Current Report Filing (8-k)

March 10 2015 - 4:29PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 4, 2015

KITE REALTY GROUP TRUST

(Exact name of registrant as specified in its charter)

|

Maryland

|

|

1-32268

|

|

11-3715772

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification Number)

|

| |

|

|

|

|

| |

|

30 S. Meridian Street |

|

|

| |

|

Suite 1100 |

|

|

| |

|

Indianapolis, IN 46204 |

|

|

| |

|

(Address of principal executive offices) (Zip Code) |

|

|

| |

|

|

| (317) 577-5600 |

| (Registrant’s telephone number, including area code) |

| |

|

|

| Not applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers.

|

(e) Executive Compensation

On March 4, 2015, the Compensation Committee (the “Committee”) of the Board of Trustees of Kite Realty Group Trust (the “Company”) approved and adopted certain compensation arrangements for John A. Kite, the Company’s Chairman of the Board and Chief Executive Officer, Thomas K. McGowan, the Company’s President and Chief Operating Officer, Daniel R. Sink, the Company’s Executive Vice President and Chief Financial Officer, and Scott E. Murray, the Company’s Executive Vice President, General Counsel and Corporate Secretary (collectively, the “Executives”). The material terms of these compensation arrangements are summarized below.

Annual Cash Bonus Performance Metrics for 2015

In prior years, the Committee awarded annual cash bonuses to its named executive officers based on its discretionary assessment of their performance. Although the Committee considered performance metrics and targets when making these assessments, whether bonuses were paid and the amounts of those bonuses were wholly discretionary. For 2015, the Committee is implementing a more objective, formula-based plan that will guide awards of annual cash bonuses to the Executives. On March 4, 2015, the Committee approved targets and performance metrics for determining the amount of cash bonuses eligible to be earned by each of the Executives with respect to 2015 performance under the Company’s executive bonus program. Award determinations with respect to 2015 will be based on the achievement of objective corporate performance metrics, including funds from operations, leverage (debt to EBITDA ratio), portfolio lease percentage and same property net operating income, as well as a review of individual performance. The Committee established threshold, target, superior and outperformance values for each of the foregoing corporate performance metrics. For 2015, each of Messrs. Kite, McGowan, Sink and Murray will be eligible to receive an annual target cash bonus of 125%, 75%, 75% and 65%, respectively, of his respective annual base salary amount and a maximum cash bonus of 250%, 150%, 150% and 130%, respectively, of his respective annual base salary amount. The Committee expects to make determinations on the cash bonus amounts to be paid to each Executive for 2015 fiscal year performance in the first quarter of 2016.

Performance Share Units for 2015-2017

The Committee also approved a long-term incentive award (the “LTIP”) pursuant to which each Executive will be eligible to receive equity awards under the Company’s 2013 Equity Incentive Plan. As part of the LTIP, each Executive was awarded performance share units (“PSUs”) which will be earned over a three-year performance period from January 1, 2015 to December 31, 2017, measured against the SNL US REIT Retail Shopping Center index, under which restricted shares may be earned based on the Company’s relative total shareholder return performance compared to this peer group. The target number of PSUs will convert at a range of 50% to 200% of target based on the Company achieving a cumulative TSR over the three-year measurement period at specific percentiles of the peer group, with payouts for performance between defined points being determined on a straight-line basis. Target amounts for Messrs. Kite, McGowan, Sink and Murray are $525,000, $202,500, $180,000 and $120,000, respectively.

Future Annual Cash Bonus Performance Metrics and Equity-Based Awards

Future annual awards pursuant to the Company’s executive bonus plan are expected to include targets and performance metrics similar to those discussed above, although different targets and metrics may be used. Future long-term incentive awards under the 2013 Equity Incentive Plan are expected to include performance-based vesting conditions similar to those discussed above, and may also include service-based vesting conditions. Performance-based vesting conditions likely will be measured over a three-year period, although a different period could be used. In addition, the performance metrics utilized in future long-term incentive awards may include the performance metrics discussed above and/or any of the performance metrics permitted by the 2013 Equity Incentive Plan, and the weighting of such metrics, the weighting of return requirements and other conditions will be determined at the discretion of the Committee, subject to the provisions of the 2013 Equity Incentive Plan.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

KITE REALTY GROUP TRUST

|

| |

|

|

|

Date: March 10, 2015

|

By:

|

/s/ Daniel R. Sink

|

| |

|

|

| |

|

Daniel R. Sink

|

| |

|

Executive Vice President and

|

| |

|

Chief Financial Officer |

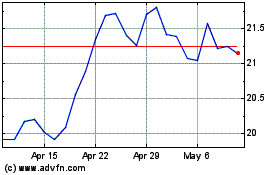

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

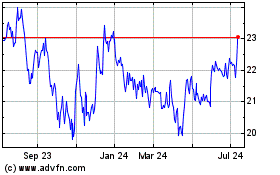

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024