UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 12, 2015

KITE REALTY GROUP TRUST

KITE REALTY GROUP, L.P.

(Exact name of registrant as specified in its charter)

|

Maryland |

|

001-32268 |

|

11-3715772 |

|

Delaware |

|

333-202666-01 |

|

20-1453863 |

|

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of incorporation) |

|

File Number) |

|

Identification Number) |

|

30 S. Meridian Street |

|

Suite 1100 |

|

Indianapolis, IN 46204 |

|

(Address of principal executive offices) (Zip Code) |

|

|

|

(317) 577-5600 |

|

(Registrant’s telephone number, including area code) |

|

|

|

Not applicable |

|

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

First Amendment to Fourth Amended and Restated Credit Agreement

On March 12, 2015, Kite Realty Group Trust (the “Company”), Kite Realty Group, L.P. (the “Operating Partnership”) and certain of the Operating Partnership’s subsidiaries entered into the First Amendment (the “Amendment”) to the Fourth Amended and Restated Credit Agreement (the “Amended Credit Agreement”), dated as of July 1, 2014, by and among the Operating Partnership, KeyBank National Association, as Administrative Agent (the “Agent”), and the other lenders party thereto. As previously disclosed, certain subsidiaries of the Operating Partnership (collectively, the “Subsidiary Guarantors”) have guaranteed payment and performance of the Operating Partnership’s obligations under the Amended Credit Agreement pursuant to a Third Amended and Restated Guaranty, dated as of July 1, 2014 (the “Guaranty”). Pursuant to the Amendment, the Agent has agreed to release any Subsidiary Guarantor from the Guaranty upon receipt from the Operating Partnership of notice that the Company or Operating Partnership has received an investment grade credit rating and certification that the applicable Subsidiary Guarantor is not liable (or will not continue to be liable) with respect to any unsecured indebtedness, provided that no default or event of default exists or would arise as a result of such release (the “Release Conditions”). The Amendment also provides that, following such notification from the Operating Partnership any subsidiary of the Operating Partnership that becomes liable with respect to any unsecured indebtedness must be made a guarantor under the Guaranty.

On March 17, 2015, in accordance with the terms of the Amendment, the Agent delivered a letter to the Company acknowledging that the Release Conditions have been satisfied and that the Agent, for itself and on behalf of the other lenders, has released all of the Subsidiary Guarantors from any and all liabilities or obligations under the Guaranty. In light of the foregoing, there are currently no subsidiary guarantors of the Operating Partnership’s obligations under the Amended Credit Agreement.

In addition to the foregoing, the Amendment also changes the calculation of unsecured debt interest expense, which is used for purposes of calculating the unsecured debt interest coverage ratio, to be the actual interest expense incurred. Previously, unsecured debt interest expense was the greater of the actual interest expense incurred and an implied expense based on an assumed 6.0% interest rate.

The foregoing summary is not complete and is qualified in its entirety by reference to the copy of the Amendment, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number |

|

Description |

|

10.1 |

|

First Amendment to Fourth Amended and Restated Credit Agreement, dated as of March 12, 2015, by and among Kite Realty Group Trust, Kite Realty Group, L.P., certain subsidiaries of Kite Realty Group, L.P., KeyBank National Association, as Administrative Agent, and the other lenders party thereto. |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

KITE REALTY GROUP TRUST |

|

|

|

|

|

Date: March 18, 2015 |

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

|

|

Daniel R. Sink |

|

|

|

Executive Vice President and |

|

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

KITE REALTY GROUP, L.P. |

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

|

|

Daniel R. Sink |

|

|

|

Executive Vice President and |

|

|

|

Chief Financial Officer |

|

|

|

|

3

EXHIBIT INDEX

|

Exhibit Number |

|

Description |

|

10.1 |

|

First Amendment to Fourth Amended and Restated Credit Agreement, dated as of March 12, 2015, by and among Kite Realty Group Trust, Kite Realty Group, L.P., certain subsidiaries of Kite Realty Group, L.P., KeyBank National Association, as Administrative Agent, and the other lenders party thereto. |

4

Exhibit 10.1

FIRST AMENDMENT TO

FOURTH AMENDED AND RESTATED CREDIT AGREEMENT

THIS FIRST AMENDMENT TO FOURTH AMENDED AND RESTATED CREDIT AGREEMENT (this “Amendment”) made as of the 12th day of March, 2015, by and among KITE REALTY GROUP, L.P., a Delaware limited partnership (“Borrower”), KITE REALTY GROUP TRUST, a real estate investment trust formed under the laws of the State of Maryland (“REIT”), the Subsidiaries executing below as Guarantors (the “Subsidiary Guarantors”; REIT and the Subsidiary Guarantors, collectively the “Guarantors”), KEYBANK NATIONAL ASSOCIATION, a national banking association (“KeyBank”), THE OTHER LENDERS WHICH ARE SIGNATORIES HERETO (KeyBank and the other lenders which are signatories hereto, collectively, the “Lenders”), and KEYBANK NATIONAL ASSOCIATION, a national banking association, as Administrative Agent for the Lenders (the “Agent”).

W I T N E S S E T H:

WHEREAS, Borrower, Agent, the Lenders and certain other parties entered into that certain Fourth Amended and Restated Credit Agreement dated as of July 1, 2014 (the “Credit Agreement”); and

WHEREAS, Borrower has requested that the Agent and the Lenders make certain modifications to the terms of the Credit Agreement; and

WHEREAS, the Agent and the Lenders have agreed to make such modifications subject to the execution and delivery by Borrower and Guarantors of this Amendment.

NOW, THEREFORE, for and in consideration of the sum of TEN and NO/100 DOLLARS ($10.00), and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto do hereby covenant and agree as follows:

1. Definitions. All the terms used herein which are not otherwise defined herein shall have the meanings set forth in the Credit Agreement.

2. Modification of the Credit Agreement. Borrower, the Lenders and Agent do hereby modify and amend the Credit Agreement as follows:

(a) By deleting in its entirety the definition of “Unsecured Debt Interest Expense”, appearing in Section 1.1. of the Credit Agreement, and inserting in lieu thereof the following:

“Unsecured Debt Interest Expense” means on any date of determination, the product of (a) actual incurred interest expense with respect to Unsecured Indebtedness of Parent, Borrower and their Subsidiaries for the period of two fiscal quarters most recently ended, multiplied by (b) 2, determined on a consolidated basis for such period.”

1

(b) By deleting in their entirety Sections 4.3.(b) and (c) of the Credit Agreement, and inserting in lieu thereof the following:

“(b) Upon receipt by the Administrative Agent of written notice from Borrower that Borrower or Parent has received an Investment Grade Rating from a Rating Agency (the “Investment Grade Rating Event”), and provided that no Default or Event of Default exists or would arise as a result thereof, Administrative Agent shall release any Subsidiary from the Guaranty upon receipt by Administrative Agent of a certificate from an officer of the Borrower certifying that such Subsidiary has not created, incurred, acquired, assumed, or suffered to exist and is not otherwise liable (whether as a borrower, co-borrower, guarantor or otherwise) with respect to any Unsecured Indebtedness (or simultaneously with the release hereunder will be released from liability with respect to such Unsecured Indebtedness). Nothing in this Section 4.3. shall authorize the release of Parent from the Springing Guaranty.

(c) Notwithstanding the foregoing, (i) if at any time prior to the occurrence of the Investment Grade Rating Event any Subsidiary of Borrower directly or indirectly owning any interest in a Borrowing Base Subsidiary shall have created, incurred, acquired, assumed, suffered to exist or is or becomes otherwise liable with respect to any Unsecured Indebtedness, whether as a borrower, co-borrower, guarantor, or otherwise, or (ii) commencing upon the occurrence of the Investment Grade Rating Event and continuing thereafter, any Subsidiary of Borrower shall create, incur, acquire, assume, suffer to exist or is or becomes otherwise liable with respect to any Unsecured Indebtedness, whether as a borrower, co-borrower, guarantor or otherwise, then in either case Borrower shall simultaneously cause such Subsidiary to become a Guarantor and to deliver to Agent an Accession Agreement and the other documents required by Section 4.2. to be delivered with respect to a new Guarantor.”

(c) By inserting the following sentence to the end of Section 10.12. of the Credit Agreement:

“Nothing in this Section 10.12. or elsewhere in the Loan Documents shall prohibit the merger of KRG Magellan into Borrower, with Borrower being the surviving entity, or the transfer by KRG Magellan of all of its assets to Borrower and the subsequent dissolution of KRG Magellan.”

3. References to Credit Agreement. All references in the Loan Documents to the Credit Agreement shall be deemed a reference to the Credit Agreement, as modified and amended herein.

4. Acknowledgment of Borrower and Guarantors. Borrower and Guarantors hereby acknowledge, represent and agree that the Loan Documents, as modified and amended herein,

2

remain in full force and effect and constitute the valid and legally binding obligation of Borrower and Guarantors, as applicable, enforceable against Borrower and Guarantors in accordance with their respective terms (except as enforceability is limited by bankruptcy, insolvency, reorganization, moratorium or other laws relating to or affecting generally the enforcement of creditors’ rights and the effect of general principles of equity), and that the execution and delivery of this Amendment does not constitute, and shall not be deemed to constitute, a release, waiver or satisfaction of Borrower’s or any Guarantor’s obligations under the Loan Documents.

5. Representations and Warranties. Borrower and Guarantors represent and warrant to Agent and the Lenders as follows:

(a) Authorization. The execution, delivery and performance of this Amendment and the transactions contemplated hereby (i) are within the authority of Borrower and Guarantors, (ii) have been duly authorized by all necessary proceedings on the part of the Borrower and Guarantors, (iii) do not and will not conflict with or result in any breach or contravention of any provision of law, statute, rule or regulation to which any of the Borrower or Guarantors is subject or any judgment, order, writ, injunction, license or permit applicable to any of the Borrower or Guarantors, (iv) do not and will not conflict with or constitute a default (whether with the passage of time or the giving of notice, or both) under any provision of the partnership agreement or certificate, certificate of formation, operating agreement, articles of incorporation or other charter documents or bylaws of, or any mortgage, indenture, agreement, contract or other instrument binding upon, any of the Borrower or Guarantors or any of their respective properties or to which any of the Borrower or Guarantors is subject, and (v) do not and will not result in or require the imposition of any lien or other encumbrance on any of the properties, assets or rights of any of the Borrower or Guarantors.

(b) Enforceability. This Amendment is the valid and legally binding obligations of Borrower and Guarantors enforceable in accordance with the respective terms and provisions hereof, except as enforceability is limited by bankruptcy, insolvency, reorganization, moratorium or other laws relating to or affecting generally the enforcement of creditors’ rights and the effect of general principles of equity.

(c) Approvals. The execution, delivery and performance of this Amendment and the transactions contemplated hereby do not require the approval or consent of any Person or the authorization, consent, approval of or any license or permit issued by, or any filing or registration with, or the giving of any notice to, any court, department, board, commission or other governmental agency or authority other than those already obtained and any disclosure filings with the SEC as may be required with respect to this Amendment.

(d) Reaffirmation. Borrower and Guarantors reaffirm and restate as of the date hereof each and every representation and warranty made by the Borrower and Guarantors and their respective Subsidiaries in the Loan Documents or otherwise made by or on behalf of such Persons in connection therewith except for representations or warranties that expressly relate to an earlier date.

3

6. No Default. By execution hereof, the Borrower and Guarantors certify that as of the date of this Amendment and immediately after giving effect to this Amendment, no Default or Event of Default has occurred and is continuing.

7. Waiver of Claims. Borrower and Guarantors acknowledge, represent and agree that none of such Persons has any defenses, setoffs, claims, counterclaims or causes of action of any kind or nature whatsoever arising on or before the date hereof with respect to the Loan Documents, the administration or funding of the Loan or with respect to any acts or omissions of Agent or any Lender, or any past or present officers, agents or employees of Agent or any Lender pursuant to or relating to the Loan Documents, and each of such Persons does hereby expressly waive, release and relinquish any and all such defenses, setoffs, claims, counterclaims and causes of action arising on or before the date hereof, if any.

8. Ratification. Except as hereinabove set forth, all terms, covenants and provisions of the Credit Agreement remain unaltered and in full force and effect, and the parties hereto do hereby expressly ratify and confirm the Loan Documents as modified and amended herein. Guarantors hereby consent to the terms of this Amendment. Nothing in this Amendment or any other document delivered in connection herewith shall be deemed or construed to constitute, and there has not otherwise occurred, a novation, cancellation, satisfaction, release, extinguishment or substitution of the indebtedness evidenced by the Notes or the other obligations of Borrower and Guarantors under the Loan Documents.

9. Effective Date. This Amendment shall be deemed effective and in full force and effect as of the date hereof upon the execution and delivery of this Amendment by Borrower, Guarantors, Agent and all of the Lenders. The Borrower will pay the reasonable fees and expenses of Agent in connection with this Amendment in accordance with Section 13.2. of the Credit Agreement.

10. Amendment as Loan Document. This Amendment shall constitute a Loan Document.

11. Counterparts. This Amendment may be executed in any number of counterparts which shall together constitute but one and the same agreement.

12. MISCELLANEOUS. THIS AMENDMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS EXECUTED, AND TO BE FULLY PERFORMED, IN SUCH STATE. This Amendment shall be binding upon and shall inure to the benefit of the parties hereto and their respective permitted successors, successors-in-title and assigns as provided in the Credit Agreement.

[Signatures on Next Page]

4

IN WITNESS WHEREOF, the parties hereto have hereto set their hands and affixed their seals as of the day and year first above written.

|

|

BORROWER: |

|

|

|

|

|

|

|

|

KITE REALTY GROUP, L.P., a Delaware limited partnership |

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole General Partner |

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

Daniel R. Sink, Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GUARANTORS: |

|

|

|

|

|

|

|

|

KITE REALTY GROUP TRUST |

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

Name: |

Daniel R. Sink |

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

|

|

KRG MAGELLAN, LLC |

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

[Signatures Continued on Next Page]

5

|

|

EACH GUARANTOR WHICH IS A SUBSIDIARY AS LISTED ON SCHEDULE 1 |

|

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., the sole member of each such Guarantor |

|

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

|

|

EACH GUARANTOR WHICH IS A SUBSIDIARY AS LISTED ON SCHEDULE 2 |

|

|

|

|

|

|

|

|

By: |

KRG Magellan, LLC, the sole member of each such Guarantor |

|

|

|

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

|

[Signatures Continued on Next Page]

6

|

|

KRG FRISCO WESTSIDE, LLC (formerly known as Inland Diversified Frisco Westside, L.L.C.) |

|

|

KRG GOLDSBORO MEMORIAL, LLC (formerly known as Inland Diversified Goldsboro Memorial, L.L.C.) |

|

|

KRG AIKEN HITCHCOCK, LLC (formerly known as Inland Diversified Aiken Hitchcock, L.L.C.) |

|

|

|

|

|

|

|

By: |

Bulwark, LLC, the sole member of each such Guarantor |

|

|

|

|

|

|

|

|

By: |

Splendido Real Estate, LLC, its sole member |

|

|

|

|

|

|

|

|

|

|

By: |

KRG Magellan, LLC, its sole member |

|

|

|

|

|

|

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

KRG TEMPLE TERRACE, LLC (formerly known as Inland Diversified/Vlass Temple Terrace JV, L.L.C.) |

|

|

|

|

|

|

|

|

|

|

|

By: |

KRG Temple Terrace Member, LLC, its manager |

|

|

|

|

|

|

|

|

|

|

|

|

By: |

KRG Magellan, LLC, its sole member |

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

|

|

|

[Signatures Continued on Next Page]

7

|

|

KRG COURTHOUSE SHADOWS, LLC |

|

|

|

|

|

|

By: |

KRG Courthouse Shadows I, LLC, its sole member |

|

|

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

|

|

|

CORNER ASSOCIATES, LP |

|

|

|

|

|

|

|

|

|

By: |

KRG Corner Associates, LLC, its sole general partner |

|

|

|

|

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

|

|

|

KITE REALTY EDDY STREET LAND, LLC |

|

|

|

|

|

|

|

|

|

By: |

Kite Realty Holding, LLC, its sole member |

|

|

|

|

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

[Signatures Continued on Next Page]

8

|

|

KITE REALTY NEW HILL PLACE, LLC |

|

|

|

|

|

By: |

Kite Realty Development, LLC, their sole member |

|

|

|

|

|

|

By: |

Kite Realty Holding, LLC, its sole member |

|

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

KRG PIPELINE POINTE, LP |

|

|

KRG SUNLAND II, LP |

|

|

|

|

|

By: |

KRG Texas, LLC, their sole general partner |

|

|

|

|

|

|

By: |

KRG Capital, LLC, its sole member |

|

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

[Signatures Continued on Next Page]

9

|

|

KRG MARKET STREET VILLAGE, LP |

|

|

|

|

|

By: |

KRG Market Street Village I, LLC, its sole general partner |

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

KRG SAN ANTONIO, LP |

|

|

|

|

|

By: |

Kite San Antonio, LLC, its sole general partner |

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

KRG EAGLE CREEK III, LLC |

|

|

KRG PANOLA II, LLC |

|

|

|

|

|

By: |

KRG Capital, LLC, their sole member |

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

[Signatures Continued on Next Page]

10

|

|

KRG CEDAR HILL PLAZA, LP |

|

|

|

|

|

|

By: |

KRG CHP Management, LLC, its sole general partner |

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

Name: |

Daniel R. Sink |

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

KRG PLAZA GREEN, LLC |

|

|

|

|

|

By: |

Kite McCarty State, LLC, its member |

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

By: |

Preston Commons, LLP, its member |

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its managing partner |

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

|

[Signatures Continued on Next Page]

11

|

|

KRG WOODRUFF GREENVILLE, LLC |

|

|

|

|

|

By: |

Kite McCarty State, LLC, its member |

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

By: |

Kite Pen, LLC, its member |

|

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

KRG COOL SPRINGS, LLC |

|

|

|

|

|

By: |

KRG Pembroke Pines, LLC, its sole member |

|

|

|

|

|

|

By: |

Kite Realty Group, L.P., its sole member |

|

|

|

|

|

|

|

By: |

Kite Realty Group Trust, its sole general partner |

|

|

|

|

|

|

|

|

By: |

/s/ Daniel R. Sink |

|

|

|

|

|

Name: |

Daniel R. Sink |

|

|

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

[Signatures Continued on Next Page]

12

|

|

KEYBANK NATIONAL ASSOCIATION, as Administrative Agent, as a Lender and as Swingline Lender |

|

|

|

|

|

|

|

|

By: |

/s/ James Komperda |

|

|

Name: |

James Komperda |

|

|

Title: |

Vice President |

|

|

|

|

|

|

|

|

|

|

WELLS FARGO BANK, NATIONAL ASSOCIATION, As Co-Documentation Agent with respect to the Revolver Loan, Syndication Agent with respect to the Term Loan and as a Lender |

|

|

|

|

|

|

|

|

By: |

/s/ Winita Lau |

|

|

Name: |

Winita Lau |

|

|

Title: |

Senior Vice President |

|

|

|

|

|

|

|

|

|

|

BANK OF AMERICA, N.A., |

|

|

As Syndication Agent with respect to the Revolving Loan, Co-Documentation Agent with respect to the Term Loan, and as a Lender |

|

|

|

|

|

|

|

|

By: |

/s/ Anne Quenette Kruer |

|

|

Name: |

Anne Quenette Kruer |

|

|

Title: |

Senior Vice President |

|

|

|

|

|

|

|

|

|

|

JPMORGAN CHASE BANK, N.A., |

|

|

As Co-Documentation Agent with respect to the Term Loan and as a Lender |

|

|

|

|

|

|

|

|

By: |

/s/ Christian Lunt |

|

|

Name: |

Christian Lunt |

|

|

Title: |

Authorized Officer |

[Signatures Continued on Next Page]

13

|

|

RAYMOND JAMES BANK, N.A. |

|

|

|

|

|

|

|

|

By: |

/s/ James M. Armstrong |

|

|

Name: |

James M. Armstrong |

|

|

Title: |

Senior Vice President |

|

|

|

|

|

|

|

|

|

|

CITIBANK, N.A. |

|

|

|

|

|

|

|

|

By: |

/s/ John C. Rowland |

|

|

Name: |

John C. Rowland |

|

|

Title: |

Vice President |

|

|

|

|

|

|

|

|

|

|

U.S. BANK NATIONAL ASSOCIATION, |

|

|

As Co-Documentation Agent with respect to the Revolving Loan and Term Loan and as a Lender |

|

|

|

|

|

|

|

|

By: |

/s/ Renee Lewis |

|

|

Name: |

Renee Lewis |

|

|

Title: |

Senior Vice President |

|

|

|

|

|

|

|

|

|

|

THE HUNTINGTON NATIONAL BANK |

|

|

|

|

|

|

|

|

By: |

/s/ Cynthia ‘Sid’ Stech |

|

|

Name: |

Cynthia ‘Sid’ Stech |

|

|

Title: |

Assistant V.P. |

|

|

|

|

|

|

|

|

|

|

REGIONS BANK |

|

|

|

|

|

|

|

|

By: |

/s/ Kerri L. Raines |

|

|

Name: |

Kerri L. Raines |

|

|

Title: |

Vice President |

[Signatures Continued on Next Page]

14

|

|

SUNTRUST BANK |

|

|

|

|

|

|

|

|

By: |

/s/ Michael Kauffman |

|

|

Name: |

Michael Kauffman |

|

|

Title: |

Senior Vice President |

|

|

|

|

|

|

|

|

|

|

FIFTH THIRD BANK, an Ohio banking corporation |

|

|

|

|

|

|

|

|

By: |

/s/ Michael P. Perillo |

|

|

Name: |

Michael P. Perillo |

|

|

Title: |

Assistant Vice President |

|

|

|

|

|

|

|

|

|

|

BARCLAYS BANK PLC |

|

|

|

|

|

|

|

|

By: |

/s/ Christine Aharonian |

|

|

Name: |

Christine Aharonian |

|

|

Title: |

Vice President |

|

|

|

|

|

|

|

|

|

|

CAPITAL ONE, NATIONAL ASSOCIATION |

|

|

|

|

|

|

|

|

By: |

/s/Ashish Tandon |

|

|

Name: |

Ashish Tandon |

|

|

Title: |

Vice President |

|

|

|

|

|

|

|

|

|

|

PNC BANK, NATIONAL ASSOCIATION |

|

|

|

|

|

|

|

|

By: |

/s/ Thomas S. Silnes, Jr. |

|

|

Name: |

Thomas S. Silnes, Jr. |

|

|

Title: |

Vice President |

[Signatures Continued on Next Page]

15

|

|

ASSOCIATED BANK NATIONAL ASSOCIATION |

|

|

|

|

|

|

|

|

By: |

/s/ Shawn S. Bullock |

|

|

Name: |

Shawn S. Bullock |

|

|

Title: |

Senior Vice President |

16

SCHEDULE 1

|

|

|

Name of Subsidiary |

|

State of Formation |

|

1. |

|

82 & Otty, LLC |

|

Indiana |

|

2. |

|

Brentwood Land Partners, LLC |

|

Delaware |

|

3. |

|

Glendale Centre, L.L.C. |

|

Indiana |

|

4. |

|

Kite Eagle Creek, LLC |

|

Indiana |

|

5. |

|

Kite Greyhound III, LLC |

|

Indiana |

|

6. |

|

Kite Greyhound, LLC |

|

Indiana |

|

7. |

|

Kite King’s Lake, LLC |

|

Indiana |

|

8. |

|

Kite Washington Parking, LLC |

|

Indiana |

|

9. |

|

Kite West 86th Street II, LLC |

|

Indiana |

|

10. |

|

KRG 951 & 41, LLC |

|

Indiana |

|

11. |

|

KRG Bolton Plaza, LLC |

|

Indiana |

|

12. |

|

KRG Castleton Crossing, LLC |

|

Indiana |

|

13. |

|

KRG College I, LLC |

|

Indiana |

|

14. |

|

KRG College, LLC |

|

Indiana |

|

15. |

|

KRG Cool Creek Outlots, LLC |

|

Indiana |

|

16. |

|

KRG Cove Center, LLC |

|

Indiana |

|

17. |

|

KRG Eagle Creek IV, LLC |

|

Indiana |

|

18. |

|

KRG Eastwood, LLC |

|

Indiana |

|

19. |

|

KRG Eddy Street FS Hotel, LLC |

|

Indiana |

|

20. |

|

KRG Estero, LLC |

|

Indiana |

|

21. |

|

KRG Fox Lake Crossing, LLC |

|

Delaware |

|

22. |

|

KRG Gainesville, LLC |

|

Indiana |

|

23. |

|

KRG ISS LH OUTLOT, LLC |

|

Indiana |

|

24. |

|

KRG Lithia, LLC |

|

Indiana |

|

25. |

|

KRG Oleander, LLC |

|

Indiana |

|

26. |

|

KRG Rivers Edge, LLC |

|

Indiana |

|

27. |

|

KRG Rivers Edge II, LLC |

|

Indiana |

|

28. |

|

KRG Vero, LLC |

|

Indiana |

|

29. |

|

KRG Waterford Lakes, LLC |

|

Indiana |

|

30. |

|

Noblesville Partners, LLC |

|

Indiana |

|

31. |

|

KRG Portofino, LLC |

|

Indiana |

|

32. |

|

KRG Beechwood, LLC |

|

Indiana |

SCHEDULE 1 — PAGE 1

|

|

|

Name of Subsidiary |

|

State of Formation |

|

33. |

|

KRG Burnt Store, LLC |

|

Indiana |

|

34. |

|

KRG Clay, LLC |

|

Indiana |

|

35. |

|

KRG Lakewood, LLC |

|

Indiana |

|

36. |

|

KRG Pembroke Pines, LLC |

|

Indiana |

|

37. |

|

KRG Toringdon Market, LLC |

|

Indiana |

|

38. |

|

KRG Hunter’s Creek, LLC |

|

Indiana |

|

39. |

|

KRG Northdale, LLC |

|

Indiana |

|

40. |

|

KRG Trussville I, LLC |

|

Indiana |

|

41. |

|

KRG Trussville II, LLC |

|

Indiana |

|

42. |

|

KRG Kingwood Commons, LLC |

|

Indiana |

|

43. |

|

KRG Centre, LLC |

|

Indiana |

|

44. |

|

KRG Four Corner Square, LLC |

|

Indiana |

|

45. |

|

KRG Bridgewater, LLC |

|

Indiana |

|

46. |

|

KRG Eastgate Pavilion, LLC |

|

Indiana |

|

47. |

|

KRG New Hill Place, LLC |

|

Indiana |

SCHEDULE 1 — PAGE 2

SCHEDULE 2

|

|

|

Name of Subsidiary |

|

State of Formation |

|

1. |

|

KRG Alcoa Hamilton, LLC (formerly known as Inland Diversified Alcoa Hamilton, L.L.C.) |

|

Delaware |

|

|

|

|

|

|

|

2. |

|

KRG Alcoa TN, LLC (formerly known as Alcoa TN, L.L.C.) |

|

Delaware |

|

|

|

|

|

|

|

3. |

|

KRG Dallas Wheatland, LLC (formerly known as Inland Diversified Dallas Wheatland, L.L.C.) |

|

Delaware |

|

|

|

|

|

|

|

4. |

|

KRG Draper Crossing, LLC (formerly known as Inland Diversified Draper Crossing, L.L.C.) |

|

Delaware |

|

|

|

|

|

|

|

5. |

|

KRG Evans Mullins Outlots, LLC (formerly known as Inland Diversified Evans Mullins Outlots, L.L.C.) |

|

Delaware |

|

|

|

|

|

|

|

6. |

|

KRG Lake City Commons II, LLC(formerly known as Inland Diversified Lake City Commons II, L.L.C.) |

|

Delaware |

|

|

|

|

|

|

|

7. |

|

KRG Lake St. Louis Hawk Ridge, LLC (formerly known as Inland Diversified Lake St. Louis Hawk Ridge, L.L.C.) |

|

Delaware |

|

|

|

|

|

|

|

8. |

|

KRG Norman University II, LLC (formerly known as Inland Diversified Norman University II, L.L.C.) |

|

Delaware |

|

|

|

|

|

|

|

9. |

|

KRG Port St. Lucie Square, LLC (formerly known as Inland Diversified Port St. Lucie Square, L.L.C.) |

|

Delaware |

|

|

|

|

|

|

|

10. |

|

KRG Port St. Lucie Landing, LLC (formerly known as Inland Diversified Port St. Lucie Landing, L.L.C.) |

|

Delaware |

|

|

|

|

|

|

|

11. |

|

KRG Shops at Moore II, LLC (formerly known as Inland Diversified Shops at Moore II, L.L.C.) |

|

Delaware |

|

|

|

|

|

|

|

12. |

|

KRG South Elgin Commons, LLC (formerly known as Inland Diversified South Elgin Commons, L.L.C.) |

|

Delaware |

|

|

|

|

|

|

|

13. |

|

KRG St. Cloud 13th, LLC (formerly known as Inland Diversified St. Cloud 13th, L.L.C.) |

|

Delaware |

|

|

|

|

|

|

|

14. |

|

KRG Jacksonville Deerwood Lake, LLC (formerly known as Inland Diversified Jacksonville Deerwood Lake, L.L.C.) |

|

Delaware |

SCHEDULE 2 — PAGE 1

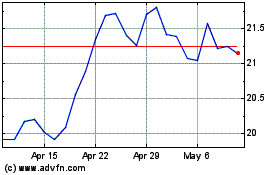

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

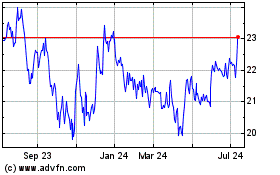

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024