Kilroy Realty Completes Acquisition of Additional Site for Its San Francisco Flower Mart Project

March 14 2016 - 8:00AM

Business Wire

Kilroy Realty Corporation (NYSE:KRC) today said it has

completed the acquisition of an approximately 1.75 acre site at the

corner of 5th and Brannan Streets, immediately adjacent to The

Flower Mart development site the company currently owns in the

heart of San Francisco’s South of Market (“SoMa”) neighborhood. KRC

purchased the site from a private family for approximately $31

million in cash and 867,701 Kilroy Realty, L.P. operating

partnership units.

KRC now owns a total of approximately seven acres on Brannan

Street between 5th and 6th Streets, with the addition of the newly

acquired site. The company has been working on the land assemblage

for several years and completed the acquisition of the first parcel

in late 2014.

Upon city approval, the company plans to develop a world class

office, retail and flower mart project, including approximately 2.1

million square feet of office and retail space. Plans for the

project include a dynamic mix of creative office, market hall style

retail and wholesale flower mart surrounded by a central public

plaza that embodies the rich urban history of the area. The site

has been and will continue to be the home to a thriving wholesale

flower market that will be redeveloped into a modern,

state-of-the-art facility, which will provide an anchor for the

company’s development plans.

The project represents one of the largest remaining commercial

development opportunities in the city’s downtown area. It is

located just one block from the 4th and Brannan stop of the future

Central Subway. The newly acquired site, with its corner location,

will add significant market presence to the already well-located

project.

About Kilroy Realty Corporation

With more than 65 years’ experience owning, developing,

acquiring and managing real estate assets in West Coast real estate

markets, Kilroy Realty Corporation (KRC), a publicly traded real

estate investment trust and member of the S&P MidCap 400 Index,

is one of the region’s premier landlords. The company provides

physical work environments that foster creativity and productivity

and serves a broad roster of dynamic, innovation-driven tenants,

including technology, entertainment, digital media and health care

companies.

At December 31, 2015, the company’s stabilized portfolio

totaled 13.0 million square feet of office properties, all

located in the coastal regions of greater Seattle, the San

Francisco Bay Area, Los Angeles, Orange County and San Diego. The

company is recognized by GRESB as the North American leader in

sustainability and was ranked first among 155 North American

participants across all asset types. At the end of the fourth

quarter, the company’s properties were 47% LEED certified and 64%

of eligible properties were ENERGY STAR certified. In addition, KRC

had approximately 1.9 million square feet of office and

mixed-use development under construction with a total estimated

investment of approximately $1.2 billion. More information is

available at http://www.kilroyrealty.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements are based on our current

expectations, beliefs and assumptions, and are not guarantees of

future performance. Forward-looking statements are inherently

subject to uncertainties, risks, changes in circumstances, trends

and factors that are difficult to predict, many of which are

outside of our control. Accordingly, actual performance, results

and events may vary materially from those indicated in

forward-looking statements, and you should not rely on

forward-looking statements as predictions of future performance,

results or events. Numerous factors could cause actual future

performance, results and events to differ materially from those

indicated in forward-looking statements, including, among others,

risks associated with: investment in real estate assets, which are

illiquid; trends in the real estate industry; significant

competition, which may decrease the occupancy and rental rates of

properties; the ability to successfully complete acquisitions and

dispositions on announced terms; the ability to successfully

operate acquired properties; the availability of cash for

distribution and debt service and exposure of risk of default under

debt obligations; adverse changes to, or implementations of,

applicable laws, regulations or legislation; and the ability to

successfully complete development and redevelopment projects on

schedule and within budgeted amounts. These factors are not

exhaustive. For a discussion of additional factors that could

materially adversely affect our business and financial performance,

see the factors included under the caption “Risk Factors” in our

annual report on Form 10-K for the year ended

December 31, 2015 and our other filings with the

Securities and Exchange Commission. All forward-looking statements

are based on information that was available, and speak only as of

the date on which they are made. We assume no obligation to update

any forward-looking statement made in this press release that

becomes untrue because of subsequent events, new information or

otherwise, except to the extent required in connection with ongoing

requirements under U.S. securities laws.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160314005258/en/

Kilroy Realty CorporationTyler H. RoseExecutive Vice

Presidentand Chief Financial Officer310-481-8484orMichael L.

SanfordExecutive Vice President,Northern California415-778-5678

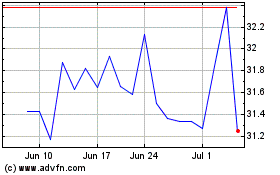

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

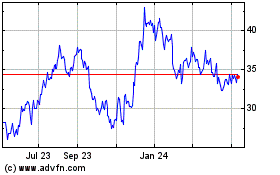

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Apr 2023 to Apr 2024