Monster Beverage Sales Growth Slows -- Update

November 03 2016 - 7:45PM

Dow Jones News

By Mike Esterl and Anne Steele

Monster Beverage Corp. on Thursday said sales growth slowed

sharply in the third quarter, weighed down by a transition to using

Coca-Cola Co. distributors for its products, before speeding up

again in October.

Revenue at the energy drink maker rose 4.1% to $788.0 million in

the three months ended Sept. 30 from a year earlier, far weaker

than the 14% growth in the first half of the year.

But Monster said sales bounced back in October, rising 12%,

including 10% growth in the U.S., its main market.

Coca-Cola acquired a 16.7% stake in the Corona, Calif. company

in June 2015 as part of an asset swap in which it also became

Monster's preferred distributor. That move should accelerate

Monster's overseas expansion but has caused uneven results in the

near term amid sometimes rocky handovers from longtime

distributors.

Monster said third-quarter results also were hurt by weaker

foreign currencies and advance purchases by retailers in the

year-earlier period ahead of price increases.

The latest sales slowdown renews questions about whether the

years of rapid revenue growth at energy drink makers such as

Monster could become a thing of the past. "We do believe we'll see

an increase in growth rates next year, but we don't have any

crystal ball," Chief Executive Rodney Sacks told analysts on an

earnings conference call.

Monster's share price, down 5.9% this year, fell another 6.5% to

$131.12 in after-hours trading.

Mr. Sacks said distribution continues to improve in the U.S., as

the company also increasingly shifts distribution to Coca-Cola

bottlers overseas.

Monster launched its namesake energy drink in Beijing in

September and Shanghai in October, part of a broader launch across

major Chinese cities in the coming months. Distribution shifted to

Coke partners in Mexico and South Africa in the third quarter. Coke

bottlers also took the reins in Turkey and Brazil in recent

weeks.

In the September quarter, the company earned $191.6 million, or

99 cents a share, up from $174.6 million, or 84 cents a share, a

year earlier.

The company said unfavorable currency exchange rates hit sales

by about $2.6 million during the quarter.

Analysts polled by Thomson Reuters had projected adjusted profit

of $1.12 a share on $818.8 million in revenue.

Gross margin improved to 63.8% from 61.5% a year ago.

Write to Mike Esterl at mike.esterl@wsj.com and Anne Steele at

Anne.Steele@wsj.com

(END) Dow Jones Newswires

November 03, 2016 19:30 ET (23:30 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

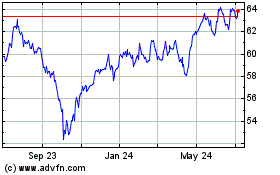

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

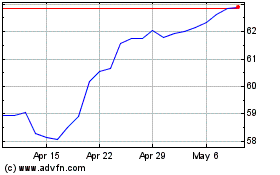

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024