Kilroy Realty Increases Common Dividend 7.1%

May 19 2016 - 4:32PM

Business Wire

Kilroy Realty Corporation (NYSE: KRC) announced today

that its board of directors declared a regular quarterly cash

dividend of $0.375 per common share payable on July 13, 2016 to

stockholders of record on June 30, 2016. The dividend is equivalent

to an annual rate of $1.50 per share and is a 7.1% increase from

the previous annualized dividend level of $1.40 per share.

The board of directors also declared a dividend of $0.4296875

per share on the company’s 6.875% Series G Cumulative Redeemable

Preferred Stock for the period commencing on and including May 15,

2016 up to and including August 14, 2016. The dividend will be

payable on August 15, 2016 to Series G preferred stockholders of

record on July 31, 2016. As July 31, 2016 falls on a Sunday, the

effective record date for the dividend will be Friday, July 29,

2016.

The board of directors also declared a dividend of $0.3984375

per share on the company’s 6.375% Series H Cumulative Redeemable

Preferred Stock for the period commencing on and including May 15,

2016 up to and including August 14, 2016. The dividend will be

payable on August 15, 2016 to Series H preferred stockholders of

record on July 31, 2016. As July 31, 2016 falls on a Sunday, the

effective record date for the dividend will be Friday, July 29,

2016.

About Kilroy Realty Corporation. With almost 70 years’

experience owning, developing, acquiring and managing real estate

assets in West Coast real estate markets, Kilroy Realty Corporation

(KRC), a publicly traded real estate investment trust and member of

the S&P MidCap 400 Index, is one of the region’s premier

landlords. The company provides physical work environments that

foster creativity and productivity and serves a broad roster of

dynamic, innovation-driven tenants, including technology,

entertainment, digital media and health care companies.

At March 31, 2016, the company’s stabilized portfolio

totaled 13.7 million square feet of office properties, all

located in the coastal regions of greater Seattle, the San

Francisco Bay Area, Los Angeles, Orange County and San Diego. The

company is recognized by GRESB as the North American leader in

sustainability, ranking first among 155 North American

participants across all asset types. At the end of the first

quarter, the company’s properties were 46% LEED certified and 66%

of eligible properties were ENERGY STAR certified. In addition, KRC

had approximately 905,000 square feet of office and residential

projects under construction with a total estimated investment of

approximately $645.0 million. More information is available at

http://www.kilroyrealty.com.

Forward-Looking Statements. This press release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements are based on our current expectations, beliefs and

assumptions, and are not guarantees of future performance.

Forward-looking statements are inherently subject to uncertainties,

risks, changes in circumstances, trends and factors that are

difficult to predict, many of which are outside of our control.

Accordingly, actual performance, results and events may vary

materially from those indicated in forward-looking statements, and

you should not rely on forward-looking statements as predictions of

future performance, results or events. Numerous factors could cause

actual future performance, results and events to differ materially

from those indicated in forward-looking statements, including,

among others, risks associated with: investment in real estate

assets, which are illiquid; trends in the real estate industry;

significant competition, which may decrease the occupancy and

rental rates of properties; the ability to successfully complete

acquisitions and dispositions on announced terms; the ability to

successfully operate acquired properties; the availability of cash

for distribution and debt service and exposure of risk of default

under debt obligations; adverse changes to, or implementations of,

applicable laws, regulations or legislation; and the ability to

successfully complete development and redevelopment projects on

schedule and within budgeted amounts. These factors are not

exhaustive. For a discussion of additional factors that could

materially adversely affect our business and financial performance,

see the factors included under the caption “Risk Factors” in our

annual report on Form 10-K for the year ended

December 31, 2015 and our other filings with the

Securities and Exchange Commission. All forward-looking statements

are based on information that was available, and speak only as of

the date on which they are made. We assume no obligation to update

any forward-looking statement made in this press release that

becomes untrue because of subsequent events, new information or

otherwise, except to the extent required in connection with ongoing

requirements under U.S. securities laws.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160519006680/en/

Kilroy Realty CorporationTyler H. RoseExecutive Vice

Presidentand Chief Financial Officer(310) 481-8484orMichelle

NgoSenior Vice Presidentand Treasurer(310) 481-8581

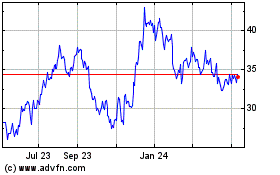

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

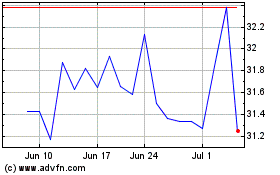

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Apr 2023 to Apr 2024