UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2015

KILROY REALTY CORPORATION

KILROY REALTY, L.P.

(Exact name of registrant as specified in its charter)

|

| | | | | | |

| Maryland (Kilroy Realty Corporation) Delaware (Kilroy Realty, L.P.) | | 001-12675 (Kilroy Realty Corporation) 000-54005 (Kilroy Realty, L.P.) | | 95-4598246 (Kilroy Realty Corporation) 95-4612685 (Kilroy Realty, L.P.) | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) | |

| | | | | |

| 12200 W. Olympic Boulevard, Suite 200, Los Angeles, California | | | | 90064 | |

| (Address of principal executive offices) | | | | (Zip Code) | |

Registrant’s telephone number, including area code:

(310) 481-8400

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2.):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

ITEM 8.01 OTHER EVENTS

Supplemental United States Federal Income Tax Considerations

The information included on this Current Report on Form 8-K under this heading “Supplemental United States Federal Income Tax Considerations” and the information on Exhibit 99.1 hereto are a supplement to, and are intended to be read together with, the discussion under the heading “United States Federal Income Tax Considerations” in the Registration Statement on Form S-3 (File No. 333-191524 and 333-191524-01) of Kilroy Realty Corporation (the “Company”) and Kilroy Realty, L.P. (the “Operating Partnership”) filed with the Securities and Exchange Commission on October 2, 2013 (the “Registration Statement) and in the related prospectus dated October 2, 2013 (the “Base Prospectus”) of the Company and the Operating Partnership.

Supplement to Certain Provisions of Maryland Law and the Company’s Charter and Bylaws

The information included on this Current Report on Form 8-K under this heading “Supplement to Certain Provisions of Maryland Law and the Company’s Charter and Bylaws” and the information on Exhibit 99.2 hereto are a supplement to, and are intended to be read together with, the discussion under the heading “Certain Provisions of Maryland Law and the Company’s Charter and Bylaws” in the Registration Statement and the Base Prospectus.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

|

| |

99.1* | Supplemental United States Federal Income Tax Considerations |

99.2* | Supplement to Certain Provisions of Maryland Law and the Company’s Charter and Bylaws |

* | Filed herewith |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | Kilroy Realty Corporation | |

| Date: February 11, 2015 | | | |

| | | | |

| | | By: | | /s/ Heidi R. Roth | |

| | | | | Heidi R. Roth Executive Vice President,

Chief Accounting Officer and Controller | |

| | | | | | |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | Kilroy Realty, L.P. | |

| Date: February 11, 2015 | | | |

| | | | |

| | | By: | | Kilroy Realty Corporation, |

| | | | | Its general partner | |

| | | | | | |

| | | By: | | /s/ Heidi R. Roth | |

| | | | | Heidi R. Roth Executive Vice President,

Chief Accounting Officer and Controller | |

| | | | | | |

EXHIBIT INDEX

|

| |

99.1* | Supplemental United States Federal Income Tax Considerations |

99.2* | Supplement to Certain Provisions of Maryland Law and the Company’s Charter and Bylaws |

* | Filed herewith |

SUPPLEMENTAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

This discussion is a supplement to, and is intended to be read together with, the discussion under the heading “United States Federal Income Tax Considerations” in the prospectus dated October 2, 2013 included in Kilroy Realty Corporation’s and Kilroy Realty, L.P.’s Registration Statement on Form S-3 (File No. 333-191524 and 333-191524-01) filed with the Securities and Exchange Commission (the “Commission”) on October 2, 2013 (the “Base Prospectus”).

The following paragraph should be inserted after the paragraph under the heading “United States Federal Income Tax Considerations—Taxation of the Company—Like-Kind Exchanges” in the Base Prospectus.

Tax Liabilities and Attributes Inherited in Connection with Acquisitions. From time to time we may acquire other corporations or entities and, in connection with such acquisitions, we may succeed to the historic tax attributes and liabilities of such entities. For example, if we acquire a C corporation and subsequently dispose of its assets within ten years of the acquisition, we could be required to pay the built-in gain tax described above under “—General.” In addition, in order to qualify as a REIT, at the end of any taxable year, we must not have any earnings and profits accumulated in a non-REIT year. As a result, if we acquire a C corporation, we must distribute the corporation’s earnings and profits accumulated prior to the acquisition before the end of the taxable year in which we acquire the corporation. We also could be required to pay the acquired entity’s unpaid taxes even though such liabilities arose prior to the time we acquired the entity.

The following paragraph supersedes the second paragraph in the discussions under the heading “United States Federal Income Tax Considerations—Material United States Federal Income Tax Consequences for Holders of Our Capital Stock and the Operating Partnership’s Debt Securities—Taxation of Non-United States Holders of our Capital Stock—Distributions Generally” in the Base Prospectus.

For withholding purposes, we expect to treat all distributions as made out of our current or accumulated earnings and profits. As a result, except as otherwise provided below, we expect to withhold United States income tax at the rate of 30% on any distributions made to a non-United States holder unless:

| |

• | a lower treaty rate applies and the non-United States holder files with us an IRS Form W-8BEN or IRS Form W-8BEN-E (or other applicable documentation) evidencing eligibility for that reduced treaty rate; or |

| |

• | the non-United States holder files an IRS Form W-8ECI with us claiming that the distribution is income effectively connected with the non-United States holder’s trade or business. |

The following paragraph supersedes the second paragraph in the discussions under the heading “United States Federal Income Tax Considerations—Material United States Federal Income Tax Consequences for Holders of Our Capital Stock and the Operating Partnership’s Debt Securities—Taxation of Non-United States Holders of our Capital Stock—Backup Withholding and Information Reporting” in the Base Prospectus.

Payments of dividends or of proceeds from the disposition of stock made to a non-United States holder may be subject to information reporting and backup withholding unless such holder establishes an exemption, for example, by properly certifying its non-United States status on an IRS Form W-8BEN or IRS Form W-8BEN-E or another appropriate version of IRS Form W-8. Notwithstanding the foregoing, backup withholding and information reporting may apply if either the Company has or its paying agent has actual knowledge, or reason to know, that a holder is a United States person. Backup withholding is not an additional tax. Rather, the United States federal income tax liability of persons subject to backup withholding will be reduced by the amount of tax withheld. If withholding results in an overpayment of taxes, a refund or credit may be obtained, provided that the required information is timely furnished to the IRS.

The following paragraph supersedes the second paragraph in the discussions under the heading “United States Federal Income Tax Considerations—Material United States Federal Income Tax Consequences for Holders of Our Capital Stock and the Operating Partnership’s Debt Securities—Taxation of Holders of the Operating Partnership’s Debt Securities—Non-United States Holders of the Operating Partnership’s Debt Securities—Payments of Interest” in the Base Prospectus.

If a non-United States holder does not satisfy the requirements above, such non-United States holder may be entitled to a reduction in or an exemption from withholding on such interest as a result of an applicable tax treaty. To claim such entitlement, the non-United States holder must provide the applicable withholding agent with a properly executed IRS Form W-8BEN or IRS Form W-8BEN-E (or other applicable documentation) claiming a reduction in or exemption from withholding tax under the benefit of an income tax treaty between the United States and the country in which the non-United States holder resides or is established.

SUPPLEMENT TO CERTAIN PROVISIONS OF MARYLAND LAW AND THE COMPANY’S CHARTER AND BYLAWS

This discussion is a supplement to, and is intended to be read together with, the discussion under the heading “Certain Provisions of Maryland Law and the Company’s Charter and Bylaws” in the prospectus dated October 2, 2013 (the “Base Prospectus”), included in Kilroy Realty Corporation’s and Kilroy Realty, L.P.’s Registration Statement on Form S-3 (File No. 333-191524 and 333-191524-01) filed with the Securities and Exchange Commission (the “Commission”) on October 2, 2013. This discussion is not complete and is subject to, and qualified in its entirety by reference to, Maryland law and the Company’s charter and bylaws, which are available as described under “Where You Can Find More Information” in the Base Prospectus.

The following caption and paragraphs shall be inserted immediately before the subheading “—The Company is not Subject to the Maryland Business Combination Statute” under the heading “Certain Provisions of Maryland Law and the Company’s Charter and Bylaws” in the Base Prospectus.

Election of Directors

The Company’s bylaws provide a majority vote standard for uncontested elections of directors. As a result, except in the case of directors to be elected by the holders of any class or series of the Company’s preferred stock, at each meeting of stockholders at which the election of directors is uncontested, a director nominee will be elected to the board of directors only if the number of votes cast “FOR” the nominee exceeds the number of votes cast “AGAINST” the nominee (with abstentions and broker non-votes not counted as a vote cast either “FOR” or “AGAINST” the director nominee). A plurality vote standard applies in contested elections, in which case stockholders will not be permitted to vote “AGAINST” any director nominee but will only be permitted to vote “FOR” or withhold their vote with respect to such nominee. An election will be considered to be contested if the Company’s secretary has received notice that a stockholder has nominated or proposes to nominate one or more persons for election as a director and, at least 14 days prior to the date on which notice of the meeting is first mailed to stockholders, the nomination has not been withdrawn and would thereby cause the number of director nominees to exceed the number of directors to be elected at the meeting.

Under the MGCL, if an incumbent director is not re-elected at a meeting of stockholders at which he or she stands for re-election then the incumbent director continues to serve in office as a holdover director until his or her successor is elected. However, the Company’s bylaws provide that if an incumbent director is not re-elected due to his or her failure to receive a majority of the votes cast in an uncontested election, the director will promptly tender his or her resignation as a director, subject to acceptance by the board of directors. The nominating and corporate governance committee of the board of directors will then make a recommendation to the board of directors as to whether to accept or reject the tendered resignation or whether other action should be taken. The board of directors will publicly disclose within 90 days of certification of the stockholder vote its decision and rationale regarding whether to accept, reject or take other action with respect to the tendered resignation. If a director’s tendered resignation is not accepted by the board of directors, such director would continue to serve until the next annual meeting of stockholders and until his or her successor is elected and qualified or his or her earlier death, retirement, resignation or removal. If a director’s tendered resignation is accepted, then the board of directors may, among other things, fill the resulting vacancy or decrease the size of the board of directors.

The following caption and paragraph should be inserted immediately before the subheading “—Dissolution of the Company” under the heading “Certain Provisions of Maryland Law and the Company’s Charter and Bylaws” in the Base Prospectus.

Proxy Access

The Company’s bylaws permit a stockholder, or group of up to ten stockholders, owning at least 5% of the Company’s outstanding common stock continuously for at least the prior three years to nominate a candidate for election to the board of directors and inclusion in the Company’s proxy materials for its annual meeting of stockholders; provided that the total number of all stockholder nominees included in the Company’s proxy materials shall not exceed 25% of the number of directors then serving on the board of directors. The foregoing proxy access right is subject to additional eligibility, procedural and disclosure requirements set forth in the Company’s bylaws.

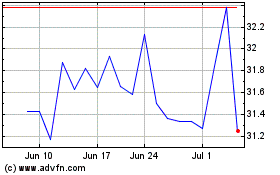

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

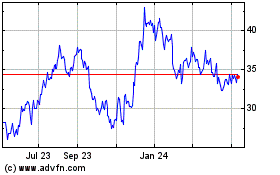

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Apr 2023 to Apr 2024