Kite Realty Group Trust (NYSE: KRG) (the “Company”) announced

today operating results for the first quarter ended March 31, 2015.

Financial statements and exhibits attached to this release include

the details of these results.

“We kicked off 2015 with another strong quarter of operating

performance, balance sheet management and follow-through

execution,” said John A. Kite, Chairman and CEO. “We

continued to grow FFO and our free cash flow while also reporting

solid same-property NOI growth. The quarter’s results are a

testament to our portfolio’s strength, our operating expertise and

our team’s ability to execute and seamlessly integrate new,

high-growth assets. Our investment grade balance sheet and

upgraded operating systems remained core to our overall

strategy. We are energized and excited about the

future.”

First Quarter Highlights

- Generated FFO, as adjusted, of $42.3

million, or $0.50 per diluted common share, for the first

quarter.

- Adjusted Funds From Operations (“AFFO”)

growth of 13% year-over-year from $0.39 to $0.44 per diluted common

share.

- Same-property net operating income

(“NOI”) growth of 4.4% year-over-year.

- Aggregate cash rent spread of

9.0%.

- Closed final tranche of previously

announced 15-asset disposition for gross proceeds of $167

million.

- Completed development project at Phase

I of Parkside Town Commons in Raleigh, North Carolina, and moved

property to the operating portfolio.

- On April 1, acquired Colleyville Downs,

a 201,000 square foot Whole Foods-anchored shopping center located

in the Dallas MSA.

First Quarter Financial

Results

FFO, as adjusted, for the three months ended March 31, 2015, was

$42.3 million, or $0.50 per diluted common share, for real estate

properties in which the Company’s operating subsidiaries own an

interest (to which we refer to as “Kite Portfolio”), compared to

$17.5 million, or $0.51 per diluted common share, for the same

period in the prior year.

The reduction in FFO per diluted common share was primarily

driven by the 15-asset disposition completed in two tranches,

closing in December 2014 and March 2015.

Reported FFO, as defined by NAREIT, was $42.1 million, or $0.49

per diluted common share, for the Kite Portfolio, compared to $13.0

million, or $0.38 per diluted common share, for the same period in

the prior year.

Net income attributable to common shareholders for the three

months ended March 31, 2015, was $5.1 million compared to a net

income of $2.2 million for the same period in 2014.

Portfolio Activity During The First

Quarter

Development and Redevelopment

The first phase of Parkside Town Commons, which is anchored by

Target and Harris Teeter, was moved into operations in the first

quarter. The remaining development projects include Phase II of

Parkside Town Commons, Phase II of Holly Springs, and Tamiami

Crossing. These three projects were in the aggregate 79% pre-leased

or committed as of March 31, 2015, with a total estimated cost of

approximately $164.5 million, of which approximately $110.7 million

had been incurred as of March 31, 2015.

As of the first quarter, the primary anchors were both open at

the redevelopment project at Gainesville Plaza in Gainesville,

Florida. This project consists of 164,665 square feet, of which

81.6% is open, pre-leased or committed as of March 31, 2015, and is

anchored by Burlington Coat Factory and Ross Dress for Less, which

opened in March.

Dispositions

On September 16, 2014, the Company announced it had entered into

a definitive agreement to sell 15 operating properties. The sale

closed in two tranches, the first in December 2014 and the second

in March 2015. As a result of these sales, the Company exited four

states in which it did not have future growth plans. The second

tranche included 7 non-core assets and resulted in gross proceeds

of approximately $167 million, or net proceeds of $103 million.

Acquisitions

On April 2, 2015, the Company announced it had closed on the

acquisition of Colleyville Downs, a 201,000 square foot shopping

center located in the MSA of Dallas, Texas. The center is 92%

leased and anchored by Petco, Ace Hardware, and a newly constructed

Whole Foods Market that opened in 2014.

Portfolio Operations

As of March 31, 2015, the Company owned interests in 117

operating properties totaling approximately 23.3 million square

feet. The owned GLA in the Company’s retail operating portfolio was

94.9% leased as of March 31, 2015, and the Company’s overall

portfolio was 94.8% leased, excluding ground leases and non-owned

anchors.

Same-property net operating income, which includes 64 operating

properties, increased 4.4% in the first quarter of 2015 compared to

the same period in the prior year. The leased percentage of these

properties was 95.1% at March 31, 2015, compared to 95.3% at March

31, 2014, and the economic occupancy increased to 92.9% in the

first quarter from 91.5% at March 31, 2014.

The Company executed 77 leases totaling 377,470 square feet

during the first quarter of 2015. There were 52 comparable new and

renewal leases executed during the quarter for 275,949 owned square

feet. Cash spreads on new leases executed in the quarter were up

18.4%, while cash spreads on renewals were up 7.1%, for a blended

spread of 9.0%.

2015 Earnings Guidance

The Company is updating its guidance for FFO, as adjusted, for

the year ending December 31, 2015, to be between $1.93 to $2.00 per

diluted common share from $1.90 to $2.00 per diluted common share

and for net income to be within a range of $0.17 to $0.24 per

diluted common share.

While other factors may impact FFO and net income, the Company’s

2015 guidance is being updated based on the following

assumptions:

- An increase of 3.0% to 3.5% in

same-property NOI compared to the prior year from the initial

guidance range of 2.5% to 3.5%;

- An increase in acquisition assumptions

to $125 million from $80 million.

The Company’s 2015 guidance is based on a number of other

factors, many of which are outside the Company’s control and all of

which are subject to change. The Company may change its guidance

during the year if actual and anticipated results vary from these

assumptions.

Following is a reconciliation of the range of 2015 estimated net

income per diluted common share to estimated FFO per diluted common

share:

Updated Guidance Range for Full Year 2015

Low

High

Consolidated net income per diluted common share $0.17 $0.24

Less: Dividends on preferred shares

(0.10)

(0.10)

Add: Depreciation, amortization and other 1.89 1.89 Less: Gain on

sale of operating property

(0.03)

(0.03)

FFO, as adjusted, per diluted common share (1)

$1.93 $2.00

(1) Excludes acquisition costs.

Non-GAAP Financial Measures

Given the nature of the Company’s business as a real estate

owner and operator, the Company believes that FFO, FFO, as

adjusted, and AFFO are helpful to investors when measuring

operating performance because they exclude various items included

in net income or loss that do not relate to or are not indicative

of operating performance, such as gains or losses from sales and

impairments of operating properties and depreciation and

amortization, which can make periodic and peer analyses of

operating performance more difficult. We believe this supplemental

information provides a more meaningful measure of our operating

performance. The Company believes presenting FFO, FFO, as adjusted,

and AFFO in this manner allows investors and other interested

parties to form a more meaningful assessment of the Company’s

operating results. Reconciliations of net income to FFO, FFO, as

adjusted, and AFFO are included in the attached table.

Earnings Conference Call

The Company will conduct a conference call to discuss its

financial results on Friday, May 1, 2015, at 11:00 a.m. Eastern

Time. A live webcast of the conference call will be available

online on the Company’s corporate website at www.kiterealty.com.

The dial-in numbers are (866) 543-6403 for domestic callers and

(617) 213-8896 for international callers (passcode 68574736). In

addition, a webcast replay link will be available on the corporate

website.

About Kite Realty Group

Trust

Kite Realty Group Trust is a full-service, vertically integrated

real estate investment trust engaged in the ownership, operation,

management, leasing, acquisition, construction, redevelopment and

development of neighborhood and community shopping centers in

selected markets in the United States. As of March 31, 2015, the

Company owned interests in a portfolio of 120 operating,

development and redevelopment properties totaling approximately 24

million total square feet across 22 states. For more information,

please visit the Company’s website at www.kiterealty.com.

Safe Harbor

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Such statements

are based on assumptions and expectations that may not be realized

and are inherently subject to risks, uncertainties and other

factors, many of which cannot be predicted with accuracy and some

of which might not even be anticipated. Future events and actual

results, performance, transactions or achievements, financial or

otherwise, may differ materially from the results, performance,

transactions or achievements, financial or otherwise, expressed or

implied by the forward-looking statements. Risks, uncertainties and

other factors that might cause such differences, some of which

could be material, include, but are not limited to: national and

local economic, business, real estate and other market conditions,

particularly in light of low growth in the U.S. economy, financing

risks, including the availability of and costs associated with

sources of liquidity, the Company’s ability to refinance, or extend

the maturity dates of, its indebtedness, the level and volatility

of interest rates, the financial stability of tenants, including

their ability to pay rent and the risk of tenant bankruptcies, the

competitive environment in which the Company operates, acquisition,

disposition, development, joint venture, property ownership and

management risks, the Company’s ability to maintain its status as a

real estate investment trust for federal income tax purposes,

potential environmental and other liabilities, impairment in the

value of real estate property the Company owns, risks related to

the geographical concentration of our properties in Florida,

Indiana and Texas, the dilutive effects of future offerings of

issuing additional securities, and other factors affecting the real

estate industry generally. The Company refers you to the documents

filed by the Company from time to time with the Securities and

Exchange Commission, specifically the section titled “Risk Factors”

in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2014, which discuss these and other factors that could

adversely affect the Company’s results. The Company undertakes no

obligation to publicly update or revise these forward-looking

statements, whether as a result of new information, future events

or otherwise.

Kite Realty Group Trust Consolidated

Balance Sheets (Unaudited) March 31,

December 31, 2015 2014 Assets:

Investment properties, at cost $ 3,753,405,895 $ 3,732,747,979

Less: accumulated depreciation (347,763,694 ) (315,092,881 )

3,405,642,201 3,417,655,098 Cash and cash equivalents1

126,743,610 43,825,526 Tenant and other receivables, including

accrued straight-line rent of $19,871,143 and $18,629,987,

respectively, net of allowance for uncollectible accounts

42,420,970 48,096,669 Restricted cash and escrow deposits

17,598,342 16,170,973 Deferred costs and intangibles, net

154,075,705 159,977,680 Prepaid and other assets 11,843,056

8,847,088 Assets held for sale — 179,642,501

Total

Assets $ 3,758,323,884 $ 3,874,215,535

Liabilities and Shareholders’ Equity: Mortgage and other

indebtedness2 $ 1,569,420,326 $ 1,554,263,020 Accounts payable and

accrued expenses 82,956,921 75,149,213 Deferred revenue and other

liabilities 134,211,750 136,409,308 Liabilities held for sale —

81,164,271

Total Liabilities 1,786,588,997

1,846,985,812 Commitments and contingencies Limited Partners’

interests in the Operating Partnership and other redeemable

noncontrolling interests 91,146,685 125,082,085

Shareholders’

Equity: Kite Realty Group Trust Shareholders’ Equity:

Preferred Shares, $.01 par value, 40,000,000 shares authorized,

4,100,000 shares issued and outstanding at March 31, 2015 and

December 31, 2014, respectively 102,500,000 102,500,000 Common

Shares, $.01 par value, 450,000,000 shares authorized, 83,579,854

and 83,490,663 shares issued and outstanding at March 31, 2015 and

December 31, 2014, respectively 835,799 834,907 Additional paid in

capital 2,043,740,457 2,044,424,643 Accumulated other comprehensive

loss (4,339,357 ) (1,174,755 ) Accumulated deficit (265,511,996 )

(247,801,217 )

Total Kite Realty Group Trust Shareholders’

Equity 1,877,224,903 1,898,783,578 Noncontrolling Interests

3,363,299 3,364,060

Total Equity 1,880,588,202

1,902,147,638

Total Liabilities and Shareholders'

Equity $ 3,758,323,884 $ 3,874,215,535

____________________ 1 Includes $94.7 million

at March 31, 2015 of funds set aside by the Company to affect a tax

deferred purchase of real estate. 2 Includes debt premium of $26.8

million at March 31, 2015.

Kite Realty Group

Trust Consolidated Statements of Operations For the

Three Months Ended March 31, 2015 and 2014

(Unaudited)

Three Months Ended

March 31, 2015 2014 Revenue:

Minimum rent $ 65,479,387 $ 31,260,036 Tenant reimbursements

18,615,086 9,162,860 Other property related revenue 2,734,139

2,237,015

Total revenue 86,828,612 42,659,911

Expenses: Property operating 12,724,292 7,315,255 Real

estate taxes 10,021,249 5,113,023 General, administrative, and

other 5,005,846 3,106,102 Merger and acquisition costs 159,497

4,480,389 Depreciation and amortization 40,435,238

17,439,606

Total expenses 68,346,122

37,454,375

Operating income 18,482,490 5,205,536

Interest expense (13,932,987 ) (7,382,845 ) Income tax (expense)

benefit of taxable REIT subsidiary (55,101 ) 53,146 Other income

(expense), net 4,514 (92,944 )

Income/(loss) from

continuing operations 4,498,916 (2,217,107 )

Discontinued

operations: Gain on sale of operating property

—

3,198,772

Income from discontinued operations

—

3,198,772

Income before gain on sale of operating

properties 4,498,916 981,665 Gain on sales of operating

properties 3,362,944 3,489,338

Net income

7,861,860 4,471,003

Less: Net income attributable to

noncontrolling interest (683,066 ) (138,912 )

Less:

Dividends on preferred shares (2,114,063 ) (2,114,063 )

Net

income attributable to Kite Realty Group Trust common

shareholders $ 5,064,731 $ 2,218,028

Income (loss) per common share - basic and diluted:

Continuing operations $ 0.06 $ (0.03 ) Discontinued operations —

0.10

$ 0.06 $ 0.07

Weighted average

common shares outstanding - basic 83,532,092 32,755,898

Weighted average common shares outstanding - diluted

83,625,352 32,755,898

Common Dividends declared

per common share $ 0.2725 $ 0.2600

Amounts attributable to Kite Realty Group Trust common

shareholders: Income (loss) from continuing operations $

5,064,731 $ (826,614 )

Income from discontinued operations —

3,044,642

Net Income $ 5,064,731 $

2,218,028

Kite Realty Group Trust

Funds From Operations For the Three Months Ended March

31, 2015 and 2014 (Unaudited) Three Months

Ended March 31, 2015 2014 Funds

From Operations Consolidated net income $ 7,861,860 $ 4,471,003

Less: dividends on preferred shares (2,114,063 ) (2,114,063 ) Less:

net income attributable to noncontrolling interests in properties

(586,952 ) (26,633 ) Less: gains on sales of operating properties

(3,362,944 ) (6,688,110 ) Add: depreciation and amortization of

consolidated entities, net of noncontrolling interests 40,292,904

17,342,631 Funds From Operations of the Operating

Partnership 42,090,805 12,984,828 Less Limited Partners' interests

in Funds From Operations (806,598 ) (624,852 ) Funds From

Operations allocable to the Company1 $ 41,284,207 $

12,359,976 FFO per share of the Operating Partnership -

basic $ 0.49 $ 0.38 FFO per share of the Operating

Partnership - diluted $ 0.49 $ 0.38 Funds From

Operations of the Operating Partnership $ 42,090,805 $ 12,984,828

Add: Merger and acquisition costs 159,497 4,480,389

Funds From Operations of the Kite Portfolio, as adjusted $

42,250,302 $ 17,465,217 FFO per share of the

Operating Partnership, as adjusted - basic $ 0.50 $ 0.51

FFO per share of the Operating Partnership, as adjusted -

diluted $ 0.50 $ 0.51 Weighted average Common

Shares outstanding - basic 83,532,092 32,755,898

Weighted average Common Shares outstanding - diluted 83,625,352

32,806,581 Weighted average Common Shares and Units

outstanding - basic 85,172,613 34,416,602 Weighted

average Common Shares and Units outstanding - diluted 85,265,873

34,467,286 ____________________ 1

“Funds From Operations of the Kite Portfolio measures 100% of the

operating performance of the Operating Partnership’s real estate

properties and construction and service subsidiaries in which the

Company owns an interest. “Funds From Operations allocable to the

Company” reflects a reduction for the redeemable noncontrolling

weighted average diluted interest in the Operating Partnership. 2

Excludes merger and acquisition costs.

Kite Realty Group

Trust Same Property Net Operating Income For the

Three Months Ended March 31, 2015 and 2014 (Unaudited)

Three Months Ended March 31, 2015

2014 % Change Number of properties at period

end1 64 64

Leased percentage at period end 95.1 %

95.3 %

Economic Occupancy percentage at period end2

92.9 % 91.5 % Minimum rent $ 29,021,553 $ 27,966,426 Tenant

recoveries 8,848,126 8,681,946 Other income 853,908 999,686

38,723,587 37,648,058 Property operating expenses

(7,635,289 ) (7,870,742 ) Real estate taxes (5,122,479 ) (4,916,450

) (12,757,768 ) (12,787,192 )

Net operating income - same

properties (64 properties)3 $ 25,965,819

$ 24,860,866 4.4 %

Reconciliation to Most Directly Comparable GAAP Measure: Net

operating income - same properties $ 25,965,819 $ 24,860,866 Net

operating income - non-same activity 38,117,252 5,370,767 Other

expense, net (50,587 ) (39,798 ) General, administrative and other

(5,005,846 ) (3,106,102 ) Merger and acquisition costs (159,497 )

(4,480,389 ) Depreciation expense (40,435,238 ) (17,439,606 )

Interest expense (13,932,987 ) (7,382,845 ) Discontinued operations

— 3,198,772 Gains on sales of operating properties 3,362,944

3,489,338 Net income attributable to noncontrolling interests

(683,066 ) (138,912 ) Dividends on preferred shares (2,114,063 )

(2,114,063 ) Net income attributable to common shareholders $

5,064,731 $ 2,218,028 ____________________ 1

Same property NOI analysis excludes operating properties in

redevelopment. 2 Excludes leases that are signed but for which

tenants have not commenced payment of cash rent. 3 Same property

NOI excludes net gains from outlot sales, straight-line rent

revenue, bad debt expense and related recoveries, lease termination

fees, amortization of lease intangibles and significant prior year

expense recoveries and adjustments, if any.

The Company believes that Net Operating Income is helpful to

investors as a measure of its operating performance because it

excludes various items included in net income that do not relate to

or are not indicative of its operating performance, such as

depreciation and amortization, interest expense, and impairment, if

any. The Company believes that Same Property NOI is helpful to

investors as a measure of its operating performance because it

includes only the NOI of properties that have been owned for the

full period presented, which eliminates disparities in net income

due to the redevelopment, acquisition or disposition of properties

during the particular period presented, and thus provides a more

consistent metric for the comparison of the Company's properties.

NOI and Same Property NOI should not, however, be considered as

alternatives to net income (calculated in accordance with GAAP) as

indicators of the Company's financial performance.

Kite Realty Group TrustMedia & Investor RelationsMaggie

Kofkoff, CFA, 317-713-7644mkofkoff@kiterealty.com

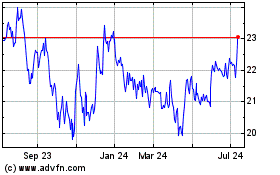

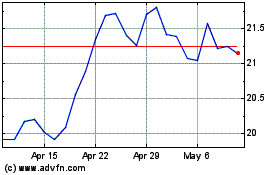

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024