms used herein which are not otherwise defined herein shall have the meanings set forth in the Credit Agreement.

2. Modification of the Credit Agreement. Borrower, the Lenders and Agent do hereby modify and amend the Credit Agreement as follows:

(a) By inserting the following definition in Section 1.1. of the Credit Agreement in the appropriate alphabetical order:

‘“Material Acquisition’ means (a) a single acquisition by Borrower or any of its Subsidiaries of properties or assets for a gross purchase price equal to or in excess of ten percent (10%) of Total Asset Value (determined without giving effect to such acquisition) or (b) one or more acquisitions by Borrower or any of its Subsidiaries of properties or assets in any two consecutive fiscal quarters for an aggregate gross

1

purchase price equal to or in excess of ten percent (10%) of Total Asset Value (determined without giving effect to such acquisitions).”

(b) By deleting in their entirety the definitions of “Interest Expense”, “Negative Pledge” and “Unencumbered Pool” appearing in Section 1.1. of the Credit Agreement, and inserting in lieu thereof the following:

“‘Interest Expense’ means, with respect to any Person, on any date of determination, without duplication, (a) total interest expense of such Person excluding any non-cash interest expense incurred (in accordance with GAAP) for the period of two fiscal quarters most recently ended, determined on a consolidated basis for such period, plus (b) such Person’s pro rata share of Interest Expense of Unconsolidated Affiliates for such period.

“Negative Pledge” means, with respect to a given asset, any provision of a document, instrument or agreement (other than any Loan Document) which prohibits or purports to prohibit the creation or assumption of any Lien on such asset as security for Indebtedness of the Person owning such asset or any other Person; provided, however, that the following shall not constitute a Negative Pledge: (a) an agreement that conditions a Person’s ability to encumber its assets (i) in order to be included in a pool of unencumbered assets to comply with financial covenant ratios with respect to Unsecured Indebtedness or (ii) upon the maintenance of one or more specified ratios that limit such Person’s ability to encumber its assets but that in each case do not generally prohibit the encumbrance of its assets, or the encumbrance of specific assets, or (b) a provision contained in any agreement that evidences Unsecured Indebtedness which contains restrictions on encumbering assets that are substantially similar to, or less restrictive than, those restrictions contained in the Loan Documents.

“Unencumbered Pool” means, as of any date of determination, (a) the Initial Unencumbered Pool Properties, plus (b) each other Eligible Unencumbered Pool Property which has been added to the Unencumbered Pool as of such date, plus (c) any Property approved by the Requisite Lenders in writing for inclusion in the Unencumbered Pool, minus (d) any Property which has been removed from the Unencumbered Pool by the Borrower or pursuant to this Agreement as of such date, minus (e) any Property which has been removed from the Unencumbered Pool pursuant to the next sentence hereof as of such date (and plus any Eligible Unencumbered Pool Property which has been added back into the Unencumbered Pool pursuant to the next sentence hereof), minus (f) any Unencumbered Pool Property which no longer satisfies the requirements of an Eligible Unencumbered Pool Property. In the event that all or any material portion of a Property then within the Unencumbered Pool shall be damaged or taken by condemnation, then, in the Agent’s reasonable discretion, such Property shall either be treated as a Renovation Property or no longer be a part of the Unencumbered Pool unless and until any damage to such Property is repaired or restored, such Property becomes fully operational and the Agent shall receive evidence satisfactory to the Agent of the projected Net Operating Income of such Property following such repair or

2

restoration. In the event that all or any material portion of any Construction-in-Process Property then within the Unencumbered Pool shall be damaged or taken by condemnation, then the Agent may reduce the amount of the Unencumbered Pool Value in an amount which the Agent reasonably deems appropriate in light of such damage or condemnation; or may remove such Construction-In-Process Property from the Unencumbered Pool unless and until such Construction-In-Process Property is repaired or restored to the Agent’s reasonable satisfaction.”

(c) By inserting the following sentence at the end of the definition of “Lien” appearing in Section 1.1. of the Credit Agreement:

“Any requirement in documentation evidencing or governing Unsecured Indebtedness that requires that such Unsecured Indebtedness be secured on an “equal and ratable” basis to the extent that other Unsecured Indebtedness is secured shall not constitute a Lien or a Negative Pledge, but there shall be a Lien to the extent any such security is granted.”

(d) By deleting in its entirety Section 4.1. of the Credit Agreement, and inserting in lieu thereof the following: “Section 4.1. [Reserved.]”.

(e) By deleting in its entirety Section 4.2. of the Credit Agreement, and inserting in lieu thereof the following:

“Section 4.2. Conditions Precedent to a Property Becoming an Eligible Unencumbered Pool Property.

No Property shall become an Eligible Unencumbered Pool Property until the Borrower shall have caused to be executed and delivered to the Agent, if such Property is owned by a Subsidiary that is not already a Guarantor or any Subsidiary which owns an interest therein is liable with respect to Unsecured Indebtedness and such Subsidiaries are not exempted from being a Guarantor pursuant to Section 4.3.(b), (i) an Accession Agreement executed by such Subsidiary, and (ii) all of the items that would have been required to be delivered to the Agent under Section 6.1.(a)(iv) through (vii) had such Subsidiary been a Loan Party on the Effective Date”.

(f) By deleting in its entirety Section 4.3.(a) of the Credit Agreement, and inserting in lieu thereof the following:

“(a) (i) From time to time the Borrower may request, upon not less than five (5) Business Days prior written notice to the Agent (or such shorter period as the Agent may agree in its sole discretion), that a Subsidiary that is a Guarantor solely pursuant to Section 4.3.(c)(ii) be released from the Guaranty, which release (the “Release”) shall be effected by the Agent if all of the following conditions are satisfied as of the date of such Release:

3

(ii) no Default or Event of Default has occurred and is then continuing or would occur or exist immediately after giving effect to such Release; and

(iii) Administrative Agent shall have received evidence satisfactory to it (which evidence may be in the form of a certificate from an officer of the Borrower certifying thereto) that such Subsidiary has not created, incurred, acquired, assumed, or suffered to exist and is not otherwise liable (whether as a borrower, co-borrower, guarantor or otherwise) with respect to any Unsecured Indebtedness (or simultaneously with the release hereunder will be released from liability with respect to such Unsecured Indebtedness). Nothing in this Section 4.3.(a) shall authorize the release of Parent from the Springing Guaranty.”

(g) By deleting in its entirety Section 7.1.(y) of the Credit Agreement, and inserting in lieu thereof the following:

“(y) Unencumbered Pool Properties. Each of the Unencumbered Pool Properties (other any Unencumbered Pool Property approved pursuant to clause (c) of the definition of “Unencumbered Pool”) satisfies all of the requirements contained in the definition of “Eligible Unencumbered Pool Property”. Each of the Unencumbered Pool Property Controlled Subsidiaries that owns (or leases pursuant to a Ground Lease) an Unencumbered Controlled Pool Property then included in the Unencumbered Pool satisfies the requirements of this Agreement to be an Unencumbered Pool Property Controlled Subsidiary.

(h) By deleting in its entirety the first (1st) sentence of Section 8.14 of the Credit Agreement, and inserting in lieu thereof the following:

“The Parent, the Borrower, each other Loan Party and each Borrowing Base Subsidiary shall each take such actions as are necessary to preserve its right and ability to pledge its interest in the Unencumbered Pool Properties to the Agent without any such pledge after the date hereof causing or permitting the acceleration (after the giving of notice or the passage of time, or otherwise) of any other Indebtedness of the Loan Parties or any of their respective Subsidiaries; provided, however, that this Section 8.14 shall not prohibit (a) an agreement that conditions a Person’s ability to encumber its assets to be included in a pool of unencumbered properties to comply with financial covenant ratios with respect to Unsecured Indebtedness or upon the maintenance of one or more specified ratios that limit such Person’s ability to encumber its assets but that in each case do not generally prohibit the encumbrance of its assets, or the encumbrance of specific assets or (b) a provision contained in any agreement that evidences Unsecured Indebtedness which contains restrictions on encumbering assets that are substantially similar to, or less restrictive than, those restrictions contained in the Loan Documents.

4

(i) By deleting the words “and 10.2.” appearing in the sixth (6th) line of Section 9.3. of the Credit Agreement and deleting the words “and the covenants in Sections 10.1.(i) and (j)” appearing in the last line of Section 9.3. of the Credit Agreement.

(j) By deleting in its entirety Section 10.1.(a) of the Credit Agreement, and inserting in lieu thereof the following:

“(a) Maximum Leverage Ratio. The Leverage Ratio to exceed the ratio of 0.60 to 1.00 at any time; provided, however, that for any one (1) period (but only one (1) period during the term of this Agreement) of up to four (4) consecutive fiscal quarters immediately following a Material Acquisition of which Borrower has given Agent written notice, the Leverage Ratio may exceed the ratio of 0.60 to 1.00 but shall not exceed the ratio of 0.65 to 1.00 during such period.”

(k) By deleting in its entirety Section 10.1.(g) of the Credit Agreement, and inserting in lieu thereof the following:

“(g) Unsecured Leverage. The ratio of (i) the aggregate Unsecured Indebtedness of the Parent, the Borrower, or any Subsidiary of Parent, determined on a consolidated basis, to (ii) Unencumbered Pool Value to exceed .60 to 1.00 at any time; provided, however, that for any one (1) period (but only one (1) period during the term of this Agreement) of up to four (4) consecutive fiscal quarters immediately following a Material Acquisition of which Borrower has given Agent written notice, the ratio of (x) the aggregate Unsecured Indebtedness of the Parent, the Borrower or any Subsidiary of Parent, determined on a consolidated basis, to (y) Unencumbered Pool Value may exceed 0.60 to 1.00 but shall not exceed the ratio of 0.65 to 1.00 during such period.”

(l) By deleting in their entireties Sections 10.1.(i) and 10.1.(j) of the Credit Agreement, and inserting in lieu thereof the following:

“(i) Reserved.

(j) Reserved.”

(m) By deleting in its entirety Section 10.2. of the Credit Agreement, and inserting in lieu thereof the following:

“Section 10.2. Restricted Payments.

The Borrower shall not, and shall not permit Parent or any of its Subsidiaries to, declare or make any Restricted Payment; provided, however, that the Parent and its Subsidiaries may declare and make Restricted Payments so long as no Default or Event of Default exists or would result therefrom. Notwithstanding the foregoing, but subject to the following sentence, if a Default or Event of Default exists, the Borrower

5

and Parent may only declare or make cash distributions to its shareholders for any fiscal year in an aggregate amount not to exceed the minimum amount necessary for the Parent to maintain its status as a REIT under the Internal Revenue Code and any Subsidiary may make Restricted Payments to the Borrower or any other Subsidiary of the Borrower. If an Event of Default specified in Section 11.1.(a) or (b), an Event of Default with respect to the Parent or the Borrower under Section 11.1.(f) or an Event of Default with respect to the Parent or the Borrower under Section 11.1.(g) shall exist, or if as a result of the occurrence of any other Event of Default any of the Obligations have been accelerated pursuant to Section 11.2.(a), the Borrower shall not, and shall not permit Parent or any Subsidiary to, make any Restricted Payments to any Person other than to the Borrower or any other Subsidiary of the Borrower.”

(n) By deleting in its entirety Section 10.4.(n) of the Credit Agreement, and inserting in lieu thereof the following:

“(n) provided that no Default or Event of Default exists or would result therefrom, repurchases of any common shares or other Equity Interests (or securities convertible into such interests) in the Parent;”

(o) By deleting in its entirety Section 10.6.(h) of the Credit Agreement, and inserting in lieu thereof the following:

“(h) the Parent, the Borrower or any Subsidiary may sell, transfer, contribute, master lease or otherwise dispose of any Property in an arm’s length transaction (or, if the transaction involves an Affiliate of the Borrower, if the transaction complies with Section 10.10), including, without limitation, a disposition of Properties pursuant to a merger or consolidation, provided, however, that (i) the same would not result in a Default or Event of Default and (ii) an Unencumbered Pool Property may not be sold, transferred or otherwise disposed of unless immediately thereafter and after giving effect thereto, the Borrower shall be in pro forma compliance with the covenants set forth in Section 10.1.;”

(p) By deleting in its entirety Section 10.9.(b) of the Credit Agreement, and inserting in lieu thereof the following:

“(b) if such agreements or documents relate to an Unencumbered Pool Property Controlled Subsidiary that owns (or leases pursuant to a Ground Lease) an Unencumbered Controlled Pool Property then included in the Unencumbered Pool, would cause such Unencumbered Pool Property Controlled Subsidiary to no longer satisfy the requirements to be one.”

(q) By deleting in its entirety Section 11.1.(l)(ii) of the Credit Agreement, and inserting in lieu thereof the following:

6

“(ii) During any period of 12 consecutive months ending after the Agreement Date, individuals who at the beginning of any such 12 month period constituted the Board of Trustees of the Parent (together with any new trustees whose election by such Board or whose nomination for election by the shareholders of the Parent was approved by a vote of a majority of the trustees then still in office who were either trustees at the beginning of such period or whose election or nomination for election was previously so approved) cease for any reason to constitute a majority of the Board of Trustees of the Parent then in office; or”

(r) By deleting in its entirety the last sentence of Section 11.1. of the Credit Agreement, and inserting in lieu thereof the following:

“In the event that there shall occur any Default that affects only certain Unencumbered Pool Property included in the calculation of the Unencumbered Pool Value, then the Borrower may elect to cure such Default (so long as no other Default or Event of Default exists or would arise as a result) by electing to have the Agent remove such Unencumbered Pool Property from the calculation of the Unencumbered Pool Value and the covenants in Section 10.1.(g) and (h) and by reducing the outstanding Unsecured Indebtedness by the amount necessary to cause compliance with the covenants in Section 10.1.(g) and (h) in a manner such that the Loans are repaid or prepaid on at least a ratable basis (determined based on the aggregate outstanding principal amount of Loans and any Letter of Credit Liabilities (provided, however, that the amount allocable to any Letter of Credit Liabilities that are not Reimbursement Obligations shall be used first to repay any Swingline Loans, second to repay Revolving Loans and then to Term Loans, and provided further that if repayment or prepayment of the Loans does not result in the repayment or prepayment of the Loans and Letter of Credit Liabilities on at least a ratable basis as provided herein, then such necessary amount shall be used to cash collateralize the amount of Letter of Credit Liabilities necessary for such ratable basis) and the aggregate outstanding principal amount of all other Unsecured Indebtedness receiving any repayment or prepayment on the date of such repayment or prepayment), in which event such removal and reduction shall be completed within five (5) Business Days after the earlier of (i) Borrower obtaining knowledge of such Default and (ii) receipt of notice of such Default from the Agent. In connection with removal, Borrower shall deliver to the Agent the items required to be delivered pursuant to Section 4.5. in connection with the removal of an ineligible property.”

(s) By deleting in its entirety Exhibit J (Form of Compliance Certificate) attached to the Credit Agreement, and inserting in lieu thereof Exhibit J attached hereto and made a part hereof.

3. Term Loan Commitments.

(a) In connection with the increase of the Term Loan Commitment pursuant to Section 2.16. of the Credit Agreement, as of the “Effective Date” (as hereinafter defined) of

7

this Amendment and following satisfaction of all conditions thereto as provided herein, the amount of each Term Loan Lender’s Term Loan Commitment shall be the amount set forth on Schedule 1 attached hereto and made a part hereof. In connection with the increase of the Term Loan Commitment, each Term Loan Lender that is increasing its Term Loan Commitment that was previously issued a Term Loan Note or that requests a Term Loan Note shall be issued on the Effective Date a replacement Term Loan Note in the principal face amount of its Term Loan Commitment, which will be a “Term Loan Note” under the Credit Agreement. Each such Note shall provide that it is a replacement for the existing Term Loan Note of each such Term Loan Lender, and following the Effective Date each increasing Term Loan Lender will promptly return to Borrower its existing Term Loan Note that is being replaced marked “Replaced”.

(b) Each Term Loan Lender that is increasing its Term Loan Commitment confirms that it has received copies of such documents and information as it has deemed appropriate to make its own credit analysis and decision to increase its Term Loan Commitment and has made its own decision to increase its Term Loan Commitment without reliance upon any Lender, Agent, any Titled Agent or any affiliate or subsidiary of any thereof.

(c) On the Effective Date of this Amendment, the Term Loan Lenders whose Term Loan Commitment is increasing shall advance, in accordance with and subject to the terms of the Credit Agreement, the amount of the increase in its Term Loan Commitment, which shall then be Term Loans under the Credit Agreement.

4. References to Credit Agreement. All references in the Loan Documents to the Credit Agreement shall be deemed a reference to the Credit Agreement, as modified and amended herein.

5. Acknowledgment of Borrower and Guarantor. Borrower and Guarantor hereby acknowledge, represent and agree that the Loan Documents, as modified and amended herein, remain in full force and effect and constitute the valid and legally binding obligation of Borrower and Guarantor, as applicable, enforceable against Borrower and Guarantor in accordance with their respective terms (except as enforceability is limited by bankruptcy, insolvency, reorganization, moratorium or other laws relating to or affecting generally the enforcement of creditors’ rights and the effect of general principles of equity), and that the execution and delivery of this Amendment does not constitute, and shall not be deemed to constitute, a release, waiver or satisfaction of Borrower’s or Guarantor’s obligations under the Loan Documents.

6. Representations and Warranties. Borrower and Guarantor represent and warrant to Agent and the Lenders as follows:

(a) Authorization. The execution, delivery and performance of this Amendment and the Term Loan Notes delivered pursuant hereto and the transactions contemplated hereby and thereby (i) are within the authority of Borrower and Guarantor, (ii) have been duly authorized by all necessary proceedings on the part of the Borrower and Guarantor, (iii) do not and will not conflict with or result in any breach or contravention of any provision of law, statute, rule or regulation to which any of the Borrower or Guarantor is subject or any judgment, order, writ, injunction, license or permit applicable to any of the Borrower or Guarantor, (iv) do not and will not conflict with or constitute a default (whether with the passage

8

of time or the giving of notice, or both) under any provision of the partnership agreement or certificate, certificate of formation, operating agreement, articles of incorporation or other charter documents or bylaws of, or any mortgage, indenture, agreement, contract or other instrument binding upon, any of the Borrower or Guarantor or any of their respective properties or to which any of the Borrower or Guarantor is subject, and (v) do not and will not result in or require the imposition of any lien or other encumbrance on any of the properties, assets or rights of any of the Borrower or Guarantor.

(b) Enforceability. This Amendment and the Term Loan Notes delivered pursuant hereto to which Borrower and Guarantor are a party are the valid and legally binding obligations of Borrower and Guarantor enforceable in accordance with the respective terms and provisions hereof, except as enforceability is limited by bankruptcy, insolvency, reorganization, moratorium or other laws relating to or affecting generally the enforcement of creditors’ rights and the effect of general principles of equity.

(c) Approvals. The execution, delivery and performance of this Amendment and the Term Loan Notes delivered pursuant hereto and the transactions contemplated hereby and thereby do not require the approval or consent of any Person or the authorization, consent, approval of or any license or permit issued by, or any filing or registration with, or the giving of any notice to, any court, department, board, commission or other governmental agency or authority other than those already obtained and any disclosure filings with the SEC as may be required with respect to this Amendment.

(d) Reaffirmation. Borrower and Guarantor reaffirm and restate as of the date hereof each and every representation and warranty made by the Borrower and Guarantor and their respective Subsidiaries in the Loan Documents or otherwise made by or on behalf of such Persons in connection therewith except for representations or warranties that expressly relate to an earlier date. Each representation or warranty made or deemed made by the Borrower or any other Loan Party in any Loan Document to which Borrower or any such Loan Party is a party is (and will be) true or correct in all material respects on the Effective Date (except for representations or warranties which expressly relate solely to an earlier date, in which case such representations and warranties shall have been true and correct in all material respects on and as of such earlier date) and except for changes in factual circumstances not prohibited under the Loan Documents.

7. No Default. By execution hereof, the Borrower and Guarantor certify that as of the date of this Amendment and immediately after giving effect to this Amendment (including after giving pro forma effect to the increase of the Term Loan Commitments and funding of the additional Term Loans), no Default or Event of Default has occurred and is continuing.

8. Waiver of Claims. Borrower and Guarantor acknowledge, represent and agree that none of such Persons has any defenses, setoffs, claims, counterclaims or causes of action of any kind or nature whatsoever arising on or before the date hereof with respect to the Loan Documents, the administration or funding of the Loan or with respect to any acts or omissions of Agent or any Lender, or any past or present officers, agents or employees of Agent or any Lender pursuant to or relating to the Loan Documents, and each of such Persons does hereby

9

expressly waive, release and relinquish any and all such defenses, setoffs, claims, counterclaims and causes of action arising on or before the date hereof, if any.

9. Ratification. Except as hereinabove set forth, all terms, covenants and provisions of the Credit Agreement remain unaltered and in full force and effect, and the parties hereto do hereby expressly ratify and confirm the Loan Documents as modified and amended herein. Guarantor hereby consents to the terms of this Amendment. Nothing in this Amendment or any other document delivered in connection herewith shall be deemed or construed to constitute, and there has not otherwise occurred, a novation, cancellation, satisfaction, release, extinguishment or substitution of the indebtedness evidenced by the Notes or the other obligations of Borrower and Guarantor under the Loan Documents.

10. Effective Date. This Amendment shall be deemed effective and in full force and effect (the “Effective Date”) upon confirmation by the Agent of the satisfaction of the following conditions:

(a) the execution and delivery of this Amendment by Borrower, Guarantor, Agent, the Requisite Lenders and each Lender whose Term Loan Commitment is increasing pursuant to this Amendment;

(b) the delivery to Agent of an opinion of counsel to the Borrower and the Guarantor addressed to the Agent and the Lenders covering such matters as the Agent may reasonably request;

(c) the delivery to Agent of a Term Loan Note duly executed by the Borrower in favor of each Lender whose Term Loan Commitment is increasing that was previously issued a Term Loan Note or that has otherwise requested a Term Loan Note in the amount set forth next to such Lender’s name on Schedule 1 attached hereto;

(d) receipt by Agent of evidence that the Borrower shall have paid all fees (including legal fees) due and payable with respect to this Amendment and the increase of the Term Loan Commitment;

(e) receipt by Agent of such other resolutions, certificates, documents, instruments and agreements as the Agent may reasonably request; and

(f) delivery to Agent of a Compliance Certificate, adjusted to give pro forma effect to the advance of the Term Loans to be made on or about the date hereof, and evidencing compliance with the covenants described in §9.3. of the Credit Agreement.

11. Amendment as Loan Document. This Amendment shall constitute a Loan Document.

12. Counterparts. This Amendment may be executed in any number of counterparts which shall together constitute but one and the same agreement.

13. MISCELLANEOUS. THIS AMENDMENT SHALL PURSUANT TO NEW YORK GENERAL OBLIGATIONS LAW SECTION 5-1401 BE GOVERNED BY AND

10

CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS EXECUTED, AND TO BE FULLY PERFORMED, IN SUCH STATE. This Amendment shall be binding upon and shall inure to the benefit of the parties hereto and their respective permitted successors, successors-in-title and assigns as provided in the Credit Agreement.

[Signatures on Next Page]

11

IN WITNESS WHEREOF, the parties hereto have hereto set their hands and affixed their seals as of the day and year first above written.

|

|

BORROWER: |

|

|

|

|

|

KITE REALTY GROUP, L.P., a Delaware limited partnership |

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole General Partner |

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

Daniel R. Sink, Executive Vice President and |

|

|

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

GUARANTOR: |

|

|

|

|

|

KITE REALTY GROUP TRUST |

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

Name: |

Daniel R. Sink |

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

LENDERS: |

|

|

|

|

|

KEYBANK NATIONAL ASSOCIATION, as |

|

|

Administrative Agent, as a Lender and as |

|

|

Swingline Lender |

|

|

|

|

|

|

|

|

By: |

/s/ James Komperda |

|

|

Name: |

James Komperda |

|

|

Title: |

Vice President |

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

WELLS FARGO BANK, NATIONAL |

|

|

ASSOCIATION, As Co-Documentation Agent |

|

|

with respect to the Revolver Loan, Syndication |

|

|

Agent with respect to the Term Loan and as a |

|

|

Lender |

|

|

|

|

|

|

|

|

By: |

/s/ Scott S. Solis |

|

|

Name: |

Scott S. Solis |

|

|

Title: |

Senior Vice President |

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

BANK OF AMERICA, N.A., |

|

|

As Syndication Agent with respect to the |

|

|

Revolving Loan, Co-Documentation Agent with |

|

|

respect to the Term Loan, and as a Lender |

|

|

|

|

|

|

|

|

By: |

/s/ Anne Q. Kruer |

|

|

Name: |

Anne Q. Kruer |

|

|

Title: |

Senior Vice President |

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

JPMORGAN CHASE BANK, N.A., |

|

|

As Co-Documentation Agent with respect to the |

|

|

Term Loan and as a Lender |

|

|

|

|

|

|

|

|

By: |

/s/ Elizabeth Johnson |

|

|

Name: |

Elizabeth Johnson |

|

|

Title: |

Executive Director |

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

CITIBANK, N.A. |

|

|

|

|

|

|

|

|

By: |

/s/ John Rowland |

|

|

Name: |

John Rowland |

|

|

Title: |

Vice President |

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

U.S. BANK NATIONAL ASSOCIATION, |

|

|

As Co-Documentation Agent with respect to the Revolving Loan and Term Loan and as a Lender |

|

|

|

|

|

|

|

|

By: |

/s/ Renee Lewis |

|

|

Name: |

Renee Lewis |

|

|

Title: |

Senior Vice President |

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

THE HUNTINGTON NATIONAL BANK |

|

|

|

|

|

|

|

|

By: |

/s/ Florentina Djulvezan |

|

|

Name: |

Florentina Djulvezan |

|

|

Title: |

Assistant Vice President |

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

REGIONS BANK |

|

|

|

|

|

|

|

|

By: |

/s/ Kerri L. Raines |

|

|

Name: |

Kerri L. Raines |

|

|

Title: |

Senior Vice President |

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

SUNTRUST BANK |

|

|

|

|

|

|

|

|

By: |

/s/ Michael L. Kauffman |

|

|

Name: |

Michael L. Kauffman |

|

|

Title: |

Senior Vice President |

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

FIFTH THIRD BANK, an Ohio banking corporation |

|

|

|

|

|

|

|

|

By: |

/s/ Michael P. Perillo |

|

|

Name: |

Michael P. Perillo |

|

|

Title: |

AVP |

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

BARCLAYS BANK PLC |

|

|

|

|

|

|

|

|

By: |

/s/ Vanessa Kurbatskiy |

|

|

Name: |

Vanessa Kurbatskiy |

|

|

Title: |

Vice President |

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

CAPITAL ONE, NATIONAL ASSOCIATION |

|

|

|

|

|

|

|

|

By: |

/s/ Frederick H. Denecke |

|

|

Name: |

Frederick H. Denecke |

|

|

Title: |

Senior Vice President |

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

PNC BANK, NATIONAL ASSOCIATION |

|

|

|

|

|

|

|

|

By: |

/s/ Thomas S. Silnes, Jr. |

|

|

Name: |

/s/ Thomas S. Silnes, Jr. |

|

|

Title: |

Vice President |

[Signatures Continued on Next Page]

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

|

|

ASSOCIATED BANK NATIONAL ASSOCIATION |

|

|

|

|

|

|

|

|

By: |

/s/ Shawn S. Bullock |

|

|

Name: |

Shawn S. Bullock |

|

|

Title: |

Senior Vice President |

Signature Page to Second Amendment to Fourth Amended and Restated Credit Agreement — KeyBank / Kite Realty 2015

SCHEDULE 1

|

Lender |

|

Term Loan Commitment |

|

|

KeyBank National Association |

|

$ |

35,000,000.00 |

|

|

Wells Fargo Bank, National Association |

|

$ |

35,000,000.00 |

|

|

Bank of America, N.A. |

|

$ |

35,000,000.00 |

|

|

JPMorgan Chase Bank, N.A. |

|

$ |

35,000,000.00 |

|

|

U.S. Bank National Association |

|

$ |

35,000,000.00 |

|

|

Regions Bank |

|

$ |

32,500,000.00 |

|

|

Suntrust Bank |

|

$ |

32,500,000.00 |

|

|

Fifth Third Bank |

|

$ |

32,500,000.00 |

|

|

The Huntington National Bank |

|

$ |

27,500,000.00 |

|

|

Barclays Bank PLC |

|

$ |

20,000,000.00 |

|

|

Capital One, National Association |

|

$ |

20,000,000.00 |

|

|

PNC Bank, National Association |

|

$ |

20,000,000.00 |

|

|

Associated Bank National Association |

|

$ |

20,000,000.00 |

|

|

Raymond James Bank, N.A. |

|

$ |

20,000,000.00 |

|

EXHIBIT J

FORM OF COMPLIANCE CERTIFICATE

, 201

KeyBank National Association, as Agent

Real Estate Capital

1200 Abernathy Road, N.E., Suite 1550

Atlanta, Georgia 30328

Attention: James Komperda

Each of the Lenders Party to the Credit Agreement referred to below

Ladies and Gentlemen:

Reference is made to that certain Fourth Amended and Restated Credit Agreement dated as of July 1, 2014 (as amended, restated, supplemented or otherwise modified from time to time, the “Credit Agreement”), by and among Kite Realty Group, L.P. (the “Borrower”), the financial institutions party thereto and their assignees under Section 13.5. thereof (the “Lenders”), KeyBank National Association, as Agent (the “Agent”) and the other parties thereto. Capitalized terms used herein, and not otherwise defined herein, have their respective meanings given them in the Credit Agreement.

Pursuant to Section 9.3. of the Credit Agreement, the undersigned hereby certifies to the Agent and the Lenders (not in his/her individual capacity but solely as an officer of the Borrower) as follows:

(1) The undersigned is the of the Borrower.

(2) The undersigned has examined the books and records of the Borrower and has conducted such other examinations and investigations as are reasonably necessary to provide this Compliance Certificate.

(3) To the undersigned’s knowledge, after reasonable due inquiry, no Default or Event of Default exists [if such is not the case, specify such Default or Event of Default and its nature, when it occurred and whether it is continuing and the steps being taken by the Borrower with respect to such event, condition or failure].

(4) Attached hereto as Schedule 1 are reasonably detailed calculations establishing whether or not the Borrower was in compliance with the covenants contained in Sections 10.1. of the Credit Agreement, and showing the calculation of Unencumbered Pool Value, Unsecured Debt Interest Coverage Ratio and listing the Unencumbered Pool Properties.

J-1

IN WITNESS WHEREOF, the undersigned has executed this certificate as of the date first above written.

J-2

SCHEDULE 1

[CALCULATIONS TO BE ATTACHED]

J-3

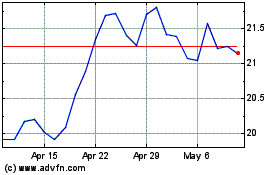

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

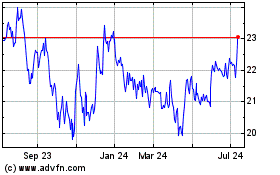

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024