Coke: Smaller Cans Pay Off -- WSJ

February 10 2017 - 3:03AM

Dow Jones News

Profit and revenue fall, but beverage maker plays up strategy

shift on packaging, pricing

By Jennifer Maloney and Anne Steele

Coca-Cola Co.'s profit fell by more than half in the final

quarter of the year, hurt by weakness in developing markets, but

the company pointed to signs in North America and elsewhere that

its shift to lower-calorie beverages and smaller, higher-priced

packages is working.

Coke has been divesting from its bottling operations to focus on

its more profitable concentrate business, a process it expects to

accelerate in 2017 to meet a self-imposed December deadline. That

contributed to the 56% decline in fourth-quarter net income, to

$550 million, compared with $1.24 billion a year earlier. The

company expects adjusted earnings per share to decline 1% to 4% in

2017.

In the U.S., Coke is shifting from a volume-based model to one

in which the company shares profit with its bottlers, selling

smaller cans and bottles at higher prices. Smaller packages in the

U.S. grew almost 10% in the quarter, said Chief Operating Officer

James Quincey, who will become CEO of the company in May.

North America offered a brighter picture of Coke's operations in

general: Higher pricing and smaller packages drove revenue growth

of 8%, even as volume grew just 1%. Global volumes fell 1% in the

quarter, dragged down by declines in Latin America.

Coke is reformulating its beverages and offering more

zero-calorie options as governments in the U.S. and elsewhere weigh

special taxes on sugary drinks to fight rising obesity and diabetes

rates.

Coca-Cola Zero Sugar, a new version launched last summer in the

U.K., saw double-digit volume growth in Western Europe, boosted by

expansion into France, Belgium, Netherlands and Ireland. The soda

tastes closer to original Coke, and its name is intended to better

communicate to consumers that it contains no sugar.

The company continued the global expansion of its premium

smartwater brand, which saw double-digit volume growth in North

America in 2016. Rival PepsiCo Inc. last month launched a competing

product called LIFEWTR.

Coke's revenue has declined in each of the past four years.

Despite a diversification push into juices, bottled waters and

other beverages, soda still represents about 70% of company

sales.

Mr. Quincey has said that he would like to go faster in

diversifying Coke's beverage portfolio. In a conference call with

analysts Thursday, he noted that the company has done a few bolt-on

acquisitions each year and "hopefully we will do a few in

2017."

On a call later in the day with reporters, Coke's current CEO,

Muhtar Kent, said that the border-adjustment tax proposed by

congressional Republicans wouldn't hurt the company.

"We produce locally...we sell locally and we pay taxes locally,"

he said. "So from our perspective, obviously, it's not going to

make a difference to our business."

But Mr. Kent expressed concern about President Donald Trump's

public statements. "This kind of rhetoric is also somewhat worrying

because it will have a negative impact on global trade," Mr. Kent

said.

Coke's soda volumes world-wide fell 2% in the quarter, while

noncarbonated drinks, which include tea, coffee and juice, grew

2%.

Revenue slipped 5.9% to $9.41 billion, but stayed above

analysts' prediction for $9.13 billion. The company said foreign

exchange shaved 2% off its revenue in the quarter.

PepsiCo is scheduled to report its results next week.

Write to Jennifer Maloney at jennifer.maloney@wsj.com and Anne

Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 10, 2017 02:48 ET (07:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

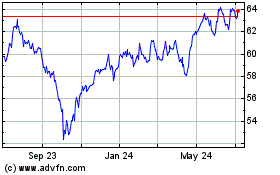

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

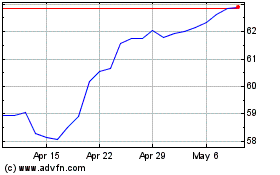

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024