Prospectus Filed Pursuant to Rule 424(b)(7) (424b7)

September 29 2016 - 5:26PM

Edgar (US Regulatory)

FILED PURSUANT TO RULE 424(b)(7)

UNDER THE SECURITIES ACT OF 1933

IN CONNECTION WITH

REGISTRATION NO. 333-213864

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title Of Each Class Of

Securities To Be Registered

|

|

Amount

To Be

Registered

|

|

Proposed

Maximum

Offering

Price

Per Share

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount Of

Registration Fee

|

|

Common Stock, $.01 par value per share

|

|

1,744,201(1)

|

|

$69.04(2)

|

|

$120,419,637(3)

|

|

—(4)

|

|

|

|

|

|

(1)

|

Including an indeterminate number of shares which may be issued by Kilroy Realty Corporation with respect to such shares of common stock by way of a stock dividend, stock split or in connection with a stock combination,

recapitalization, merger, consolidation or otherwise.

|

|

(2)

|

Based upon the average of the high and low prices of the common stock reported on the New York Stock Exchange on September 28, 2016, pursuant to Rule 457(c) of the Securities Act of 1933, as amended (the

“Securities Act”).

|

|

(3)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457 of the Securities Act. Kilroy Realty Corporation previously registered shares of common stock having an aggregate offering price

of $98,435,396 and $54,266,021 (based upon the average of the high and low prices of the common stock reported on the New York Stock Exchange on the applicable date of determination pursuant to Rule 457(c) of the Securities Act), offered by means of

prospectus supplements dated October 2, 2013 and June 9, 2016, respectively (the “Prior Prospectus Supplements”), and an accompanying prospectus dated October 2, 2013 and pursuant to Registration Statement on Form S-3

(Registration No. 333-191524) filed on October 2, 2013 (the “Prior Registration Statement”). Shares of common stock having an aggregate offering price of $120,419,637 (as calculated in note (2) above) are available for offer and sale

pursuant to this prospectus supplement and the accompanying prospectus.

|

|

(4)

|

The filing fees of $12,678 and $5,465 that were paid in connection with our filing of the Prior Prospectus Supplements with the Securities and Exchange Commission (the “SEC”) on October 2, 2013 and June 9,

2016, respectively, were calculated in accordance with Rule 457(c) under the Securities Act. The entire amount of the registration fee of $12,678 for shares of common stock having an aggregate offering price of up to $98,435,396 was paid to the SEC

on October 2, 2013. The entire amount of the registration fee of $5,465 for shares of common stock having an aggregate offering price of up to $54,266,021 was paid to the SEC on June 9, 2016. Pursuant to Rule 415(a)(6) under the Securities Act,

securities with an aggregate offering price of $120,419,637 offered hereby are unsold securities previously registered on the Prior Registration Statement, for which a filing fee (as part of the $12,678 and $5,465 filing fees) was previously paid to

the SEC on October 2, 2013 and June 9,2016 and will continue to be applied to such unsold securities. The Prior Registration Statement terminated effective upon the filing of Registration Statement on Form S-3 (Registration Nos. 333-213864 and

333-213864-01) filed on September 29, 2016.

|

PROSPECTUS SUPPLEMENT

dated September 29, 2016

(to Prospectus dated September 29, 2016)

KILROY REALTY CORPORATION

1,744,201 Shares of Common Stock

This prospectus

supplement supplements the prospectus of Kilroy Realty Corporation, a Maryland corporation (“we” or “our”), dated September 29, 2016

and relates to the possible offer and sale of shares of our common stock held by a

stockholder identified herein and the possible issuance of shares of our common stock to the holders of common units representing common limited partnership interests (“common units”) in Kilroy Realty, L.P., our operating partnership,

identified herein and the possible resale of shares of common stock by such holders. Holders of common units identified in this prospectus supplement were issued common units in a private placement transaction and are entitled to tender their common

units to our operating partnership for cash redemption. We may elect to exchange such tendered common units for shares of our common stock on a one-for-one basis. We will not receive any of the proceeds from the issuance of the common stock to the

holders of common units or from the resale of the shares by the stockholder or the holders of common units.

You should read

this prospectus supplement in conjunction with the prospectus. This prospectus supplement is not complete without, and may not be delivered or used except in conjunction with, the prospectus, including any amendments or supplements to it. This

prospectus supplement is qualified by reference to the prospectus, except to the extent that the information provided by this prospectus supplement supplements information contained in the prospectus.

Before you invest in our common stock, you should consider the risks discussed in “Risk Factors” beginning on page 1 of the

prospectus as well as the risk factors relating to our business that are incorporated by reference in the prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

September 29, 2016

The section entitled “Selling Securityholders” in the prospectus is hereby

supplemented as follows:

SELLING SECURITYHOLDERS

The “selling securityholders” are persons named below who hold shares of our common stock or may receive shares of our common

stock registered pursuant to the registration statement of which this prospectus supplement and the accompanying prospectus form a part. The following table sets forth information, as of September 29, 2016 with respect to the selling

securityholders named below and provides the number of shares of our common stock owned prior to an exchange, the maximum number of shares of our common stock issuable to the selling securityholders in an exchange, the aggregate number of shares of

our common stock that will be owned by each selling securityholder after an exchange and the aggregate number of shares of our common stock that may be resold pursuant to this prospectus supplement and the accompanying prospectus. The maximum number

of shares of common stock issuable in the exchange on the following table represents the number of shares of our common stock into which common units held by the selling securityholders named below are exchangeable. Because the selling

securityholders may sell all, some or none of their shares, we cannot estimate the aggregate number of shares that the selling securityholders will offer pursuant to this prospectus supplement and the accompanying prospectus or that the selling

securityholders will own upon completion of the offering to which this prospectus supplement relates.

The selling

securityholders named below may from time to time offer the shares of our common stock offered by this prospectus supplement and the accompanying prospectus:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name(1)

|

|

Shares of

Common

Stock

Owned

Prior to the

Exchange

|

|

|

Maximum

Number of

Shares of

Common Stock

Issuable in the

Exchange

and

Available for

Resale

|

|

|

Shares of Common

Stock Owned

Following the

Exchange(2)

|

|

|

Number of

Shares of

Common

Stock to be

Resold

|

|

|

Shares of Common

Stock Owned after

Resale(3)

|

|

|

|

|

|

Shares

|

|

|

Percent

|

|

|

|

Shares

|

|

|

Percent

|

|

|

John Kilroy

|

|

|

94,441

|

|

|

|

782,059

|

|

|

|

876,500

|

|

|

|

0.9

|

%

|

|

|

876,500

|

|

|

|

—

|

|

|

|

—

|

|

|

Zappettini Properties LLC(4)

|

|

|

—

|

|

|

|

867,701

|

|

|

|

867,701

|

|

|

|

0.9

|

|

|

|

867,701

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total:

|

|

|

94,441

|

|

|

|

1,649,760

|

|

|

|

1,744,201

|

|

|

|

1.9

|

%*

|

|

|

1,744,201

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Column does not sum to total due to rounding.

|

|

(1)

|

Additional selling securityholders not named in this prospectus supplement will not be able to use this prospectus supplement and the accompanying prospectus for

resales until they are named in the selling securityholder table by a prospectus supplement or post-effective amendment to the registration statement of which this prospectus and the accompanying prospectus supplement forms a part.

|

|

(2)

|

Assumes that we exchange the common units of the selling securityholders for shares of our common stock. The percentage ownership is determined for each selling

securityholder by taking into account the issuance and sale of shares of our common stock issued in exchange for common units of only such selling securityholder. Also assumes that no transactions with respect to our common stock or common units

occur other than the exchange.

|

|

(3)

|

Assumes the selling securityholders sell all of their shares of our common stock offered pursuant to this prospectus supplement and the accompanying prospectus. The

percentage ownership is determined for each selling securityholder by taking into account the issuance and sale of shares of our common stock issued in exchange for common units of only such selling securityholder.

|

|

(4)

|

William and Paula Zappettini Family LLC has the sole voting and disposition power of such securities and may be deemed to have beneficial ownership over such

securities. Pursuant to an Assignment and Pledge of OP Units and Collateral, dated June 6, 2016, by and among Zappettini Properties LLC and JPMorgan Chase Bank, N.A., Zappettini Properties LLC, as security for its obligations to JPMorgan Chase

Bank, N.A. as a lender under a promissory term note, pledged and granted to JPMorgan Chase Bank, N.A. a first priority security interest in the 867,701 common units set forth in the table above and any shares of our common stock issued upon

redemption of such common units, and JPMorgan Chase Bank, N.A. shall also be deemed a selling securityholder hereunder.

|

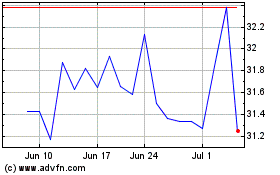

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

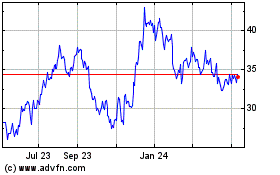

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Apr 2023 to Apr 2024